Pre-March Corn Stock Update

Market Analysis

The corn market’s focus will be split on March 31 between the USDA’s prospective plantings & quarterly stocks reports next week. The US’s 1st survey-based planting intentions each year normally gets the most attention, but the US quarterly stocks are important updates on how US demand has performed during in the 1st half of the crop year.

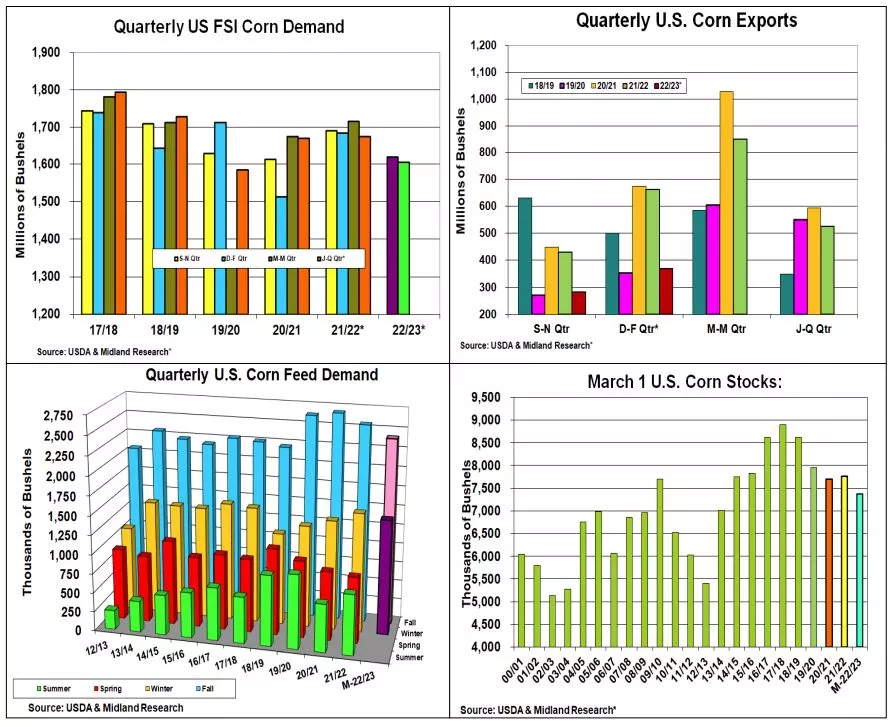

After a lackluster fall quarter, corn’s 22/23 winter quarter FSI (ethanol) corn demand continued its sluggish output as high US gasoline prices reduced overall driving & lower processing margins reduced this domestic demand. This year’s 1.34 billion smaller US crop and tight producer marketing were behind the higher costs reducing corn usage. This year’s 2nd quarter food, seed & industrial demand likely declined by 5% to 1.605 billion bu vs last year. A cold December snap also reduced last quarter’s bio-fuel output when many Central US plants missing a production cycle.

With China reemerging from their Covid shut-downs and US/Mexico trade tensions this winter, this year’s seasonal increase in winter corn exports were modest. During the 2nd quarter, shipments were up just 88 million to 370 million bu. However, exports were down 45% from 2022’s 662 million bu pace. China adjusting their sanitary import regulations & taking some test shipments from Brazil suggests competition from S America is on the horizon. However, China’s recent 2.6 mmt (102 million bu) corn purchases to cover needs before Brazil’s safrina exports begin shipping in late summer is a positive for US 2nd half export demand.

US cattle feedlot numbers & hog slaughters have been running 4-5% behind last year’s data suggesting this past quarter’s corn feed demand will be down vs 2022. Reduced wheat and other feedgrains substitution & smaller distiller’s dry grain supplies because of lower 2nd quarter ethanol output will counter lower livestock numbers in corn’s feed demand. These factors put our 2nd quarter corn feed demand at 1.48 billion bu, down 4% from last year. Overall, 2022’s March 1 corn stocks are projected at 7.37 billion, down 390 million from last year & the smallest in 8 years.

What’s Ahead:

The upcoming March stocks will provide more insights into the size & the quality of the 2022 US corn crop. The size of this quarter’s stocks also monitors the level of this year’s feed demand. 2023’s US planting level is important, but Brazil’s safrina corn output could be a big price factor ahead of the US growing season. Hold your final 20% of the 2022/23 crop and keep your 2023/24 sales at 10-15% for now.

More By This Author:

Strong 1st Half Exports & A Smaller US 2022 Crop Tightens StocksMarch S&D Updates: Despite Big Cuts In Argentina Crops, Modest World Stock Changes

Pre-March US/World S&D Reports

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more