Tuesday Talk: A Big Dip

A big dip may be an understatement for some, given the losses in the market, yesterday. Not much of an August season opener. Be that as it may, stock futures are up this morning.

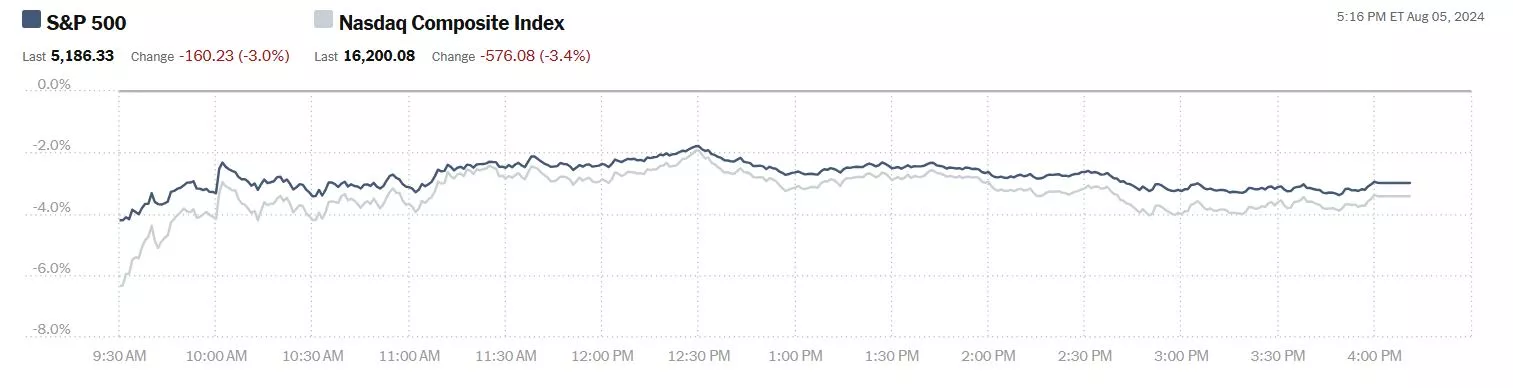

Monday the S&P 500 closed at 5,186, down 160 points, the Dow closed at 38,703, down 1,034 points and the Nasdaq Composite closed at 16,200, down 576 points.

Chart: The New York Times

Most actives were led by Nvidia (NVDA), down 6.4%, followed by Intel (INTC) also, down 6.4% and Ford (F), down 3.2%.

Chart: The New York Times

In morning futures trading the major indices are all signaling rebounds. S&P 500 market futures are up 34 points, Dow market futures are up 213 points and Nasdaq 100 market futures are up 138 points, though activity is erratic.

TalkMarkets contributor Tim Knight reminds readers What I Wrote At The Peak.

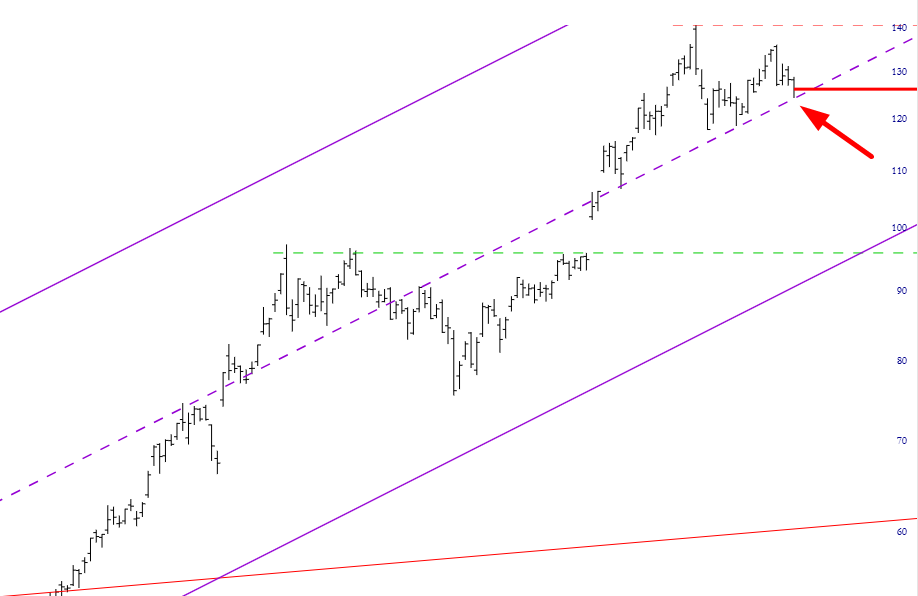

"Now that the market is utterly falling to pieces, I was curious to know what I wrote back at the VERY TOP of the market, July 16th, when the VIX was at 11, and I absolutely detested trading and could barely bring myself to compose posts for Slope. Well, here it is – and it’s about Nvidia. I wrote the following, which should be chiseled into granite with its date:

For 22 months (!), NVDA has politely traveled within the tidy confines of an ascending price channel. I suggest keeping a close eye on this dashed midline. A failure here would open up the prospect for a trip down to the price gap, marked in green, at $96.01, which is a long, long way from here.

