Tuesday Talk: Market Rallies, China Worries

China worries helped spark Friday's pre-holiday correction, but overall conditions are still good in the markets. US housing data out later today are the next data points to watch.

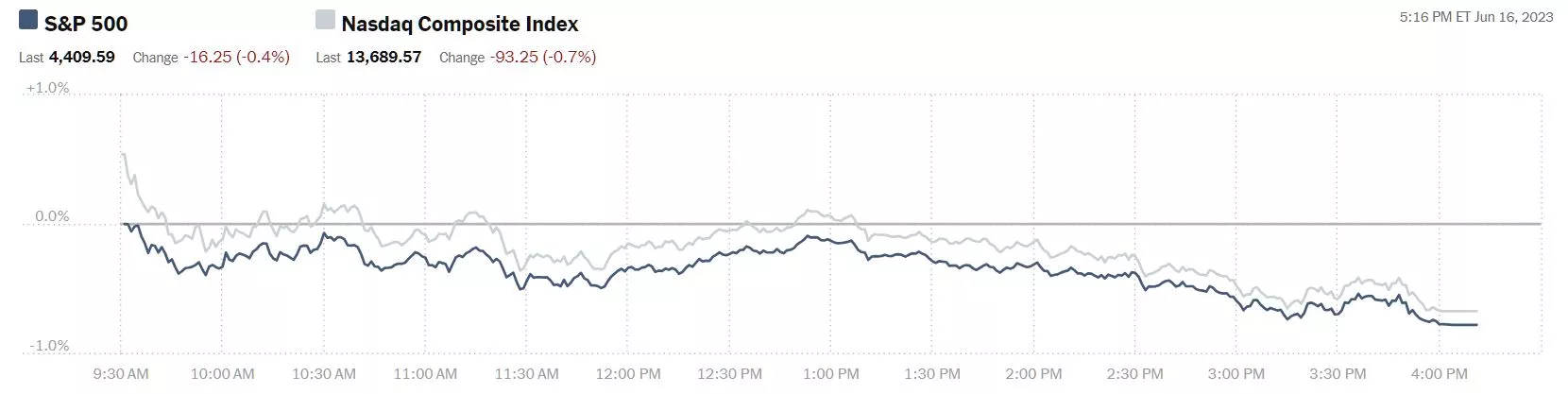

Almost old news, but not for those who made the most of the Juneteenth holiday and went fishing; on Friday the S&P 500 closed at 4410, down 16 points, the Dow closed at 34,299, down 109 points and the Nasdaq Composite closed at 13,690, down 93 points.

Chart: The New York Times

In most actives, Telsa (TSLA), +1.9%, still holds the daily title and on Friday was followed by Intel (INTC), +1.5%, and Apple (AAPL), -0.6% respectively.

Chart: The New York Times

In morning futures action, S&P 500 market futures are trading down 18 points, Dow market futures are trading down 127 points and Nasdaq 100 market futures are trading down 77 points.

Just in "The People's Bank of China on Tuesday trimmed its one-year loan prime rate (LPR) by 10 basis points from 3.65% to 3.55%, and reduced the five-year rate by the same margin to 4.2%."

TM contributor Seb noted that Chinese Stock Market Slips As Investors Await PBOC’s Loan Prime Rate Decision on Monday; and today the Hong Kong stock market's Hang Seng index also closed down 1.5%.

In addition to the cut in prime rates some of the other actions and developments in the Chinese economy according to Seb are as follows:

- "China’s central bank recently cut key short-term lending rates to support the economy amid a faltering post-pandemic recovery.

- Downgraded GDP growth forecasts for 2023 due to lower-than-expected industrial production and retail sales in May.

- Heavyweight firms, including Kweichow Moutai, Wuliangye Yibin, Talkweb Information, Contemporary Amperex, and Longi Green Energy, faced notable losses.

- Offshore yuan weakened, reaching its lowest levels in nearly seven months.

- Chinese authorities mentioned a slowdown in global trade and investment as factors affecting the economic rebound."

"The Yuan (CYB) could potentially strengthen against the dollar if there are indications of a dovish stance from the US Federal Reserve, suggesting the possibility of an earlier-than-anticipated interest rate cut in the current year.

Given the geopolitical situation, caution is warranted when considering the long-term direction of the Yuan, as any significant headlines or developments could have an impact on its value in the short- to medium-term perspectives."

Staying in Asia contributor Ruholamin Haqshanas notes that Berkshire Hathaway Adds To Japanese Holdings Amid A Booming Stock Market.

"Berkshire Hathaway (BRK-B) has added to its existing holdings in five major Japanese trading houses, bringing its average ownership of the companies to more than 8.5%...Berkshire Hathaway announced that it had purchased additional shares in five top Japanese trading houses, including Itochu, Marubeni, Mitsubishi Corp., Mitsui & Co., and Sumitomo Corp, according to a report from Nikkie Asia. The report added that Berkshire’s holdings in four out of the five companies now surpass 8%... (The) Japan Nl225, commonly called Nikkei Stock Average, or Nikkei 225, is up 29.54% YTD. The index is up around 3% over the past 5 days and more than 7% over the past month."

Image courtesy of 123rf. via The Tokenist

"In a comment to Nikkie Asia, Buffett reportedly reiterated its intention to hold these stakes for the long term. He even claimed that he wants to own up to 9.9% of the five companies, implying that the billionaire aims to keep adding to his holdings in Japan."

