Tuesday Talk: Bitcoin And Boeing

Bitcoin (BITCOMP) and Boeing (BA) are not directly related but both are in the news. Bitcoin continues to hover and fall and Boeing is hoping to move ahead after making a plea agreement with the Justice Dept.

Yesterday the S&P 500 closed at 5,573, up 6 points, the Dow closed at 39,345, down 31 points and the Nasdaq Composite closed at 18,404, up 51 points.

Chart: The New York Times

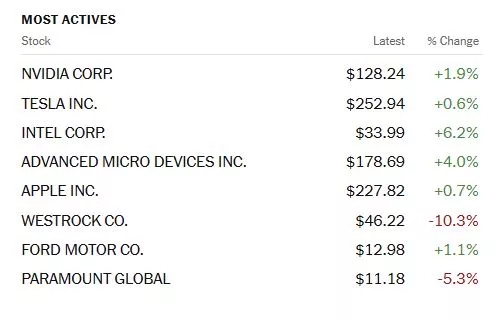

Most actives were led by Nvidia (NVDA), up 1.9%, followed by Tesla (TSLA), up 0.6% and Intel (INTC), up 6.2%.

Chart: The New York Times

In morning trading S&P 500 market futures are up 13 points, Dow market futures are up 53 points and Nasdaq 100 market futures are up 78 points.

TalkMarkets contributor Crispus Nyaga says Bitcoin Downtrend Could Continue

"Bitcoin price remained under pressure on Tuesday morning due to concerns about the liquidations by the German government and Mt.Gox wallets. The BTC/USD pair was trading at 56,350, a few points above last week’s low of 53,630...

The daily chart shows that Bitcoin price found a substantial resistance at $72,640. It failed to move above this level since April. It has formed a double-top pattern whose neckline is at 56,350. In most cases, this pattern is one of the most bearish signs in the market.

The pair has moved below the 50-day and 200-day Exponential Moving Averages (EMA). It has remained at the 38.2% Fibonacci Retracement point, which is also the neckline of the double-top pattern.

Bitcoin’s volume has been falling in the past few days while the Relative Strength Index (RSI) has dropped to the oversold level. The Stochastic oscillator has moved near to the oversold level.

Therefore, the BTC/USD pair will likely continue falling as sellers target the next key support at 53,000."

Contributor Benson Toti counters that Bitcoin Price Rises Amid Spot ETF Inflows Of $295 Million.

"Bitcoin rose nearly 4% early Tuesday morning to trade above $57,400, despite sell-off pressure that continues to face the flagship cryptocurrency.

Today’s upside comes after Monday saw a barrage of dumping from the German Federal Criminal Police Office (BKA).

The BKA sent thousands of BTC to exchanges and market makers, with BTC price declining as the dump reached over $915 million. It was the most aggressive selling of Bitcoin by the German government so far.

While Bitcoin dipped to under $55k again amid the bearish outlook, prices are higher amid dip buying. Japanese firm Metaplanet is among those to scoop up Bitcoin on the cheap, with a 400 million yen BTC purchase...

The Bitcoin spot ETFs market in the US recorded its highest daily inflows in three weeks on Monday as a spike in demand sent inflows to $295 million. The inflows are also the largest since spot Bitcoin ETFs inflows hit $488 million on June 5.

According to data tracking the spot ETFs flows, July 8 saw BlackRock’s IBIT fund attracted the largest share of the daily inflows with over $187 million. Fidelity’s FBTC managed over $61.5 million in inflows, while Grayscale’s GBTC ended the trading with $25.1 million of inflows...

Monday’s Bitcoin selling by the BKA, which transferred more than $915 million to various exchanges, is a blitz that had traders nervous for what next for BTC.

However, today’s bounce in Bitcoin price comes as on-chain data reveals that exchanges have sent back more than $200 million to the government controlled wallets..."

Contributor Bert Dohmen says This Rally Is Flashing Big Warning Signs.

"Currently, we’re seeing an ever-increasing number of preliminary warning signs for the markets.

The big smart money is already lightening up their positions. You can see that when companies announce very good results but the stocks get hit by lots of selling. That is because large amounts of shares can only be sold when there is demand for the stocks, such as good earnings announcements.

This typically happens when money managers, such as hedge funds, are selling lots of shares. This is always a preliminary signal. It is called “distribution”...

Another warning sign has been the narrowness of the market rise, which has sent several indices to new record highs. Over the past few months, it has continued to narrow with fewer sectors and stocks participating. Analyst Fred Hickey says that so far this year, “the top 10 stocks in the S&P 500 have accounted for more than 76% of the index’s gain.”

