Thoughts For Thursday: Will 2022 End With A Bang, And If So, What Kind?

With just two trading days left in 2022, will the year end with a bang, and if so will it be an up bang or a down bang, or maybe just a whimper to say that the year is glad to be over?

Whichever scenario closes out the year at the end of trading on Friday, 2022 seems certain to close lower than where it began.

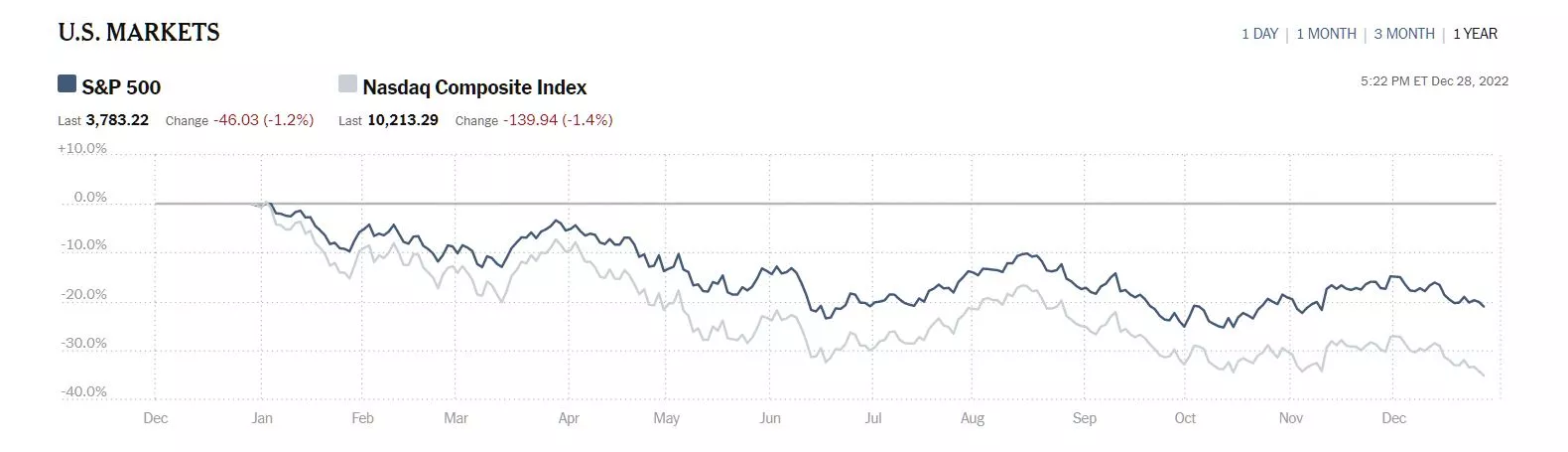

Yesterday the S&P 500 closed at 3,783, down 46 points, the Dow closed at 32,876, down 366 points and the Nasdaq Composite closed at 10,213, down 140 points.

Chart: The New York Times

Most actives were mostly down on Wednesday, though Tesla (TSLA) bounced back 3.3% and Bank of America (BAC) mustered a close to 3/4 of a percent gain.

Chart: The New York Times

In morning futures trading S&P 500 market futures are currently up 29 points, Dow market futures are up 170 points and Nasdaq 100 market futures are up 116 points.

The Staff at contributor JustMarkets take on the end of the year is Volatility Declines, Investors Shift To Safe-Haven Assets Ahead Of New Year Holidays.

"Investors continue to get rid of stocks before the end of the trading year. As the stock market closed Wednesday, the Dow Jones Index (US30) decreased by 1.10%, and the S&P 500 Index (US500) was down by 1.20%. The Nasdaq Technology Index (US100) fell by 1.35%. The Nasdaq (US100) fell to a two-month low as the technology downturn continues, and the S&P 500 (US500) is poised for its biggest annual loss since the 2008 financial crisis. Recession fears are highly likely to continue in the market in early 2023, but analysts believe equity markets will begin to recover in the second half of 2023."

