Thoughts For Thursday: Profit For The Taking

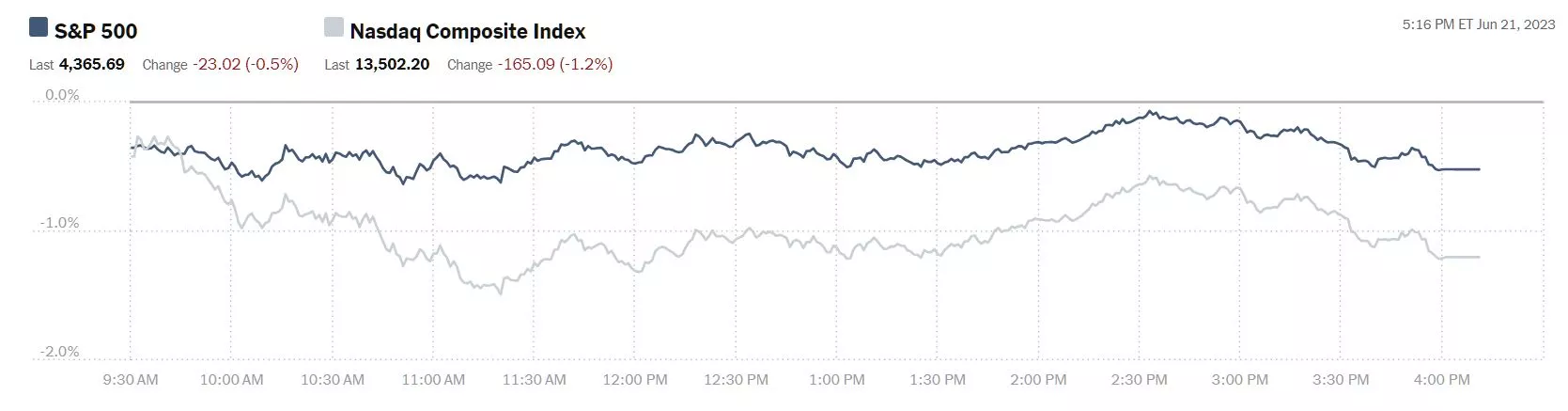

In the two days following the return from the Juneteenth holiday the market seems to be concerned with trimming prices and taking profits, particularly in the Nasdaq.

While nothing major yet, seems like the technical traders are busy at trying to cool off the likes of hot Nvidia and AMD. Tesla continues in its most active game of sometimes up and sometimes down.

Wednesday the S&P 500 closed at 4,366, down 23 points, the Dow closed at 33,952 down 102 points and the Nasdaq Composite closed at 13,502, down 165 points.

Chart: The New York Times

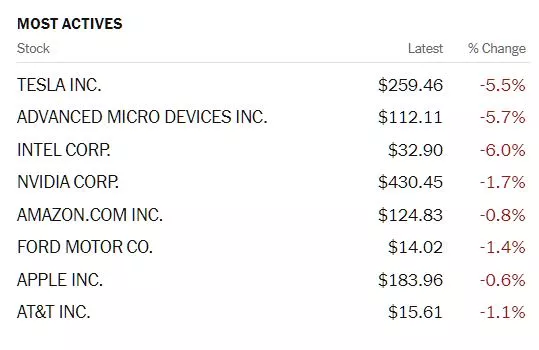

Most actives were led by Tesla (TSLA), down 5.5%, followed by Advanced Micro Devices (AMD), down 5.7%, and Intel (INTC), down 6.0%.

Chart: The New York Times

Currently in morning futures activity, S&P 500 market futures are down 10 points, Dow market futures are down 64 points and Nasdaq 100 market futures are down 44 points.

Before wading too far into the weeds, yesterday, Fed Chair Jerome Powell testified before the House Committee on Financial Services on Capitol Hill. TM contributor Martin Armstrong highlighted Powell's remarks in his Wednesday evening Market Talk feature.

"Federal Reserve Chairman Jerome Powell has affirmed that more interest rate increases are likely ahead as inflation is “well above” where it should be, and the process of getting inflation back down to 2% has a long way to go. Powell said the labor market is still tight, though there are signs that conditions are loosening. The Fed has pledged to leave interest rates near zero for years, through at least 2023, and will tolerate periods of higher inflation as they try to revive the labor market and economy. Powell has also indicated that the Fed may need more aggressive interest rate hikes to fight inflation. However, Powell has also said that stresses in the banking sector could mean that interest rates won’t have to be as high to control inflation. The Federal Reserve kept its key interest rate unchanged on June 14, after having raised it 10 straight times to combat high inflation, but signaled that it may raise rates twice more this year, beginning as soon as next month."

