Thoughts For Thursday: Fireworks - Fourth Of July And A.I.

It's U.S. Independence Day today; Happy Fourth of July and happy times to all the A.I. start-ups who received funding in Q2.

The NYT reports that "the A.I. boom that started in late 2022 has become the strongest counterpoint to the broader start-up downturn. Investors poured $27.1 billion into A.I. start-ups in the United States from April to June, accounting for nearly half of all U.S. start-up funding in that period, according to PitchBook, which tracks start-ups. In total, U.S. start-ups raised $56 billion, up 57 percent from a year earlier and the highest three-month haul in two years."

In Wednesday's short trading session, the S&P 500 closed at 5,537, up 28 points, the Dow closed at 39,308, down 24 points and the Nasdaq Composite closed at 18,188, up 160 points.

Most actives were led by Nvidia (NVDA) up 4.6%, followed by Tesla (TSLA), up 6.5% and Apple (AAPL), up 0.6%.

Options are not trading this morning due to the July 4, holiday.

TalkMarkets contributor Sagar Dua notes that in Forex trading EUR/USD Turns Quiet With US NFP And French Elections In Focus.

"EUR/USD consolidates in a tight range slightly below the round-level resistance of 1.0800 in Thursday’s European session. The major currency pair shifts to the sidelines amid uncertainty ahead of United States (US) Nonfarm Payrolls (NFP) data for June, which will be published on Friday, and the second round of French legislative elections on Sunday. Also, the trading volume appears to be light due to a holiday in the US markets on account of Independence Day.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, looks fragile near 105.30 ahead of the US NFP data. Cooling strength in the US labor market conditions has weighed heavily on the US Dollar (USD)...

Signs of easing labor market conditions were also exhibited by Initial Jobless Claims data for the week ending June 28. The number of individuals applying for jobless claims for the first time came in higher at 238K than estimates of 235K and the former release of 233K.

Also, the economic health of the US economy appears to be deteriorating as the ISM Services Purchasing Managers’ Index (PMI), a measure of service sector activity, contracted to 48.8 from expectations of 52.5 and the prior release of 53.8. A figure below the 50.0 threshold is itself considered as contraction in service activities...

EUR/USD hovers below 1.0800 as investors stay on the sidelines ahead of the second round of legislative elections in the Eurozone’s second-largest economy. After suffering a defeat by the Marine Le Pen-led-far right National Rally party, a coalition by the Central Alliance led by French President Emmanuel Macron and the left wing moved to a tactical withdrawal of at least 200 candidates from Sunday’s parliamentary elections in an attempt to thwart the far right from gaining an absolute majority.

An attempt to block the far right from winning a majority in the legislative elections has limited the downside in the Euro. Investors worry that the formation of a new government would favor expansionary fiscal policies, which will widen the already vulnerable financial crisis in France..."

See the full article for additional analysis.

Elsewhere in a TalkMarkets Editor's Choice column, contributor Sheraz Mian notes The Setup For The Q2 Earnings Season Gets Underway.

"Here are the key points:

- The setup for the Q2 earnings season, whose early reports have started trickling in, is one of continued resilience coupled with a steadily improving outlook. Given the favorable revisions trend ahead of this reporting cycle, we will be looking for further improvement in the earnings outlook.

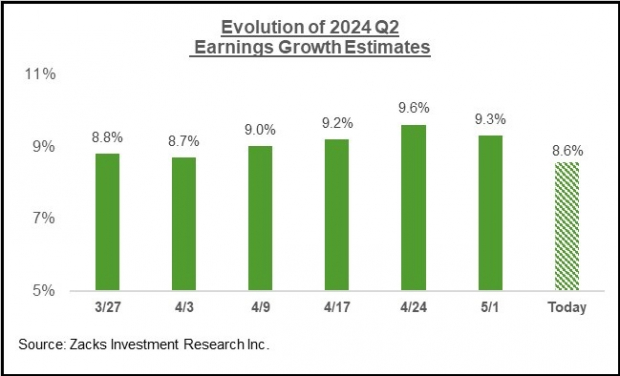

- For 2024 Q2, S&P 500 earnings are expected to be up +8.6% from the same period last year on +4.7% higher revenues. This will be the highest earnings growth rate since the +9.9% growth rate in the first quarter of 2022.

