Record US Crush & Solid Exports, But Focus On US Midwest Weather

Photo by Kelly Sikkema on Unsplash

Market Analysis

With this year’s 2 previous US quarterly soybean stocks being below the trade’s estimates, next week’s USDA June 30 report will have more attention than normal. This year’s 1st half of soybean processing & export demands were on solid & strong paces until the world switched focus to S America’s prospects this past spring. Argentina’s devastating drought that cut their output by over 50% & slashed their soy product output has boosted the US processing demand. However, Brazil’s record soybean crop & aggressive overseas sales have slowed US export sales & shipments this past quarter.

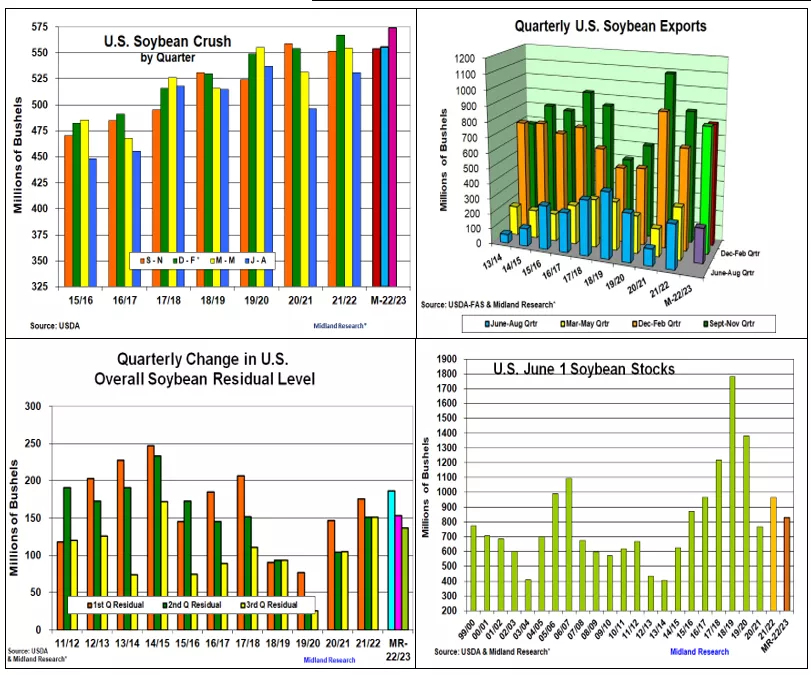

May’s US (NOPA) processing pace posted its third monthly record output of 177.9 million bu. last month. This suggests 2023’s 3rd quarter soybean crush will be 574 million bu, 7 million bu higher than the previous record quarterly crushing pace in last year’s winter quarter. Overall, 2022/23’s US processing pace through the first three quarters is projected at 1.683 billion bu. or 10 million larger than last year. To reach this year’s USDA crush forecast, this summer’s processing pace needs to be 537 million bu or 179 million bu per month. This seems doable with the last 9 months averaging 187 million bu. Expanding US domestic renewable diesel demand & Argentina’s sharply reduced soy product exports because of their lower output also seems to support this outlook.

After Brazil’s 20 mmt shortfall in their 2022 soybean output, the US first-half shipments strengthen by 122 million bu to 1.61 billion bu this year. This was the third highest first six-month pace for US soybean exports. However, this year’s record Brazilian bean crop & aggressive marketings because of inadequate storage has curtailed US export shipments to 227 million this past quarter, down 113 from 2022. Current export sales are about 100 million below the USDA’s 2.0 billion forecast while weekly shipments this summer need to average 12.6 million bu to reach this goal.

After no quarterly US spring residual decrease in the past 4 years, we anticipate a 16 million bu decline because of commercial operations shifting back to normal. Overall, this spring’s June soybean stocks are forecast at 830 million bu.

What’s Ahead:

The EPA threw a wrench into the soy complex the past few days with its modest biofuel upward adjustment, but the upcoming June 30th quarterly stocks and US acreage levels remain important to soybeans and their product prices. Dry weather has boosted prices, but August determines bean yields. Market your last 10% with August in the $14.15-25 area & have Nov sales at 35-40% above $13.30-40.

More By This Author:

US & World Weather Factors Remain Key For Limited US Wheat Crop

US S&D Changes Will Be Modest, But Central US Weather Holds Price Key

Lower US/World Wheat Crops, USDA Optimistic On Corn & Beans

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more