"Analysts believe that the energy crisis will lead to a significant slowdown of the European economy in 2023. At the same time, real estate prices will collapse, and unemployment will rise substantially. The main risk comes from the energy crisis amid falling temperatures in winter. And suppose Europe manages to get through this winter without significant problems in the energy system. In that case, it will be possible to say with certainty that the peak of inflation is over..."

"Gold and silver are inversely correlated to the dollar index and US government bond yields. As monetary policy tightens, the dollar index and government bond yields go up, and gold and silver prices go down, which they have been doing for 2022. But the first signs of a slowdown in rate hikes have returned investor interest in precious metals. The US Federal Reserve will peak rates in 2023, potentially setting the stage for a new medium-term or even long-term uptrend in gold."

In a TM Editor's Choice column, TalkMarkets contributor James Picerno who charts market ETFs looks at the year just ending in his 2022 Review: US Equity Risk Factors.

"Short of a miraculous rally between now and Friday’s close, this realm of financial engineering is on track to dispense black eyes all around, based on a set of proxy ETFs.

The widespread losses aren’t surprising, given the slide in US stocks generally, based on SPDR S&P 500 (SPY), which has tumbled more than 18% year to date through December 27...

By contrast, the best-performing factor on our list: high-dividend yield (VYM), which has shed a mere 40 basis points."

"Judging by the gains for the trailing 3- and 5-year windows for all the factor funds, there’s a case for seeing 2022 as a downside outlier. If so, the red ink reflects an opportunity for a round of factor rebalancing. Large-cap growth (IVW), in particular, has taken a severe beating this year, which implies that its expected return tops the list."

Contributor and Energy sector analyst Robert Rapier reviews and reflects on the year in a piece entitled, Grading My 2022 Energy Predictions.

"At the beginning of each year, I make several predictions about the energy sector. You can see those predictions and read the context for my Energy Sector Predictions For 2022."

"1. The average price of WTI in 2022 will be between $70/bbl and $75/bbl.

The spot price of West Texas Intermediate (WTI) on December 19, 2022, was $75.05 per barrel (bbl). That’s not far from where we started the year ($75.99/bbl). But Russia’s invasion of Ukraine sent oil prices on a wild ride in 2022. Prices soared to over $120/bbl, which has only ever happened once before (in 2008).

Thus, the average price of WTI for the year (through 12/19/22) was $95.44/bbl, significantly more than I expected.

I find that this is consistently the hardest prediction to nail, simply because global events can swing oil prices wildly. I think the prediction would have been close to correct had Russia not invaded Ukraine, but those kinds of geopolitical events are always a wildcard when attempting to predict oil prices.

2. Total U.S. oil production will increase for the first time in three years.

We won’t have final monthly numbers from the EIA until early next year, but through September, the average daily oil production in the U.S. is 11.7 million barrels per day (BPD). This is already higher than the 11.3 million BPD average of 2021, but it will be even higher once the final numbers are in because the weekly numbers for the past three months have averaged over 12 million BPD. It seems likely that the average daily production for 2022 will be about 11.8 million BPD, which would be the second-highest level ever recorded.

3. The average natural gas price will be lower than it was in 2021.

In 2021 the average Henry Hub natural gas spot price was $3.89/MMBtu, which was the highest annual average since 2014. I believed U.S. production would increase in 2022, and that did in fact happen. When the final numbers are in, it looks like 2022 will represent the highest U.S. natural gas production on record.

However, once again Russia’s invasion of Ukraine disrupted the energy markets. As Europe grappled to fill a shortfall of Russian natural gas — and U.S. producers exported as much as they could — natural gas prices averaged $6.48/MMBtu (through 12/20/22).

This was a significant miss.

4. The Biden Administration will announce additional releases of oil from the SPR ahead of the midterm elections.

Although the Strategic Petroleum Reserve (SPR) is supposed to be used in case of emergency, politicians have historically used it for political purposes. Primarily, when voters are complaining about gasoline prices, presidents have released oil in an attempt to cause prices to dip. The fact that it was an election year led me to make this prediction.

