Strong 1st Half Exports & A Smaller US 2022 Crop Tightens Stocks

Photo by James Baltz on Unsplash

Market Analysis

For the 2nd year in a row, South America’s crop prospects & the Black Sea conflict have been the market’s focus over the Northern Hemisphere’s winter. La Nina’s continued impact on Argentina and southern Brazil’s soybean output because of ongoing heat & dryness has many S American analysts & exchanges cutting Argentina’s crop by nearly 50% from their initial expectations to the current 25-29 mmt soybean outlook. The strong US dollar, China’s measured reopening of their economy from the Covid pandemic, and the last year’s US Avian flu outbreak that significantly cut- back the US laying flock have combined to curtail demand. All these issues along with a smaller US 2022 crop will be a part of the USDA’s quarterly soybean stocks report being released on March 31. The US planting intentions will also be announced on that day getting plenty of market attention. Expanding US renewable diesel demand that utilizes soybean oil, lower crop inputs than corn, and the current tight domestic supplies suggest a boost in US bean plantings if this spring’s weather cooperates.

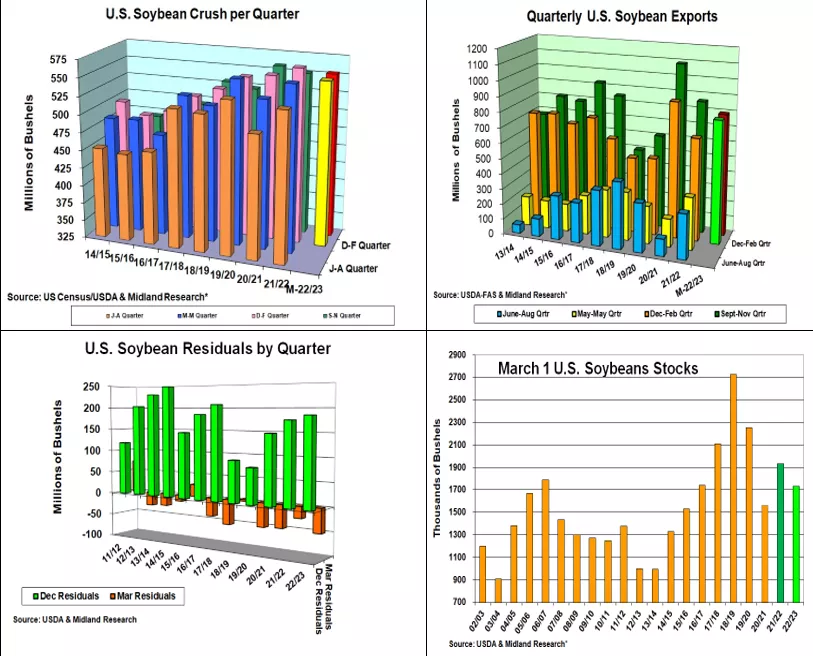

After a record 2nd quarter US soybean processing pace last year, December’s extreme US cold spell & reduced US hog & poultry numbers this past winter likely slipped the US crush by 2.5% to 553 million bu this quarter. This year’s first-half processing demand is 12 million lower than 2021/22.

However, Argentina’s sharply lower crop could open up US export meal demand in the 2nd half of this year.

Argentina’s drought issues jump US export shipments during January & February. Overall, 2022/23’s 2nd quarter exports likely rose 128 million bu to 794 million vs last year. Interestingly, this projects the same rate as this year’s first quarter. Overall, 2023’s 1st half of US export shipments appear to be 50 million larger than 2021/22 at 1.587 billion bu.

This year's strong exports & smaller US crop project a 197 million smaller March 1 stocks at 1.735 billion bu. Last fall’s 185 million bu residual prompted us to project a 56 million smaller level this winter. This is the combination of export supplies in transit & soybeans moving to seed firms.

What’s Ahead:

The USDA’s March 1 soybean stocks will be the first check if 2022’s crop size is on target. This quarter’s residual and June’s quarterly stocks will determine if a crop size change is needed. 2022’s planting intentions will get plenty of attention on March 31, but the perceived size of 2022’s crop & soybeans’ demand rate remain important. Hold old-crop sales at 80% & have 10-15% of your 2022 output priced.

More By This Author:

March S&D Updates: Despite Big Cuts In Argentina Crops, Modest World Stock ChangesPre-March US/World S&D Reports

In Grains South America’s Weather Is The Focus

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more