Jobs, Jobs And Jobs

Here are some things I think I am thinking about this weekend.

1) All About Jobs.

In an interview with Schwab earlier last week I said that the future path of Fed policy will be determined more so by employment reports and not inflation reports. The reason for this is that the shift in labor markets is likely to be far more meaningful than any shifts we see in future inflation reports. We expect inflation to glide very modestly lower in the coming quarters and finish the year near the 2.35% range in core PCE. That’s not a significant change, however, we could see much larger shifts in labor market trends, for instance, if unemployment ends the year at 4.5%. This would mark a distinct change in trend from the persistently low readings around 3.85% that we’ve seen over the last year.

Friday’s labor report showed that a (somewhat) worrisome trend is developing across many labor market metrics. Here’s the quick summary:

- Private payrolls came in softer than expected at 136K.

- Hourly earnings notched their lowest level since 2021 at 3.86%.

- The unemployment rate ticked up to 4.1%.

- Temporary employment notched a new low at -7.7% year over year.

- Long-term unemployed surged to 2.6MM, up 29% year over year.

- The last two labor reports were revised down by 111K.

All of this is consistent with a growing, but slowing and loosening labor market. It is not remotely consistent with a second wave of inflation or tight labor market. Most importantly, there are some worrisome trends developing in the underlying data that increase the odds of the Fed remaining tight for too long.

2) A High Risk Equity Market?

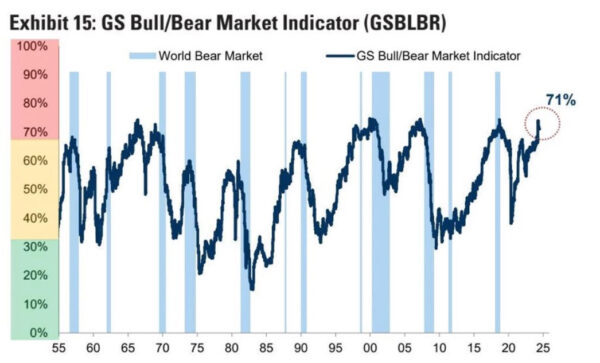

Goldman Sachs publishes a bull/bear indicator that appears very similar to our countercyclical index which is currently consistent with a higher risk equity market. Goldman says the 12 month forward returns in environments like this are low single digits.

In the Defined Duration model the Countercyclical Index manages risk around a 10 year time horizon or the approximate average duration of a global stock/bond portfolio. This is the portfolio that reflects the market cap of all outstanding stocks and bonds.

The summary view of the Defined Duration approach is:

0-2 years: manage liquidity for short-term expenses and match these liabilities to T-Bills and other short-term instruments.

2-5 years: manage liquidity for principal stability with modest growth and match these instruments to short and intermediate bonds.

5-15 years: Manage principal stability and growth using a stock/bond allocation. This is the global stock/bond portfolio and reflects the approximate 10 year duration of the global market portfolio.

15+ years: Pure growth. Use equities to be aggressive and long-term oriented.

Of all these time horizons the 5-15 year time horizon is the most interesting to me and the one that requires the most finessing because the total market portfolio is so overexposed to high stock market volatility. And the basic gist of something like the Goldman metric is that equities presently expose investors to outsized potential negative volatility. Goldman, like us, says that that the combination of high valuations and low unemployment creates an especially tricky economic and market environment. However, Goldman appears to use this concept to time the short-term moves in the stock market. In my opinion this is too near sighted. You can’t use inherently long-term metrics like valuations and unemployment to manage risk around inherently long-term assets like stocks, which is why we focus on a longer 10 year time horizon.

3) Why Are Low Unemployment Rates Bad?

One component of the Goldman metric is unemployment. This is a key component of our countercyclical index as well. The reasoning for this is quite simple – unemployment tends to be highly procyclical. The basic thinking is that corporations use workers to manage their risks. So, when economic risks are declining corporations soak up workers. This reduces slack in the economy and adds to demand. But when demand slows corporations start to cut or reduce the growth in their workforce which helps corporations reduce risk.

As I’ve noted in the past, most large economic and stock market downturns begin with low unemployment. That’s because very low unemployment generally results from firms becoming overly optimistic and hiring too many people. Is that what’s happening now? Well, we can’t really know and the goal of managing risk in a portfolio isn’t to try to perfectly predict every twist and turn in the economy, but to avoid substantial and devastating downturns.

None of this is to say that a devastating downturn is on the horizon. But if you’re managing a portfolio in that 5-15 year time horizon the equity market presents an unusually large risk as unemployment is low and trending up.

NB – Happy 4th of July weekend. The older I get the more I find myself appreciating the simple freedoms we have in the USA. I hope you take some time to enjoy it.

More By This Author:

Three Things – Weekend ReadingThree Things – Is A Stock Bubble Forming?

It’s Time To Cut Rates

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more