Siebert Financial Up 650% As "Wall Street Bets" Short Squeeze Continues

As the broader US index futures point lower, it looks like the "Wall Street Bets" army is back on the offensive, as some of the big-name "Reddit" stocks - as Bloomberg calls them - are back in rally mode.

Gamestop (GME) is up a 'healthy' 80% this morning..

(Click on image to enlarge)

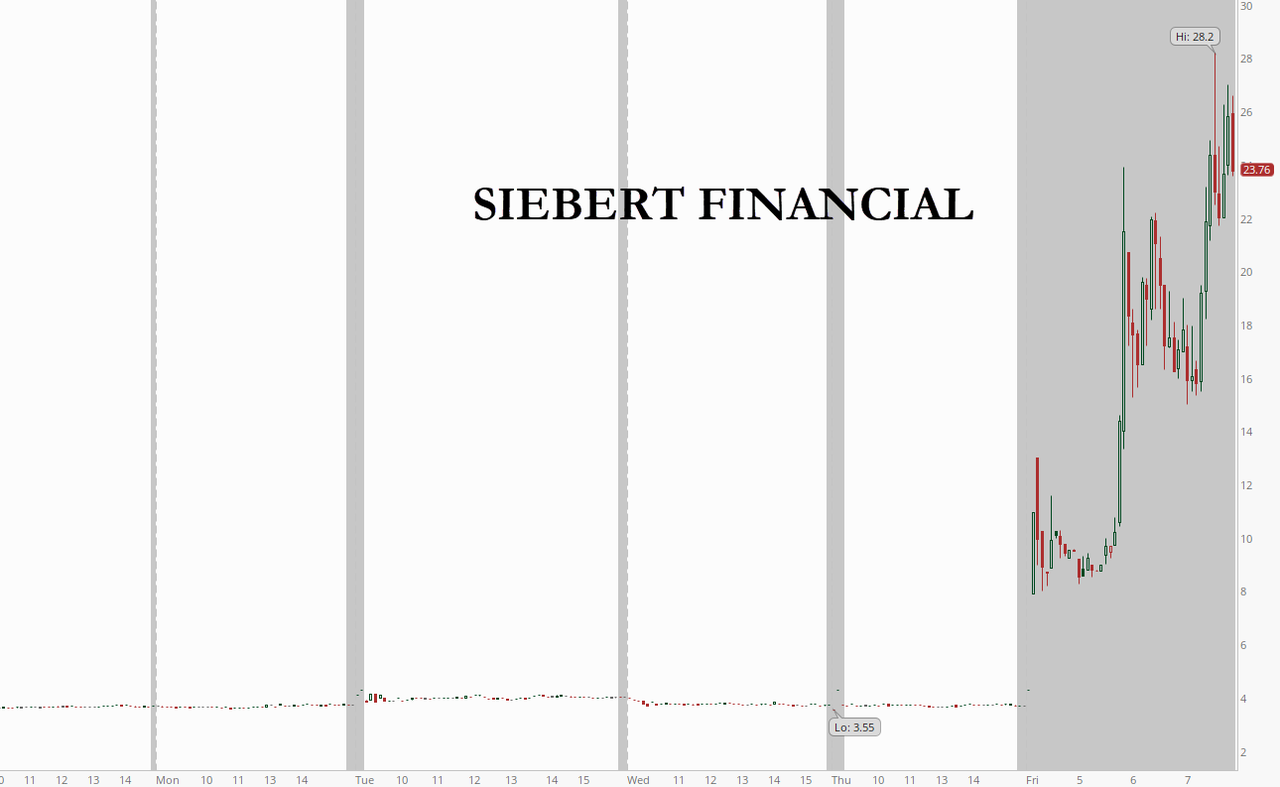

But it is Siebert Financial (SIEB) that really stands out, having surged as much as 650% on Friday morning...

(Click on image to enlarge)

The retail brokerage/finance company is now trading at its highest since 1999...

(Click on image to enlarge)

Other stocks that got caught up recently in a retail-trading frenzy include:

-

Cinema operator AMC Entertainment +49%

-

Apparel retailer Express +37%

-

Homeware retailer Bed Bath & Beyond +10%

-

Cannabis firm Sundial Growers +14%

-

Underwear manufacturer Naked Brand +40%

-

Airport spa operator which pivoted to Covid-19 testing XpresSpa +5.3%

-

Silver miner First Majestic Silver +13%

-

Fashion retailer Fossil Group +11%

-

Shipping firm Castor Maritime +17%

-

Guardion Health Sciences +9.6%

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Certainly some interesting data here. BUT no conclusions? It seems that somehow mob rule is being choreographed by somebody. Or has the Siebert Finacial management all at once done something to add huge value? Or are the earnings suddenly much greater? The symptoms point more towards an active hyp campaign by external forces, because the company was "shorted" a lot. If data exists it will be interesting to see.

Will this settle down or is this the new normal?