The World's Speedy Recovery From The Pandemic

The OECD’s latest global economic outlook is a real tour de force, in that it seems to cover virtually all of the issues affecting the world’s economy.

As with other forecasting groups, the OECD couches its baseline projections with the usual caveats, and of course, and the biggest unknown for the world economic outlook is the future course of the pandemic.

To date, both the recession and the recovery has been very uneven, though there are some common characteristics that seem to affect all of the advanced countries.

Image Source: Pexels

That is, worker participation has dropped due to the pandemic and labor shortages have emerged which triggered a modest increase in money wages. As well, the wage gains have not kept up with the inflation increases.

So far, the recovery from the 2020 pandemic shock has revealed a stark gap between the rapid rebound of the rich countries and the much slower recovery of the middle-income and low-income economies.

It is also important to recognize that there is a sharp difference in the way the advanced economies moved away from the recent 2020 pandemic shock compared to the much slower recovery from the 2008 financial crisis.

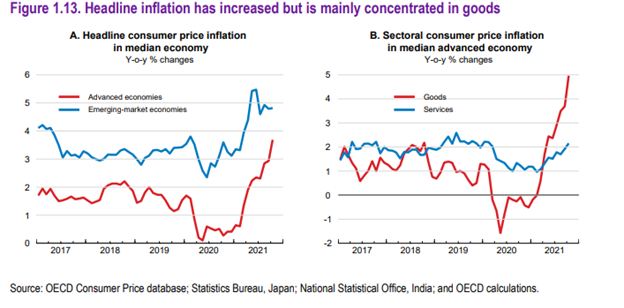

As matters currently stand, the scope of the recovery has been rather uneven among the advanced economies, though they all seem to experience similar supply bottlenecks, labor shortages, and somewhat higher consumer price increases than was earlier expected.

The differences in the style of the economic recovery stands out in terms of several important benchmarks.

For example, the US currently exceeds its pre-COVID peak level of Feb. 2020 real GDP, though American employment has not yet fully recovered.

In contrast, employment in the Euro Area countries currently exceeds its pre-COVID high, though its economic growth recovery has been slower than the American. Of course, the Euro economies always supported their workforce better than the United States, and this surely accounts for some of the employment recovery differences.

The OECD projections also recognize the rather huge economic imbalances due to supply bottlenecks.

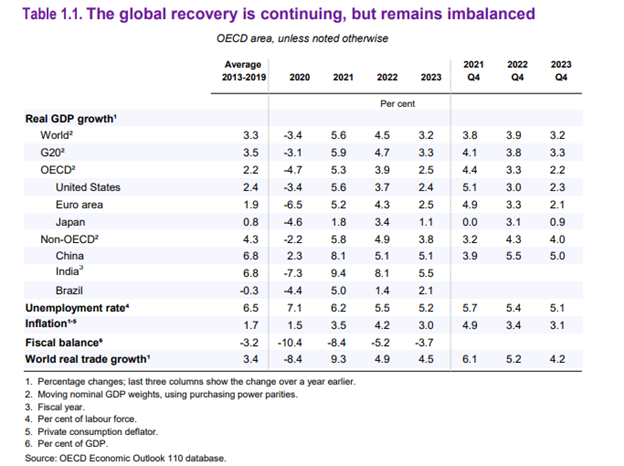

With respect to the recent downturn, the pandemic spurred contractions in 2020 were far heavier in the Euro Area (-6.5%) and Japan (-4.7%) than in the United States (-3.4%). India’s economy shrunk sharply in 2020, and China’s economy expanded 2.3% even though virtually all other countries experienced declines.

With respect to this year’s recovery, the growth rates virtually everywhere were positive and of course high by historical standards.

The global economy is projected to expand by 5.6% this year and by 4.5% in 2022 and 3.2% in 2023. China’s economy is projected to advance strongly this year by 8.1% and then by 5.1% in each of the following two years.

The American economy is expected to post a solid 5.6% growth this year and then expand by 3.7% in 2022 and 2.4% in 2023.

World trade declined far worse than the global economy in 2020 but is projected to grow faster than the world economy in 2022 and 2023.

All in all, the OECD report should be viewed as cautiously optimistic, but much depends on the future course of the coronavirus.

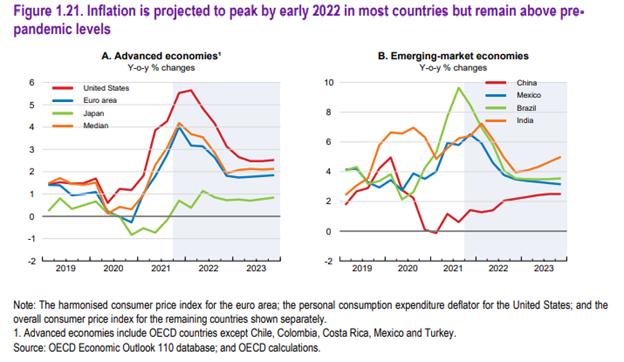

In addition, the future course of monetary policy in advanced economies is also very important.

As the OECD report underscores, “a key issue is the extent to which central banks will continue to maintain the accommodative monetary policy and look through the current upturn in headline inflation such judgments will become more challenging if current supply shocks and inflationary pressures turn out to be more persistent than currently expected.”