So we went from this:

To this…………..A 30%, TRILLION DOLLAR DROP IN A MATTER OF DAYS………"

Contributor Bill Smead looks at investor sentiment in Crowd Strike.

"One of the very popular technology companies in recent years has been CrowdStrike, Inc. It provides cybersecurity to numerous major technology companies including the top Artificial Intelligence (AI) players. Its shares got blasted recently as the first big correction in the glamour tech stocks has taken hold of the market’s agenda. However, a much bigger issue in the stock market would be if the crowd of people who have come into the stock market since 1989 went on a buyer’s strike.

Not only are American public investors crowded with glamour tech and growth stocks, but so is the S&P 500 Index:

Source: Source: Bloomberg, as of 7/31/2024

...What would happen if the 52 million common stock owners and the crowd of religious passive investing individuals, financial advisors and writers for major investment outlets (The Death of Stock Picking) decide to go on strike? It could create a circumstance that feeds on itself. Selling begets more selling and feeds on itself. Major stock prices begin to perform poorly, which drags down the S&P 500 Index, which in turn causes the selling of the index. The index selling puts a drag on the largest-cap stocks, which adds more legs to the index selling...It could easily become a circular wave with no source of buyer interest...a massive crowd could be unwinding as buyers go on strike. As Warren Buffett likes to say, be fearful when others are greedy! The crowd is as greedy as it has ever been and prepare yourself for what could be a long strike."

There's more "optimism" in the full article.

Contributor Lance Roberts tries to explain what happened yesterday in Yen Carry Trade Blows Up Sparking Global Sell-Off.

"...Leverage + Valuations + Psychology + Ownership + Momentum = “Mean Reverting Event”

Importantly, this particular formula remains supportive of higher asset prices in the short term. Of course, the more prices rise, the more optimistic investors become. While the combination of ingredients is dangerous, they remain “inert” until exposed to the right catalyst.

That catalyst is always an unexpected, exogenous event that triggers a rush for the exits.

...The Yen carry trade has been going on in the financial markets for decades. It has been a significant driver for hedge funds in leveraging their portfolios to generate higher returns. An elementary example of the Yen carry trade is as follows:

- A hedge fund sells short $10 million in Japanese Government Bonds that yield zero percent. (The hedge fund sold an asset they didn’t own, netting the fund $10 million and effectively shorting the Japanese Yen.)

- The hedge fund then buys $10 million in U.S. Treasuries, yielding 4%, capturing the spread between the bonds.

- Then, the hedge fund leverages that $10 million into $100 million (10x leverage) to buy risk assets.

Now, consider that “yen carry traders” have leveraged highly volatile risk assets like cryptocurrencies, small-cap stocks, mega-cap stocks, and even the Japanese market. The carry trade works well as long as the Japanese Yen does not markedly appreciate, forcing a liquidation of the market leverage.

The problem, as shown below, is that the Yen has appreciated more than 15% in the last few weeks. As the Yen appreciates, the Japanese banks demand margin calls (i.e., the catalyst). When that occurs, the hedge funds, pension funds, insurance companies, or investors using the “Yen carry trade” must either put up more collateral or sell the leveraged assets. That reversal and forced liquidation created a vicious spiral by pushing the Yen higher and risk assets lower.

...As an investor, the most crucial action to take during an “unexpected, exogenous event” is to DO NOTHING.

That’s right, don’t do anything. When something occurs, like a sharp market correction, our initial emotional response is to take action and begin liquidating positions. Such would certainly seem to be a logical reaction; however, more often than not, the time to sell positions was ahead of the event. Over the last two months, we have repeatedly warned that a 5-10% market correction was likely heading into the election...

