Apple And Tech And The Market, Oh My

This coming Tuesday evening, what is arguably the biggest, most successful, most loved, and most widely held company on earth gives us its quarterly report. I speak of Apple (AAPL) and, while I don't own it or even pay much attention to quarterly reports in general, I will be watching this one. I am mostly a technical analyst, and AAPL is at an interesting place right now.

I don't pay much attention to quarterly eps for several good reasons. Most all of the "financial engineering" and creative bookkeeping that goes on is focused on quarterly eps numbers, because that's what most people care about. But that also makes them the least telling about how the company is really doing, in my view. I look at multi year patterns in cash flow, EBITDA, revenue, and the market's technical opinion on a stock.

As for the direction of the broad market, I look at technicals, of course, but I also look at leader groups, because they are a very trustworthy tell. Like clockwork, certain leaders turn ahead of the broad market. For the last couple years, as I have shown in previous articles, key leader groups have been doing a pronounced bearish turn - the financials (European banks in particular), the Russell 2000 small caps, high yield debt, etc. These groups all confirm what things like aggregate corporate revenue and successful forward looking summations like the ECRI lead indicators all show. All this reliable data is carefully avoided by the hard working men and women at the Fed:

Getting back to Apple, they could be considered a "lead group" just by the sheer reach of their products.Although I am not a stockholder, I plan on my next computer being an Apple.

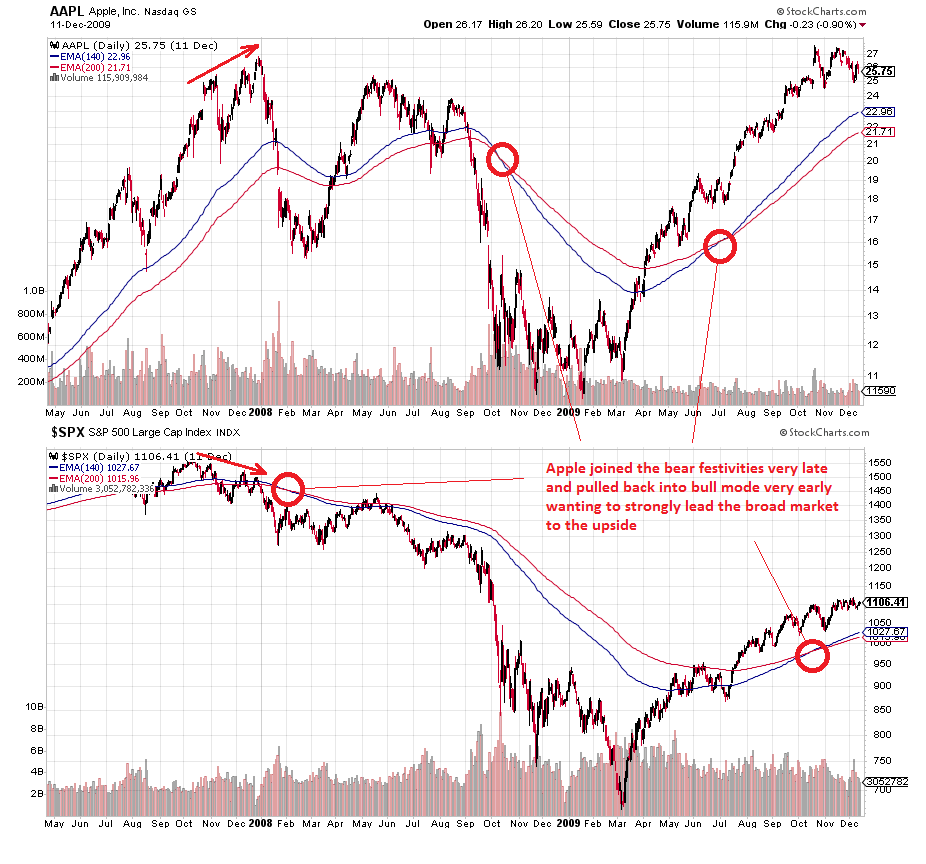

This company has not just made the best communication devices in the world, but they have been a very well run business for 20 years now. If you look at how the stock behaved during the last bear market, you see a remarkable leadership to the upside:

The 140/200 day ema is a good divider of bull and bear markets, and when they cross, we should pay attention.Apple didn't do the bear cross until October, 2008 and sprang back to a bull market way ahead of the broad market, hitting new highs before 2009 was done with.

