Thoughts For Thursday: Cautious Optimism Takes Hold, Seemingly

Amidst a coup d'etat attempt in Russia, severe economic slowdown in China, central bank rate hike forecasts and persistent inflation, the market continues to work at broadening its rally.

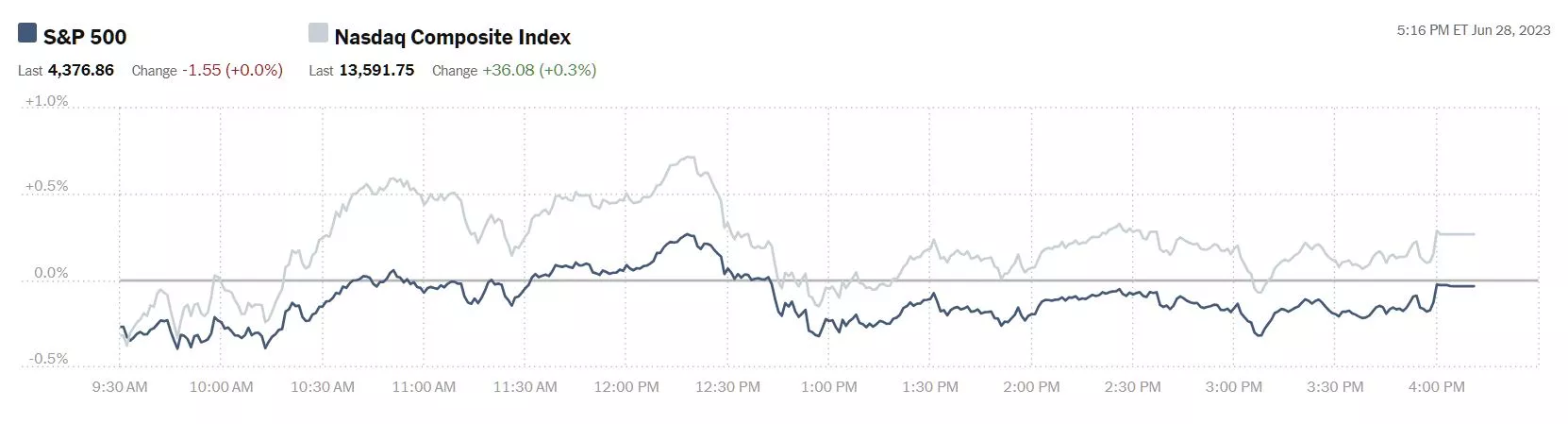

On Wednesday the S&P 500 closed at 4,377, down 2 points, the Dow closed at 33,583, down 74 points, and the Nasdaq Composite closed at 13,592, up 36 points.

Chart: The New York Times

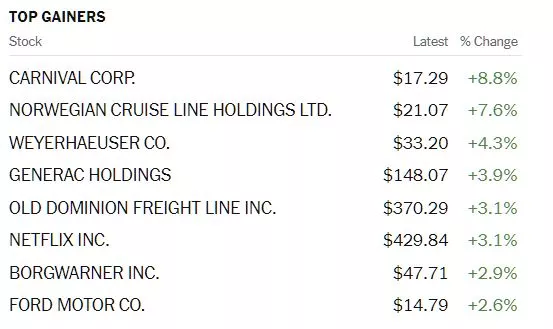

In a sign, perhaps, that the current rally is reaching beyond A.I. and high tech, none of yesterday's top gainers were from the Tech sector. Leading the pack was Carnival Cruise Lines (CCL), up 8.8%, followed by Norwegian Cruise Lines (NCL), up 7.6%, Weyerhaeuser (WY), up 4.3%, and Generac Holdings (GNRC), up 3.9%.

Chart: The New York Times

Currently S&P 500 market futures are trading up 14 points, Dow market futures are trading up 95 points, and Nasdaq 100 market futures are trading up 62 points.