And now into the weeds...

TM contributor Wajeeh Khan writes that Google Just Filed A Complaint Against Microsoft Azure.

"In a letter it sent to the Federal Trade Commission on Wednesday, the tech behemoth accused Microsoft of employing unfair licensing terms to exercise control over the cloud space...

With overly complex agreements that seek to lock in clients to their ecosystems, [they] are forcing customers toward a monolithic cloud model.

Azure currently has about a 23% market share in global cloud infrastructure versus 10% for Google Cloud. “MSFT” is up 40% for the year at writing.

Google also dubbed the attempt from Microsoft to control the cloud space a meaningful threat both in terms of national security and cybersecurity.

In its complaint to the Federal Trade Commission today, the California-based company accused Microsoft Corp of unfair practices that it said were:

Also limiting choice, increasing costs for customers, and disrupting growing and thriving digital ecosystem in the United States and around the world.

An FTC spokesperson refused to comment on the news. It is noteworthy that Google (GOOGL) itself was sued this week by Gannett – the largest newspaper publisher in the U.S. for its monopoly in online advertising. Google shares are currently up nearly 35% versus the start of the year."

Stay tuned.

Contributor Doug French suggests After The Debt Ceiling Deal: Look For Liquidity Problems In The Markets.

"Everything seems to be lining up perfectly for individual investors with Joe Biden and Kevin McCarthy making a debt ceiling deal...But that same debt ceiling fix will unleash a torrent of US Treasury issuance that will overwhelm the markets leaving stock investors in its wake. Cem Karsan of Kai Volatility Advisors told Maggie Lake on Real Vision, “By most estimations . . . we’re going to have to issue $1.4 trillion in debt before the end of the year. That is a massive sucking sound out of asset markets.”

“There’s got to be buyers of that debt,” Karsan said, stating the obvious, “which means that money is going to come from somewhere. And if that means interest rates go higher, as that supply comes on the market, demand has to be met. That means equity markets or somewhere else, some other risk asset has to reduce liquidity.”

"Falling commercial real estate prices are infecting other things, leading to disruptions in the market, which leads to a lack of liquidity and more risk aversion. And more risk aversion means more lack of liquidity in these markets. Don’t count on the Fed to fix this mess. As Jeff Snider said, “The Federal Reserve and central banks are always looking backwards. They don’t see these things coming so there’s no help from them either. And pretty soon before you look around, markets are illiquid. Banks are struggling for funding. Some more of them are failing.”

Lyn Alden is another who is being kept up at night worrying about liquidity. She tweeted on June 1, “However, now that the Treasury cash drain is finished, and we start looking ahead past the debt ceiling, we are potentially encountering the next period of negative liquidity (rather than sideways liquidity).”

She wonders what will break next. Last September it was the United Kingdom gilt market and nearly the US Treasury market. In March a few regional banks with unusually high duration exposure and uninsured deposit exposure failed, and now she says we have to watch the small banks and the Treasury market.

Jeff Snider has his eye on September for a liquidity crisis. “So, if you’re thinking ahead, there’s probably a really good chance that something happens in September, if not beforehand.” Karsan echoes that view: “It’s not a coincidence that mid-August into mid-September is often a scary time.”"

See the full article for additional examples, but none of this is good for the stock market according to French.

In a TalkMarkets Editor's Choice column, contributor Lance Roberts reminds us that Speculation In A.I. May Face Challenges.

"The current market speculation surrounding artificial intelligence (A.I.) has garnered everyone’s attention. You can’t turn on a television or pick up a newspaper without a mention of “artificial intelligence.” The “F.O.M.O.” (Fear Of Missing Out) in stocks associated with developing and implementing artificial intelligence is evident. The chart below shows the performance differential between the basket of the big “7” stocks associated with A.I. versus the S&P 500 and the Small/Midcapitalization Russell 2000 indices."

![]()

"Companies are not oblivious to the investor flows into their corporate stock and are jumping on the bandwagon as well to hype the speculation by mentioning “artificial intelligence” in earnings reports and press releases. As shown below, the number of mentions of artificial intelligence has soared in recent months.

“Of these companies, 110 cited the term “AI” during their earnings call for the first quarter. This number is well above the 5-year average of 57 and the 10-year average of 34.

