A Major Bear Market Sign Is Developing

I've outlined some very dependable markers of bear turns now developing in our stock market in some recent articles.I don't like being a such sour puss as I mainly like analyzing individual stocks and seeing them climb. All I ask of the market is to leave my individual stocks alone. A flat, boring market is my favorite. But sometimes there is such a concentration of downside risk, you have to take measures against a market intrusion.

A bear attack is looking likely. One of the many signs is the megaphone. And I don't mean the device the Fed is holding up to its chin to say "everything is fine", although that is a very good contrary indicator. The megaphone I am referring to is a technical formation. Like all good formations, they happen because of the human psychology involved in buying and selling.

We won't do an exhaustive survey of all bear markets, and this sign doesn't accompany all bears. But it has a strong tendency to accompany the really bad ones. Let's start with an early US bad bear, the 1852-1857 sell down. This one doesn't readily pop to mind when "really bad bears" are discussed. But a Wall Street Journal piece written March 6, 2009, three days before the bottom, discussing how '08 stacks up in history, features it prominently. It pointed out that we had to fall way more in 2009 to catch up with the #1 fall in history, 1929-1932 (-83%) and the #2 fall, 1852-1857 (-66%) inflation adjusted. Of course, we didn't do that in March of 2009, so the 1852 bear kept its # 2 all time ranking. So what did this bad one look like?

That's right - it looked like a megaphone. This technical formation is one that I look for in stocks, because they usually break violently to the upside, given other positive indicators, but not after a severe thrashing to the downside.

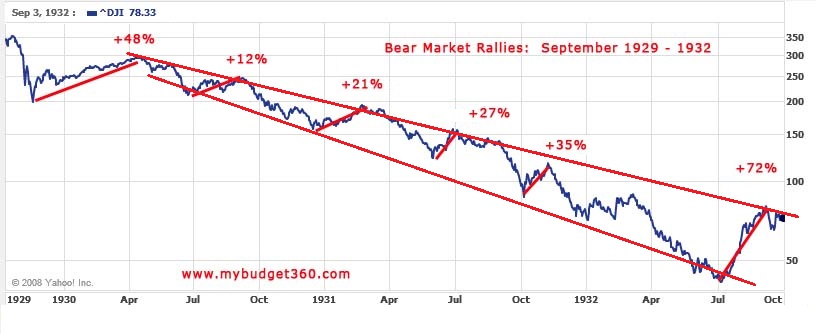

So #2 was a megaphone, what about #1? Well, sort of. The Crash of 1929 was just that - a crash. A bear market, which transpires over years, is not a crash. Thus the crash of 1987 was not a bear, and the crash in 1929 was not a bear. As I discussed in "A Study In Crashology" 1929 was just a big correction to an over bought condition (like 1987) but the fallout from this in the banking world caused the severe economic downturn, which was a bona fide bear. This was an exception to the rule that bull markets end with a wimper, not a bang. Bulls typically do a gentle roll over into a bear. So, how did all this look?

(Click on image to enlarge)

We see that, after the atypical bang at the end of the 1920s bull market, we had a big, near 50% recovery, and many felt the economy was back on track. Then the market did indeed settle into a megaphone as the banking problems took over. This diagram shows how the market gyrations get bigger as the megaphone progresses. Each bear market rally was progressively bigger percent wise, like an amplifying sound wave.

Probably the next bad bear we think of is 1973-74. The decline was as bad as 2007-08 and the recession was one the worst ever. The recovery was weak and led to "the misery index" being a big election campaign item in the 1980 elections. How did this market look?

(Click on image to enlarge)

This one was not as sharply defined, but the overall pattern was there.

