Three Bad Narratives That Are Dead (But Will Persist)

Image source: Pixabay

The combination of the Great Financial Crisis period and the Covid era created some of the most interesting economic experiments in history. They also resulted in some of the worst narratives in finance and economics. Here are three bad narratives that are dead, but won’t yet be laid to rest because economic narratives are hard to bury.1

Bad Narrative #1: Raising Interest Rates Adds to Inflation.

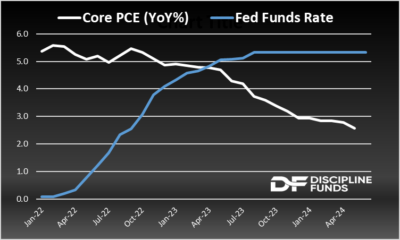

In the wake of the Financial Crisis it became clear that Monetary Policy wasn’t as powerful as many expected. In 2008 the Fed cut rates to 0% and began huge QE programs. Many expected this to create hyperinflation risk, but the exact opposite thing happened – inflation fell and remained low. This led some people to believe that interest rates do the opposite of what we’ve always been told. The basic logic was that interest rates ultimately end up being a type of fiscal policy and if the Fed cuts rates to 0% then that’s less fiscal stimulus via Treasury’s interest payments. Likewise, if the Fed were to raise rates then that would result in higher government interest expenses which would add to inflation. The most prominent proponents of this theory are Modern Monetary Theorists such as Warren Mosler. While this looked smart following the GFC it’s been a very different story in the post-Covid era. The Fed raised rates from 0% to 5.25% beginning in 2022 and the rate of inflation peaked almost exactly when they started raising. The rate of inflation has fallen ever since. There is now almost zero evidence that rate hikes resulted in higher inflation, yet this myth still persists.

The reason Mosler and the MMT people got this wrong is because I don’t think they understood the specific environment or the transmission mechanism at work.2 For instance, cutting rates in 2008 didn’t spur lending because consumers were cutting debt following the housing bubble and so there was no demand for loans. Those of us who understood Richard Koo’s Balance Sheet Recession were vocal about this and how Monetary Policy wouldn’t suffice. Cutting rates in 2008 appeared to cause low inflation, but the true cause of the low inflation was a structurally low demand for borrowing thanks to the credit bust. But by 2020 that dynamic was completely different, consumer balance sheets were healthy again and interest rates took a more traditional economic impact. Raising rates hurt lending by making new loans unattainable for millions of households. Household debt growth, for instance, has fallen from 10% to just 2.9%. It peaked, not coincidentally, as soon as the Fed started hiking rates and this loss in loan demand has been a direct contributing factor to slowing inflation. This was further exacerbated by the way rate hikes hurt banks. Banks have incurred hundreds of billions in losses from their bond allocations which forced many of them to increase lending standards and reduce risk.

But most importantly, it was the distribution of interest income that made the biggest impact. It would be easy to look at government interest expenses and assume that the current level of $1.1T in interest expense will be inflationary. But who is this income going to? 65% of it is going to the Fed, foreign governments and intra-government accounts like Social Security. The remaining 35% goes primarily to domestic retirement accounts and wealthy bond investors who don’t spend the income. In other words, the Fed’s rate hikes added about $500B of new deficit spending into the economy, but the vast majority of that is going to the Fed, government and foreign governments. The remaining piece is going to retirement accounts and wealthy investors who save the income. So there’s less than $200B of new annual income from the rate hikes. Meanwhile, bond holders lost $5T in principal from the rate hikes, the economy has lost hundreds of billions in new potential credit creation and the interest income went primarily to rich investors who don’t even spend it back into the economy. And this is the main reason why we’ve had an explosion in interest income and a declining rate of inflation.

This data is even more convincing when you look outside the USA at countries like Canada, UK and EU where they’ve all raised rates and are near recessionary GDP growth. It’s now increasingly clear that the rate hikes aren’t adding to inflation and are in fact helping push inflation down. But this theory probably won’t die because it’s just intuitive enough that even smart people like Warren Mosler will continue to promote it.

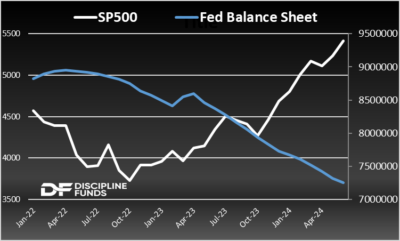

Bad Narrative #2: Stocks are Only Up Because of QE

When it became clear that QE wasn’t causing high consumer price inflation after the Financial Crisis many commentators began saying that QE causes “asset price inflation” in stocks. The general thinking was that the Fed was flooding the system with liquidity, but consumers weren’t spending it into the real economy and were instead just pumping up stock prices. I jokingly referred to this as “assflation” after the GFC and no, I was not referring to the size of my butt, which has increased quite significantly in the last few years thanks to spending too much time on the leg press machine and cycling on Zwift (which I highly recommend by the way). The problem with this narrative was obvious once you looked outside the USA though. With the exception of US tech stocks there was nothing extraordinary about global stock performance. Europe, for instance, was doing all the same QE programs the Fed was doing and their markets languished in comparison. The story was broadly similar across the 20 years Japan had been doing QE. But the narrative persisted in the USA.

