Thoughts For Thursday: Fed Expectations Continue To Push Market Higher

Despite war dangers in Ukraine, the Middle East and saber-rattling by Russia and China, markets seem unfazed and seem focused on expectations of a Fed rate cut in September, as well as positive earnings, perhaps.

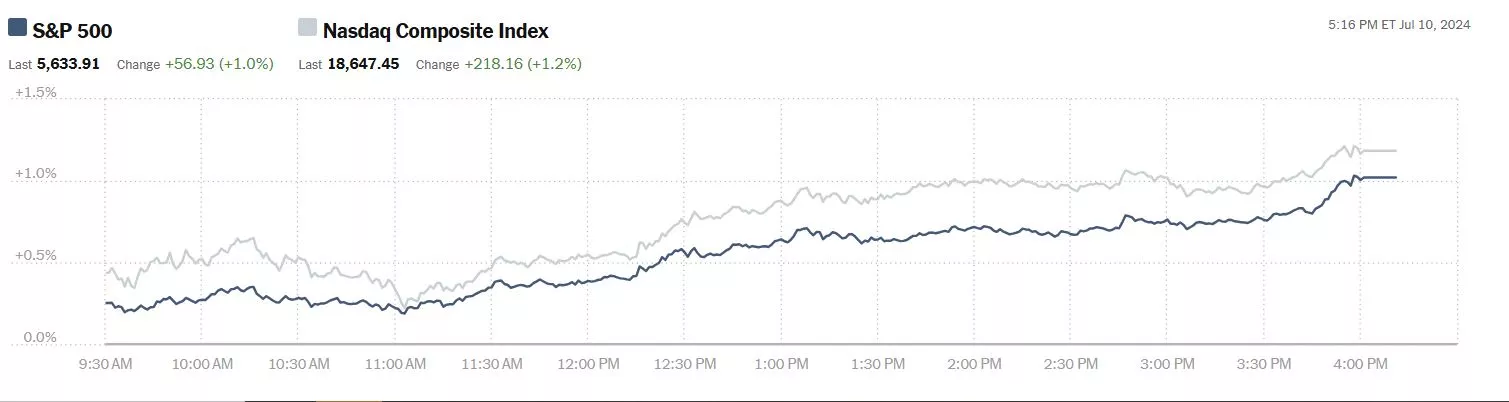

Wednesday the S&P 500 closed at 5,634, up 57 points, the Dow closed at 39,721, up 429 points and the Nasdaq Composite closed at 18,647, up 218 points.

Chart: The New York Times

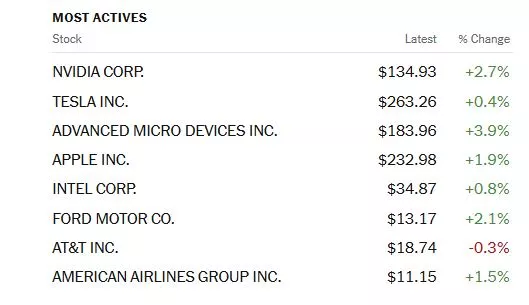

Most actives were led Nvidia (NVDA), up 2.7%, followed by Tesla (TSLA), up 0.4% and Advanced Micro Devices, up 3.9%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are trading 7 points lower, Dow market futures are trading 62 points lower and Nasdaq 100 market futures are trading 20 points lower.

TalkMarkets contributor Derek Lewis cites 3 Key Reports To Watch This Earnings Season.

"There are some worthy Q2 reports that investors should keep on their radars, a list that includes beloved Nvidia (NVDA - Free Report), McDonald’s (MCD - Free Report), and Discover Financial Services (DFS - Free Report)...

With Nvidia, we’ll get some more color on the AI trade, whereas MCD and DFS can provide us with deeper views into the current state of consumers.

Let’s take a closer look at how each presently stacks up heading into their respective releases...

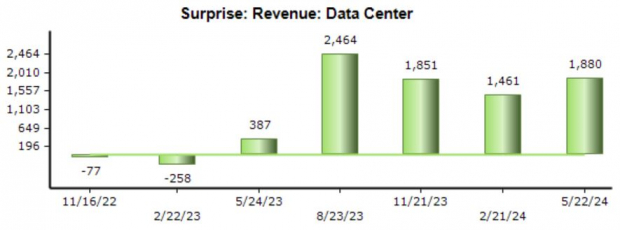

Investors will be tuned into Nvidia’s Data Center results, which include sales from its AI chips. The company has consistently blown away our consensus estimates regarding the metric, with the most recent beat totaling a sizable $1.8 billion.

As shown below, all four of the most recent beats have been more than $1.4 billion, reflecting the company’s red-hot demand.