This is yet another prediction that was impacted by Russia’s invasion of Ukraine. In order to minimize market disruptions, President Biden announced the largest release from the SPR in history. So this prediction was certainly correct, but the release was far greater than I ever would have imagined.

5. The Invesco Solar ETF (TAN) will return at least 20%.

Technology stocks were battered in 2022, and most of the stocks that make up the Invesco Solar ETF (TAN) fall into the category.

In 2021, TAN lost 27% as rising input costs hit renewable energy companies across the board. I felt like shares would bounce back in 2022. I was right, and then I was wrong.

TAN closed 2021 at $76.97. Shares reached $91.12 in August, a return of 18% since the end of 2021. However, rising interest rates hit the market hard in the second half of the year, and that 18% gain has turned into a 4% loss with a few trading days left in the year.

So, this one was wrong, but at one point it was within 2% of being right. I do note that I wasn’t specific enough on this one. I didn’t say that TAN would close the year with a 20% gain; only that it would return at least 20%. It nearly did this, but this one still goes into the “miss” column."

Looking ahead to 2023 TM contributor Tim Plaehn discusses Why Investing In 2023 Will Be Completely Different.

"Howard Marks, the billionaire founder and chairman of Oaktree Capital, sends out his “Memos” several times a year. His December issue, titled Sea Change, offers food for thought about successful investment strategies to use in the new year.

Let’s take a look, and see how we can earn some nice cash returns next year with less risk…

In 1980, Fed Chairman Paul Volker ratcheted the federal funds rate up to 20% to kill the high inflation that had persisted since 1974. The move succeeded and ushered in four decades of falling interest rates, which were tremendously positive for investing and the economy. Bond prices go up when interest rates fall. As a result, bond funds posted year after year of positive returns.

Falling rates also fueled corporate investments that led to massive economic growth. Low interest rates reduce the cost of capital for businesses and increase the fair value of assets.

Per Marks:

It seems to me that a significant portion of all the money investors made over this period resulted from the tailwind generated by the massive drop in interest rates. I consider it nearly impossible to overstate the influence of declining rates over the last four decades.

The (third) sea change, now underway, is that inflation and high interest rates have produced investor uncertainty and pessimism. These are valid concerns, as growth-focused companies can no longer count on cheap money to fund their growth.

Marks closes the memo with this:

We’ve gone from the low-return world of 2009-21 to a full-return world, and it may become more so in the near term. Investors can now potentially get solid returns from credit instruments, meaning they no longer have to rely as heavily on riskier investments to achieve their overall return targets. Lenders and bargain hunters face much better prospects in this changed environment than they did in 2009-21… if you grant that the environment is and may continue to be very different from what it was over the last 13 years—and most of the last 40 years—it should follow that the investment strategies that worked best over those periods may not be the ones that outperform in the years ahead..."

Stay tuned.

I'll let contributor Allison Brickell close out the column for the year with Three Ways 2023 Can Benefit Investors.

"2023 is likely to be another challenging year. It may take several more months for the Federal Reserve to bring inflation down and for the crypto bear market to end. But I’m an optimist. And I believe 2023 will bring us some good news too.

To that end, let’s dive into three things I hope investors see in 2023.

