Tuesday Talk: Almost Gone Fishing Time

It's July 30, today which is almost August "Gone Fishing" time, though this year there is a lot of action on tap in Chicago that may spillover into the market. We will see.

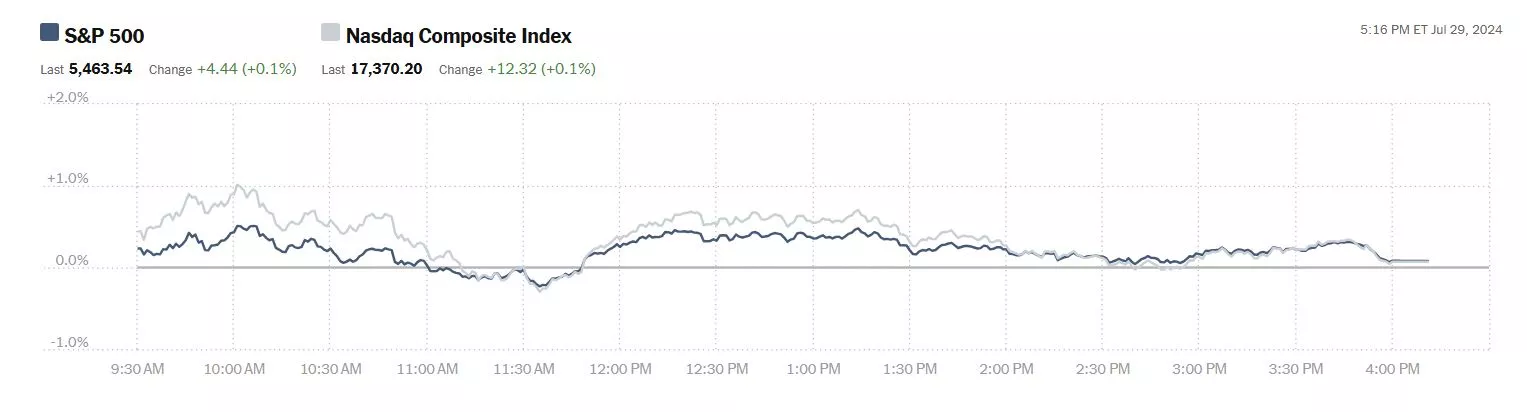

Monday the S&P 500 closed at 5,464, up 4 points, the Dow closed at 40,540, down 49 points and the Nasdaq Composite closed at 17,370, up 12 points.

Chart: The New York Times

Most actives led by Nvidia (NVDA) down 1.3%, Followed by Tesla (TSLA) up 5.6% and Ford (F) down 1.6%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are up 11 points, Dow market futures are up 24 points and Nasdaq 100 market futures are up 52 points.

TalkMarkets contributor Mark Vickery takes note of the Flat Trading Day Ahead Of Key Q2, Econ Reports.

"The first trading day of the week was flat. It didn’t look like it was starting out that way, with pre-market futures well into the green — continuing Friday’s rally for the full trading day. But around lunchtime, three of the four major indices went to zero and the small-cap Russell 2000 sank below it and never recovered...

With employment decelerating from the robust highs of a year or two ago, and inflation metrics moving rather steadily down toward the ideal +2%, the trick will be whether the Fed will cut rates at the right time. Too early and, like in the 1970s and early ’80s, we saw inflation rekindle and surge past prior highs; too late and we risk burrowing into recession with higher unemployment and still-high interest rate levels...we expect Powell to explain why the Fed will make its first move in several years at the September meeting.

Seattle-based F5 (FFIV - Free Report) shares are up +10% in the after-market. The Internet networking company posted fiscal Q3 earnings of $3.36 per share, above the $2.97 analysts were expecting and the $3.21 per share reported in the year-ago quarter...Next-quarter guides have both improved, to $3.38-3.50 in next-quarter earnings on $720-740 million in sales — both improvements on the $3.32 per share and $715 million previously expected.

Lattice Semiconductor (LSCC - Free Report) missed Q2 estimates after the closing bell. Earnings of 23 cents per share missed the Zacks consensus by a penny, while revenues of $124 million came up short of the $130 million anticipated. Revenue guidance was also lowered, to a range of $117-137 million from the previously projected $142.4 million...Shares have fallen -10% in late trading.

Sprouts Farmers Market (SFM - Free Report), a grocery chain based in Phoenix, is having the best post-earnings rally of all. Shares are up +13% on sizable beats on both top and bottom lines: earnings of 94 cents per share trounced the 77 cents in the Zacks consensus, with revenues of $1.89 billion improving from the $1.83 billion estimate...Sprouts shares are now +85% year to date, including this afternoon’s buy-in.