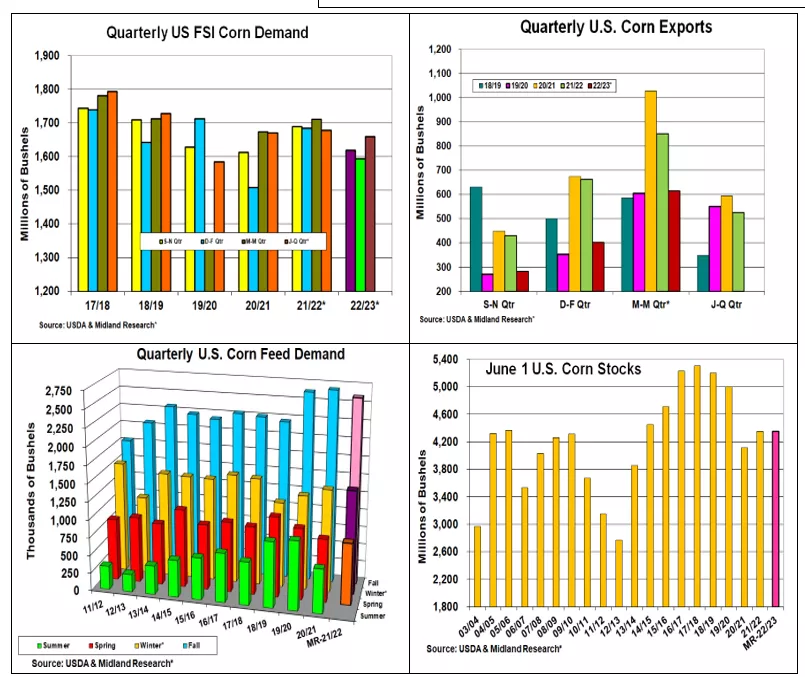

In cereal grains, contributor Jerry Gidel notes that Smaller Supply & Stronger Dollar Have Impacted US Demand, for corn.

"The corn market’s focus will be split between the US quarterly stocks & acreage reports that will both be released on June 30. New-crop plantings always get plenty of attention, but the current supplies in the US bins remain important given the 7.5% smaller beginning US supplies this year. Curtailed ethanol demand because of higher feedstock costs & reduced export demand from a higher dollar and lower Chinese demand has dropped 2 major 1st half-corn usage levels this year. Russia indicating its desire to end its part in the Black Sea grain corridor agreement on July 18 will keep the world’s corn market in an emotional state. Domestically, modestly higher pork & poultry slaughter will counter lower cattle feedlots numbers from the impact of last year’s Plains drought. Smaller wheat and alternative feedgrains supplies will keep corn as the major calorie source in US feed rations."

"US feed demand is quantified by comparing corn’s quarterly stocks from one quarter to the next. Spring hog & poultry numbers were up slightly while feedlot cattle numbers were down 3%. With very limited wheat, spring’s feed demand could still be 770 million bu, down 10% from 2022. Overall, June’s US corn stocks are projected at 4.353 billion bu., the same as last year."

See the full article for more details.

Political musings aside, TM constributor Mish Shedlock reports two important pieces of news, Ford To Layoff At Least 1,000 Workers, EV Startup Lordstown Motors Dies.

"Other than Tesla (TSLA), the EV business in the US is struggling. Ford’s (F) layoffs will significantly affect its North American engineers.

Ford Plans to Lay Off at Least 1,000 Contract and Salaried Workers

Ride chart courtesy of Stockcharts.Com.

The Wall Street Journal reports Ford Plans to Lay Off at Least 1,000 Contract and Salaried Workers

In internal meetings Monday, Ford began notifying some salaried workers in North America that job cuts would be coming, a company spokesman confirmed Tuesday morning.

This latest reduction of Ford’s white-collar workforce includes employees in its electric-vehicle and software side of the business, the company spokesman confirmed. The cuts will also affect workers in the automaker’s gas-engine and commercial-vehicle divisions, he said. Managers at the company held meetings Monday in which they informed employees that layoffs were coming and that affected teams should work from home for the rest of the week, a company spokesman said.

