Thoughts For Thursday: Back From The Holiday With Caution

Caution is perhaps what was reflected in yesterday's back from the holiday trading. First there is the question of upcoming Fed action and second there is the visit of Secretary Yellen to China, to name a few issues. Much of the run-up in the market has been based on semiconductors and A.I. technologies and now the U.S. finds itself on the cusp of a trade war with China centered around both.

![]()

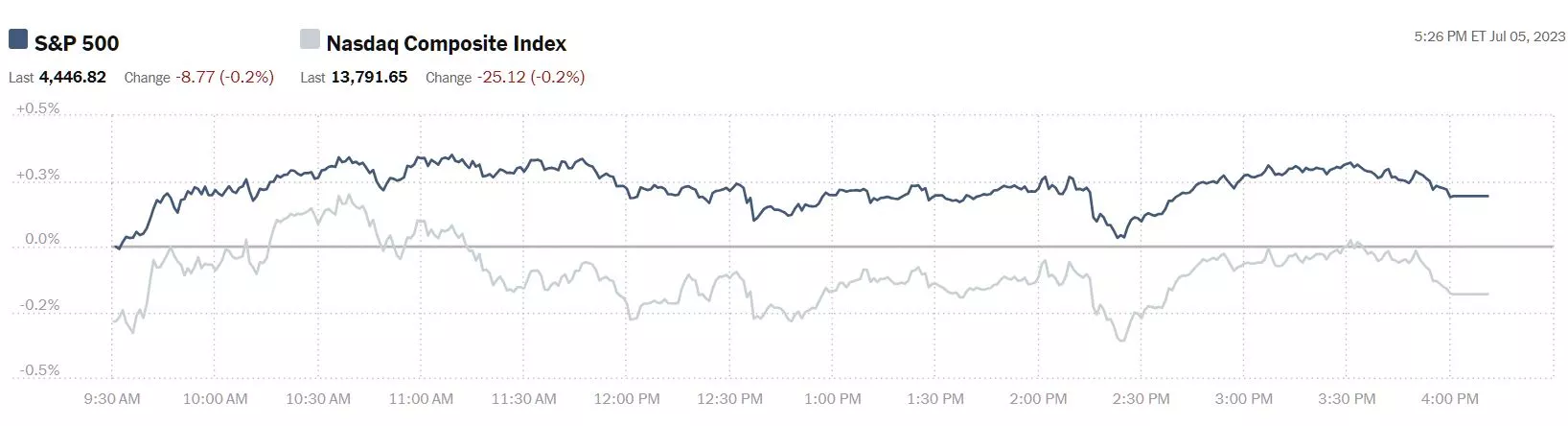

Wednesday the S&P 500 closed at 4,447, down 9 points. The Dow closed at 34,289, down 130 points, and the Nasdaq Composite closed at 13,792, down 25 points.

Chart: The New York Times

The top loser for the day was BorgWarner (BWA), down 13.5%, followed by Generac (GNRC), down 8.0% and Las Vegas Sands Corp. (LVS), down 5.6%.

Chart: The New York Times

In morning futures action S&P 500 market futures are trading down 20 points, Dow market futures are down 159 points and Nasdaq 100 market futures are down 62 points.

Noting the current volatility here and across the pond contributor Fiona Cincotta chooses Two Trades To Watch: DAX, Oil at the top of her screen for today.

"The DAX, along with European markets, are heading for a lower open as investors continue digesting the minutes from the June FOMC meeting and look ahead to eurozone retail sales.

The minutes were more hawkish than expected and showed that the decision to pause rate hikes in June was not quite as unanimous as expected, with several fed officials keen for a 25 basis point rate hike.

The minutes they were confirmed that the absence of a hike in June was a skip, with officials looking to hike rates again in July and beyond as concerns over sticky inflation, which is unacceptably high...attention will be on Eurozone retail sales, which are expected to rise 0.2% YoY. The data comes as concerns mount over the health of the economy in Europe after the composite PMI contracted in June to 49.9, down from 52.8 in May.