So what's up with this leadership now?Well - not so much:

Charging into October, 2014, the broad market was hit hard, but it barely fazed AAPL. But then a subtle change began taking shape. When the SPX formed a roll-over top in mid 2015, AAPL went meekly along for the ride. It snapped back from the August panic better than the market, but since then, it has, for the first time in over a decade, begun to be a drag on the SPX. It did not go anywhere near a new high in the November rally nor in the current rally.

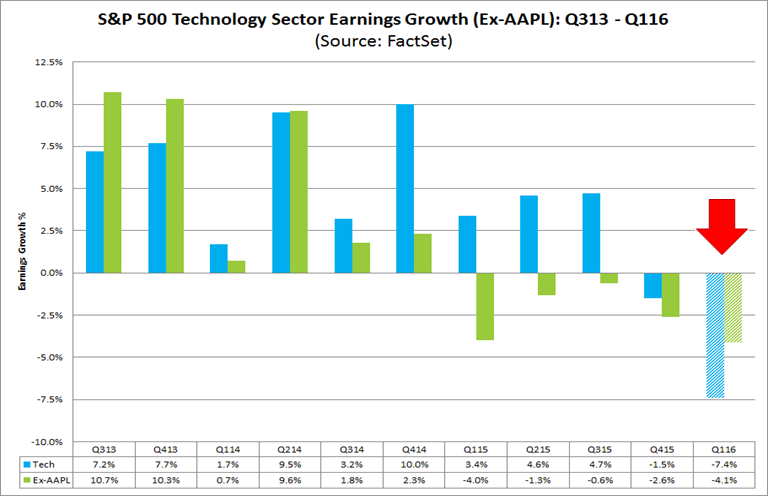

Does this technical take have any roots in Apple's fundamentals? I refer you to an overview at TalkMarkets where this change in leadership is presented in eps numbers:

The article, saying in its title that Apple is to be the "biggest drag" on SPX tech, shows a phase change from Apple (blue bars) pulling up the tech average (green bars) to Apple pulling down the tech average. The current blue bar is estimate.

I, for one, am going to be interested in the behavior of AAPL this week. The stock has already clearly broken down out of the current rally. If the quarter doesn't propel the stock back up through $115, its bear leader status won't change. It really will be in limbo if it doesn't go through $130 and retake the baton of leadership. And even if it were to do that, it would be one leader group saying "bull" while all the others continue to say "bear". Maybe Apple will be the first to change its tune.

Disclosure: None.

@[Bruce Pile](user:22524) Thought about buying an apple computer but read (5 min search) that the models are all outdated and not populated since two years. They never lowered prices and new models not yet announced. Could have some impact to stockprices too...

@[David Bruchmann](user:15733), what are you talking about? Perhaps they haven't come out with a new design, but that's just aesthetics. It's the components that matter. Apple's components are just as current as any PC.

@[Bill Johnson](user:14917) The macBook has a processor with 1.1 GHz. Current values on the intel page have 2.2GHz - this is already outdated with 2.2 GHz already too: ark.intel.com/.../Intel-Core-m3-6Y30-Processor-4M-Cache-up-to-2_20-GHz. So correct my if I'm wrong but I call it still outdated even on the apple page there is a label "NEW"

Fair enough,I see your point. My apologies. Though I don't understand the Apple mania if their products are so behind PC technology. Why do you suppose that is and why doesn't Apple stay up to date?

Bruce- are you aware that aapl has cut iphone production 30 % going forward, and are you aware that the iphone represents over 60 % of aapl's revenues? if you are aware of both, then how on earth could you possibly think this earnings call will go well? especially forward guidance? cook has pulled every trick in the book in keeping aapl from plunging, and when it did, he sent an email (lies) to jim cramer. also know that the fed traders purchase aapl heavily to help prevent spx plunging when needed. so maybe tim and janet can buy enough aapl to rally wednesday, who knows?

I didn't say the outlook for Apple is good. I don't really know, but it seems that the trend change going on all around them suggests more bad news. If traders are trying to paint the tape of AAPL, they haven't kept it from tracing out a bear track.

All fair points.