Investment Research

Contributor's Links:

Marketocracy Good Stock Investing

I run a model fund at Ken Kam's Marketocracy, where they do capital management using the best member mutual fund track records with extensive tabulations of alpha, beta, R-squared, and many other fund management evaluations.

Marketocracy Capital Management offers SMA (Separately Managed ...more

I run a model fund at Ken Kam's Marketocracy, where they do capital management using the best member mutual fund track records with extensive tabulations of alpha, beta, R-squared, and many other fund management evaluations.

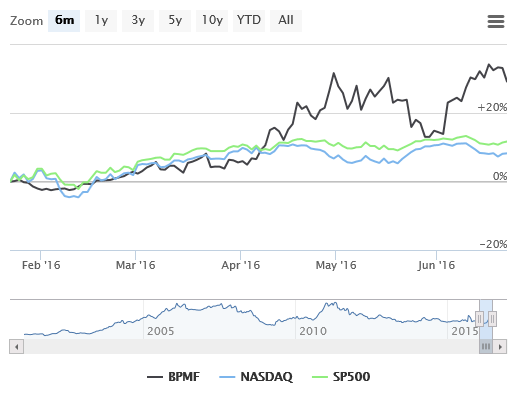

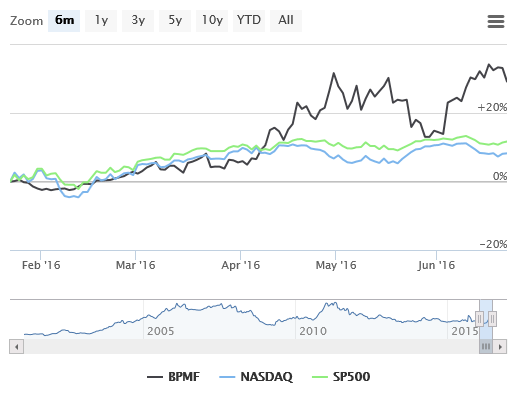

Marketocracy Capital Management offers SMA (Separately Managed Accounts) through FOLIOfn Institutional ($100,000 minimum accounts) to individual or institutional investors set up to track the top 15 or so fund managers based on their long-term track records (many 12 years plus) out of the 30000 or so active members that run models at their site. You can sign up and choose any one of these fund managers or any combination of them to run your account. My fund is one of those top models available for SMAs. My SMA product has around a one year record now with good alpha vs the S&P 500.  My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

Latest Comments

The Problem With The Modern Gold Miner

I'd like to post a correction. In the BPMF data, I was going by some charts that are part of a switchover to the FOLIOfn website and they were showing some incorrect data. The YTD figure is +10% and one year is +32% and 5 year is +35%. Since inception is correct.

Gold Upleg Momentum Building

You said:

"The timing of this next golden cross depends on how fast gold keeps advancing and thus dragging its 50dma higher. Its 50dma could cross back over its 200dma within a couple weeks at best, or a couple months on the outside. Either way, that big technical event is going to really accelerate the shift in prevailing gold sentiment"

But if you look at the exponential moving averages (50/200) you see that a "golden cross" has already happened several days ago. Exponential moving averages weight more recent prices higher and thus tend to catch major trend changes earlier. If you look at how this behaved in the early 2016 breakout of gold, you see that the exponential 50/200 cross occurred in mid February while the simple cross was early March.

From The Makers Of Wal-Mart And Bank Of The Ozarks Comes Bear State Bank

As a fine point of terminology, I'd like to point out the difference between "Stephens, Inc." and "Stephens Group", the creators of Alltel, Bear State, and other enterprises. Sometimes "Stephens Group" is used to describe Stephens in general, but actually Stephens, Inc. is the investment banking arm, which helped form Alltel, Wal-Mart, and others, while Stephens Group, which does other business formation activities, is what is helping with the formation of Bear State. They are two separate entities.

Gold's Direction: The State Of The Trend Vs. The Waves

Everybody loves to hate the chicken scratching study (chart reading) and you have to have some faith in the efficient market theory to not feel silly doing it. I also have some faith in fundamental analyses, and cash flow and revenue value and patterns enter into my thinking. But honestly, I feel that fundamental screens, and looking for good vs bad areas of the market just provide a universe of buys that improve your odds with technical analyses.

The efficient market theory forces you to admit that, no matter how much you read and know, the market is a composite of more reading and knowing than any one person can muster. Of course, any idiot can digest facts and come up with a buy/sell opinion. But consider this. A mindless, well informed idiot making a trade is just as likely to be wrong bearish or bullish - its a coin flip since he's an idiot. Well, thousands of coin flips cancel each other out, and what you have left is just the well thought out conclusions with more good minds and information than you or I can accomplish on our own!

The result of all this thought and buy/sell action is right there on your chart. You have to respect it. I look more at trends than valuation or reactions to headlines. You can disagree on the market's valuations or headline knee-jerk moves. But a trend will more consistently show you the future and is the result of all the market's work for you.

Gold's Direction: The State Of The Trend Vs. The Waves

The click to enlarge feature isn't working on the charts. After Monday night, I will have this article at Good Stock Investing and you can view the enlarged charts there.

Why Margin Debt Should Make You More Fearful Of The Stock Market Today

Your 12 month moving average chart is especially telling. If you look at the times when the slope turned negative with the amount of margin money anywhere near a new high, you see it has happened just twice over the last 20 years (before now) - just in front of the massacre of 2002, and just in front of late 2008.

The Fed Is Entering A New Bull Market In Confusion

Rich people don't spend on things that are necessarily more important, just different. The point is, all this spending doesn't effect an economic cycle. All the Fed efforts of the last 5 years amount to about 3.5% of total consumer spending on a yearly basis. That transient amount probably isn't changing a basic cycle. And if they replace the Fed debt creation money with helicopter money (which they maybe should have done in the first place), it would be a massive amount and it would probably not do much differently than the Fed money as far as fundamentally fixing the economy.

The Fed Is Entering A New Bull Market In Confusion

helicopter money:

Taking all the debt creation measures of the Fed so far the last 10 years and dividing it by the number of households in the US, you get some $21000 per household. That was given to Wall Streeters, they bought Mercedes, yachts, and Rolexes with it. That temporarily benefited the makers of the yachts and then we have the same old zero growth economy suffocating in taxes to pay for all the central planning.

If the helicopter changes its targeting away from the 1% to the 99%, you would have another 10 years, only this time the $21000 would be spent on bars, casinos, cigarettes, video games, cock fights, and vacations to Las Vegas. Studies have found that after the last episode of check mailing from the government to fix the economy, the January, 2008 stimulus checks, it raised nondurable spending the next quarter by 2.4%. One study found that about half of that, 1.1% went to increased emergency room visits for alcohol and narcotics related issues. And it did wonders to avert a recession, didn't it? A new helicopter blast would temporarily benefit Las Vegas and then we would have the same old zero growth economy suffocating in taxes to pay for all this brilliant central planning.

You have to wonder what kind of confidence build would transpire if the Fed turns from interest rate normalization to the check mailing. In 2008, those checks were a message from our government saying, "the economy is in deep trouble and we don't know what to do". Now after many years of complicated monetary maneuvers, if they do any check mailing again, the message would be, "We are clueless as to how to really fix the economy". All the confidence based activity (hiring, taking on loans, planning of all sorts) could be very badly influenced.

Gold And Safe Haven Confusion

Also, I guess I should disclose that I am long gold in general with some gold miners and a royalty company.

Gold And Safe Haven Confusion

OK, the google brings up the Seeking Alpha copy - the chart enlarges nicely there, too. It was bringing up the blog article earlier when I was doing some checking.