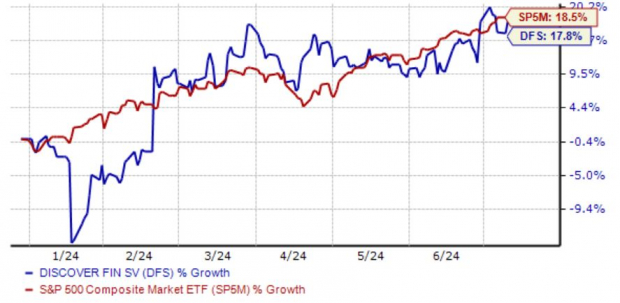

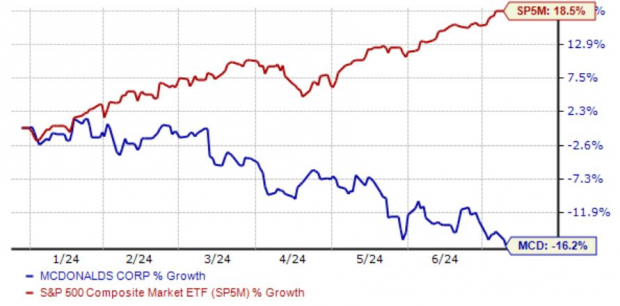

Discover Financial Services shares have loosely tracked the broader market in 2024, gaining roughly 18% compared to an 18.5% gain from the S&P 500. Shares enjoyed post-earnings positivity following its latest release despite falling short of EPS expectations, with favorable segment results enough to please investors...

McDonalds shares have displayed considerable weakness year-to-date, losing roughly 16% in value and widely underperforming. Shares haven’t been able to sustain positivity following quarterly results, with consumers seemingly growing tired of elevated prices. Earnings expectations moved lower following its latest release but have since remained stable, with the $3.10 Zacks Consensus EPS estimate suggesting a 2% pullback relative to the same period last year. Revenue expectations have similarly moved lower, with the $6.7 billion expected down from the $6.8 billion estimate in late April...

The Q2 earnings season has already officially started, but this Friday’s big bank results will really kick the period into high gear.

The earnings picture has largely remained stable, with tech expected to flex strong growth yet again."

See the full article for additional details.

The Staff of Just Markets says Oil Rises Amid Falling Inventories.

"WTI crude oil prices rose to 82.7 dollars per barrel on Thursday, rising for the second consecutive session thanks to a larger-than-expected decline in US crude inventories. According to the EIA, the US crude oil inventories fell by 3.444 million barrels in the week ended July 5, a larger-than-expected decline of 3.0 million barrels. Gasoline inventories also fell more than expected. In addition, OPEC reaffirmed its forecast for strong growth in global oil demand in 2024. The EIA forecasts global oil demand to reach 104.7 million bpd by 2025, slightly higher than the projected supply of 104.6 million bpd, indicating a future deficit."

The full Just Markets article contains additional updates in Forex and various equity markets.

Contributors Warren Patterson and Ewa Manthey note in The Commodities Feed: US Gasoline Demand Trends Higher.

"Oil prices rallied yesterday following a constructive weekly inventory report from the EIA. US commercial crude oil inventories declined by 3.44m barrels over the last week, more than the 1.92m barrel draw the API reported the previous day. This larger-than-expected draw came despite crude oil exports falling 402k b/d WoW and imports growing 213k b/d. This would have been partly offset by stronger refinery activity over the week. Refiners increased their run rates by 1.9pp, which led to crude oil input into refiners increasing 317k b/d WoW. Gasoline inventories also fell, declining by 2m barrels, while distillate stocks increased by 4.88m barrels. Implied demand for refined products fell by 334k b/d WoW. However, the 4-week average implied gasoline demand continues to trend higher, increasing by 89k b/d to 9.29m b/d, taking it above 2023 levels for the first time since March. This will ease some of the concerns that there have been over US gasoline demand as we move deeper into the US driving season.

The US Department of Energy has released a notice to buy a further 4.5m barrels of US-produced sour crude oil for the Strategic Petroleum Reserve. Delivery will be for October, November and December at a price no higher than US$79.99/bbl. While prompt prices are trading above this level, the forward curve is in backwardation with November and December WTI contracts trading sub-$80/bbl.

OPEC released its latest monthly oil market report yesterday which had very little in the way of changes to its balance. OPEC continues to hold onto its aggressive demand growth forecasts, expecting demand to grow by 2.25m b/d YoY in 2024 and then by a further 1.85m b/d in 2025. Non-OPEC+ supply growth was also left unchanged at 1.23m b/d for 2024 and 1.1m b/d for 2025. OPEC crude oil output averaged 26.57m b/d in June, down 80k b/d MoM. This decline was driven largely by Saudi Arabia and Iraq. Meanwhile, OPEC+ output in June (which includes the likes of Russia) fell by 125k b/d MoM to 40.8m b/d. Russia was the main driver behind this decline with its output falling 114k b/d MoM to 9.14m b/d. The IEA will release its latest monthly oil market report later today."

Check the complete article for other commodity updates.

In other commodities, contributor Tyler Durden writes that Cocoa Grinding Estimates Suggest Demand Destruction Nearing.

"With cocoa prices hovering over $8,000 a ton in New York, the long-anticipated demand destruction for cocoa is finally approaching. New estimates indicate that global bean processing likely declined in the second quarter.

According to six analysts and traders tracked by Bloomberg, second-quarter global grindings—where cocoa transforms into butter and powder used in food products—likely fell from a year earlier. Estimates from European grindings likely fell 2% in the quarter, hitting lows not seen since early 2020. All of the analysts forecasted much larger declines in the second half of the year.