Ford’s annual costs are $7 billion to $8 billion, too high relative to rival automakers, executives have said. To eliminate this cost gap, the company is streamlining its supply-chain spending, reducing complexity in its vehicle lineup and clamping down on warranty costs, executives have said. Ford has said it expects to lose $3 billion in operating profit on its EVs business this year. While executives at the automaker have said profits from its gas-engine operations would sustain the business in the midst of these losses, some analysts have questioned whether the automaker would require additional funding.

Lordstown Motors Dies

Also note As Lordstown Motors Dies, Lordstown’s EV Business Survives

Electric-vehicle startup Lordstown Motors (RIDE) wants a buyer for its pickup truck, the Endurance. To clear the asset of “legacy issues,” it sought bankruptcy protection on Tuesday, a sorry step for a company whose purchase of General Motors’ redundant factory in Lordstown, Ohio, made it an unlikely darling of the Trump administration. The stock fell 30% in early trading.

The company is now pitching the Endurance not to vehicle-fleet buyers, but as a “springboard” to other manufacturers that might want a ready-designed electric pickup. Its value is doubtful given the Endurance’s history, which has included battery fires, quality issues and a recall—all before it entered full-scale production.

Another question for the residual value of Lordstown Motors is the merit of the legal case it kicked off Tuesday against Foxconn. The contract manufacturer turned from white knight to foe for Lordstown when Foxconn withheld a promised slug of investment earlier this year, claiming breach of contract.

The Journal comments “Lordstown Motors is now in the hands of lawyers and bankers. But don’t write off the Lordstown EV business.”"

Contributor Tim Fries reports on How New AI Restrictions May Throw A Wrench In Nvidia’s Plans.

Image courtesy of 123rf. via The Tokenist

"...the U.S. Department of Commerce seeks to limit China’s access to AI chips further. According to the Wall Street Journal’s report on Tuesday, these new restrictions could come in as early as next month...

In August 2022, Nvidia filed its 8-K form to the SEC, revealing that the U.S. government (USG) imposed a new license requirement “for any future export to China (including Hong Kong) and Russia of the Company’s A100 and forthcoming H100 integrated circuits.”

Thanks to ChatGPT taking the internet by storm, these chips have become a hot commodity as they offer high-performance computing (HPC) necessary to scale AI demand.

However, to defend its bottom line and fiduciary duty to shareholders, Nvidia released another suitable AI chip, the A800, in November 2022. Nearly equal in computing power to the A100 series, the A800 is a cut-down version of the A100, effectively short-circuiting existing export restrictions to China...

Tuesday’s WSJ report on another export restriction responds to that evasion. Additionally, the USG would restrict Chinese access to cloud services. That makes sense because Microsoft Azure, Amazon Web Services (AWS), and Google Cloud use Nvidia’s chips for their data centers.

Therefore, even if Nvidia (NVDA) chip exports are restricted, China could still access Nvidia-powered AI computing...

Nvidia’s CEO clarified that they “are significantly increasing our supply to meet surging demand for them.” But the latest USG-induced FUD could significantly cut that demand short. Consequently, Nvidia’s forecast-beating revenue model that boosted the stock could no longer be in play.

...since Tuesday’s WSJ article to press time, NVDA shares barely nudged, dropping by 1.23%. The “buy the rumor, sell the news” trading strategy seems to be in play. However, if new export controls come online next month, Nvidia will likely dip under the $1 trillion market cap threshold again."

Read the full article for more details, but in a word "messy".

Contributor Steve Sosnick writes that Four Central Bankers Aren’t Enough To Sink The Market. I'll let you read the article on your own for Sosnick's reactions to the major central bank governors' remarks at their recent confab in Sintra, Portugal which prompted the headline.