However, there was some good news after German factory orders came in well ahead of forecast at 6.4% MoM in May, defying expectations of a 0.4% fall...While the DAX has risen over 35% from its October low, the rally is running out of steam. The price has fallen out of the multi-month rising channel breaking below its 20 & 50 sma, which, combined with the RSI below 50, keeps sellers hopeful of further losses."

"Oil prices are holding steady after two days of solid gains. Oil prices jumped around 3% on Wednesday in a post-holiday response to supply cuts that Saudi Arabia and Russia announced at the start of the week.

The 1 million bpd voluntary cut by sat Arabia and 500,000 bpd by Russia shows that oil cooperation as part of the OPEC+ alliance it's going strong.

At the meeting in Vienna, the Saudi energy minister Prince Abdulaziz bin Salman said, “We will do whatever is necessary, whatever it takes,” in a show of determination to support the oil market.

While supplies are tightening, concerns over the economic outlook and slowing oil demand are keeping gains in oil capped...Buyers will look for a rise above yesterday’s high to expose the 100 sma at 73.65 ahead of 75.00, the June high. On the downside, support can be seen at 71.20, the 50 sma, and 70.40, the falling trendline support. However, sellers need a break below 67.00 to create a lower low."

Contributors Francesco Pesole and Frantisek Taborsky of ING Economics further weigh in on the FOMC meeting notes in Hawkish Fed Minutes Raise The Bar For Data Disappointment.

"Yesterday’s release of the June FOMC minutes gave very few reasons to doubt the Fed’s determination to keep raising rates. In a way, the bar for data disappointment and consequent dovish repricing may now be higher. Still, expect a hit to the dollar if the ISM services fall into contractionary territory. Job openings and ADP payrolls will also be watched.

The narrative that emerged from the minutes of the June FOMC meeting fell unequivocally on the hawkish side of the spectrum. The summary of opinions confirmed some divergence within the committee, as some members would have favoured a hike already in June, but accepted a pause and signalled instead more tightening via the new dot plot projections. “Almost all” participants thought more tightening was likely this year.

There was also an acknowledgement of ongoing firm GDP growth and high inflation, with core inflation, in particular, showing no tendency to ease as of yet this year. The Fed also noted that credit remains available to high-rated borrowers, but that lending conditions had tightened further for bank-dependent borrowers. Still, the risk of a credit crunch was deemed modest.

All in all, the minutes offered no reason to doubt the Fed will go ahead with a July hike (85% priced in) unless data points firmly in the opposite direction on the economic and inflation side. The hawkish minutes, however, may have further raised the bar for disappointing data to cast doubt on further tightening."

Contributor Mish Schneider asks the perennial question, Sell In July And Go Away? Calendar Range Reset.

"One of the most interesting things about July in the market is the biannual reset of the 6-month calendar range.

Here is a chart of the Nasdaq 100 with the January 6-month calendar range drawn in.

To clarify, it is the solid green line that goes perfectly horizontal across the screen.

The lower chart is the Real Motion momentum indicator.

The bottom is the daily volume.

Since the beginning of 2023, QQQ cleared the 6-month calendar range high and never looked back. We had a brief test in March, but no violation.

As we are about to reset that range, note the momentum.

QQQs are working off a mean reversion from early June.

The current momentum, considering how close QQQs are to the recent highs made June 16th, is not bad, but meh.

The volume pattern in July thus far is also meh.

So, we do not know yet how much more upside versus downside the large cap growth stocks have yet.

What we do know though, is that the Nasdaq looks one way, while the small caps look completely different.

In January IWM cleared its 6-month calendar range high. Then, in March, IWM failed those highs.

Since then, IWM has not been able to get back above the calendar range high on a closing basis.

The Real Motion momentum indicator is also mainly meh but holding.

