Tuesday Talk: Continuing Yuletide Cheer?

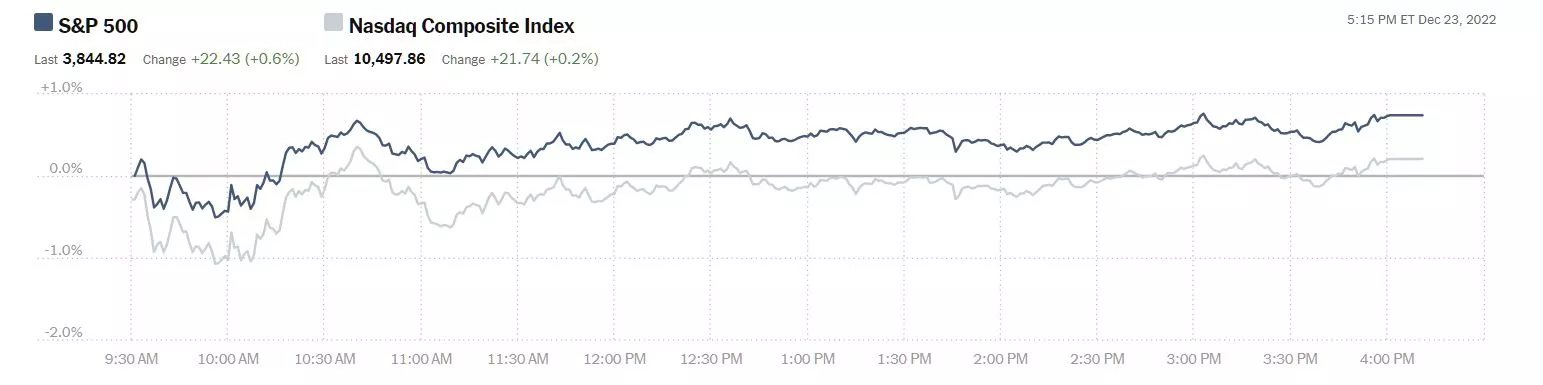

The major indices closed up in the run-up to the Christmas holiday. Will the holiday mood flow into the short trading week ahead?

On Friday the S&P 500 closed at 3,845, up 22 points, the Dow closed at 33,204, up 176 points and the Nasdaq Composite closed at 10,498, also up 22 points.

Chart: The New York Times

Top gainers were mostly oil industry related issues, in first place was Apache (APA), up 5.7%, followed by beleaguered CarMax (KMX), up 5.2% and Hess (HES), up 4.7%.

Chart: The New York Times

In morning trading S&P 500 market futures are up 27 points, Dow market futures are up 226 points and Nasdaq 100 market futures are up 64 points.

It's a slow news week traditionally but a few TalkMarkets contributors take on the Fed, China and Central Bankers, while others look for stock picks.

Contributor Nomi Prins posits what happens When The Fed’s Crystal Ball Fails.

"As we close out the year, we find ourselves in a very different spot from where we opened it.

High inflation, a slowing economy, and a stubborn Fed that’s been on a break-neck rate-hiking pace, yet will have no choice but to pivot.

When inflation began to creep upward in the early part of the year, Federal Reserve Chairman Jerome Powell declared an end to the use of the term “transitory.”

It was clear that the Fed’s crystal ball had failed.

You see, the Fed is not good at seeing patterns as they develop.

The economists and experts within the halls of the Fed tend to measure the economy from a limited vantage point.

That means they typically exaggerate and are reactionary in their policies while ignoring the obvious as it’s unfolding.

Things like creeping inflation or housing bubbles get overlooked..."

"(At the end of 1997) Banks around the world were cutting back. They were looking to protect themselves from additional losses.

This was in the wake of an Asian currency crisis that wreaked havoc on the markets and the profitability of banks.

JPMorgan saw its own earnings drop by 35% that year alone.

The Asian currency crisis was largely caused by an overheating in property and stock market values… while the Fed ignored the growing risks and allowed the dollar to strengthen.

The boom of the dollar hurt other currencies and their respective economies.

As the San Francisco Fed noted in 2011 with its post-crisis analysis: “Reduced oversight and high leverage tend to reduce transparency” and negatively impact market resiliency.

In Fed speak, that’s as close to admitting they were caught off guard as it gets.

So, why does this matter? Because history shows us how economies were slowing at a time when a strong dollar intensified global market turbulence.

If all of this rings a bell, it’s because similar elements are at play right now."

So a weakening dollar going into 2023 is a good thing...?

TM contributor Martin Hutchinson says Central Banks Must Play Grinch, Not Santa Claus.

"The core imperative for the move to fiat money and then to permanent “stimulus” policies was the urge by central banks to play Santa Claus. By lowering interest rates, they raise asset prices and make everyone feel richer. This is dangerous; it produces asset bubbles, kills productivity, and increases inequality, making everybody but the very lucky poorer in the long run. The need, therefore, is for an institutional framework that will force central bankers to play Grinch."

