Strong Ag Prices Could Return Total US Plantings To Recent Levels

Image Source: Pexels

Market Analysis

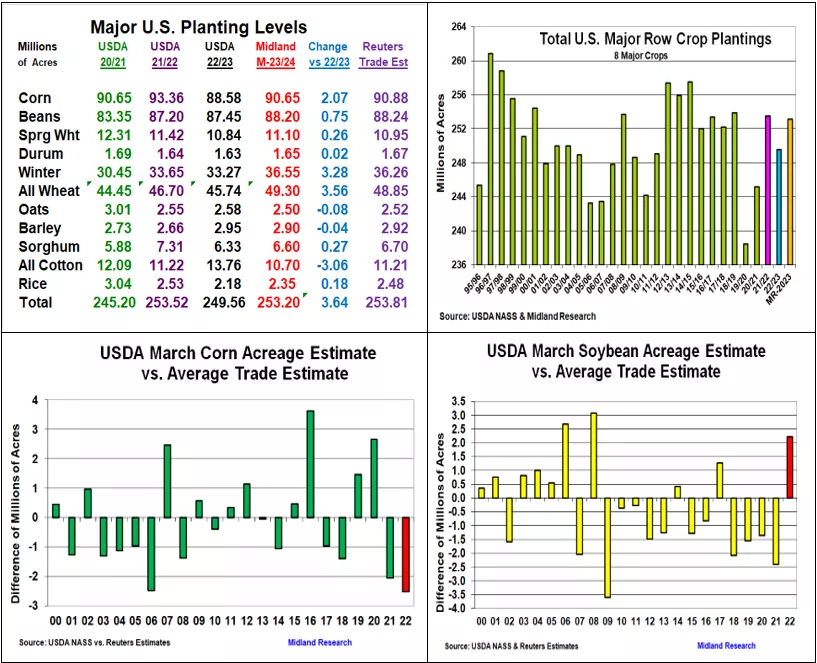

The USDA surveys US producers each March to get their planting ideas for the upcoming year. The results of this sampling will be released on March 31. Because of Argentina’s drought hurting both their corn & soybean crops and the Black Sea conflict continuing into a 2nd year, 2023’s total US seedings should rebound to the recent general 253 million level after 2022’s wet spring jumped prevented plantings in the N Plains. 2023’s US spring weather will be the final arbiter of how many & what type of crops will be planted. With the Pacific Ocean’s La Nina shifting towards an El Nino, many weather forecasters & traders are optimistic about US crop yields bouncing back after 2022’s US Plains yields were curtailed. However, the US hard red wheat region in the W Plains remains locked in an ongoing drought. The Delta & the SE’s excess moisture could delay plantings in this region. The current N Plains snowpack also reminds many of late seedings & the prevented plantings in this region last year.

Argentina’s drought-cutting yields by 40-50% from initial estimates will heighten the market’s Northern Hemisphere crop outlooks from the Black Sea, to Europe, to N America, and to finally China. Currently, there are excessive climate conditions in many parts of the world. The USDA’s February Ag Outlook Forum economic-based forecasts raised the major US crops seedings by 3.87 million to 253.3 million acres after 2022’s N Plains flooding cut plantings by 3.94 million. Lower fertilizer & energy costs suggest many of 2022’s prevent plantings will increase corn by 2.07 million to 90.65 million acres. Lower input costs vs corn & WCB dryness could boost soybeans by 750,000 acres to 88.2 million. Ongoing W Plains dry- ness could slip winter wheat’s area and prompt more sorghum plantings. The biggest down occurs in cotton because of prices and last fall’s higher HR wheat seedings.

Interestingly, US corn plantings have swung sharply on both sides of the trade ideas over the past 8 years while their soybean level has been too high 6 out of the last 8 years.

What’s Ahead:

The USDA’s Planting Intentions report has produced some unexpected surprises over the years. This year’s soybean trade planting range of 2.3 million acres is the lowest since 2007 suggesting Friday’s actual Ag Depart number could be outside of expectations. Corn’s estimate range is 4.4 million, the largest since 2009. Hold old-crop corn & soybean sales at 80% with your new-crop sales at 10-15%.

More By This Author:

Pre-March Corn Stock UpdateStrong 1st Half Exports & A Smaller US 2022 Crop Tightens Stocks

March S&D Updates: Despite Big Cuts In Argentina Crops, Modest World Stock Changes

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more