Tuesday Talk: Stabilized But Still Spooky

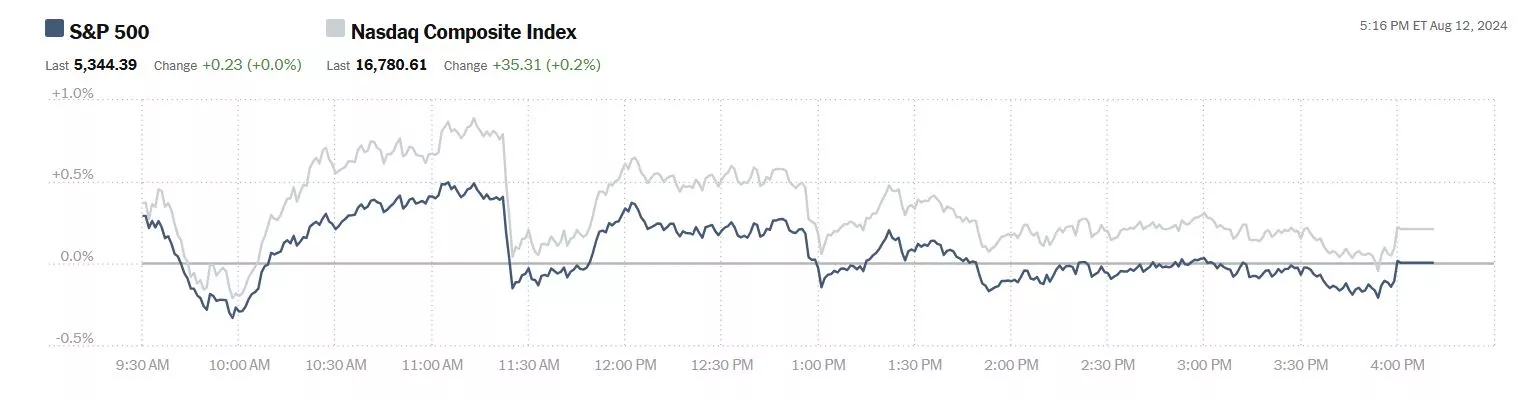

The markets popped up last Friday and seemed to maintain those positions at the close of trading on Monday. Still the market is concerned about major events this week such as Wednesday's release of the latest CPI data which is predicted to again be out of reach of the Fed's 2% inflation target.

Yesterday the S&P 500 closed at 5,344, up 0.23 points, so really no change from Friday. The Dow closed at 39,357, down 141 points and the Nasdaq Composite closed at 16,781, up 35 points.

Chart: The New York Times

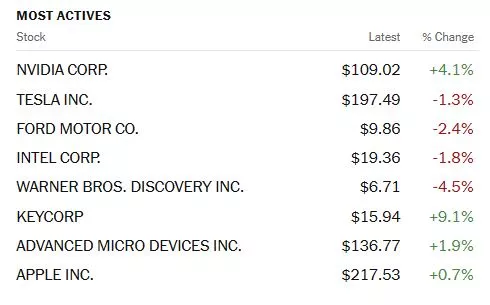

Most actives were led by Nvidia, up 4.1%, followed by Tesla (TSLA), down 1.3% and Ford Motor Co. (F), down 2.4%.

Chart: The New York Times

In morning futures action S&P 500 market futures are up 23 points, Dow market futures are up 56 points and Nasdaq 100 market futures are up 115 points.

TalkMarkets contributors Francesco Pesole, Frantisek Taborsky and Chris Turner write about the First Inflation Test Of The Week from a Forex point of view.

"US PPI data will be the first inflation-related test of this week for global equities (which have continued to recover) before tomorrow’s key CPI figures. We expect 0.2% month-on-month prints to keep investors’ nerves relaxed and favor an orderly USD decline.

USD: First hurdle of the week

The most noteworthy development in an otherwise quiet start to the week in FX has been the continuation of the USD/JPY recovery. Interestingly, the high-carry Mexican peso has been the other major loser since the weekend, signaling that the JPY correction is more macro- and equity-driven than caused by a rebuilding of carry trades. We expect macro to be the key driver of the yen in the coming months, especially now that speculative positioning has flattened and the Bank of Japan hike has dented the funding appeal of the yen. As discussed in the G10 section of FX Talking, an orderly USD/JPY decline is one of our key calls for the month ahead.

