A Big US Crop & Lower Exports Vs. The Size Of Brazil’s 2nd Crop

Photo by Wouter Supardi Salari on Unsplash

Market Analysis

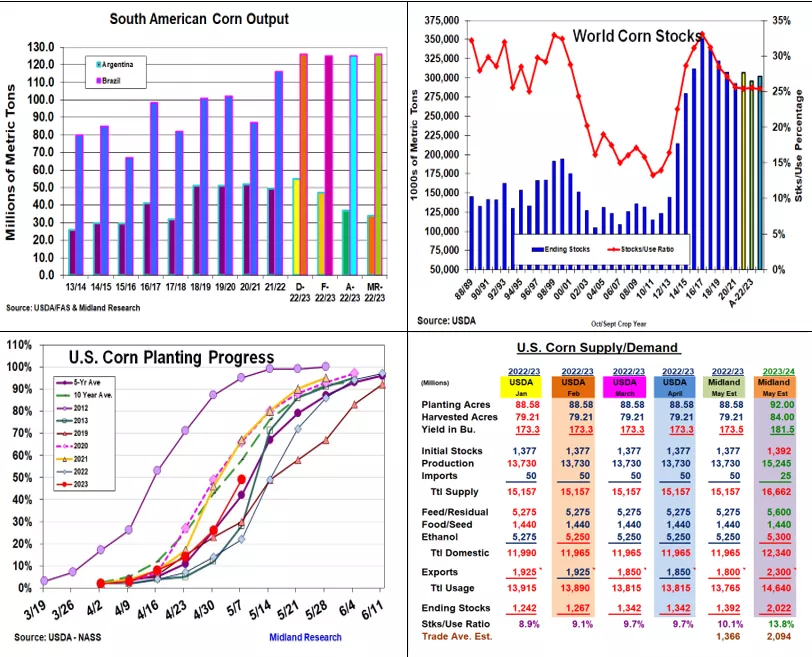

A set of conflicting events are occurring as the 2023/24 feed grain growing season begins. In trade, China has recently canceled US corn purchases while the Black Sea shipping agreement doesn’t appear it will be extended. A building El Nino weather trend suggests stronger N AM yields are ahead while Argentina’s drought could cut its May 2023 output. In plantings, open central US conditions have prompted an above-normal planting pace while wet soils in the North & dry soils in the SW could prompt larger prevent planting areas than 1st projected. Overall, plenty of uncertainty remains ahead for the USDA’s May 12 US & World reports & balance sheets for 2022/23 & 2023/24.

Previous S-American projections and limited positive reports suggest Argentina’s 2023 crop could drop another 3 mmt to 34 mmt in May’s USDA update. With Mato Grasso’s safrina corn crop in the midst of its pollination, no USDA change in Brazil’s 125 mmt forecast is expected. Some signs of an early retreat in Mato Grasso rainy season are a bit disconcerting for Brazil’s final corn output. The USDA may dip old-crop world stocks slightly because of Argentina’s issues, but their strong 2024 US crop estimate & other countries rebounding has the trade upping 2024’s world stocks 12 mmt to 307,5 mmt.

This spring’s mixed bag of cold & wet soils in the Northern areas, dry soils in the SW, and benign central Corn Belt conditions advanced this week’s plantings by 23% to 49%. This is 7% higher than the 5-yr average. However, hefty weekend rains from the SW to the N Plains could complicate 2023’s final plantings with just 5.2 million of the current 18 million Dakotas & MN seeded by last weekend. Depending upon the amount & duration of this rainfall, acres could be switched to soybeans and small grains.

China’s cancellations could drop corn’s export by 50 million & raise 2023 stocks to 1.392 billion. The USDA will utilize its AG Outlook 181.5 yield & a slightly higher 150 million demand projects 2.02 billion bu stocks. A lower yield & seedings can quickly tighten 2024’s stocks like last year.

What’s Ahead:

Despite a smaller Argentina crop, China’s cancellations and the USDA’s optimistic 2023 US crop will catch the trade’s eye. The US corn planting pace, Brazil’s safrina corn crop prospects, and Ukraine’s grain export capabilities will be major factors in the world’s corn market. Up old-crop sales to 90% at $6.10- 20 basis July and increase Dec sales to 30% at the $5.40-50 range.

More By This Author:

Pre-May US/World Soybean Update

US Corn & Soybean S&Ds Unchanged Despite Lower S Am Crops

2022 US Plantings Were Mixed, But March Corn & Bean Stocks Were Lower

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more