US Corn & Soybean S&Ds Unchanged Despite Lower S Am Crops

Image Source: Pixabay

Market Analysis

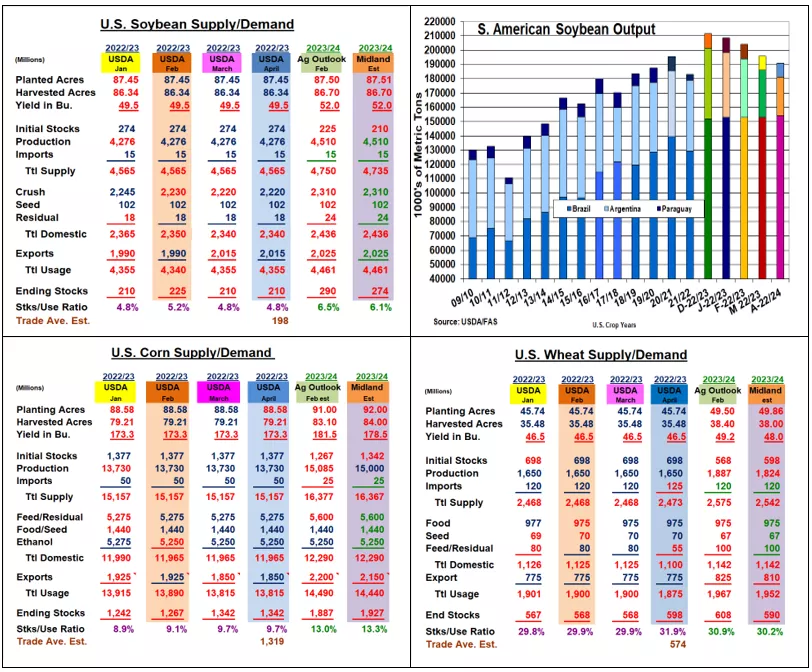

In somewhat of a classic move, the World Board left both their US corn & soybean 2022/23 supply/demand data unchanged despite both crops’ stocks being below the trade’s March expectations. The USDA did up wheat’s 2022/23 carryover by 30 million bu by reducing wheat’s feed demand to reflect this crop’s larger quarterly stocks.

After last month’s 3.3% lower-than-expected March quarterly stocks, all eyes were focused on the USDA’s 2022/23 soybean ending stocks. Instead of a 10-15 million smaller carryover, the World Board left its 2022/23 S&D unchanged. The USDA didn’t up exports or increase their residual demand to reflect last month’s 30 million bu difference actual & the calculated March demand. It appears they are optimistic about finding these lost bushels so kept 22/23s stocks unchanged. This year’s March residual demand being at 156 million bu, the highest in 7 years, suggests 2022’s US yield could be over-estimated. Interestingly, the USDA did lower Argentina’s crop by 6 mmt to 27, but upped Brazil’s crop by 1 to 153 mmt. 2023’s 22.5 mmt decline in Argentina’s output from December (45.5% drop) didn’t up US exports or change the USDA’s world stocks that stayed at 100 mmt this month.

The USDA’s unchanged 22/23 corn stocks wasn’t as big of a surprise given this feed grains 70 million bu lower March stocks. Since a high portion of corn’s feed demand comes from on-farm supplies, waiting until June’s data to revise this demand or make a call about crop size seems appropriate. S Am’s overall output was near estimates with Argentina down 3 mmt to 37 while Brazil was unchanged at 125 mmt. Similar to beans, the USDA sliced only 1 mmt from their world stocks to 295.4 mmt despite their lower S AM crop ideas. The USDA upped its wheat imports by 5 million while de- creasing feed demand by 25 million to reflect March’s higher stocks than expected. 2023’s 598 million US wheat stocks remain at their lowest level since 2013/14. With numerous reports of US Plains wheat fields being zero-out because of the current drought, the market focus will be quickly returning to the US new-crop prospects.

What’s Ahead:

After no USDA demand changes for soybeans and corn, the market focus will now switch to 2023/24’s US and World crop output potential. Russia’s chatter about leaving the Black Sea Corridor deal adds to market nervousness. Looking to add 10% in May sales at $15.35-50 & $6.70-80 and 20% for Chicago May wheat at $7.30-45. Move new-crop bean and corn sales to 30% at $13.60 and $5.80.

More By This Author:

2022 US Plantings Were Mixed, But March Corn & Bean Stocks Were LowerUS Planting Intentions/Q-STKS

Reaction To USDA's March 2023 Prospective Plantings And Grain Stocks

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more