Investment Research

Contributor's Links:

Marketocracy Good Stock Investing

I run a model fund at Ken Kam's Marketocracy, where they do capital management using the best member mutual fund track records with extensive tabulations of alpha, beta, R-squared, and many other fund management evaluations.

Marketocracy Capital Management offers SMA (Separately Managed ...more

I run a model fund at Ken Kam's Marketocracy, where they do capital management using the best member mutual fund track records with extensive tabulations of alpha, beta, R-squared, and many other fund management evaluations.

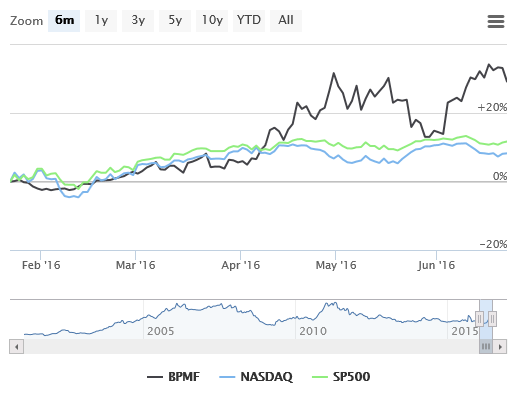

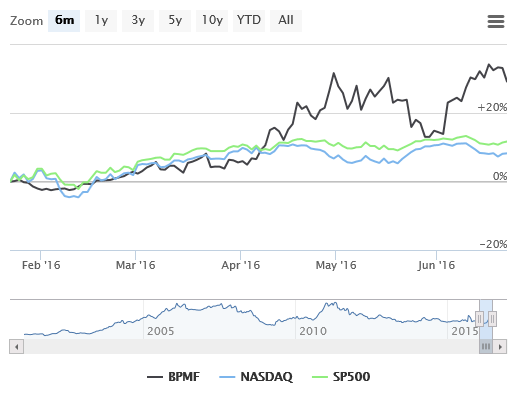

Marketocracy Capital Management offers SMA (Separately Managed Accounts) through FOLIOfn Institutional ($100,000 minimum accounts) to individual or institutional investors set up to track the top 15 or so fund managers based on their long-term track records (many 12 years plus) out of the 30000 or so active members that run models at their site. You can sign up and choose any one of these fund managers or any combination of them to run your account. My fund is one of those top models available for SMAs. My SMA product has around a one year record now with good alpha vs the S&P 500.  My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:less

Latest Comments

Gold And Safe Haven Confusion

I agree that rates are a nonfactor with gold. So many people think rising rates means better dollar and lower gold. But that's just not the way it works in history. I have a chart I made showing interest rates vs gold through the '70s and it shows that rates and gold rose almost in lock step through those years.

Gold And Safe Haven Confusion

My chart above doesn't click and enlarge very well for easy viewing here, but you can go to the copy of it at my blog "Good Stock Investing". Just google "Gold and Safe Haven Confusion" and click on the blog copy - the chart there enlarges very nicely. It shows the average gold performance of +39% vs the USD average of -3% over all the major stock market tumbles since 1971 - what actually works best as a safe haven.

Apple And Tech And The Market, Oh My

I didn't say the outlook for Apple is good. I don't really know, but it seems that the trend change going on all around them suggests more bad news. If traders are trying to paint the tape of AAPL, they haven't kept it from tracing out a bear track.

Huge Repo Warning

I have been watching the Fed's reverse repo reports and was a little surprised to see all this going on with the reverse repos "undisturbed" as you put it. They have been making heavy use of this new "tool" since early 2014. Why are they not using it with this pretty dangerous looking gap? Will they use it now? I find it interesting that all this massive repo operation began about the same time that the big European banks began rolling over and breaking down technically - early to mid 2014. Does the Fed publish a repo fail chart like the one you show, or do you tabulate it?

A Major Bear Market Sign Is Developing

The run-up of the last 4 weeks doesn't even show in the 200 day moving average. Chris Ciovacco just put out an entertaining video here at Talk Markets "Have The Long-Term Trends Improved? You can decide" where he looks at how well the slope of the 200 say (SMA I'm assuming) tells if a major trend is changing amid volatility of a month or so.

I agree that there seems to be a crisis of confidence brewing over monetary policy globally. It looks like Marc Faber's Zero-Hour of monetary help is upon us. I've been writing articles on his projection for this for years now, the latest one being "Mapping The Zero-Hour Projections For 2015" I wrote at Seeking Alpha back in September. He was making this projection clear back in 2002, pegging 2015 as the year of vanishing monetary effectiveness.