There Is No Doubt That We Are On The Verge Of A Global Recession

Image Source: Pexels

“Global output contracted in the second quarter of this year, owing to downturns in China and Russia, while US consumer spending undershot expectations. Several shocks have hit a world economy already weakened by the pandemic: higher-than-expected inflation worldwide––especially in the United States and major European economies––triggering tighter financial conditions; a worse-than-anticipated slowdown in China, reflecting COVID- 19 outbreaks and lockdowns; and further negative spillovers from the war in Ukraine…The risks to the outlook are overwhelmingly tilted to the downside.” (IMF, July 26, 2022)

“As western countries stand on the edge of a potentially ruinous recession in the coming year, China is also facing a slump thanks to “total collapse” of confidence among ordinary people in the once-buoyant housing market, the continued ravages of Beijing’s draconian zero-Covid strategy and an extreme heatwave that is affecting the supply of power and food.” (Manchester Guardian, August 29, 2022)

You don’t have to be an economic soothsayer to recognize that we are on the precipice of a global economic downturn. It is also very clear that the effects of the coming downturn will be far worse for continental Europe, the United Kingdom, and the developing countries than for the US, Canada, and Japan.

Indeed, it is quite worrisome that even China seems to be incapable of offsetting the array of negative economic influences slowing its economy. As revealed by the latest major downshift in China’s economic growth rate, China’s underperforming economy has been seriously hurt by the slowing global economy and its own Covid economic lockdowns, as well as the internal ravages associated with its housing sector collapse.

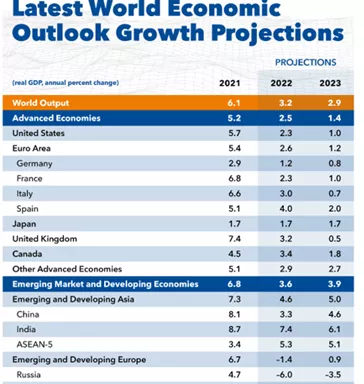

As a recent IMF report illustrates, the rapid 6.1% global economic recovery in 2021 is projected to transfer into a much slower 3.2% growth this year and 2.9% growth in 2023.

The advanced economies are projected to record very steep slowdowns this year and next (2.5% and 1.4%), and the emerging market economies are also expected to post extremely low economic growth rates over the next year and a half.

With respect to the key advanced economies, economic growth is expected to slow very sharply in 2023 – the US to 1%, Germany to 0.8%, Japan to 1.7%, and the UK to 0.5%.

China’s economy has not been immune to the many negative factors at work, as China’s growth rate in 2023 is projected to decelerate to nearly half of the pace in 2021, while Russia’s economy is projected to record two massive GDP declines (6% in 2022 and 3.5% in 2023)

For those of you who are more pessimistically inclined, I have also presented below a recent set of global projections made by the National Bank Financial. The National Bank’s projections are slightly more pessimistic than the IMF’s and portray the global economy growing only 2.7% next year, with the advanced economies slipping down to 1.2% growth in 2023. The IMF, in contrast, projected 3.2% and 2.9% growth in 2022 and 2023.

Although the pre-pandemic growth rates may not appear too different than these forecasts, in fact, the differences are very profound. In 2018 global growth was 3.7%, in 2019 it was 3.5% and in 2020 it was 3.6%.

More By This Author:

The Key To Our Inflation Problem Is Reducing Inflationary Expectations

The World's Speedy Recovery From The Pandemic

Canada’s Labor Force Participation Rate Has Been Shrinking For Quite A While