US & World Weather Factors Remain Key For Limited US Wheat Crop

Market Analysis

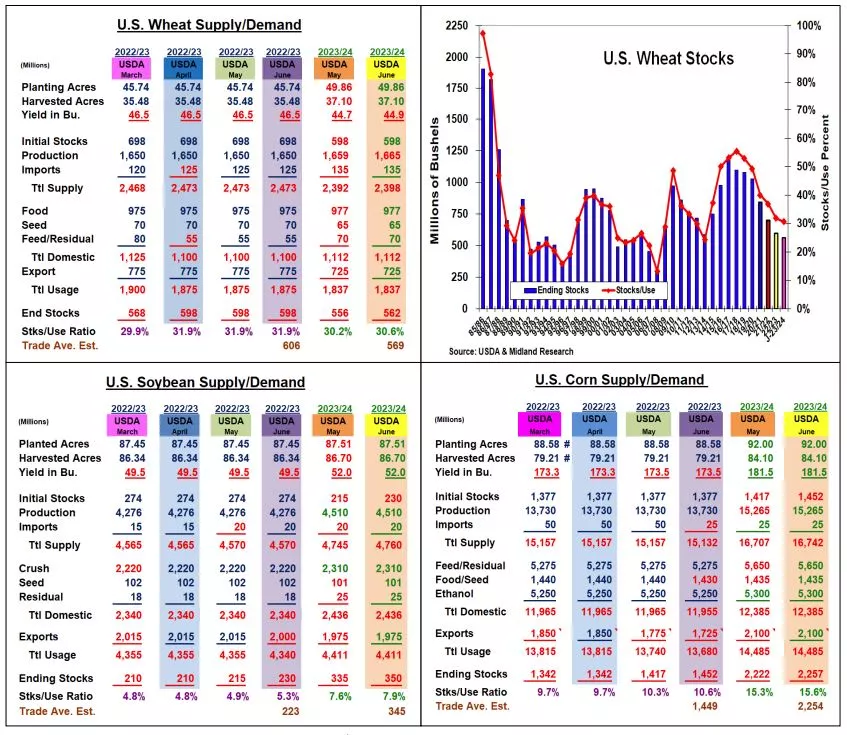

Despite recent sluggish US export sales & S Plains rainfall, the USDA’s June supply/demand adjustments weren’t as dramatic as many feared.

The World Board did slice Argentina’s corn & bean crop ideas, but they also upped Brazil’s outputs slightly too. A report of US beans moving to Europe & bean oil returning to meet higher renewable diesel demand lifted this pit ahead of the report. A modest US wheat 6 million bu rise & a mid-day NWS’s drop in its weekend Midwest rainfall forecast provided support late.

The USDA decision to leave all US major crops acreage level unchanged ahead of the upcoming June 30 report kept US wheat harvested areas unchanged. They did up OK, TX & CO yields by 2 bu, but left KS unchanged resulting in an 11 million bu rise in hard red’s output. However, the USDA slipped MI, OH, MS, TN and left the IL & IN unchanged decreasing soft red’s crop by 4 million. A late surge in exports prompted the USDA to leave its old -crop US stocks unchanged. The World Board did up its world output by increasing Russian & Indian crops by 3.5 mmt, but the destruction of major Ukrainian dam seem to counter the USDA’s 1 mmt higher crop projection. Overall, June’s modest 6 million increase in US output and stocks to 562 million bu which remains the lowest US carryover since 2007/08.

Friday’s unknown bean sale & EU export rumors helped advance July beans through a downtrend. The USDA lowered US 22/23 exports by 15 million, but no other old or new-crop demand changes were made. These higher stocks advanced 23/24 stocks by similar amount. The World Board did drop Argentina’s 2023 crop by 2 mmt to 25 mmt, but they also upped Brazil’s output by 1 mmt to156 mmt. With only an 840,000 ton jump in bean’s world stocks, the rumors of higher European sales carried the day.

US corn’s old-crop export were cut by 50 million bu because of China’s cancellations & sluggish sales. However, reductions in US imports (-25 million) & food demand (-10) limited old-crop’s stock increase to 35 million. With no 2023/24 demand changes, corn’s higher beginning stocks boosted 2023/24 carryover by similar amount. The USDA did slice Argentina’s crop by 2 mmt, but upped Brazil estimate by 2 mmt this month. Overall, the USDA’s 23/24 world ending stocks were upped just 1 mmt to 314 mmt.

What’s Ahead:

The upcoming June 30th US acreage and quarterly US grain stocks are important reports for US grain prices. However, the current low initial corn & soybeans crop ratings makes the Central US rainfall a very important price factor ahead of these USDA reports.

Hold remaining corn and bean sales at 90% and new-crop sales in their 20-30% range.

More By This Author:

US S&D Changes Will Be Modest, But Central US Weather Holds Price Key

Lower US/World Wheat Crops, USDA Optimistic On Corn & Beans

A Big US Crop & Lower Exports Vs. The Size Of Brazil’s 2nd Crop

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more