Ford To Layoff At Least 1,000 Workers, EV Startup Lordstown Motors Dies

Other than Tesla, the EV business in the US is struggling. Ford’s layoffs will significantly affect its North American engineers.

Ford Plans to Lay Off at Least 1,000 Contract and Salaried Workers

(Click on image to enlarge)

Ride chart courtesy of Stockcharts.Com.

The Wall Street Journal reports Ford Plans to Lay Off at Least 1,000 Contract and Salaried Workers

In internal meetings Monday, Ford began notifying some salaried workers in North America that job cuts would be coming, a company spokesman confirmed Tuesday morning.

This latest reduction of Ford’s white-collar workforce includes employees in its electric-vehicle and software side of the business, the company spokesman confirmed. The cuts will also affect workers in the automaker’s gas-engine and commercial-vehicle divisions, he said. Managers at the company held meetings Monday in which they informed employees that layoffs were coming and that affected teams should work from home for the rest of the week, a company spokesman said.

Ford’s annual costs are $7 billion to $8 billion, too high relative to rival automakers, executives have said. To eliminate this cost gap, the company is streamlining its supply-chain spending, reducing complexity in its vehicle lineup and clamping down on warranty costs, executives have said. Ford has said it expects to lose $3 billion in operating profit on its EVs business this year. While executives at the automaker have said profits from its gas-engine operations would sustain the business in the midst of these losses, some analysts have questioned whether the automaker would require additional funding.

Lordstown Motors Dies

Also note As Lordstown Motors Dies, Lordstown’s EV Business Survives

Electric-vehicle startup Lordstown Motors wants a buyer for its pickup truck, the Endurance. To clear the asset of “legacy issues,” it sought bankruptcy protection on Tuesday, a sorry step for a company whose purchase of General Motors’ redundant factory in Lordstown, Ohio, made it an unlikely darling of the Trump administration. The stock fell 30% in early trading.

The company is now pitching the Endurance not to vehicle-fleet buyers, but as a “springboard” to other manufacturers that might want a ready-designed electric pickup. Its value is doubtful given the Endurance’s history, which has included battery fires, quality issues and a recall—all before it entered full-scale production.

Another question for the residual value of Lordstown Motors is the merit of the legal case it kicked off Tuesday against Foxconn. The contract manufacturer turned from white knight to foe for Lordstown when Foxconn withheld a promised slug of investment earlier this year, claiming breach of contract.

The Journal comments “Lordstown Motors is now in the hands of lawyers and bankers. But don’t write off the Lordstown EV business.”

Indeed, especially when Biden is going to mandate building EVs no matter what they cost to the manufacturer or consumers, whether consumers want them or not.

Ford Gets a $9.2 Billion Cheap Government Loan With Inflationary Strings Attached

Please note that Ford Gets a $9.2 Billion Cheap Government Loan With Inflationary Strings Attached. So not even $9.2 billion is enough to make Ford profitable.

Most likely, its due to the strings like profit-sharing and child-care mandates. And the Wall Street Journal comments “The Mercatus Center’s Christine McDaniel estimates the IRA battery production tax credit will cost $152.8 billion—more than five times as much as Congress’s Joint Tax committee estimated last year.“

The UAW Demands a “Just Transition” to Electric Vehicles

Biden is hell-bent on socializing the auto industry to his liking. And the socialists are pleased. Ford has already agreed to a union “neutrality” agreement at the battery factories that will make it easier for the United Auto Workers to organize workers.

Everything Biden does adds inflation pressures.

Note that the Inflation Reduction Act Price Jumps From $385 Billion to Over $1 Trillion. That’s just a start.

And if you missed it, please see Hoot of the Day: The UAW Demands a “Just Transition” to Electric Vehicles

But don’t worry. If the vehicles cost too much, Biden’s inflation reduction solution is sure to be more free money subsidies. There’s nothing like free money to artificially boost jobs and create inflation along the way.