In fact, this is the highest number of S&P 500 companies citing “AI” on earnings calls going back to at least 2010 (using current index constituents going back in time). The previous record was 78, which occurred in the prior quarter (Q4 2022).

At the sector level, the Information Technology (38), Industrials (17), and Communication Services (15) sectors have the highest number of S&P 500 companies citing “AI” on Q1 earnings calls, while the Communication Services (75%) and Information Technology (66%) sectors have the highest percentages of companies citing “AI” on Q1 earnings calls.” – FactSet...

All of this is interesting because we saw much the same in 1999 as companies rushed to jump into the “internet boom” that would change the world...

While the current speculation can last much longer than logic, or valuations, would dictate, reality will eventually matter. For now, the speculation is supported by the dreams of a new A.I. world with endless possibilities. The belief is that EVERY company will eventually buy products from the likes of NVDA and MSFT, which will provide a massive surge in earnings. However, there are some significant challenges to that thesis.

“The barriers to entry are massive in terms of IP, capital, and established industry relationships. The investment that companies will need to make to be successful in AI is enormous, and only a handful of companies can afford that investment.

I think it’s reasonably similar to the cloud, where GOOG, MSFT, and AMZN have become the dominant players because they have the capital in what is also a capital-intensive game. Similar idea for NVDA et al. here for AI.” – Jim Covello via Goldman Sachs...

There is nothing wrong with speculating in these names while speculation runs rampant. However, just remember that eventually, reality will prevail. So, from an investor’s view, don’t get too greedy and forget to sell."

Wise words those last eight. See Roberts' full article for additional history lessons.

Closing out today's column with another TM Editor's Choice piece, contributor James Picerno notes the Tech Sector Is Hot, But Returns Vary Widely Across ETFs.

"Technology is the strongest equity sector to date in 2023, but how you define tech matters for evaluating performance, risk, and other factors. That’s tougher than it sounds because there are more than 90 ETFs in this space, according to ETFdb.com.

For some perspective on the choices available and how results vary, CapitalSpectator.com zooms in on ten of the largest ETFs in the tech sector. The data source is ETFdb.com — you can find the full list here. As a first look, here’s a subset of funds selected from the 25-largest (based on assets under management). The table below attempts to minimize overlap by listing one fund for any given focus within tech. For example, there’s only one semiconductor industry ETF listed.

The main takeaway: tech ETFs vary on multiple dimensions, including performance, holdings, and risk. For example, the table above sorts funds by year-to-date return, which ranges from the top-performing VanEck Semiconductor (SMH) — up more than 50% so far in 2023 — to the relatively modest 13% year-to-gain for Defiance Next Gen Connectivity (FIVG). Note, too, that the degree of concentration in the top-10 holdings varies substantially, from more than 70% for XLK to under 20% for the equal-weighted tech fund RSPT."

Before we go, this just in from our "Where To Invest (For Thrill Seekers) Department". Contributor Kate Hayden writes to us about Evogene - A Company With Valuable Assets Trading At Zero Enterprise Value.

Image: Evogene.com

"Evogene is a Nasdaq and Tel Aviv listed company under the ticker EVGN. The company is both an agri-tech (agricultural technology) and bio-tech company with a computational predictive biological platform technology, which supports three AI tech-engines (GeneRator AI, ChemPass AI & MicroBoost AI)...

The company was a key holding in Cathie Wood’s ARK Genomic Revolution ETF fund (ARKG) back in 2021. However, as ARK’s funds grew significantly, ARK exited most of their smaller holdings including Evogene, and combined with the 2021-2022 market crash, the company has since taken the hit to its share price, despite prospects significantly improving versus its position in 2021-2022.

Today, with effectively zero (or lower) enterprise value, when purchasing the shares, investors today are basically buying that same amount in cash, getting all the AI technology assets contained within the company and the value in the subsidiaries for free....

While the market is valuing Evogene at its cash level at around $30 million, the conservative value of Evogene of its subsidiaries: net cash above $29m; Biomica at $38m; Lavie Bio at $57m; Canonic above $0m; AgPlanus well above $0m, and Casterra at least $100m; yields a value of well above $224 million, or well over $5 per share, versus around $0.73 today, and upside of well above 6X.

When this will eventually come, nobody knows, but the recent news at Casterra represents a very significant catalyst and ultimately value is hard to keep locked up forever."

Please see the full article for a more comprehensive work-up of Evogene.

Caveat Emptor +

Have a good one.

More By This Author:

Tuesday Talk: Market Rallies, China Worries

Thoughts For Thursday: The Pause That Refreshes?