Contributor Cullen Roche is looking at Three Things – Commodities, Bitcoin & Stocks.

Here are three things I think I am thinking about to start the week. Let’s talk about three big asset classes….

1) Commodities and an inflation resurgence.

I think I’ve had a decent track record on inflation over the last few years during a pretty tumultuous period of inflation. Early in Covid, I said the huge government deficits created high inflation risk. In 2022 I said the rate of inflation had peaked just a few months before it did. And in 2023 and 2024 I’ve been calling for disinflation. Another risk I consistently dismissed over the years was the risk of hyperinflation and the risk of a 1970s/40s double bump resurgence in inflation. But I have to admit, the stickiness of inflation in recent months made me a little worried that I had that last one wrong. But I still think the risk there is relatively low and one of the main reasons for this is commodities.

Commodities are one of the main inputs in our inflation model. They give us just about the best real-time measure of inflation and where broad prices are headed. Of course, they’re not a perfect leading indicator and often correspond more closely to cost-push inflation trends, but they’re still a good measure of broader supply/demand dynamics at work in the global economy. And the trend here remains pretty clearly to the downside.

After a brief bump earlier this year, commodities have retrenched and are now negative on the year at -1%. They’re down -7% on a year-over-year basis and -25% off the peak. Geopolitical risk and commodity prices would be one of the primary potential ways we get a double bump in inflation. So far it ain’t happening so disinflation remains the most likely outcome going forward from here.

2) Governments Buying Bitcoin.

Senator Cynthia Lummis was at the Bitcoin 2024 conference proposing legislation for the US government to buy $68B of Bitcoin (BITCOMP). Her theory is that the US government needs a “strategic Bitcoin reserve” to help pay off the national debt...But this issue is more fundamental in my opinion – governments shouldn’t save to fund future investments...

More fundamentally – the government has a printing press. So, not only does it not need prior savings to fund investment, but it isn’t well structured to spend for investment in the first place because the for-profit incentive structure doesn’t exist. So buying secondary market assets with the goal of investment makes no sense from the view of a government...

...it’s fair to argue that the government spends too much....if that’s your view then buying things like...Bitcoin is not the solution. We should be asking the government to help fund private sector investment so we can increase growth and create the real resources that make our money valuable in the first place...printing money to buy and hold secondary market assets for decades is not a solution to inflation or a society’s lack of productive resources. And it certainly won’t help the government “pay off” the national debt because that’s not even a thing in the first place.

3) Is the market more reasonably priced than we think?

Here’s a great chart from JP Morgan’s latest quarterly review showing the valuation of the market with big tech and without it. It’s actually three charts, but we’re talking about three things here so let’s just go with three charts as well...

With the top 10 largest stocks included the S&P 500 looks wildly expensive. And without it, it looks expensive, but much more modestly so...

This worry has been largely overblown...but it goes to show how much the top 10 firms in the S&P are contributing both to growth and higher valuations. It’s all good as long as it remains good. But if the trend flips then just be prepared...it also goes to show that the S&P 490 is a lot more reasonably priced than the 500 might make us think."

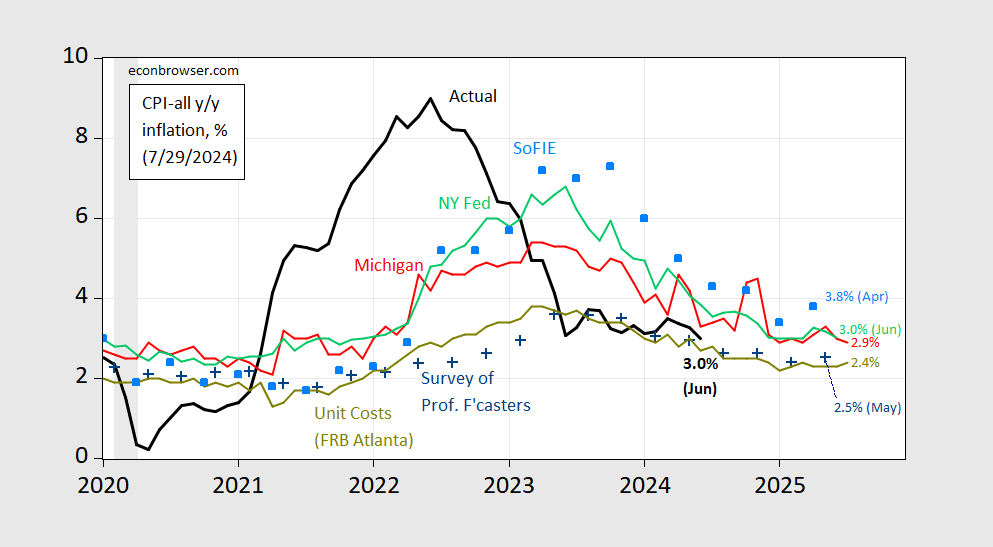

Economist and TM contributor Menzie Chinn takes a "historic" look at Inflation Expectations In July (And June).

