The Fed Is Entering A New Bull Market In Confusion

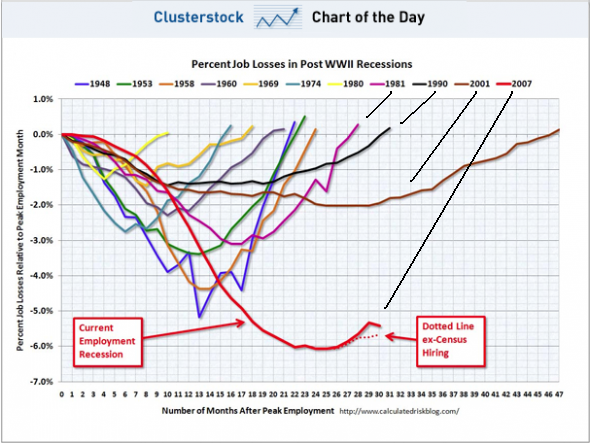

The Federal Reserve these days seems to want to focus on employment as a reason to justify rate normalization, hinting just this week about an "active" June meeting coming up.Of course, there are many reasons put forth to dismiss the reported numbers as being phony as a three dollar bill, with Shadowstats reporting a real unemployment rate at around 23%.But let's take the government reporting at its word for a moment and view this employment recovery in the context of past employment recoveries from recessions: (click on images to enlarge).

This chart shows that there seems to be some growing problem with each subsequent employment recovery that slows it down from what a normal downturn and recovery in the economy should look like.What has been growing in recent decades with regard to economic downturns?I'll give you three hints - "F" "E" "D" - and its middle initial is Federal Reserve Board.

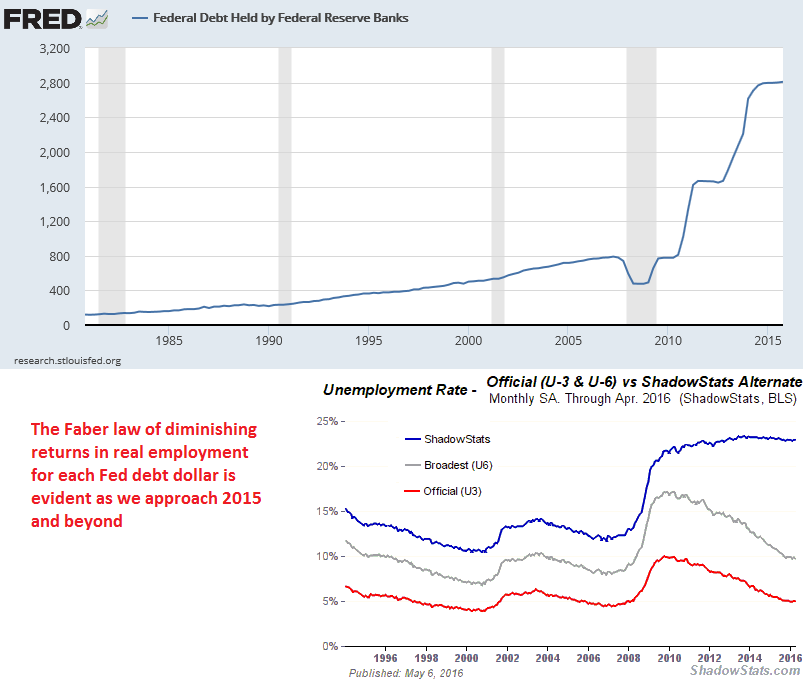

What's the problem with these ever slowing recoveries?With our high-powered Fed, now more high-powered than ever, you would think we could snuff out a nagging problem like this. But maybe that's just the problem.Our Fed has been busy snuffing out problems for so long that it has created a problem that can't be snuffed out - the mountain of debt left over from all the snuffing:

If you compare the above charts, you can see that the sharply growing employment lag back to normal in each recession recovery from 1980 onward in chronological order correlates well with the sharply growing debt level.As we attempt to normalize from our last recession, we appear to be going up against some kind of wall with real employment as measured by Shadowstats actuallyclimbing even as the Fed frantically mashes its machinery into a screaming over-heated condition.

We hear a lot about all the Fed's largess going to repair the mortgage ravaged balance sheets of banks, making them hesitant to lend. But the mortgage ravaging was the left-over of the Fed's previous snuffing project, loose money home ownership. I guess these repairs get to be a bigger job each time.

For all the trouble the Fed's debt creation causes, we are getting less and less bang for the debt dollar as the decades roll by:

This Marc Faber chart formulated 15 years ago shows the diminishing positive effect of each debt dollar on GDP growth.Clear back then, he projected "zero hour" - when piling on new monetary debt gets us nothing but pathetic real economic growth. This was projected to come at around the year 2015. Fifteen years ago, few could find fault with the wonderful help from the Fed's activity.Here in 2015ville the feeling is quite different.This out-of-control debt dynamic is nothing new in history. A fascinating article over at Zerohedge points out the math of debt creation vs the math of economic growth and how previous civilizations have had to deal with this diminishing return on debt path.We may be approaching such a point now in America.