"When I went through Cambridge in the late 1960s, the professor in our introductory economics course began by claiming that the function of the economist was to assist in the redistribution of wealth. Needless to say, even at that callow, inexperienced age, I profoundly disagreed and resolved to take no more economics courses in that institution, which was already polluted by Keynesianism and the even worse doctrines of the Marxist Joan Robinson.

...Ben Bernanke’s promulgation of “helicopter economics” which in practice involved dropping $100 bills only over Wall Street, causing asset prices to soar, the rich to get richer, and productivity to stagnate, allowed the Fed to muscle its way onto Santa’s sleigh.

We are now paying the price. The bankruptcy of Sam Bankman-Fried’s FTX is a sign, not of essential rottenness in the entire economy, but that the checks and balances preventing outright fraud from taking over our lives were destroyed by Bernankeism. The rise in short-term interest rates to a current range of 4.25-4.5%, compared with the 1% indicated for today by the Fed’s “dot-plot” last December is an indication that all over the economy, projections for the year, let alone for 2023, have gone horribly wrong. Even without any more Bankman-Frieds (and believe me, there are many other politically connected fraudulent Bankman-Frieds out there) the more leveraged parts of the financial system, however honestly run, are in deep trouble.

Since debt is at record levels in terms of GDP, another effect of a decade of Santa Claus, the collapse will be exceptionally severe. The Fed will reverse course when the first big bankruptcies appear, but by then it will be too late – any further Santa Clausism will stoke inflation and store up even more severe recessions for the future...

Now it’s the Grinch’s long-overdue turn. Welcome, Grinch! – green and scaly are the fashion colors for 2023, and probably 2024 as well."

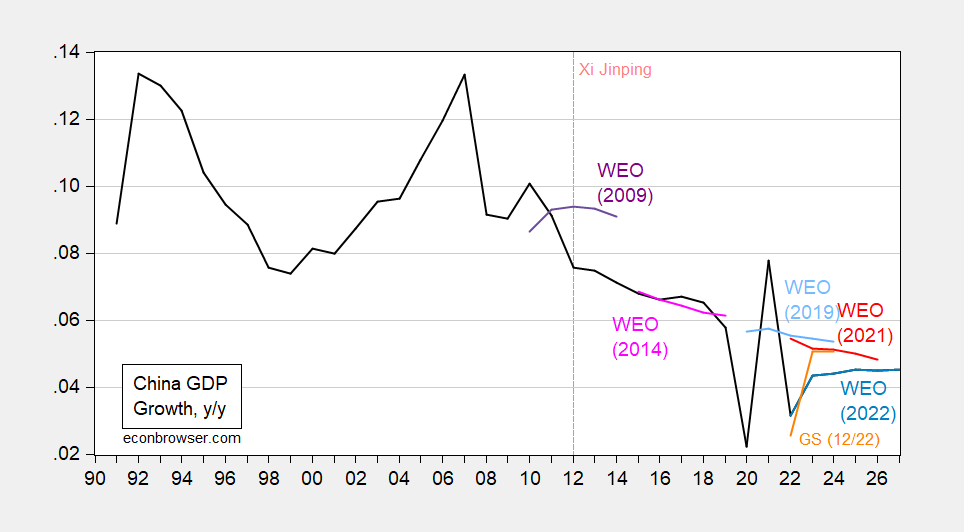

China is definitely going to impact what happens in world economies in 2023 and contributor and economist Menzie Chinn uses the holiday recess to examine Chinese GDP Growth Over The Xi Jinping Era.

"Over this period, growth has generally surprised on the downside...

(In the chart below), I show actual GDP growth (in log differences) since 1991 (as reported, in black), and forecasts from the corresponding World Economic Outlook forecasts.

Figure 2: Year-on-year Growth of Chinese GDP from October 2022 WEO (black), October 2022 forecast (gray-blue), October 2021 forecast (red), October 2019 forecast (sky blue), October 2014 forecast (pink), Goldman Sachs 22 December 2022 forecast (orange), all in bn 2015CNY, on log scale. Source: IMF World Economic Outlook databases (October, various issues), Goldman Sachs 12/22/2022.

The World Bank has just marked down 2022 y/y growth to 2.7%, Goldman Sachs down to 2.6%, while the IMF WEO forecast 3.2% in November.

If you don’t think 3.2% vs. 10% in 2010 (or the 5.5% target) isn’t “hitting a wall”, I don’t know what is.

In my view, this is not a good thing. A prosperous global economy needs a growing Chinese economy — so no schadenfreude here (although more appropriate would be to write 没有 幸灾乐祸 )."

See Chinn's article for an additional chart showing growth in Chinese GDP from 2015.

In the "Where To Invest" Department, TalkMarkets contributor Ian Wyatt finds APA: "Grossly Undervalued".