"Michigan is down in July, while business unit costs are up slightly.

Figure 1: Year-on-year actual CPI inflation (bold black), and expected inflation from University of Michigan (red), NY Fed (light green), Survey of Professional Forecasters (blue +), Coibion-Gorodnichenko SoFIE mean (sky blue squares), and unit cost growth rate (chartreuse), all in %. Source: BLS, U.Michigan via FRED, NY Fed, Philadelphia Fed, Atlanta Fed, Cleveland Fed, and author’s calculations."

Chris Turner, Francesco Pesole and Frantisek Taborsky are Looking Out For Further Signs Of A US Slowdown.

"The big question for Forex markets is whether July’s sharp correction is over. We think events tomorrow (Bank of Japan and Fed meetings) will have a big say. Before then, US JOLTS and consumer confidence data today should add to the case that the US economy is slowing. And in Europe, we’ll see second-quarter GDP releases and insights into the July CPI data...

The job opening JOLTS data are expected to correct back to the eight million level after the unexpected spike to 8.14 million last month. Remember that the JOLTS data have been representing the excess demand for labor and a lower figure would confirm the Fed's view that the labor market is coming back into better balance. Also in focus is July consumer confidence data, which is expected to dip lower. Over recent weeks there has been growing momentum – aided by second-quarter earnings reports – that the US consumer is finally rolling over. A softer confidence figure today will add to the view that the Fed will want to "sustain the expansion" with a September rate cut...

This morning, we have already seen a better-than-expected second-quarter GDP figure from France and later today we will see similar updates from Germany, Italy, Spain and then the eurozone. Any upside surprise to the consensus of 0.2% QoQ second quarter GDP reading for the eurozone could provide a modest lift for the euro – breaking the narrative of downside risks to growth and reining in market pricing which is now looking for more than two further ECB rate cuts this year.

Today will also see the national releases of the July CPI data ahead of the eurozone release tomorrow. Currently, the consensus expects the core CPI figure to dip back to the 2.8% YoY area, which looks unlikely to move the needle on ECB pricing.

EUR/USD had a soft Monday but could find some support on the GDP releases today and move higher tomorrow evening should the Fed turn more overtly dovish as we expect. 1.0800 could prove the floor for EUR/USD this week...

USD/JPY is consolidating after a sharp 6% drop from 11 July, when soft US CPI data and strategic Japanese FX intervention took its toll. Speculative yen shorts in Chicago futures markets, in the week to 23 July, had scaled back their positions by 40% over the prior two weeks. This community probably cut positions a little further later last week when USD/JPY traded on a 152 handle. It seems fair to assess that the speculative market is a lot better balanced than it was at the start of July – but is still running decent yen short positions...

The CEE market opened yesterday with a sell-off across the board with Polish zloty leading the losses. Rates aggressively followed the rally in core markets and alongside a stronger US dollar, undermined FX in the region and the emerging market space. Still, EUR/CZK showed some resistance to going higher and the Czech koruna remains our favorite currency for this week given our hawkish expectations from the CNB meeting. EUR/HUF is back close to 394, which we think is now fair value and we remain negative on the Hungarian forint given yesterday's rally in the rates space, outperforming CEE peers. On the other hand, EUR/PLN has jumped close to 4.300..."

Closing out with Oil (again) TalkMarkets contributor Lallalit Srijandorn reports that WTI Extends Its Decline Below $76.50 Amid China Demand Concerns.

"West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $76.25 on Tuesday. WTI price extends its decline to the lowest level since June 10 amid the Federal Reserve's (Fed) rate cut expectation in September and China’s weaker demand.

The Fed is anticipated to keep interest rates unchanged in the range of 5.25%-5.50% for the eighth time in a row at its July meeting on Wednesday. Traders will also take more cues from the Fed Press Conference for the interest rate cut path. Any dovish messages from the US central bank could be positive for risk-sensitive assets like WTI price...

The market reaction to the recent Middle East conflict has been muted. However, escalating geopolitical tensions between Israel and Hezbollah might disrupt oil supplies and lift the WTI price."

That's a wrap.

Find a good fishing hole.

Peace.

c

More By This Author:

Words For Wednesday: No Major Shoe Dropping Yet

Words For Wednesday: Politics and Economics

Thoughts For Thursday: Fed Expectations Continue To Push Market Higher