The Financial Markets Are Signaling Either A Slowdown Or A US Recession

Image Source: Unsplash

“The gap between long-term and short-term government borrowing rates in big, developed economies has narrowed drastically since the autumn. In the US, a so-called “yield-curve inversion” occurred last week for the first time since 2019 - an event that in the past has been the harbinger of economic downturns. Historically, a US recession tends to follow a year after the curve inverts, though the variance is large and there are occasional false positives.” (Financial Times, an inverted yield curve: why investors are watching closely, Sept 13, 2022)

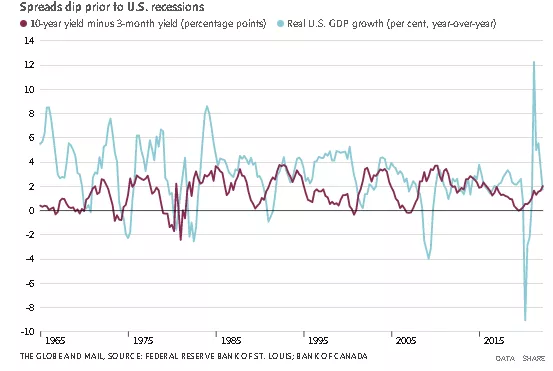

The following chart was published by Norman Rothery in a September 13th Globe and Mail article.

The main thrust of his article, which is summarized in the chart, is that even as the Fed tackles soaring inflation with higher interest rates, America’s bond market is flashing an ominous warning signal about the growth prospects for the US economy.

The shape of the Treasury yield curve provides important clues on how the US bond market feels about the longer-term prospects for the US economy. A brief primer on the shape of the yield curve is needed to understand this conclusion.

Usually, longer-term Treasury bonds provide higher yields than shorter-term ones, resulting in a yield curve that is upward-sloping. However, the yield curve tends to flatten out when bond investors expect that an economic slowdown or a recession may be in the offing.

When yields for short-term Treasuries are higher than yields for long-term ones, market watchers describe it as an “inverted yield curve.”

Every recession in the past 60 years has been preceded by an inversion of the yield curve between the three-month and 10-year Treasuries.

The following chart, which compares year-over-year growth rates in real GDP against the interest spread between US 10-year and 3-month treasury yields, demonstrates this association.

The chart suggests that whenever the interest rate spread narrows between the usually higher ten-year bonds and 3-month Treasuries, the narrowing spread foreshadows an economic slowdown. The historical evidence also suggests that negative interest rate spreads are associated with US economic downturns.

In the chart, the spread between 10-year and three-month U.S. Treasury bond yields was 0.20 of a percentage point on Sept. 7th. It was nearly negative just a while earlier.

As Rothery observes, while the spread has not gone negative, its low level is still very worrisome because of the environment of increasing central bank interest rates.

In other words, the financial markets are signaling almost exactly what the IMF and the National Bank projections seem to imply, i.e. slower US growth, and /or even a US recession is just ahead.

More By This Author:

There Is No Doubt That We Are On The Verge Of A Global Recession

The Key To Our Inflation Problem Is Reducing Inflationary Expectations

The World's Speedy Recovery From The Pandemic