In our view, this is confirmation that the markets are within a few months of a strong decline. It could be shocking to the majority of market participants...

We believe there are lots of shorts in small caps, which perhaps gives the HFT outfits an opportunity to squeeze the shorts and move the small cap stocks up for a short time. See the 2-day chart below:

However, we would NOT consider that sector a longer-term investment opportunity.

Conclusion: The organized illusion is that the stock market has risen strongly this year. As we wrote, it was only a handful of stocks that had big gains, with several thousand others being flat or declining."

Well, I think that is the most bearish article I have posted on this page in a while.

TM contributor Scott Martindale notes that Inflation And The Economy Slow, Real Rates Rise, And The Fed Is Behind The Curve.

"The first half of 2024 looked a lot like the first half of 2023. As you recall, H1 2023 saw a strong stock market despite only modest GDP growth as inflation metrics fell, and H2 2023 continued on the same upward path for stocks despite a slowdown in inflation’s retreat, buoyed by robust GDP growth. Similarly, for H1 2024, stocks have surged despite a marked slowdown in GDP growth (from 4.1% in the second half of 2023 to an estimated 1.5% in the first half of 2024) and continued “stickiness” in inflation—causing rate-cut expectations to fall from 7 quarter-point cuts at the start of the year to just 2 at most.

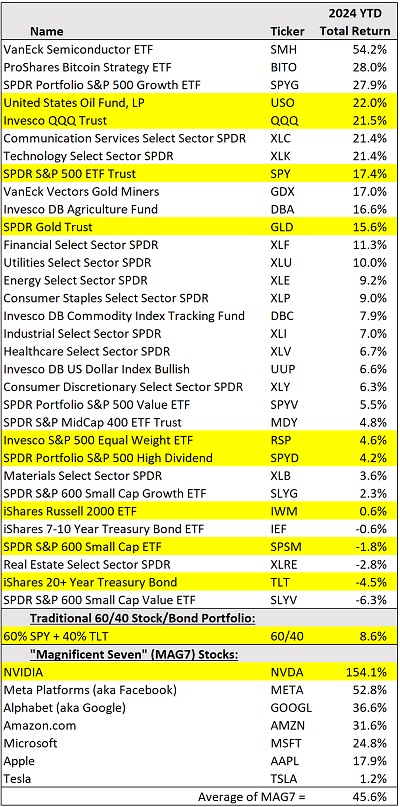

And yet stocks have continued to surge, with 33 record highs this year for the S&P 500 through last Friday, 7/5. Of course, it is no secret that the primary driver of persistent market strength, low volatility (VIX in the mid-12’s), and an extreme low in the CBOE put/call ratio (around 0.50) has been the narrow leadership of a handful of dominant, innovative, mega-cap Tech titans and the promise of (and massive capital expenditures on) artificial intelligence. But while the S&P 500 is up +17.4% YTD and Nasdaq 100 +21.5% (both at all-time highs), the small cap indexes are flat to negative, with the Russell 2000 languishing -14% below its June 2021 all-time high.

Furthermore, recessionary signals abound. GDP and jobs growth are slowing. Various ISM indexes have fallen into economic contraction territory (below 50). Q2 earnings season kicks off in mid-July amid more cuts to EPS estimates from the analyst community. Given a slowing economy and falling estimates, it’s entirely possible we will see some high-profile misses and reduced forward guidance. So, investors evidently believe that an increasingly dovish Fed will be able to revive growth without revving up inflation.

But is this all we have to show for the rampant deficit spending that has put us at a World War II-level ratio of 120% debt (nearly $35 trillion) to GDP (nearly $29 trillion)? And that doesn’t account for estimated total unfunded liabilities—comprising the federal debt and guaranteed programs like Social Security, Medicare, employee pensions, and veterans’ benefits—estimated to be around $212 trillion and growing fast, not to mention failing banks, municipal pension liabilities, and bankrupt state budgets that might eventually need federal bailouts.

Moreover, the federal government “buying” jobs and GDP in favored industries is not the same as private sector organic growth and job creation. Although the massive deficit spending might at least partly turn out to be a shrewd strategic investment in our national and economic security, it is not the same as incentivizing organic growth via tax policies, deregulation, and a lean government. Instead, we have a “big government” politburo picking and choosing winners and losers, not to mention funding multiple foreign wars, and putting it all on a credit card to be paid by future generations. I have more to say on this—including some encouraging words—in my Final Comments section below.