"Shares of Apache stock have been a solid performer — rising 62% in 2022. That puts the stock ahead of the 51% gain for the Energy Select Sector ETF (XLE). Along with the entire energy sector — APA is benefitting from higher oil and natural gas prices.

The company’s sales are expected to jump 24% this year to hit $9.8 billion. Meanwhile, EPS are expected to soar 117% to reach $8.46 per share. And that means the price-to-earnings multiple is just 5. It also trades at a 50% discount from other major energy stocks. The stock is simply too cheap to ignore."

APA is currently gushing cash and rewarding shareholders. Management has been aggressively returning cash to investors and cleaning up its balance sheet. Since October 2021, Apache has spent $1.4 billion to repurchase its own stock. The average price paid was $31 per share — well below the recent share price."

"There are two primary growth opportunities. First, a Suriname offshore project appears to be very promising and could develop into a major oil project in the coming years. Second, APA signed a deal to supply natural gas to Europe and Asia in partnership with Cheniere Energy (LNG). The deal could add $500 million or more in free cash flow...Even without these projects, APA shares are grossly undervalued today. Based on a P/E multiple of 8-times 2023 EPS of $9.51, my price target for the stock $75 per share."

Read the full article for additional details.

Contributor Thompson Clark prowls The Dogs Of The S&P 600 for stocks that can beat the market.

"There’s a dead-simple strategy for putting up market-beating returns.

It’s called the “Dogs of the Dow,” and it’s a stock-picking approach that’s easy to follow. It focuses on companies that have fallen out of favor with investors and are undervalued relative to other stocks in the Dow Jones Industrial Average (DIA)."

"The DJIA includes 30 blue-chip, high-quality companies. These are household names like JPMorgan Chase (JPM), Apple (AAPL), and Nike (NKE). All 30 members are profitable and enduring companies. The Dogs of the Dow strategy involves picking 10 of the 30 companies at the end of each calendar year solely based on the dividend yield...

The Dogs of the Dow strategy is dumb-simple to implement. It has also been historically profitable. From the beginning of 2008 to the end of 2018, investors who started with $10,000 and held it in the DJIA would’ve grown their accounts to approximately $17,350. However, an investor who followed the Dogs of the Dow strategy would’ve had an ending balance of $21,420, which highlights the value of adjusting positions once a year...

However, I (still) like the idea of applying the Dogs of the Dow strategy to the S&P 600.

This is why I’ve combed through the S&P 600 and picked three names that fit into a Dogs of the Dow-type strategy.

To select these three ideas, instead of looking at dividend yield, I focused on earnings yield. That is the inversion of the P/E ratio. Ten times earnings equal a 10% earnings yield. And 12 times earnings is an 8.3% earnings yield. The higher the yield, the cheaper the stock.

Second, I looked at return on equity. A good company earns a high return on equity… simple as that.

Lastly, I looked at each company’s balance sheet. How much debt does it carry? And especially, how much debt does it carry in relation to profitability?

I factored all these in and came up with a few small-cap ideas that are worth further consideration.

The first idea: Shutterstock, Inc. (SSTK).

Shutterstock sells digital images, videos, music, and other content to brands, businesses, and media companies.

The company trades for 13X next year’s earnings, which is about in line with the S&P 600. However, it’s a high-quality company that generates a 20% return on equity. The balance sheet has more cash than debt, and it’s made money every year since going public in 2012.

The second idea: Boot Barn Holdings, Inc. (BOOT).

Boot Barn is a specialty retailer of western clothing and workwear. It has over 300 stores and is continuing to grow its store fleet.

The company trades for 10X next year’s earnings, which is below the average for the S&P 600. Boot Barn is also a high-quality company. Return on equity is a whopping 38% on a trailing 12-month basis. The balance sheet is also strong, with no long-term debt outside of leases.

Like Shutterstock, Boot Barn has been profitable every year since its initial public offering (IPO). And since that IPO, revenue has grown from $345 million to over $1.5 billion.

There’s still growth in front of it. It’s a great “Dogs of the S&P 600” candidate.

The third and final idea is Installed Building Products Inc. (IBP).

Installed Building Products provides and installs insulation for residential and commercial builders.

The company has been a serial acquirer of other insulation companies for many years, having acquired well over 150 companies in the past few decades.

The business is cyclical, but that is more than factored into the price.

IBP trades for 10 times next year’s earnings. It’s a high-quality business, having generated a return on equity of well over 30%. And the balance sheet is in good shape, with a net debt-to-EBITDA of under 2X.

On top of that, revenue has grown from $430 million in 2013 to $2.5 billion on a trailing 12-month basis.

In short, IBP is another solid pick as a “Dog of the S&P 600.”

If you’re looking for small-cap exposure to individual stocks, these three merit a deeper look. All three have the potential to outperform the broader market—and even the S&P 600—over the coming months and years."

As always, Caveat Emptor.

Have a good one and enjoy your holiday down time.

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Forecast - Slippery

Tuesday Talk: Where is Santa?