- Earnings growth for the Energy sector is on track to turn positive in Q2 after remaining in negative territory over the preceding four quarters.

- Q2 earnings for the ‘Magnificent 7’ companies are expected to be up +25.5% from the same period last year on +13.2% higher revenues. Excluding the ‘Mag 7’, Q2 earnings growth for the rest of the index drops to +5% (from +8.6%).

Regular readers of our earnings commentary are familiar with our favorable take on the overall earnings picture. A big part of our positive view reflects developments on the revisions front, both for the current period (2024 Q2) as well as the remainder of the year...

Image Source: Zacks Investment Research

In addition to the Energy sector, Q2 estimates have increased for the Tech, Utilities, Transportation, and Autos sectors, helping partly offset negative cuts for the other sectors...

We will be closely watching how the revisions trend for the space unfolds as the Q2 reporting cycle really gets going, but the early results from the likes of Oracle (ORCL - Free Report) and Adobe (ADBE - Free Report) suggest that we can expect continued favorable momentum here...

Please note that this year’s +9.1% earnings growth on only +1.7% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +9.0%, and the revenue growth rate improves to +3.9%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest.

On the margins front, 12 of the 16 Zacks sectors are expected to have higher margins in 2024 relative to last year, with Tech, Finance, and Consumer Discretionary as the big gainers."

In precious metals, contributor Christian Borjon Valencia discusses how Gold Takes Off As FOMC Minutes Weighed On USD.

"Gold prices surged over 1% on Wednesday after softer-than-expected economic data from the United States increased bets that the Federal Reserve (Fed) could cut interest rates by September. In the meantime, the latest FOMC meeting minutes showed that “several participants” were ready to lift rates if inflation remained elevated. At the time of writing, XAU/USD trades at $2,356 above its opening price.

The Fed’s minutes showed that most participants estimated that the current policy is restrictive but had opened the door for rate increases. Policymakers acknowledged the economy is cooling and could react to unexpected economic weakness...

The Gold price uptrend is set to continue and is testing the neckline of a Head-and-Shoulders chart pattern that has emerged since April 2024.

From a price action perspective, XAU/USD is downwardly biased in the near term, but the overall trend is bullish and is intact. This is further confirmed by momentum as the Relative Strength Index (RSI) is bullish...

See the full article for further commentary on how weakening U.S. economic signs could propel gold higher.

From the pessimist's corner Bryan Lutz discusses How Money Dies, In 3 Charts (Plus One More On What’s Coming Next).

"After about two years of the Fed’s plan to reduce their balance sheet we see M2 growing once again.

According to their reasoning, this should improve the economy...

Is the expansion of the M2 supply improving the economy?

Since the Fed started raising interest rates in 2022, you can see the velocity of the M2 Supply increase, below.

Velocity is the frequency at which people are using their money to buy goods and services. So, it is how often the money is being used to contribute to real things...

Overall, as the money supply increases, it becomes less and less effective in the real economy of goods and services...

Whenever the Money Supply increases, it increases for a moment then the effectiveness of the new money wears out.

The whole process repeats itself from the mid-90s onward. That’s when the Clinton administration chose to start Big Bank bailouts.

This eventually happens until there is so much money no one really knows what effect it can have on the economy.

Then money dies...

In the chart above you can see that every time there’s a recession the response has been to fill the economy with more money.

Then inflation rises dramatically as the new money enters the economy until inflation hits once again.

In 2008, the answer was to add more money, then start sucking it up out of the economy through Quantitative Easing(QE)...

When you compare the intervention of 2008 to 2020, the same pattern is playing out again, only on a larger scale.

This time the money will become worth less much faster."

In the "Where To Invest Department" we have two articles to send us off to a glorious Fourth.