Today, one key test for USD/JPY and the broader FX market is the release of July’s US PPI report. We expect a consensus 0.2% MoM print across headline and core measures to ease market nerves about a round of higher CPI/PCE that would deliver a hard hit to the risk sentiment just as global stock indices finalize their recovery of recent losses. We could see USD/JPY halt its rally after the release today and the dollar trade generally on the soft side across the board as some pre-inflation data defensive positioning is scaled back. Another important release is the NFIB Small Business Optimism report for July. The hiring plans sub-index is one of the most reliable predictors of private payrolls three months ahead: a resumption of the early 2024 decline following a recent rebound would fuel jobs market concerns.

Tomorrow’s CPI will undoubtedly generate higher FX volatility with markets likely to focus on the second percentage point decimal in the MoM print (consensus is 0.2%). We are generally optimistic that data will fall in line with consensus expectations and continue to endorse market pricing for 100bp of Fed cuts by year-end. An orderly USD decline is our baseline scenario for this and the next few weeks."

See the rest of the article for current insights on the Euro, British Pound and Middle and Eastern European currencies.

Contributor Mark Vickery notes Markets Mixed Ahead Of Key Inflation Data.

"Over the past month, the A.I. trade has gotten a re-think. By this I mean it has sold off from its lofty perch after a year-plus of leading the markets. But today we see NVIDIA (NVDA - Free Report) catching a bid: +4% on the day, leading all mega-caps. Super Micro Computer (SMCI - Free Report) — a server-based A.I. play — led the way higher by way of filling in the big hole from mid-last week.

Otherwise, we’re seeing what we more or less hope we would after last week’s rollercoaster ride: the Volatility Index (VIX) — the chief gauge of nervousness among market participants — leveled off around 20 today, after spiking up nearly double that a week ago. That 38.6 we saw last Monday was the highest in more than a year. So it would stand to reason that less volatile stocks like UnitedHealth (UNH - Free Report) would lead the Dow today...

Tomorrow morning, the Producer Price Index (PPI) will hit the tape. This will demonstrate the levels of wholesale inflation, which in the supply chain nightmare of a few years ago had ballooned up to +9.7%. The July core number year over year is expected to remain at +3.0%, where it was in the same print a month ago. This is actually the highest we’ve seen since April in 2023; back in December of last year, PPI had sunk to +1.8%. A surprise to the downside would be welcome, core PPI year over year has now increased in each of the past six months."

Elsewhere, TM contributor Ironman tells readers about US-China Trade Racing To Beat Clock On New Biden-Harris Tariffs.

"China's exports to the U.S. increased year-over-year in June 2024. Looking forward to next month, China's exports to the U.S. are expected to come in higher than previously projected as well.

Unfortunately, the increase in Chinese goods arriving in the U.S. this summer is not because the U.S. economy is experiencing a summer growth spurt.

"Instead, it's mainly because many U.S. businesses importing goods from China were racing the clock to bring in as many goods as they can before the Biden-Harris administration's latest set of higher tariffs on Chinese goods went into effect on August 1...

Because it takes several weeks for the container ships carrying Chinese goods to cross the Pacific Ocean before reaching the U.S.' west coast ports, most of these shipments had to be underway by the end of the first week of July to deliver their goods before the new tariffs went into effect on 1 August 2024. After that week, it would be logical to expect China's exports to the U.S. to slow significantly, since they would face higher costs from the new tariffs taking effect at the beginning of August. Early reports on China's July exports suggest that's exactly what happened:

China’s exports growth unexpectedly slowed in July, signaling a cooling of global demand that has been propping up growth in the world’s second-biggest economy.

In the context of trade growth between the U.S. and China in recent years, China's export surge in the last several months contributed to the apparent bottoming of what had previously been a negative, downward trend in trade between the two nations...

As of June 2024, the gap between a post-pandemic counterfactual based on how trade between the two countries expanded following the 2008-09 recession has expanded to $17.2 billion. Since September 2022, the Biden-Harris administration's anti-free trade policies have collectively shrunk the total value of trade between the U.S. and China by nearly $224 billion...