As for inflation, the Fed’s preferred gauge, Core Personal Consumption Expenditures (PCE, aka Consumer Spending), for May was released on 6/28 showing a continued downward trend (albeit slower than we all want to see). Core PCE came in at just +0.08% month-over-month (MoM) from April and +2.57% YoY. But Core PCE ex-shelter is already below 2.5%, so as the lengthy lag in shelter cost metrics passes, Core PCE should fall below 2.5% as well, perhaps as soon as the update for June on 7/26, which could give the Fed the data it needs to cut. By the way, the latest real-time, blockchain-based Truflation rate (which historically presages CPI) hit a 52-week low the other day at just 1.83% YoY...

As inflation recedes, real interest rates rise. As it stands today, I think the real yield is too high—great for savers but bad for borrowers, which would suggest the Fed is behind the curve. The current fed funds rate is roughly 3% above the CPI inflation forecast, which means we have the tightest Fed interest rate policy since before the 2008 Global Financial Crisis (aka Great Recession). This tells me that the Fed has plenty of room to cut rates and still maintain restrictive monetary policy...

Inflation erodes purchasing power. Of course, war is inherently inflationary, and no one (except of course the defense industry) benefits from the resulting death, destruction, and wide-ranging, long-term repercussions. Moreover, war is mostly financed through deficit spending, and as it escalates or spreads, it can disrupt supply chains and create outsized demand for scarce resources leading to supply shortages, as well as induce moments of panic in the capital markets.

And massive deficit spending is inherently inflationary as well, particularly on fiscal pet projects, earmarks, boondoggles, student debt forgiveness, and other efforts to “buy votes.” Government wages rose 0.5% MoM and are up 8.5% YoY, which is the largest YoY increase in over 30 years (driven of course by deficit spending)...

Market breadth remains disappointing:

The table below compares YTD performances (through 7/5) of a variety of asset class ETFs, as well as a generic 60/40 portfolio and the MAG-7 stocks. I have highlighted several for discussion purposes. Oil (USO) is up +22.0% and Gold (GLD) is up +15.6%. The Nasdaq 100 (QQQ) is up +21.5%, and SPY is up +17.4%, but the equal-weight S&P 500 (RSP) is up only +4.6%, followed closely by the S&P 500 High Dividend (SPYD) at +4.2%, as the market-leading Tech names typically don’t pay much in the way of dividends and thus don’t qualify for the portfolio. And languishing at the bottom with flat or negative returns are the small cap and Treasury Bond ETFs. Notably, the quality-oriented (stocks must be profitable for admission) S&P 600 (SPSM) at -1.8% is performing worse than the Russell 2000 (IWM) in which roughly 30% of the stocks are unprofitable. And despite the poor showing of the 20+ Treasury ETF (TLT), the generic 60/40 portfolio is up a respectable +8.6%.

Solid market breadth is a sign of confident investors and a healthy stock market. Today, however, the percentage of S&P 500 stocks outperforming index has hit a 50-year record low at about 24%, following last year’s record low. The only previous occurrence of two consecutive years of bad market breadth was 1998-1999. Moreover, although there are plenty of names in the S&P 500 other than NVIDIA , +154% YTD, that are up more than 30% YTD, the harsh reality is the historic divergences between SPY:RSP and SPY:IWM...

The 10 largest stocks by market cap now make up 34% of the S&P 500’s total market cap, and they are responsible for about 75% of the 17.4% YTD total return of the index. As shown in the table, the average gain of the MAG-7 stocks is 45.6%, but the median stock in the index is up only a little over 3%."

Martindale's article is thorough but long, the rather long sections that I have posted above are the tip of the iceberg. See the full article for a further in depth look at what to expect from the market and the economy in the second half of 2024.

Taking us out for the day, contributor Jim Van Meerten in the "Where To Invest Department" posted Chart Of The Day: Arista Networks - 10 Year Gain Of 2,115%.

"The Chart of the Day belongs to the technology company Arista Networks (ANET). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 5/9 the stock gained 23.67%...

I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 12 strong buy, 6 buy, 7 hold and 1 sell recommendation

- Analysts have price targets between $220 and $425 with a consensus at $332

- Value Line rates the stock its above average rating of 2 with price target between $271 and $601 with a mid-point of $436 for a 20% gain

- CFRAs MarketScope has a 4 star buy rating but a price target of $350

- MorningStar gives the stock an below average 2 star rating with a Fair Value of $270 that is a 35% premium

- 57,400 investors monitor the stock on Seeking Alpha"

Caveat Emptor.

Have a good one.

Peace.

More By This Author:

Thoughts For Thursday: Fireworks - Fourth of July and A.I.

Tuesday Talk: Short Week Fourth

Thoughts For Thursday: Debate Wait