U.S. Inflation Over The Next 5 Years

Image Source: Pexels

“An inflation regime, as the BIS defines it, is one of sustained and general price increases. This cannot be a one-round affair. It requires successive price and wage adjustment. It can only happen if you have a wage-price spiral, with both price and wage setters driving up their demands.” (Adam Tooze, Chartbook, #123)

The US and the entire world are experiencing an unusual wave of high inflation after almost two decades of low and stable inflation. Indeed, until 2020, a whole new generation of investors have grown up with a consensus view of a future based on continued low inflation.

Of course, this comfortable expectation was turned upside down by the pandemic, the expansive fiscal and monetary measures required to minimize the Covid downturn, the war in Ukraine, and the related supply shortages that were triggered by seeming everything that could go wrong.

One of the troubling features of all of this was the unexpected severity of global inflation.

As the following table and chart illustrate, increases in American consumer prices (y/y) peaked in June of this year at 9.1%. As of September, the inflation rate had decelerated to 8.2%. But a year earlier the US inflation rate was 5.4%, while in September of 2020 the inflation rate was only 1.8%.

US Consumer Inflation, Year Over Year % Change

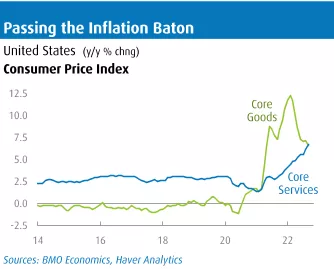

As the previous chart illustrates, even as US goods inflation has been moderating over the past several months, services inflation has significantly accelerated.

Goods inflation has slowed for obvious reasons since in recent months commodity prices have been declining, shipping rates have dropped, and global supply chain pressures have eased.

On the services inflation side, the biggest contributor recently has been soaring rents in the US.

The specific component in the US housing price index which is escalating very rapidly is entitled owners’ equivalent rent. This rent measure is expected to start decelerating in the coming months, which will lower the general rate of overall inflation.

Turning to monetary policy and inflation, many central banks, including the Fed, initially believed that inflation was a transitory phenomenon. Now the central banks are slamming on the breaks to control inflation, and their actions will likely trigger a global recession.

In the US, inflation was initially dismissed as a transitory phenomenon until March 2022. Indeed, since March of this year, the Fed has significantly tightened financial conditions to get inflation under control.

It should be emphasized that the erroneous conclusion that the inflation problem was only transitory was widely shared by economists, western governments, and central banks. For example, the Bank of Canada also shared the same view. Accordingly, there has been a rapid tightening of monetary conditions by most central banks this year,

Indeed, in September the Fed raised its benchmark federal funds rate by three-quarters of a percentage point, for the third time in a row. Interest rates across the board in the US and Canada are much higher, particularly sensitive mortgage rates.

Fortunately, signs are now appearing that the international sources of inflation are slowing — first in commodities, then in energy, and now in manufacturing prices.

Finally, investors are looking at all the noise surrounding recent inflation reports and clearly don’t like what they see. Though inflation is slowing, the pace of slowing is simply not rapid enough to satisfy jittery investors.

Thus, investors have been hammering the bond market, and of course, the equity market is still in a major bear market phase.

Still, it is rather fascinating that the expected five-year forward US inflation rate embedded in the bond market is currently at 2.18%.

It should be emphasized that the bond markets inflation expectation five years from now is virtually the same as expectations taken a year earlier.

The current five-year inflation projection is rather similar to the longer-term inflation average of 2.25%, which suggests that inflation is expected to gradually return to normal over the next five years. Are the bond markets wrong?

US Inflation Rate As Projected In The Bond Market

(Click on image to enlarge)

More By This Author:

Canada Will Not Be Able To Avoid The Coming Global DownturnUS Inflation May Have Peaked, But What About The Lasting Effects?

The Financial Markets Are Signaling Either A Slowdown Or A US Recession

Arthur

As soon as the BoC announced rate hike of 50bps the a Canada 5 yr nominal bond yield dropped by 25bps and today another 8bps drop

The yield is inverting fast, so why is the bank raising rates?.

It will take 5 years to get back to normal?!!