With the major markets deeply oversold short-term and sentiment becoming more bearish, it is quite likely the market will bounce over the next several days to a couple of weeks. However, as shown below, many investors were caught by the swiftness of the sell-off across all markets. These “trapped longs” will look for a rally to sell into, particularly in the more speculative areas of the market like small and mid-cap stocks, cryptocurrencies, and meme-stocks.

Crucially, this event will pass, and patient investors will be rewarded with an opportunity to acquire assets at discounted prices...

While the sell-off will certainly impair investor confidence, the demise of the “yen carry trade” is temporary...However, while expected, this decline could be with us for a while longer, particularly as the economy continues to show signs of slowing down. While the economy will likely avoid a “deep recession,” the odds of a “no landing scenario” are slim. Therefore, we should at least prepare for a slower earnings growth rate as economic activity recedes. The rules are simple but effective.

- Use near-term rallies to raise cash levels in portfolios.

- Reduce equity risk, particularly in areas highly dependent on economic growth.

- Add or increase the duration of bond allocations, which tend to offset risk during recessionary downturns.

- Reduce exposure to commodities and inflation trades as economic growth slows.

If the market declines further or a recession occurs, preparation allows you to survive the impact..."

More analysis and recommendations can be found in the full article.

TM contributors Francesco Pesole, Frantisek Taborsky and Chris Turner write in their column FX Daily: Dollar May Be Left Wounded After Equity Stabilization.

"...The key takeaway at this stage is that the dollar has lost its safe-haven appeal. That is because soft US data was behind the market turmoil, and investors are not reluctant to price in aggressive Fed easing as a reaction, which is a dollar negative and highly favors the other safe-havens JPY and CHF. The bet here was that Fed Chair Jerome Powell would react not just particularly to the worsening macro picture, but to a greater extent to an equity selloff instead.

After all, Austan Goolsbee (a dovish-leaning FOMC member) said that the Fed won’t overreact to one soft jobs print, the ISM service rebounded above 50 yesterday, and there are explicit concerns about the inflation trajectory at the Fed. All this may not be entirely consistent with the 111bp of easing priced into the USD curve by year-end. The question is perhaps whether Powell has a line in the sand for the stock market after which it would deliver an off-meeting rate cut. That is, however, an emergency measure that generally requires some concerns about financial stability, which looks premature.

We are not equity strategists, but risk assets are looking at the potential risk of the Fed underdelivering in terms of dovish communication. We also have the US CPI report next week, and any upside surprise can definitely ignite more risk-off as hopes of large cuts have to be scaled back. In that scenario, the dollar would regain safe-haven appeal, but for now, the greenback will retain a positive correlation to equities due to the Fed easing implications...

Once stock markets ultimately stabilize – and barring an inflation surprise next week – the dollar should head lower, in our view. The repricing lower in the Fed terminal rate now means that the dollar’s rate advantage has been trimmed and there is room for pro-cyclical currencies to readjust higher versus USD on the back of more favorable rate differentials."

Closing out the column contributor Crispus Nyaga explains that Bitcoin Takes A Hit As Momentum Ends.

"Bitcoin (BITCOMP) and other cryptocurrencies continued their downward trend as a sense of fear continued in the crypto industry. The BTC/USD pair has now dropped in the past four straight days and is hovering at its lowest point since February.

Bitcoin’s crash coincided with the sell-off among other risky assets. On Monday, Japan’s top indices like the Nikkei 225 and the Topix crashed by over 10%, in their worst day in years. The same trend continued in the US where the Dow Jones fell by more than 1,000 points.

Crypto-related stocks also continued falling, with Coinbase retreating by over 8% and MicroStrategy declining by almost 10%. Mining stocks like Riot Platforms and Marathon Digital slumped as well.

The main drivers for the sell-off was the Bank of Japan’s rate hike and the weak US economic numbers. The decision by the BoJ to hike rates at a time when other central banks are cutting means that traders are now unwinding their yen carry trades.

Bitcoin will likely attempt to bounce back as some investors buy the dip. If this happens, it could rise to as high as 58,000. However, a drop below Monday’s low of 49,200 will point to more downside.

Bullish view

- Buy the BTC/USD pair and set a take-profit at 58,000.

- Add a stop-loss at 49,500.

- Timeline: 1-2 days.

Bearish view

- Sell the BTC/USD pair and set a take-profit at 49,500.

- Add a stop-loss at 58,000."

For today, that's a wrap. Hopefully, there will be better news on Thursday.

Be well.

More By This Author:

Thoughts For Thursday: All About Earnings

Tuesday Talk: Almost Gone Fishing Time

Words For Wednesday: No Major Shoe Dropping Yet