The trade data for July 2024 that's coming next month, inflated by the rush to beat the Biden-Harris tariff clock, may the be last good news we'll see in this trade data for a while."

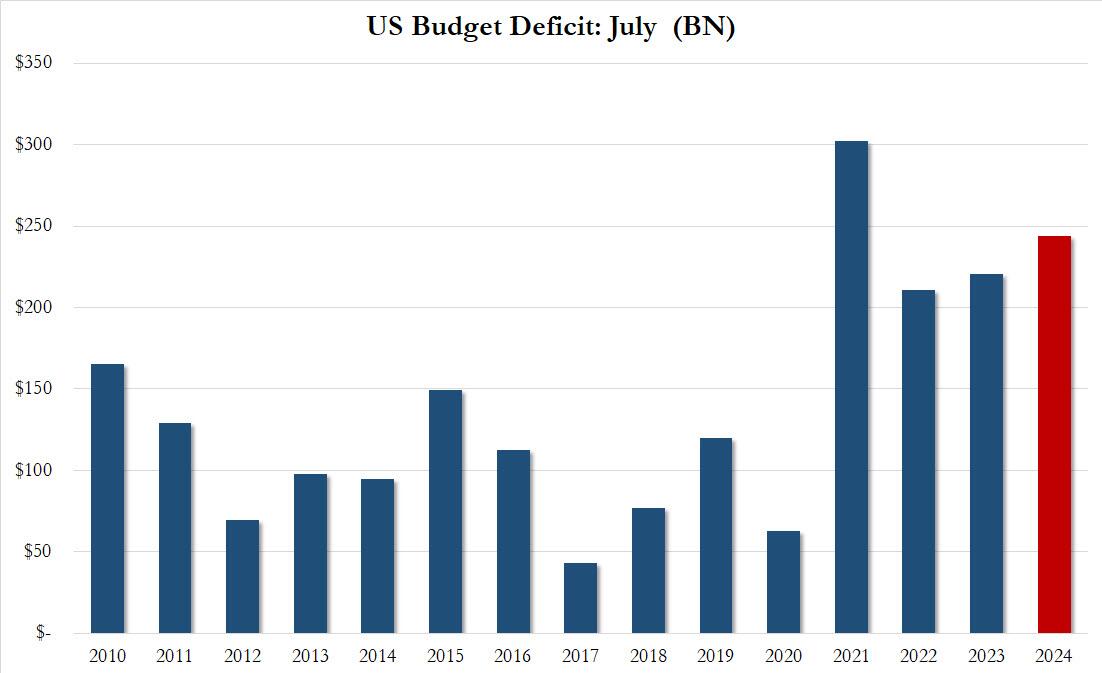

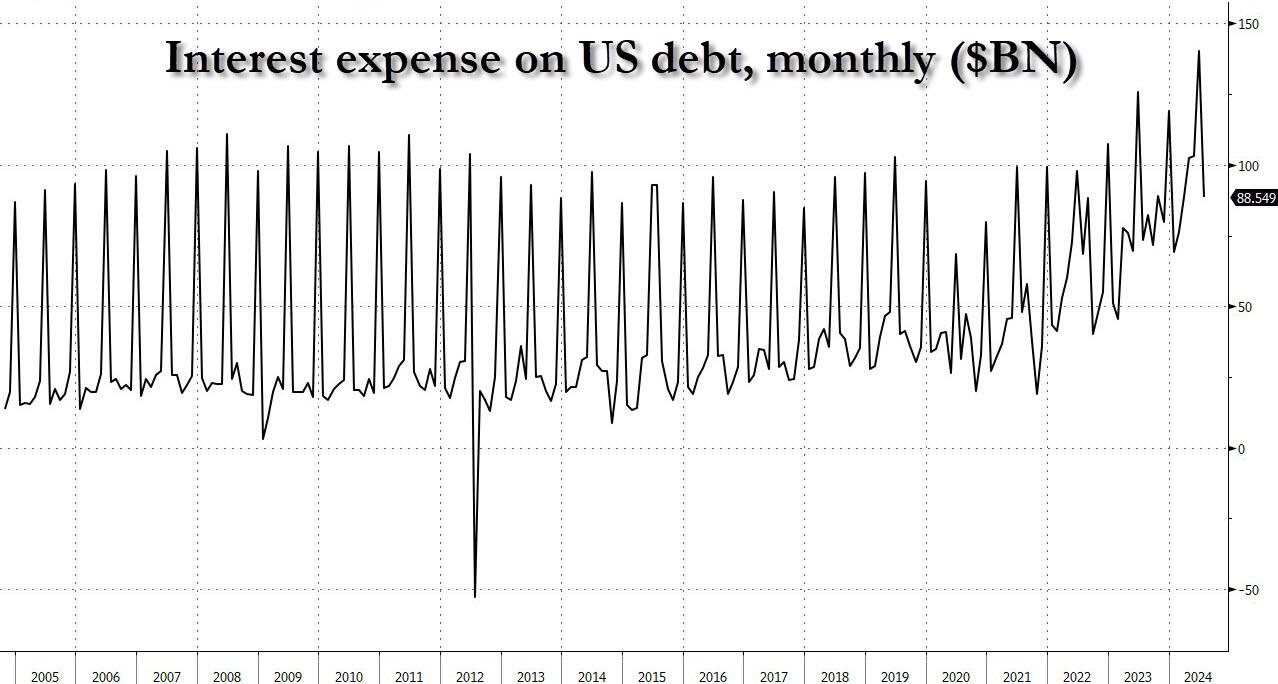

More from the "Department of Bad News", contributor Tyler Durden reports US Records 2nd Biggest July Deficit In History As 25% Of Tax Revenue Go To Pay Interest.

...(Talk about the Federal deficit has) become almost taboo perhaps because neither presidential candidate has any plan or clue how to normalize the trend which assures fiscal collapse for the US and the loss of dollar reserve status.

