US Planting Intentions/Q-STKS

Market Analysis

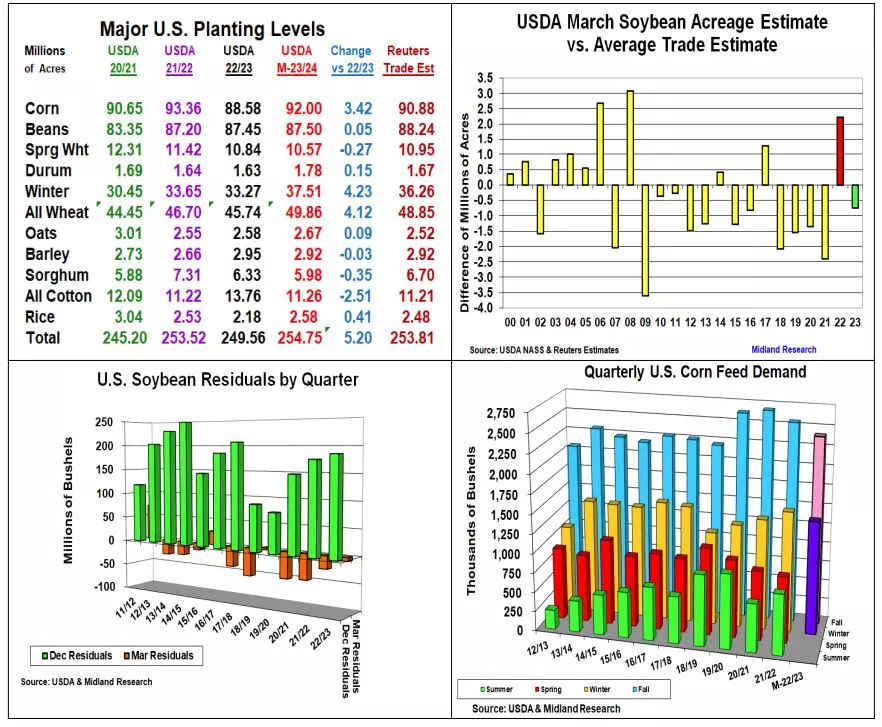

The USDA provided surprises in both US planting intentions & their quarterly stocks reports. DC’s producer survey revealed higher corn plantings & smaller soybean and spring wheat seedings than the trade expectations. The latest quarterly soybean & corn stocks were also lower than trade average estimates. Instead of a 792,000 increase, US soybean plantings are projected to be up just 55,000 acres. Corn planting intentions are up 3.42 million from last year and 1.12 million over the trade estimate at 91.996 million acres. The WCB’s area is up 1.5 million with ND 800,000 of the total. Spring wheat’s area was down 270,000 acres from 2022, but KS’s 600,000 jump in seedings while soft red plantings slipped 85,000 was totally unexpected increasing US W wheat area by 555,000 to 37.51 million. Overall, the 8 major crops plantings are forecast at 254.75 million, up 1.23 million from 2021/22 & the highest in 9 years.

The lack of increase in US bean planting wasn’t expected, but the latest stocks level at 1.685 billion bu. was a bigger surprise. This year’s stocks are 247 million lower than 2022, but this update was 57 million below the trade estimate. Using known quarterly US crush & export data, this projects last quarter’s residual disappearance of exports in transit & seed bean processing declined to less than 10 million bu from fall quarter. This suggests 2022/23’s bean crop could be 50-70 million smaller which could mean US soybean endings stocks maybe 150 vs current 210 million bu.

The USDA’s planting estimate was higher than expected, but March 1 stocks were 70 million less at 7.4 billion bu. Given the past quarter’s ethanol & export demand levels, this suggests corn’s winter feed demand was 1.45 billion bu. With smaller supplies reducing wheat and sorghum feeding, corn’s domestic demand remained at 94% of 2022’s usage level for 2nd quarter in a row. This pace suggests the USDA’s current yearly demand appears on track to achieve the USDA’s 5.275 billion yearly objective.

Winter wheat’s higher seedings suggests US yield vulnerability given the current drought in the C. & S Plains.

What’s Ahead:

The USDA’s 2023 planting intentions and March quarterly stocks updates provided some surprising turns for the markets, particularly for soybeans. Weather in the Central US & Brazil’s Mato Grasso remains important along with the Black Sea to prices. The USDA will utilize these current plantings in their 2022/23 S&Ds, but no new-crop balance sheets until their May report.

Hold sales for now.

More By This Author:

Reaction To USDA's March 2023 Prospective Plantings And Grain Stocks

Strong Ag Prices Could Return Total US Plantings To Recent Levels

Pre-March Corn Stock Update

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more