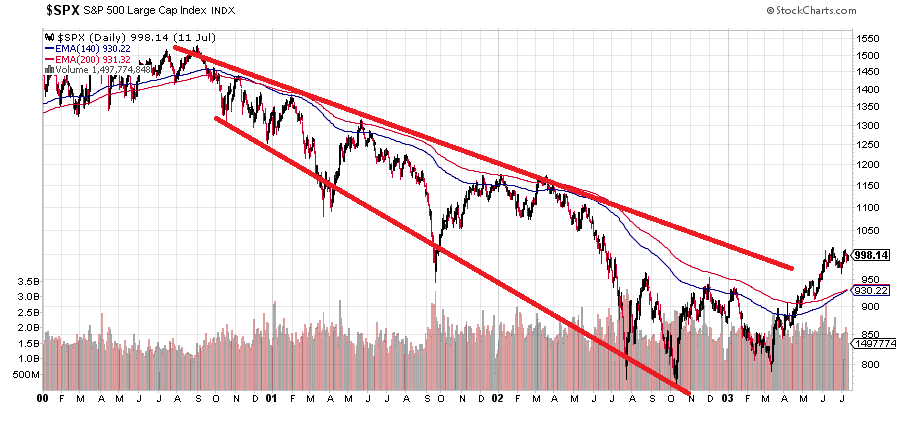

What about the bear markets we all know and hate - 2000 and 2007? As I've shown before, they were both of the typical, gentle roll over type. Let's look at 2000:

(Click on image to enlarge)

It was a megaphone with the brutal 2002 meltdown being the last trip down. And 2007?

(Click on image to enlarge)

This was a higher beta megaphone than its predecessors. I would like to point out that the moving average pair I'm showing above is the 140 ema and 200 ema (exponential moving average) which is the best divider I have found between a bull and a bear market. When it consistently acts as support, it's a bull. When it consistently acts as resistance, it's a bear.

To look at where our current market may be headed, I want to look at probably the best leader index, the small caps of the Russell 2000. This index has telegraphed the Dow very well lately, and here is how it looks now:

(Click on image to enlarge)

The leading transports (TRANQ) are also showing a nascent megaphone.

(Click on image to enlarge)

I say nascent, because the Dow is just a few percentage points off its high and has a long way down to go if this is indeed a major bear market beginning. The present rally looks like it should run some more to test the moving average pair and the top of the megaphone, maybe to 1140 on the Russell, around 2040 on the SPX. But this may be a good area to lighten long positions that you don't want in a bear market, and take other bear precautions.

Disclosure: None.

Are you Americans at it again? Greed Greed Greed!

I wonder how recessions correlate with these megaphone bear markets? Having lived through 73-75, 00-03 and 07-09 it seemed like the recessions trailed the bear markets. Although in the 07-09 bear the housing downturn lead the 07-09 bear. Some would argue that the great recession following the 07-09 bear is still ongoing, because 45 million Americans are on food stamps and 10's of millions are severely under-employed, not participating in the work-force, or in early retirement.

The current data show that we have already entered a global recession. But no one in Government has admitted that there is any kind of recession at all.

Sadly the real economy has been near a bear market for some time but is hidden by those claiming we should look at the stock market. The economy is the economy and it is still in bad shape and getting worse even though the Fed has repeatedly caused inflation no one can afford and says its good. Inflation in weak to no growth is bad not good. The Fed should read economics books rather than trying to solve economic dilemmas by treating the symptoms without treating the disease.

Inflation with low to no growth is deadly to the economy, not a godsend.

Agreed Bruce Pile, the upturn is merely a bounce from the lows and does not signify anything major, especially the low volume it is being done at. Worse yet, it is driven on oil speculation and share buybacks both which will not last. There needs to be a material change in earnings growth or consumer income and spending to change the market direction. Even the Federal Reserve will have a hard time faking that like they do with their focus on jobless filings.

Anyone watching volatility should realizes the run up is not all that great. It is just more volatility and price action as the market fumbles along the megaphone. The loss of leadership now that the Fed realizes it can't easily sugar the market any more will set in. A recent study indicates over 90% of the market's rise is due to Fed activity and nothing else meaning, we are really not that better than we were the last downturn. The market is once again primed for a big regression when the Federal Reserve runs out of steam.

finance.yahoo.com/.../...--analysis-194426366.html

The run-up of the last 4 weeks doesn't even show in the 200 day moving average. Chris Ciovacco just put out an entertaining video here at Talk Markets "Have The Long-Term Trends Improved? You can decide" where he looks at how well the slope of the 200 say (SMA I'm assuming) tells if a major trend is changing amid volatility of a month or so.

I agree that there seems to be a crisis of confidence brewing over monetary policy globally. It looks like Marc Faber's Zero-Hour of monetary help is upon us. I've been writing articles on his projection for this for years now, the latest one being "Mapping The Zero-Hour Projections For 2015" I wrote at Seeking Alpha back in September. He was making this projection clear back in 2002, pegging 2015 as the year of vanishing monetary effectiveness.