Smaller Supply & Stronger Dollar Have Impacted US Demand

Market Analysis

The corn market’s focus will be split between the US quarterly stocks & acreage reports that will both be released on June 30. New-crop plantings always get plenty of attention, but the current supplies in the US bins remain important given the 7.5% smaller beginning US supplies this year. Curtailed ethanol demand because of higher feedstock costs & reduced export demand from a higher dollar and lower Chinese demand has dropped 2 major 1st half-corn usage levels this year. Russia indicating its desire to end its part in the Black Sea grain corridor agreement on July 18 will keep the world’s corn market in an emotional state. Domestically, modestly higher pork & poultry slaughter will counter lower cattle feedlots numbers from the impact of last year’s Plains drought. Smaller wheat and alternative feedgrains supplies will keep corn as the major calorie source in US feed rations.

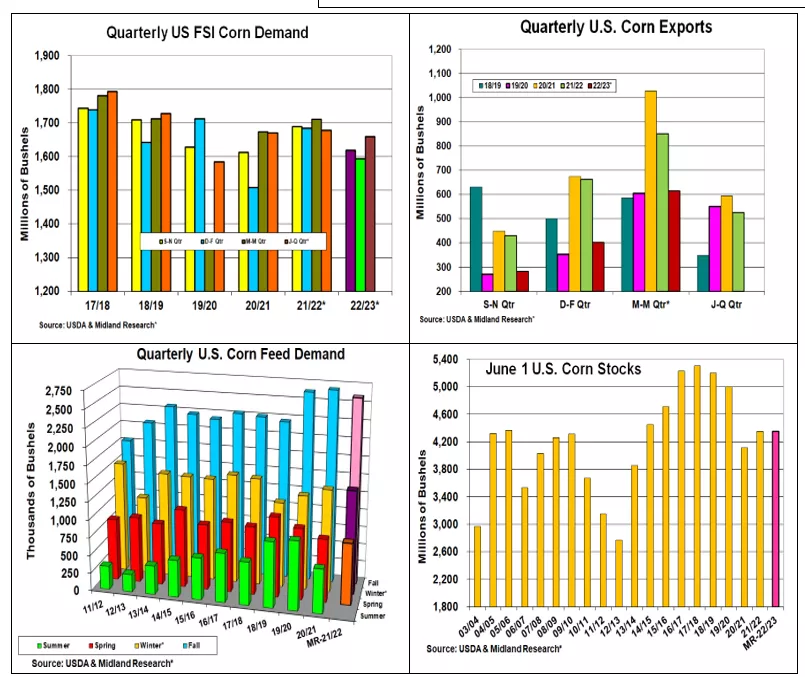

High gas prices & a stronger ethanol conversion rate because 2022/23’s higher quality corn crop moderated this year’s 1st half industrial corn demand. However, corn’s FSI demand rebounded by 70 million bu on stronger US transportation patterns as Covid concerns continue to wane. This spring’s 1.665 billion bu is down 3% vs 2022, but June’s strong ethanol output near re- cent summer highs suggests no change in this demand.

Last Summer’s Black Sea grain export corridor opening & China’s sizable corn crop and their desire to utilize alternative sources & wheat sharply reduced 1st half US corn exports. Brazil switching its exports seasonally to soybeans has opened up the US to sourcing this feedgrain prompting this quarter’s shipments to jump to 620 mililon bu. This is the best of the year, but it is down sharply from the past 2 years. Note, US summer exports need to reach 425 million bu to hit USDA forecast, a 33 million weekly average.

US feed demand is quantified by comparing corn’s quarterly stocks from one quarter to the next. Spring hog & poultry numbers were up slightly while feedlot cattle numbers were down 3%. With very limited wheat, spring’s feed demand could still be 770 million bu, down 10% from 2022. Overall, June’s US corn stocks are projected at 4.353 billion bu., the same as last year.

What’s Ahead:

This week’s June 30 quarterly stocks & acreage reports are important updates to monitor for old-crop supplies & new-crop area for the 2023/24 crop year. However, Central US weather has overtaken prices with corn approaching its highly important pollination period. Use price rallies in the $5.60-75 range in September & December to finalize old-crop & market 30-40% of your new crop.

More By This Author:

Record US Crush & Solid Exports, But Focus On US Midwest Weather

US & World Weather Factors Remain Key For Limited US Wheat Crop

US S&D Changes Will Be Modest, But Central US Weather Holds Price Key

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more