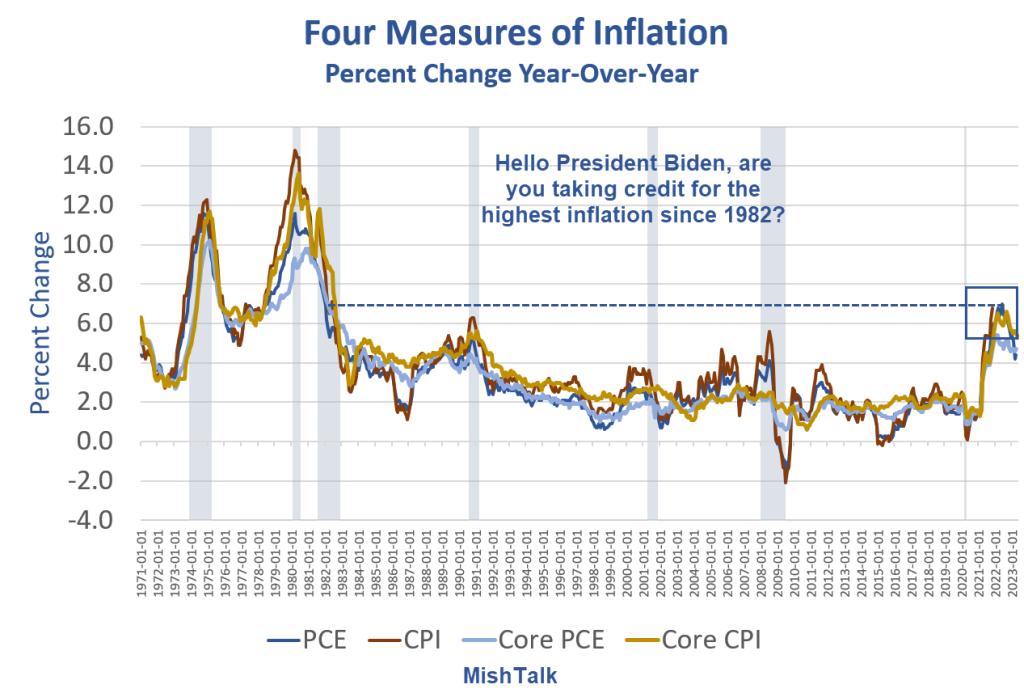

Four Measures of Inflation

CPI and PCE inflation data from the BLS and BEA respectively. Chart by Mish.

Of course, the Fed had a hand in inflation. The Fed had a hand in job creation as well.

But if Biden is going to take 100% credit for creating jobs, I suggest he take 100% of the credit for creating inflation as well.

For discussion, please see Disingenuous Claims by President Biden on the Number of Jobs He Created

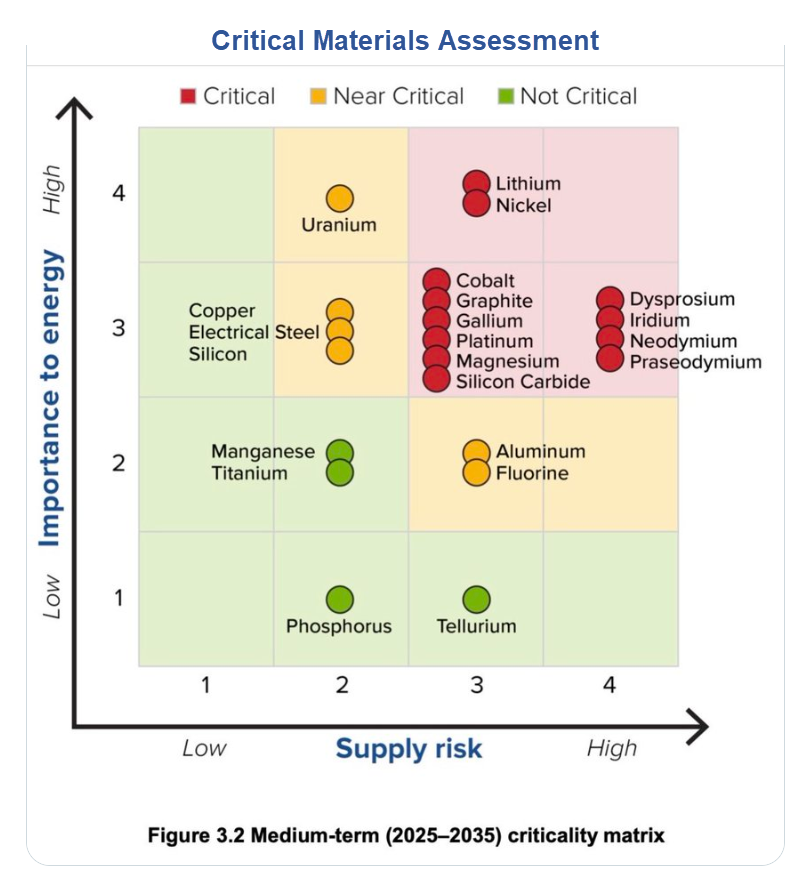

What About Minerals for the Batteries?

No one yet has factored in the cost of minerals to make the batteries. EVs will not go from 3 percent of sales to a Biden-mandated 67 percent with the price of the needed metals and rare earth elements to stay flat.

For discussion, please see Critical Materials Risk Assessment by the US Department of Energy

Yep, Biden’s own energy department is issuing mineral warnings.

And by the way please note Biden’s Solar Push Is Destroying the Desert and Releasing Stored Carbonhttps://mishtalk.com/economics/bidens-solar-push-is-destroying-the-desert-and-releasing-stored-carbon/

All in all, it’s a brilliant plan on numerous fronts simultaneously, to create more inflation, just what the Fed wanted for years, but now doesn’t.

More By This Author:

Disingenuous Claims By President Biden On The Number Of Jobs He Created

Largest Ever 6-Month Decline In Price Explains The New Home Buying Surge

A Surge In Durable Goods Orders Is Fueled By Motor Vehicles And Parts

Disclaimer: Click here to read the full disclaimer.