US S&D Changes Will Be Modest, But Central US Weather Holds Price Key

Image Source: Pexels

Market Analysis

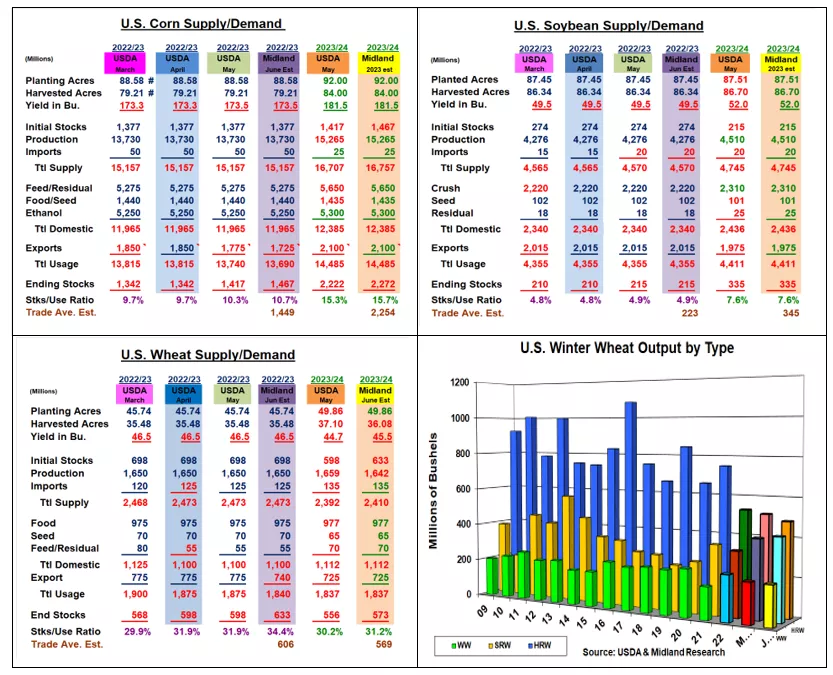

The upcoming June US balance sheets traditionally have had minimal changes after the USDA issued its May US & World new-crop supply/demand tables. Adding to the World Board’s stay-the-course approach are the upcoming June 30 acreage & quarterly grain stock reports. These two reports are highly important to the size of 2023 crops and help determine corn & wheat’s past quarter’s feed demand.

Despite these past tendencies, the upcoming US corn balance sheet will likely reveal higher ending stocks for both old and new crop years. China’s recent old-crop corn cancellations & reports of higher wheat utilization in their feed rations suggest that.US 2022/23 exports will be cut by 50 million bu. Heavy rains in China’s wheat province damaging 30 mmt of its 2023’s 120 mmt crop suggests this trend continues in 2023/24. With US ethanol production on the upswing for summer driving, no change in this demand is likely. Given 2023’s small US hard red wheat crop, the USDA won’t change its feed demand either. Overall, corn’s stocks could rise 50 million bu in both years.

US old-crop soybean ending stocks are expected to stay at 215 million. However, US exports have slowed their pace because of strong Brazilian exports. Continued reports of poor Argentine yields likely dropping the USDA’s 27 mmt forecast to 24-25 mmt suggest no change in US exports.

With a record monthly US crushing pace this spring, no change in this demand is expected either. Without any monthly change in US 2023/24 crop size which is normal, 2024’s USDA stocks should remain unchanged.

Wheat’s US 2023 stocks could rise 35 million bu because of sluggish late-season exports & shipments. Numerous KS tour yields under 10 bu has us concerned about a hefty cut in harvested acres cutting hard red’s US output to 484 million (-30). However, an IL wheat tour had record yields suggesting ECB soft red will be up 15 million. Oregon dryness may slice 2 million for a PNW dip to 208 million. Overall, W. wheat’s 17 million crop decline will limit wheat’s overall US stocks increase to 17 million & 573 million bu June level.

What’s Ahead:

Black Sea corridor issues, Argentine crops continue to shrink, US Plains drought slicing the winter wheat crop & dryness impacting the Central US corn & soybeans ratings have firmed prices the past few weeks ahead of USDA’s June report. It’s early for a lasting weather impact on US crops, but 2023’s crops are off to a shaky start. Hold old-crop corn & bean sales at 90% & new-crop sales at 20-30%.

More By This Author:

Lower US/World Wheat Crops, USDA Optimistic On Corn & BeansA Big US Crop & Lower Exports Vs. The Size Of Brazil’s 2nd Crop

Pre-May US/World Soybean Update

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more