And looking at volume, IWM has had only 1 accumulation (June 29th), on an up day since June 26...

Our guess is that if IWM can clear the calendar range we got ourselves at least a leg higher and perhaps more.

However, should IWM fail to clear the calendar range high and worse, break down under a new 6-month calendar range low (the thick red horizontal line), then it would be hard to think Nasdaq sustains current levels.

Either way, the range will reset in less than 2 weeks."

See the article for additional stats.

Regarding caution, TM contribuor Tim Knight charting in Peak Economy takes a look at U.S. capital goods manufacturing.

"If you believe in cycles – – and I tend to – – please take note of this chart based on data straight from our friends at the Federal Reserve: it illustrates the capital goods manufacturing in the U.S. economy. To my eyes, this looks like a very regular, reliable cycle, and I’d say it looks rather on the toppy side. Not that fundamentals MATTER anymore, but still…………."

Contributor Rod Raynovitch is expecting biotech earnings to be rocky and suggests Stay Balanced Through July Earnings Season.

As per usual Rod's columns are full of data so find some of the highlights below and jump to the full article for more details.

"You’ve heard by now about the huge gains over six months for equities but alas not so much for biotech and even healthcare stocks. It’s a bifurcated market. The QQQ is up 38.73% YTD and the S&P is up 15.9 % YTD. The results for key biotech ETF sector performance has been very disappointing given the momentum of tech. Even the S&P is doing better in 2023. Biotech peaked in August 2021 and is unlikely to regain momentum until Q4 2023. Moreover, the XLV Healthcare SPDR Fund has been flat since Aug 2021. Keep in mind that many investors prefer healthcare because of its defensive nature but not over the last 2 years."

"The best trading opportunities for the Life Science/Biotechnology sector should be SMID stocks. We gave our last update for this portfolio on June 14 when weakness became apparent. especially with the XBI. We still hold many of these stocks and will publish a new portfolio sometime in the future. Best picks have been CRSP, GERN, and PACB but volatility remains high."

Closing out the column today with the latest from META, contributor Ruholamin Haqshanas writes, Meta’s Threads Can Have A Larger User Base Than Twitter, But There’s A Catch.

"Threads will be a standalone app linked to Instagram, allowing users to port over their accounts to the new platform.

However, there is a catch — Threads will collect data from users’ phones, including health data, financial information, location data, purchases, and browsing history, and port user data when they sign up using their Instagram credentials."

Image courtesy of 123rf. via The Tokenist

"One significant advantage of Threads is that users will not have to start from scratch when building their community. Instagram will assist users in bringing their followers over to Threads. It will notify their followers to follow them on the new platform, ensuring a seamless transition. Threads also allow users to carry over their preferences from Instagram...

The ability to reply to, repost, and forward posts will be reminiscent of Twitter’s functionalities. Additionally, users can choose the audience to reply to their posts, allowing for more control over the discussions.

The App Store description says Threads is “Instagram’s text-based conversation app,” where users can “say more.” “Threads is where communities come together to discuss everything from the topics you care about today to what’ll be trending tomorrow,” it said, adding:

“Whatever it is you’re interested in, you can follow and connect directly with your favorite creators and others who love the same things – or build a loyal following of your own to share your ideas, opinions and creativity with the world.”

Meta can combine data from Facebook and Instagram in the US, but the Irish regulator has prohibited Meta from launching advertising services on WhatsApp that utilize data from Facebook or Instagram.

It is worth noting that Meta is already under scrutiny in the EU for violating EU privacy laws. Back in May, the European Data Protection Board announced that it had fined Meta a record-breaking €1.2 billion ($1.3 billion) for violating EU privacy laws by transferring the personal data of Facebook users to servers in the United States."

See the full article for more.

That's a wrap for today.

Have a good one.

More By This Author:

Tuesday Talk: A Glorious First Half And A Glorious Fourth

Thoughts For Thursday: Cautious Optimism Takes Hold, Seemingly