Contributor Aman Jain posits Boeing Stock Forecast: About To Take Off Or Major Crash Ahead?

"Boeing (BA) made headlines again on Monday after announcing that it had agreed a $4.7bn deal to buy parts supplier Spirit AeroSystems. The news was warmly received by the market, with the stock retreating just slightly.

However, partly thanks to the recent and ongoing scandals, Boeing stock is still down almost 30% YTD.

Several experts have predicted a major crash for Boeing stock, but there are hints of a turnaround for the aerospace giant.

Since the acquisition of parts supplier Spirit AeroSystems is an all-stock deal, Boeing can avoid using its precious cash reserves.

Following the news, investment banking firm Jefferies reiterated its buy rating on the stock with a price target of $270, representing a 45% upside to the current price. The analysis also noted that the deal might dilute Boeing’s earnings per share (EPS) for 2026, but that the benefits from the deal will be “priceless”.

Deutsche Bank also maintained a buy rating on the stock with a $225 price target. The bank noted that an equity-financed deal is better than a cash offer and that an equity offering would help move the share price up due to reduced liquidity risk...

There is no denying that Boeing needs to address a few key issues in the short term – growing delivery backlog, potential charges from the Department of Justice related to the 2018 and 2019 crashes of the 737 Max aircraft, and the search for a new CEO – before it can pull off a turnaround.

However, Boeing is moving in the right direction, and while it would be fair to say that the firm faces near-term headwinds, its long-term growth prospects look promising.

Based on this, we think Boeing stock would be a sensible buy right now."

See the full article for more specifics.

TM contributor Sanghamitra Saha says Stocks Often Pop In July: Time To Buy These 4 ETFs?

"...BofA studied the first and last 10 trading days of each month going back to 1928 and found that the start of July has the highest average of any period (up 1.5% with positive results 69% of the time), Yahoo Finance says...

Against this backdrop, below we highlight a few ETFs that might make your portfolio enriching in July.

Invesco QQQ (QQQ - Free Report)

The Invesco QQQ ETF tracks the technology-heavy Nasdaq-100 Index, which outperformed in the first half of 2024. The artificial intelligence (AI) craze, hopes of rate cuts and the rising share of the "Magnificent Seven" drove the Nasdaq Index. We expect the AI rally to continue in July. This is especially true given the cooling inflation and Fed rate cut hopes. On July 2, 2024, the benchmark U.S. treasury yield was 4.43%, down 5 bps from the day earlier. This decline in yields is favorable to growth sectors like technology.

Vanguard High Dividend Yield ETF (VYM - Free Report)

As the rates dived to start July, investors can take a look at the dividend ETFs. Dividend stocks normally outperform in a falling rate environment. Notably, the underlying FTSE High Dividend Yield Index of the ETF VYM consists of common stocks of companies that pay dividends that generally are higher than average. This ETF looks to be a great pick. After all, high-dividend ETFs provide investors with avenues to make up for capital losses, if that happens at all.

First Trust NASDAQ Clean Edge Green Energy ETF (QCLN - Free Report)

The increasing focus on the usage of alternative energy sources and diminishing global reliability on fossil fuels has resulted in a surge in investment in clean energy sources. Rapidly increasing electricity demand from data centers is proving to be a tailwind for the clean energy industry. The AI boom should thus continue to boost clean energy ETFs like QCLN.

SPDR S&P Transportation ETF (XTN - Free Report)

The global economy has shown signs of improvement since the pandemic ebbed. Increased activities and higher demand for transportation are now understandable. Moreover, as summer heats up, travelers look all set to experience adventures and leisure travel. This Fourth of July, a record 70.9 million Americans are likely to hit the road, marking a 5% rise from last year. Hence, investors can bet on this Zacks Rank #2 (Buy) transportation ETF."

As always, caveat emptor.

Happy Fourth of July!

Peace.

More By This Author:

Tuesday Talk: Short Week Fourth

Thoughts For Thursday: Debate Wait

Tuesday Talk: Calling It What It Is: A Correction

Happy Independence Day!