Pre-May US/World Soybean Update

Market Analysis

South America’s soybean output will be highly involved when the USDA revises its old-crop demand levels & initiates their first 2022/23 US/World crop & S&Ds on May 12. China’s pick-up of US bean imports after Beijing reduced their covid restrictions firmed up US export demand, but Argentina’s major drought will impacted both the world’s meal & soybean trade for the balance of 2023. This spring’s unchanged US soybean planting intentions has also added to price uncertainty for this protein with dry soils in the Central Plains & excess moisture to the North.

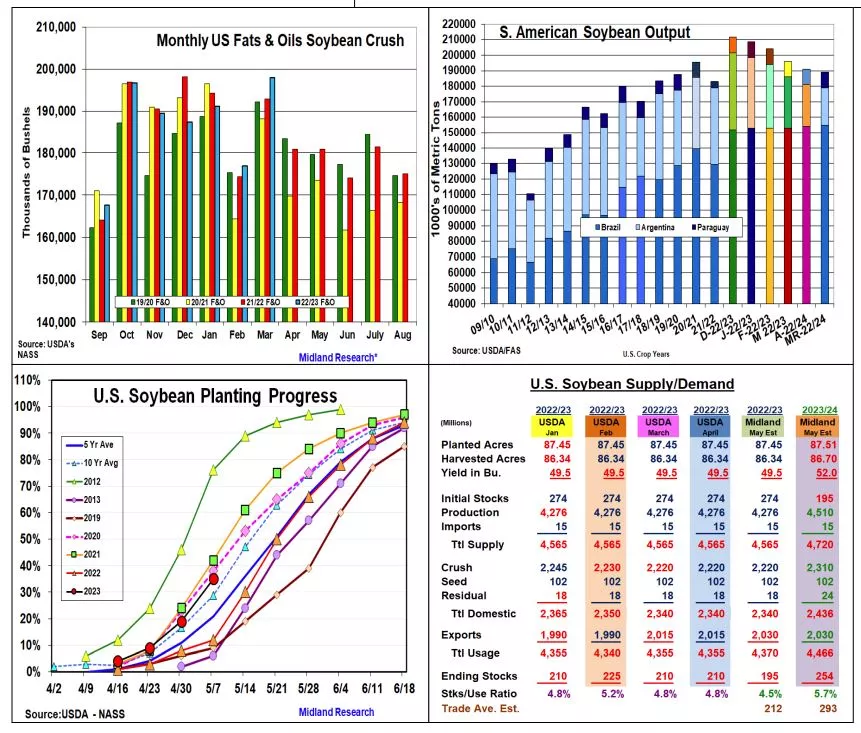

After a modest winter slowdown, March’s US soybean crush advanced to its second highest monthly level ever of 197.97 million bu and just 274,000 bu below December 2021’s all-time monthly processing level. Given Argentina’s major crop decline, meal’s overseas meal demand should stay strong the balance of the crop year even with US pork & poultry numbers slipping slightly lower the final two quarters of the year.

Last fall’s dryness delayed S America’s soybean plantings, but the Pacific’s below normal La Nina sea surface temperatures intensified Argentina’s drought. From Dec’s 49.5 mmt crop projection, the world’s 3rd largest producer’s outlook has declined by 22.5 mmt to 27 mmt last month. With initial Argentine yields poor, May’s output could be down another 3 to 24 mmt. Rio Grande’s dryness has curtailed Brazil’s output, but 2023’s crop could be up 3 mmt from Dec to 155 mmt (+ 1 mmt this month). Argentina’s smaller crop could slice the world’s stocks by 2.3 mmt to 98 mmt, but a likely rebound in S Am’s output will be in the USDA’s world balance sheet and stocks for 2023/24.

Similar to 2021, limited rainfall in the central Midwest has advanced 2023’s soybean plantings by 16% last week to 35% with IA, MO and IL over 50% done. However, excessive winter snow & spring rains have kept the Dakotas & MN seedings delayed. With just 1.5 million of the 3 states projected 19.4 million plantings completed, prevent planting concerns remain high, particularly with hefty rains being forecast for the weekend.

15 million higher exports because of Argentina, slips 2023 US stocks to 195 million. USDA keeps its US yield at 52 bu, but strong renewable diesel keeps 23/24 crush higher & stocks OK.

What’s Ahead:

Even with Brazil’s large soybean crop, Argentina’s drought damaged output has made the US spring planting period relevant to bean prices. Without an increase in US seedings & a strong US yield, the 2023/24 world supplies may not be adequate to cover expanding renewable diesel and protein demand.

Up old-crop sales to 90% at $14.60-75 and increase Nov sales to 30% at $13.00-25.

More By This Author:

US Corn & Soybean S&Ds Unchanged Despite Lower S Am Crops

2022 US Plantings Were Mixed, But March Corn & Bean Stocks Were Lower

US Planting Intentions/Q-STKS

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more