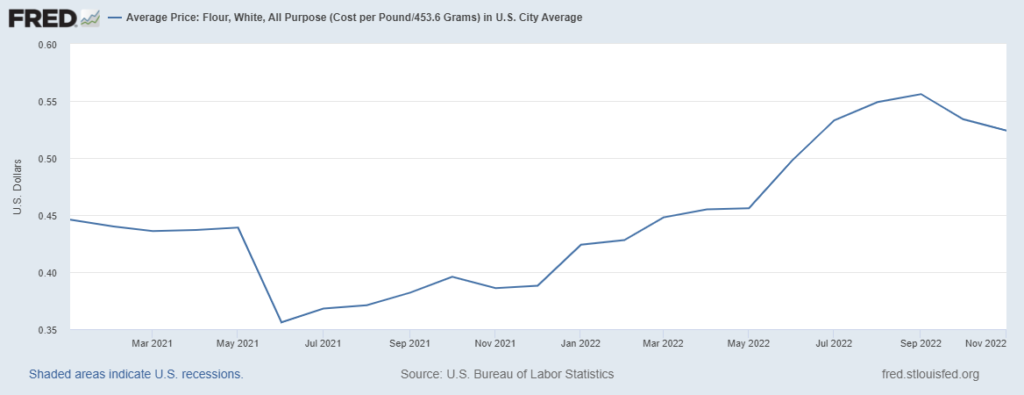

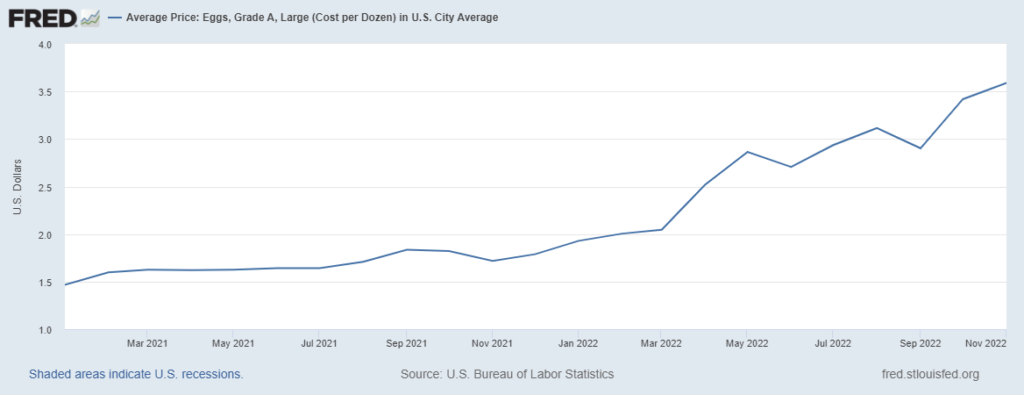

Lower Inflation

First, I hope the Fed gets inflation under control...The charts below illustrate just how severe the increased costs have been. And that’s just for two items! It’s like this for almost everything we pay for.

...If the Fed can get inflation under control, investor sentiment will improve. They’ll feel more confident about the direction of the economy and will begin investing in stocks, startups and crypto. The markets will spring back. And more startups will have the funding they need to innovate and succeed.

Which leads me to my next point…

More Healthcare Solutions

I’d like to see innovative startups in a number of different industries. But if I had to pick one, I’d say the American healthcare system is in the most desperate need of disruption.

To be clear, I don’t think startups can completely fix our broken healthcare system. That’s on the government. But I do think startups can do a lot to improve the current system. Take insurance, for example...

As they are now, insurance companies are designed to leech as much money as possible out of people and severely limit the amount of medical care they actually cover.

It’s a terribly broken system. And the government isn’t likely to change it anytime soon — so we need a way to improve the system we’re stuck with.

That’s why I want to see startups that make it easy to understand healthcare coverage. Startups that advocate for patients. Startups that have integrated systems so that healthcare providers and insurance companies actually talk to each other without forcing patients to go on a wild goose chase to track down their own medical records.

More Equitable Funding

My final wish for 2023 is that we’ll see more underrepresented founders get the support they need. And I don’t just mean female founders. I want to see female founders, founders of color, female founders of color, queer founders, queer founders of color, and disabled founders get a larger piece of the funding pie...We also know that crowdfunders don’t seem to hold the same biases. So I see no reason why that trend can’t continue into 2023. KingsCrowd has highlighted a number of startups run by underrepresented founders — some of which were rated very favorably as investment opportunities.

Innovation comes from all kinds of people from all parts of the world. Let’s hope that the new year will bring us more of that."

That's a wrap. I'll see you next year.

As always, Caveat Emptor.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: Continuing Yuletide Cheer?

Thoughts For Thursday: Forecast - Slippery