What we need to normalize isn't interest rates, that appears to be impossible now.What we need to normalize is the economic cycle, where blundering managements have their properties taken away from them and handed over to whole new teams in bankruptcy courts.Jim Rogers has been saying this for a long time, and he is finding lots of company these days.We need to stop subsidizing incompetence.Capitalism can't work this way.That's the way it worked for hundreds of years before the Fed, and no sword of Damocles debt burden swept over the whole world.It was just isolated countries going through the debt binge/bust exercise with limited global collateral damage. Now the eight major central banks have extended this to the global village.

The Fed is talking higher interest rates to cool down this overheating economy while we suffer at nano% growth with virtually every reliable lead indicator pointing down:

- The ECRI Weekly Lead Index chart

- The transports

- The small caps

- The banks, especially Europe

- Aggregate corporate SPX revenue

- Copper

And there are more, but you don't have to look very far beyond the dismal fact that 20% of Americans are on food stamps and similar aid, up 25% since 2004, and most are living paycheck to paycheck - the worst real economy since the Depression.But I guess the questionable employment numbers mean all is well.

In case you haven't noticed, there is a growing resentment against the Fed's business as usual.The Tea Party this time is a revolt not against England's meddling with our colonies, but against another foreign entity meddling with our freedoms - the government in general and the Federal Reserve System in particular. I always used to think Jim Rogers' call for abolishing the Fed to be a little extreme.Now I see a poll out from 2010 with the stunning title "More Than Half Of Americans Want The Fed Reined In Or Abolished".

Since then, this feeling has only grown with several recent presidential candidates, including one still in the race right now, calling for public disclosure of full FOMC transcripts within six months, not the secretive five years now being done.This current candidate claims that if we had made this change in the early 2000s, Americans would have been dismayed by the housing bubble well in advance of the financial crisis, perhaps in time to avert it. I won't say who this candidate is because I am Disenchanted Voter and I do not approve of their message.

This same politician, by the way, is the only serious candidate for the presidency ever to advocate reinstating Glass-Steagall.This banking run/failure inspired safeguard from the 1930s would put a serious crimp in the banker's dangerous toying with depositors' money developing today and with their Fed gifted toys in general.

One thing is certain, the Fed is not viewed the same as in years past.Most Americans don't want too-big-to-fail anymore, and they don't want too-big-to-bail either.The Fed model has run into the ditch, and we may not be too excited about pulling it back onto the road.

This is absolutely why real helicopter money is the only answer. Real helicopter money is debt free, at least until prosperity is achieved. Then government could help the central bank. But for now, the central bank needs to help the government and the people, as debt creation is not getting the job done. If Faber's chart is right, the Fed needs to do this now, not later: www.talkmarkets.com/.../responsibly-expand-the-monetary-base-before-it-is-too-late

helicopter money:

Taking all the debt creation measures of the Fed so far the last 10 years and dividing it by the number of households in the US, you get some $21000 per household. That was given to Wall Streeters, they bought Mercedes, yachts, and Rolexes with it. That temporarily benefited the makers of the yachts and then we have the same old zero growth economy suffocating in taxes to pay for all the central planning.

If the helicopter changes its targeting away from the 1% to the 99%, you would have another 10 years, only this time the $21000 would be spent on bars, casinos, cigarettes, video games, cock fights, and vacations to Las Vegas. Studies have found that after the last episode of check mailing from the government to fix the economy, the January, 2008 stimulus checks, it raised nondurable spending the next quarter by 2.4%. One study found that about half of that, 1.1% went to increased emergency room visits for alcohol and narcotics related issues. And it did wonders to avert a recession, didn't it? A new helicopter blast would temporarily benefit Las Vegas and then we would have the same old zero growth economy suffocating in taxes to pay for all this brilliant central planning.

You have to wonder what kind of confidence build would transpire if the Fed turns from interest rate normalization to the check mailing. In 2008, those checks were a message from our government saying, "the economy is in deep trouble and we don't know what to do". Now after many years of complicated monetary maneuvers, if they do any check mailing again, the message would be, "We are clueless as to how to really fix the economy". All the confidence based activity (hiring, taking on loans, planning of all sorts) could be very badly influenced.

The stimulus checks were a drop in the bucket. You cannot compare them to serious helicopter money, Bruce. And it almost seems as though you are saying rich folks spend their money on more important things than the average guy. Perhaps the average guy should understand that view more clearly, so he can quit trusting rich people.

The difference between the government sending checks and the Fed sending the checks is that it would be an admission that the Fed bailed out everyone except main street. It would show the nation that the Fed was trying to be fair. But then, that wouldn't be how bankers generally operate, now is it?

Rich people don't spend on things that are necessarily more important, just different. The point is, all this spending doesn't effect an economic cycle. All the Fed efforts of the last 5 years amount to about 3.5% of total consumer spending on a yearly basis. That transient amount probably isn't changing a basic cycle. And if they replace the Fed debt creation money with helicopter money (which they maybe should have done in the first place), it would be a massive amount and it would probably not do much differently than the Fed money as far as fundamentally fixing the economy.