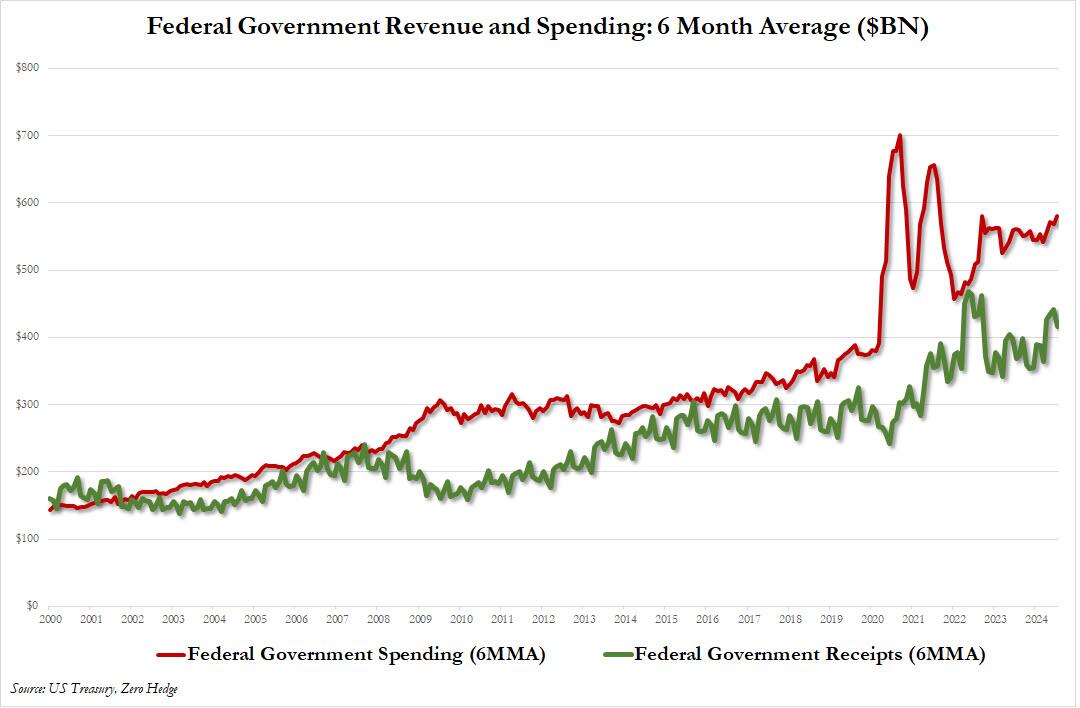

While others may have conflicts of interest in reporting on this most important topic, we don't, and we are sad to inform our readers that July was another catastrophic month for US fiscal viability: that's because US tax revenue of $330.4BN (down sharply from the $466.3BN in June, if higher than the $276.2BN a year ago), was far below the $573.1BN in government outlays (which was materially above the $537.2BN in June and also the $496.9BN last July)...resulting in a monthly deficit of $243.7BN, the second largest July budget deficit on record, surpassed only by the record post-Covid print in July 2021.