TM contributor Fathom Consulting compares the trajectories of the VIX and the S&P 500 in Chart Of The Week: Low Uncertainty, High Equity Prices.

"Economies have proved far more resilient to rate hikes than many had anticipated, with even a mini-banking crisis in March failing to light the recessionary touch-paper. This resilience has caused the VIX Index, the leading indicator of market uncertainty, to fall to its lowest level in three years and well below its average since 1990 of 19.6...Markets seem increasingly confident that the Federal Reserve can restore inflation to target without requiring a deep downturn in economic activity."

With regard to the VIX contributor Tim Knight suggests we take a look at the index's twelve month pattern which he provides for us in VIX Through The Year.

"Here’s an interesting chart I created with the Time Perspective mode in SlopeCharts. It shows, on average, what the VIX does over the course of a typical year. Please note the nadir of this is in a few weeks."

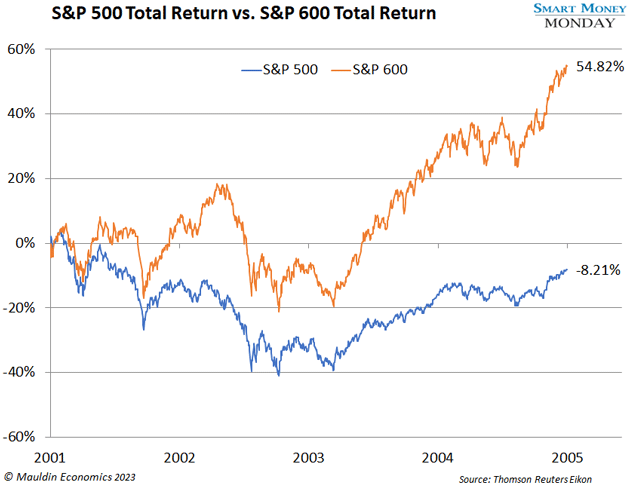

TalkMarkets contributor Thompson Clark looks for additional depth and breadth in the current stock market rally noting that Small Caps Are Starting To Work—and We’re Likely Still Early.

"Over the past month, the S&P 600 Index has jumped over 8% - a sign that small-cap stocks are finally starting to work.

That’s slightly ahead of the S&P 500, which is up 7.6% over that same time frame.

I believe this is just the beginning. If history is any guide, the S&P 600 has a lot further to run.

That’s because small caps are still cheap—on both a relative and absolute basis.

On an absolute basis, the S&P 600 trades for just 13.4X forward earnings. On the other hand, the S&P 500 trades for 18.5X forward earnings—a massive spread in valuation.

Looking back over the past 20 years, it’s quite rare for the S&P 500 to trade at such a steep multiple compared to the S&P 600."

"I’m not suggesting you short the S&P 500 and go long the S&P 600. What I am suggesting is that regardless of what happens to the S&P 500, its small-cap cousin—the S&P 600—is quite cheap...Small caps deserve a look. As for the specific weight you should put into small caps, that’s totally up to you and your financial situation. But from my perspective, the weight certainly shouldn’t be 0%."

See the full article for more particulars.

Closing out the column this morning contributor Michael Taylor has a bit of sober fun Gravedancing On Crypto.

"First, the US Securities and Exchange (SEC) sued US-based cryptocurrency exchange and public company Coinbase for violating securities law by operating an illegal securities exchange.

Second, the SEC sued Binance, the largest cryptocurrency exchange platform globally, for violating securities law by operating an illegal securities exchange and also for misusing customer funds. The iconoclastic multi billionaire founder of Binance, Changpeng (CZ) Zhao, was also personally charged for securities violations.

Third, the SEC declared 10 additional cryptocurrencies as securities, a designation that makes trading in them in the United States subject to SEC regulation. Interestingly, the two cryptocurrencies in widest usage – Bitcoin and Ether – were not declared securities.

Ok, I don’t want to gravedance on the crypto market but –

Ok, fine, I do want to gravedance a little bit."

"The theoretically great thing about cryptocurrency was that you didn’t have to trust anyone. It was just code. Immutable, mathematical, scientific, apolitical, and non-geographic. Outside of any particular regulatory regime. No trust in a government regime or finance companies required.

What crypto enthusiasts hate about the SEC action is that it brings the heavy hand of US government regulation down on the free-wheeling markets of this promising area of financial technology. What non-crypto enthusiasts hate is people pumping up fake securities to investors and stealing money, which happens an awful lot in the free-wheeling markets of this promising area of financial technology."

In his article Taylor also reports on some of the reactions registered on Reddit.

"Reddit news threads (show there) is lots of anger at the SEC for either:

1. Being too late

2. Being too early

3. Specifically targeting the little guy

4. Specifically targeting the whales, but leaving the little guy exposed.

What there is less of is introspection into the fact that the absence of regulation of financial assets – the thing crypto enthusiasts seem to want – historically correlates to a very high level of fraud.

On the Reddit threads, many claim to be still accumulating their magic beans.

By the way, the best description of crypto is “magic beans.” If you know nothing else about crypto, remember this: These are invented magic beans that true believers think other people will someday value highly for “reasons.” "

As always, caveat emptor.

Have a good one.

More By This Author:

Thoughts For Thursday: The Pause That Refreshes?

Tuesday Talk: Not Clear Yet