In 2022 the Fed began reducing their balance sheet via QT. Now, according to the assflationists this should have been terrible for stocks. And while stocks went down briefly in 2022 they roared back to life in 2023 and 2024 despite this unwind in the Fed’s balance sheet. So now the assflationists had a real problem on their hands. The prior 10 years of global stock performance disproved the assflation theory, but the 2022-2024 period appeared to slam a nail in that coffin.

Of course, I am being too hard on the assflationists. The world is never as black and white as some might like to think it is and QE or QT are exceedingly complex programs. My view is that QE can have an asset impact that has diminishing returns outside of crises. For instance, in 2008 or 2022 during the bank panics the Fed can expand their balance sheet and intervene in the banking system which helps to prop up banks, supports the economy and then has a market wide multiplier effect. But as the banking system normalizes the Fed’s balance sheet expansion matters less and less and fundamentals then start to matter much more. For instance, in the current environment the US stock market is surging because corporate profits are surging and accruing primarily to US tech. The European stock market has performed worse because they don’t have the same level of tech innovation that the US has had. You don’t need to make up conspiracy theories to explain this. You just need to look at the fundamentals of corporate America to find the truth. Earnings are booming and so are stocks, regardless of what the Fed’s balance sheet does and so stock prices are following the fundamentals.

So yes, we’ve had assflation, but it’s not because of the Fed. It’s because corporate America (and especially US tech) has been doing a lot of heavy lifting. Or, if you want to blame the government you could more appropriately argue that huge government deficits went straight to corporate coffers. And as I’ve noted in the past many times, this is probably the single biggest lesson from the GFC and Covid – big deficits can add to inflation and corporate profits while QE has far smaller impacts.

Bad Narrative #3: Zero Interest Rate Policy (ZIRP) Causes a Speculative Mania

Another narrative that became popular in the last 15 years was the idea that 0% interest rates must spur a speculative mania. Now, this one isn’t as fun as the prior two because there’s a lot more truth to this idea than the other ones. That is, 0% rates certainly could spur a speculative mania. For instance, I think that 0% rates during 2021 helped spur a huge amount of housing demand that contributed to surging house prices. If the Fed had raised rates earlier they might have nuked a lot of shelter inflation before it occurred. But in general the last 25 years have shown us that speculation in the stock market is about a lot more than just interest rates and so we need to be careful arriving at conclusions based on one indicator like rates. Here are some data points from recent history:

- In 1999 we had the biggest stock boom in modern US economic history despite interest rates at 5%+.

- Japan had one of the largest stock/bond bubbles in history in the 1990s despite rates of 5%+ and then cut rates to 0.5% by 1996 and the low rates spurred little to no speculation for 20 years.

- The Fed cut rates to 0% in 2009 and housing, the most interest sensitive asset class, was sluggish for 10 years. Stocks appreciated during this period, but didn’t generate returns that were all that different from historical averages. Meanwhile, global equities generated below average returns despite virtually all major central banks being near or at 0%.

- Interestingly, the stock market in the USA has boomed in the last 2 years despite a Fed hiking cycle. Speculation has perked up despite high interest rates!

You have to be careful making broad conclusions based purely on interest rate changes. The economy is a complex system with manic participants at the wheel. Certainly, bad government policy can create bad incentives and spur irrational exuberance, but so can our inherent behavioral biases. We don’t need the government to give us consent to speculate and very often the most speculative environments occur despite the government trying to slow the economy down.

1 – I know how hard it is to kill bad economic myths. I’ve spent much of the last 10 years trying to kill myths like the money multiplier or the idea that QE is inflationary and these myths tend to evolve instead of die despite significant empirical evidence otherwise.

2 – It’s been a tough couple for years for MMT advocates and my view is that Covid proved their theory of inflation is incomplete at best and wrong at worst. For instance, in 2021 they said inflation would be transitory (we now know inflation was never transitory). Then, right before inflation surged they said the government should spend even more to bring down inflation (we now know deficit spending adding significantly to inflation). They were even advocating for a huge Green New Deal in late 2021, just about the worst possible time to be promoting huge spending packages. Then when inflation spiked they denied that tax hikes were necessary despite writing in all of their books that they’d advocate for tax hikes if inflation surged (tax hikes would have reduced the deficit and brought down inflation faster). But MMT said there was no excess demand from fiscal policy and that it was all supply side inflation and now we know that was wrong and that fiscal policy played a huge role in the excess inflation. And then in 2023 when inflation looked sticky they started loudly promoting the view that higher rates were keeping inflation high (we now know that was wrong also). This was clearly a diversionary tactic to distract people from the fact that they got inflation so wrong and could now hang their hat on an old idea of theirs that looked somewhat right at the time and has now turned out to be demonstrably wrong. As I’ve said in the past, MMT has so many conflicting narratives that it can never be completely wrong because they just shift the narrative every time one of their various ideas appears wrong. As Paul Krugman once said, it’s all a game of Calvinball where the rules are constantly shifting under vague narratives, but the last few years proved that MMT’s theory of inflation is wrong at best and probably dangerous if actually implemented.

More By This Author:

Chart Of The Week: More Signs Of Disinflation

Jobs, Jobs And Jobs

Three Things – Weekend Reading

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more