With two months left in the fiscal year, the US budget deficit for fiscal 2024 has hit $1.517 trillion, tracking last year's blowout expansion almost dollar for dollar (one year ago the cumulative deficit was $1.613 trillion), and the 4th highest on record despite there being no raging emergency and no war demanding such a massive deficit spend...

Unfortunately, that's as good as it gets, because when one takes a step back and ignores the monthly calendar effects, the picture remains the same: the US is spending far more than it is generating in tax revenues.

...So where are we now? Well, according to the latest Treasury Monthly Statement, in July the US spent a gross $88.6 billion on debt interest, bringing the YTD total to $956 billion and is on pace to hit $1.157 trillion for the full year.

And putting it in context, the $87 billion in gross interest spending (which follows June's record $140 billion) was 25% of all US receipts (mostly taxes) in June..."

Looking at commodities contributors Ewa Manthey and Warren Patterson note that currently, Oil Trades Under Pressure.

The Organization of the Petroleum Exporting Countries (OPEC) released its latest monthly oil market report yesterday with the group trimming its forecasts for global oil demand for this year and next, primarily on expectations of softening demand from China. OPEC expects global oil demand to grow by 2.11m b/d in 2024 (vs earlier estimates of 2.25m b/d) and by a further 1.78m b/d (vs previous forecasts of 1.85m b/d) in 2025. However, these numbers are still stronger than those forecasted by the Environmental Investigation Agency (EIA) and the International Energy Agency (IEA).

Meanwhile, OPEC left its non-OPEC+ supply growth forecasts unchanged for 2024 and 2025 at 1.3m b/d and 1.1m b/d respectively. The report also showed that OPEC production increased by 185k b/d month-on-month to 26.75m b/d in July, as the group exceeded the July oil target by 84k b/d. This rise was driven by Saudi Arabia, Iraq and Iran, where output rose by 97k b/d, 57k b/d and 20k b/d respectively. The OPEC+ production increased by 117k b/d in July to 40.91m b/d. The IEA will release its latest monthly oil market report today.

Mysteel Oilchem said that state and independent oil refineries in China might increase crude processing rates in August to around 69.6% of capacity. Looking at products, the gasoline yields at state refiners may fall to 24% (ending a four-month growth streak) following slowing consumption, while diesel is expected to enter its peak demand season."

The latest Natural Gas, Metals and Grain Crops data are also, reviewed in the full article.

Closing out the column we look at how global concerns are affecting crypto currencies with TalkMarkets contibutor Aleksandar Aleksin who notes Solana And Cardano: Solana Fails To Stay On The Bullish Side.

Solana chart analysis

The price of Solana is in retreat after it rose to $163.70 on Friday. Over the weekend, the price tried to hold above $152.00 but was unsuccessful in doing so. By falling below, we also went below the EMA 200 moving average, which strengthened the bearish momentum to the $141.50 level. On Monday, Solana managed to stabilize there and recover to $150.00. There, we met the EMA 200 again and again failed to move above its line...

Cardano chart analysis

...Cardano started to pull back again and fell to the 0.333 level today. Pressure is growing, and we expect further pullback and the formation of a new daily low. Potential lower targets are the 0.330 and 0.325 levels. For a bullish option, we need a positive consolidation and a jump to the 0.345 level. Then, we need to stabilize there if we want EMA 200 moving average support. Potential higher targets are the 0.350 and 0.355 levels.

It remains to be seen if the market will continue to maintain its stabilizing rhythm today and Friday.

Have a good one.

Peace.

More By This Author:

Thoughts For Thursday: Markets And Mayhem

Tuesday Talk: A Big Dip

Thoughts For Thursday: All About Earnings

What does the last photo have to do with the article?