Sosnick's takeaway that you should consider is this:

"It is quite clear that optimistic thinking remains supreme within the equity markets right now. We had reason to be concerned this morning after the Wall Street Journal story about the Biden Administration’s desire to restrict the sale of semiconductors that could be used for AI purposes to China. Nvidia and AMD sold off on that news since each to indeed sell a fair number of chips to that country. But traders saw the recent that saw that dip in tech to be yet another buying opportunity, and we see tech stocks resuming their rally. We also see the S&P 500 (SPX) as a result trading marginally higher around noon Eastern Time

Call it what you will: trendiness — FOMO, or window dressing ahead of the end of a very positive quarter — but it it’s clear that equity markets continue to see the same sort of inertia that we wrote about earlier this month. In this case, the market remains in motion unless acted upon by an external force. So far, we have not had an external force substantial enough to disrupt the positive momentum, or as I prefer to call it, inertia. Let’s see if the end of the quarter, or earnings season that begins in just three weeks, becomes that force."

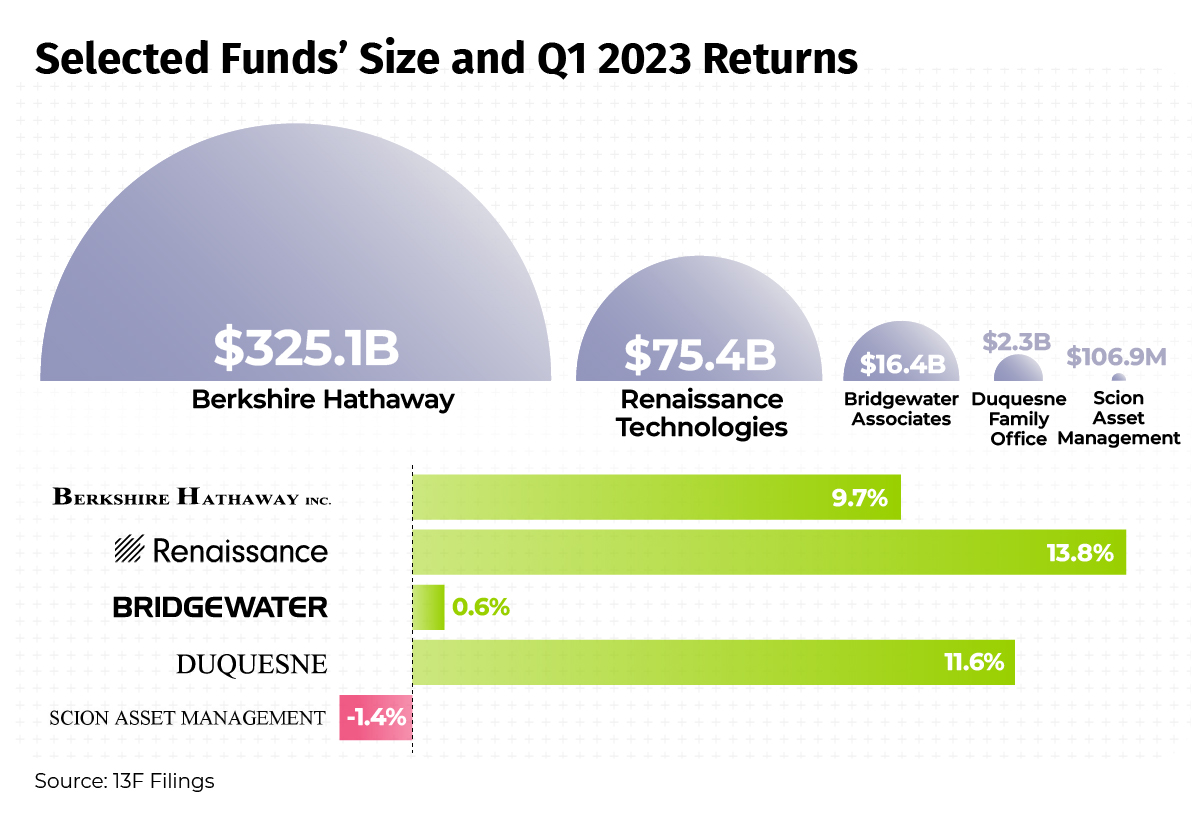

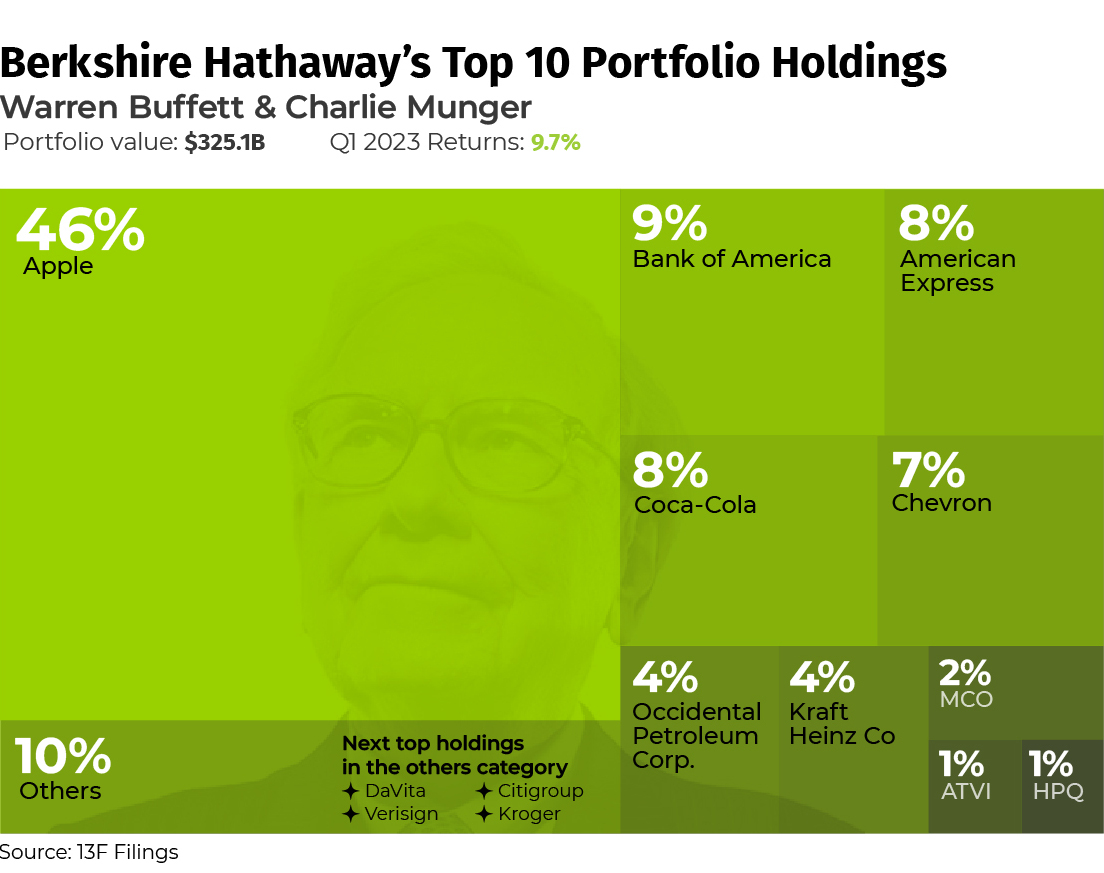

TalkMarkets contributors Niccolo Conte and Bhabna Banerjee have some fun with their visualizations answering the question, What Are Top Investment Managers Holding In Their Portfolios?

"We selected five funds of various sizes, each one with a renowned investor at its helm that often has a unique outlook on the market and strategy towards building out their portfolio."

"The differences in portfolio compositions underline the variety of investment strategies, showing how some of the top investors approach portfolio construction."

Below is the Berkshire-Hathaway (BRK-B) breakdown. See the article for the other four.

As always, Caveat Emptor.

Have a good one.

More By This Author:

Thoughts For Thursday: Profit For The Taking

Tuesday Talk: Market Rallies, China Worries