"The cheap stuff is beginning to drop off, and the expensive stuff is coming in," said Jonathan Parkman, head of agricultural sales at broker Marex Group.

Parkman said, "The worst of input inflation will affect the second half of this year."

The grinding numbers are nowhere near the deterioration to end elevated cocoa prices, but the estimates suggest emerging demand destruction.

"We are more likely to see a significant change in the grind number in the second half of the year," said Darren Stetzel, vice president of soft commodities for Asia at broker StoneX...

Last month, the KitKat-maker warned 'cocoaflation' will soon send candy bar prices higher."

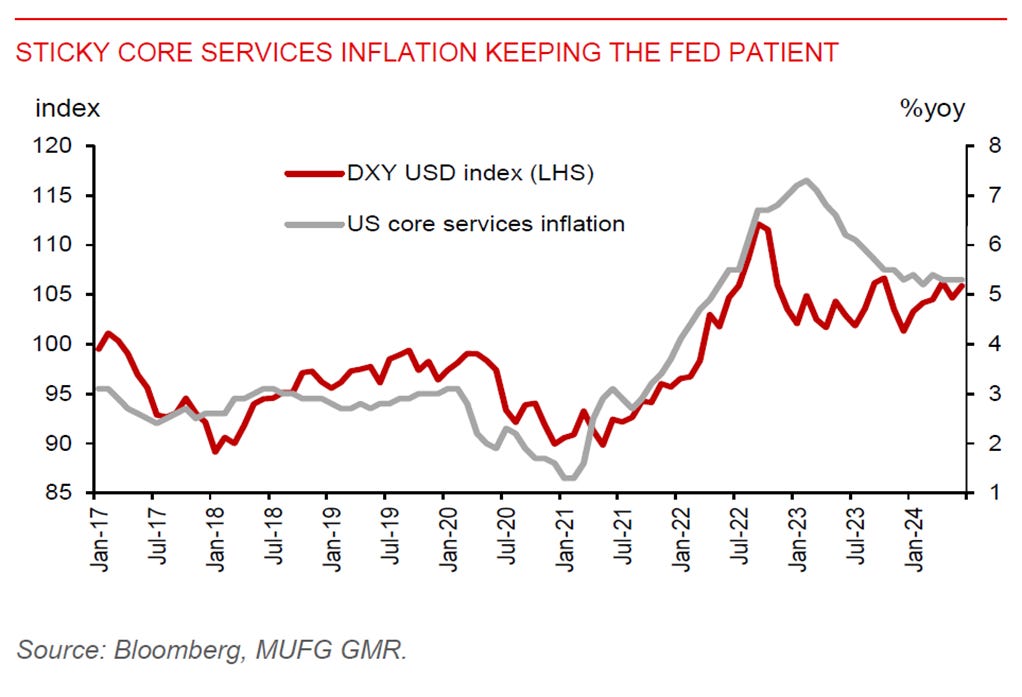

Closing out today's column today is TM contributor Stephen Innes who notes All Eyes Are On Service Inflation.

"The 10-year US Treasury yield has settled back in the 4.25% to 4.30% range, but USD/JPY continues its upward trajectory, driven by carry trade enthusiasm.

The market is looking for an excuse to push US yields lower and keep the S&P 500 rally wagon rolling; Tonight's CPI report will be pivotal in determining if this happens.

All eyes are on service inflation, the sticky element that keeps the Fed patient. And with the Algo’s in full swing, remember those decimals will count.

In contrast to the US, eurozone markets do not foresee a rate-cutting cycle. EUR/USD now appears to be more aligned with movements in rate spreads. The narrowing of the 2-year EZ-US swap spread is consistent with the rise in EUR/USD. Market fears of a significant surge in volatility due to a sell-off in OATs are easing, where the OAT-Bund 10-year spread has been stabilizing around 65bp. As a result, the drop in US yields exerts more influence on European currencies and the pound. However, this is pushing EUR/JPY and GBP/JPY higher and further pressuring USD/JPY upwards, all via carry trade appeal...

Regarding the CPI report, traders see a two-way risk to US inflation. On the one hand, tighter monetary conditions and a softer labor market could help bring inflation down. On the other hand, the recent 15% increase in WTI oil futures and an 11% rise in gasoline futures prices could lead to higher monthly headline inflation in the July reports if there aren't offsetting improvements elsewhere.

Markets are currently pricing in two US rate cuts this year, with a 75% chance of the first cut happening in September. It's like a financial tug-of-war, with traders anxiously watching to see which side wins...

The dollar's next move will hinge on the CPI report and its implications for the Fed's rate decisions. If inflation shows signs of cooling, we might see a push lower in US yields and a subsequent sell-off on the dollar. Conversely, any signs of persistent inflation could reinforce the current stronger US dollar trends.

That's a wrap for today.

Peace.

More By This Author:

Tuesday Talk: Bitcoin And Boeing

Thoughts For Thursday: Fireworks - Fourth of July and A.I.

Tuesday Talk: Short Week Fourth