Three Things – Commodities, Bitcoin & Stocks

Image Source: Pexels

Here are three things I think I am thinking about to start the week. Let’s talk about three big asset classes….

1) Commodities and an inflation resurgence.

I think I’ve had a decent track record on inflation over the last few years during a pretty tumultuous period of inflation. Early in Covid, I said the huge government deficits created high inflation risk. In 2022 I said the rate of inflation had peaked just a few months before it did. And in 2023 and 2024 I’ve been calling for disinflation. Another risk I consistently dismissed over the years was the risk of hyperinflation and the risk of a 1970s/40s double bump resurgence in inflation. But I have to admit, the stickiness of inflation in recent months made me a little worried that I had that last one wrong. But I still think the risk there is relatively low and one of the main reasons for this is commodities.

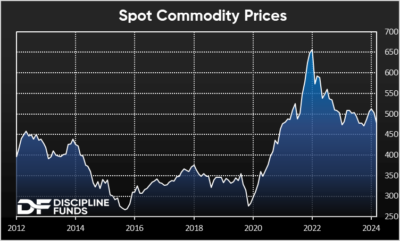

Commodities are one of the main inputs in our inflation model. They give us just about the best real-time measure of inflation and where broad prices are headed. Of course, they’re not a perfect leading indicator and often correspond more closely to cost-push inflation trends, but they’re still a good measure of broader supply/demand dynamics at work in the global economy. And the trend here remains pretty clearly to the downside.

After a brief bump earlier this year, commodities have retrenched and are now negative on the year at -1%. They’re down -7% on a year-over-year basis and -25% off the peak. Geopolitical risk and commodity prices would be one of the primary potential ways we get a double bump in inflation. So far it ain’t happening so disinflation remains the most likely outcome going forward from here.

2) Governments Buying Bitcoin.

Senator Cynthia Lummis was at the Bitcoin 2024 conference proposing legislation for the US government to buy $68B of Bitcoin. Her theory is that the US government needs a “strategic Bitcoin reserve” to help pay off the national debt. This makes little sense in my view, especially from a Bitcoiner perspective. After all, if you’re against government money printing then why propose printing money to buy an asset that is supposed to protect us from…money printing? But this issue is more fundamental in my opinion – governments shouldn’t save to fund future investments.

The private sector is very good at competing to create goods and services. Firms that fail are outlived by firms that succeed. Profit motivates competition and competition breeds scarcity. This creates an incentive structure that results in many good outcomes over time. At the same time, there are many things that for-profit endeavors are bad at – things like fighting wars, putting out fires, etc. The government is much better suited to do these negative net present value endeavors because the private sector won’t organize itself in for-profit entities to do these things efficiently. In other words, let the private sector take the calculated risks in the positive net present value endeavors and let the government fill in the gaps in socially necessary capacities that have a negative net present value. Buying and saving strategic reserves of assets does not fit into the latter category and so I see no reason why we should encourage the government to take risks in asset purchases that the private sector is better suited to engage in.

More fundamentally – the government has a printing press. So, not only does it not need prior savings to fund investment, but it isn’t well structured to spend for investment in the first place because the for-profit incentive structure doesn’t exist. So buying secondary market assets with the goal of investment makes no sense from the view of a government. We should be letting the private sector save and invest and let the government do the things that the private sector is less well-suited for.

Now, it’s fair to argue that the government spends too much or that it should do things to better protect the purchasing power of our Dollars. But if that’s your view then buying things like gold or Bitcoin is not the solution. We should be asking the government to help fund private sector investment so we can increase growth and create the real resources that make our money valuable in the first place. I’d prefer that we let the private sector figure out most of that investment on its own, but printing money to buy and hold secondary market assets for decades is not a solution to inflation or a society’s lack of productive resources. And it certainly won’t help the government “pay off” the national debt because that’s not even a thing in the first place.

3) Is the market more reasonably priced than we think?

Here’s a great chart from JP Morgan’s latest quarterly review showing the valuation of the market with big tech and without it. It’s actually three charts, but we’re talking about three things here so let’s just go with three charts as well.

With the top 10 largest stocks included the S&P 500 looks wildly expensive. And without it, it looks expensive, but much more modestly so. They also throw in some added perspective and how skewed the S&P 500 has become over the last few years.

This worry has been largely overblown (because big tech continues to perform well), but it goes to show how much the top 10 firms in the S&P are contributing both to growth and higher valuations. It’s all good as long as it remains good. But if the trend flips then just be prepared. You’ll get a lot of near-term volatility that could disrupt long-term financial plans if you’re not prepared for it. But it also goes to show that the S&P 490 is a lot more reasonably priced than the 500 might make us think.

More By This Author:

The Death Of The Dollar (In Perspective)

Three Bad Narratives That Are Dead (But Will Persist)

Chart Of The Week: More Signs Of Disinflation

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more