US Inflation May Have Peaked, But What About The Lasting Effects?

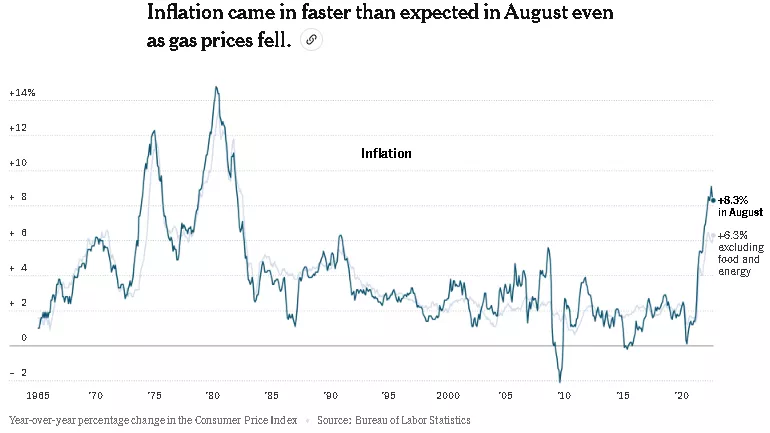

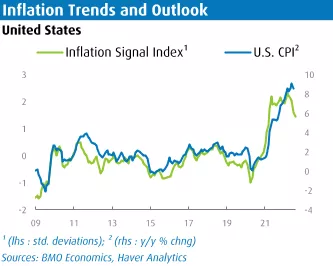

In August, the US consumer-price index, or the CPI, rose 0.1% from the previous month and the year-over-year pace slowed to 8.3% from 8.5% in July and 1.6% as of July 2021.

Despite year over year slowing, the equity markets tanked on the release data since markets felt that the pace of the slowing was disappointingly slow.

US inflation is clearly too high for Fed policymakers, and with the jobs market still rather tight, the Fed will likely increase the fund rate another 75-basis points at its September meeting.

Since 2012, the US Federal Reserve (and the Bank of Canada) has targeted a 2% inflation rate for their so-called core measures.

While many of today’s young investment professionals have not experienced lengthy periods of high inflation, for others of my vintage the experience has been more searing. Events can go awfully wrong if Fed policy tightening because of inflation triggers a deep recession.

For example, in the early 1980s during Paul Volker’s chairmanship at the Fed, the inflation rate climbed as high as 14.93%, causing the Fed to raise the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. The bank prime lending rate rose to 21.5% in 1981 and the unemployment rate rose to over 10%. The extremely high interest rates of this period resulted in the deep 1980–1982 economic downturn.

In other words, Volker and the Fed wrung inflation out of the US economy, but at a great cost — hurling the US into not just one recession, but two, in rapid succession. Unemployment soared, stocks fell repeatedly, interest rates oscillated, and, for a while, the bond market also looked shaky.

Fortunately, we are not returning to an inflationary environment of the early 1980s.

Indeed, the financial markets seem to believe that global inflation has already peaked, but of course, inflation will remain very elevated for some time. At the same time markets are correctly projecting a global slowdown in 2023.

Russia’s invasion of Ukraine has seriously disrupted global energy markets and damaged the global economy. The World Bank points out that compared with the oil price shocks of the 1970s, Russia’s war shock has led to price increases across a broader set of energy related commodities, particularly natural gas.

The World Bank’s global model estimates that the war-driven surge in energy prices will, at the margin, reduce global output by 0.8 percent after two years.

In closing, when inflation was soaring 40 years ago and the economy slowed, short-term investing was perilous. But investors with patience and long horizons came out fine.

More By This Author:

The Financial Markets Are Signaling Either A Slowdown Or A US Recession

There Is No Doubt That We Are On The Verge Of A Global Recession

The Key To Our Inflation Problem Is Reducing Inflationary Expectations

Good article, but that first image is a bit hard read.