Tuesday Talk: Calling It What It Is: A Correction

There's no getting around that we are in the midst of a correction.

I am not sounding any alarms; this is a normal occurrence. Just be aware of what it is. Doubts? Look at the Nvidia chart.

Now onto the numbers.

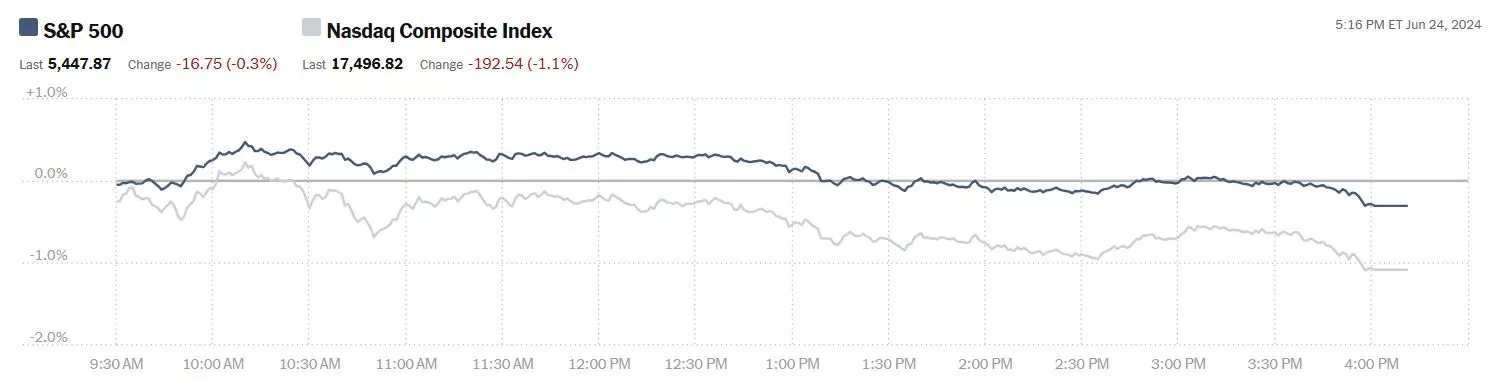

Yesterday the S&P 500 closed 5,448 down 17 points, the Dow closed at 38,411, up 261 points and the Nasdaq Composite closed at 17,497, down 193 points.

Chart: The New York Times

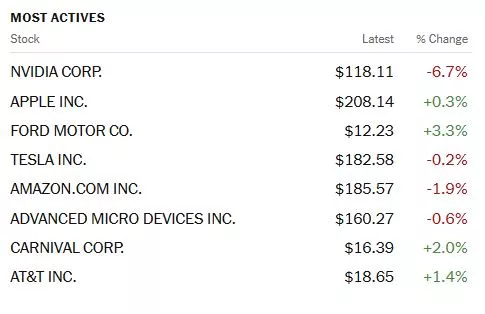

Most actives were Nvidia (NVDA), down 6.7%, followed by Apple (AAPL), up 0.3% and Ford (F), up 3.3%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are up 9 points, Dow market futures are down 22 points and Nasdaq 100 market futures are up 78 points.

TalkMarkets contributor Stephen Innes notes Nvidia's Market Cap Takes Significant Hits Amid Pedestrian Pullbacks.

"Nvidia shares experienced their second-worst day since 2022, extending a retreat that began after the company briefly became the world's most valuable company last Tuesday...

This year, the excitement around artificial intelligence has been a major driving force for the market, even as investors juggled the uncertainty of rate cuts and a cooling economy. The S&P 500 has climbed an impressive 14%, marking 31 record closes along the way.

When companies reach the scale of Nvidia, even modest fluctuations—what we might call pedestrian pullbacks—can have colossal implications for market capitalization.

Nvidia's recent three-day decline has technically pushed its shares into correction territory. More importantly, the company's market value has reportedly shrunk by around $400 billion in just three sessions."

Additional market updates are in the full article.

Contributor James Harte gives his take on the market in his Nasdaq 100 Commentary - Tuesday, June 25.

"Nasdaq Pushes Lower

The Nasdaq remains under heavy selling pressure across early European trading on Tuesday. The index is now down almost 3% from the all-time highs printed last week. The drop lower has been largely attributed to the correction we’re seeing in Nvidia.

Nvidia Volatility

After a rally last week saw the stock become the most valuable in the world, overtaking Microsoft and Apple, shares plunged by around 16%. The plunge in Nvidia’s stock is being linked to profit taking on the back of last week’s news. Fundamentally, the picture remains the same and the stock is expected to recover though we could see the current correction run a little further.

Shifting Fed Views

The downturn in the Nasdaq also comes amidst a slight uptick in September easing expectations over recent days. CME pricing for a cut in Q3 has jumped back up to 60% from less than 50% on the back of the FOMC. Yesterday, Fed’s Daly warned of a coming inflection point in the US labour market which could lead to higher unemployment, having a dampening effect on inflation..."

TM contributor Mark Vickery reports that the A.I. Trade Rolls Over To Energy; Consumer Discretionary In Focus.

"Market indices begin a new trading week where they left off last week. A rollback in tech stocks over the past three sessions has joined a positive streak of now five sessions on the blue-chip Dow index.

Coming off last week’s Juneteenth holiday, where trading had been relatively in-line across indices, we’ve seen the Dow and small-cap Russell 2000 break out to the upside and the Nasdaq and S&P 500 to the downside. For today, the Dow gained +260 points, +0.67%, while the Nasdaq lost -192 points, -1.09%. The S&P was down -0.31% and the Russell +0.62%.

Keep in mind this is the final trading week of calendar Q2 and the first half of 2024 (1H24). We already know the Nasdaq was off to the races this quarter, thanks to NVIDIA’s (Free Report) historic rise in valuation — +145% year to date — helping the index grow +20% from the initial trading day of 2024. But a leveling off has taken the reins in the past few sessions, helping bring a semblance of some parity in the indices where before there was none. NVIDIA itself is down more than -15% from its recent all-time highs, and -6.6% today.

The Dow is still down quarter-to-date (as is the Russell). But its five-day winning streak is making up some ground, led by the Energy space. Among these companies, oilfield services led the way, with companies like Baker Hughes (BKR - Free Report) and SLB (SLB - Free Report) up +4.5% and +4.1% on the session, respectively. Drillers like Devon (DVN - Free Report) and Occidental (OXY - Free Report) were both up +4% on the day, while super-major Exxon Mobil (XOM - Free Report) was up +3%.

We don’t see these developments as a knock on the A.I. trade, or Tech in general. But this leveling-off of share allotments doesn’t seem the dumbest idea the market has ever come up with, especially with plenty of things up in the air, both for this week and looking ahead to 2H24. Nor do we see Energy posing a true challenge to the A.I. trade at any time in the near future. What we’re really looking at is whether to drive indices higher, more evenly parse our portfolios evenly or consider cutting positions based on what’s to come."

See the full article for more commentary.

Contributor Lallalit Srijandorn notes WTI Consolidates Gains Near $82.00 Amid Hope For Strong Summer Driving Demand.

"West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $82.00 on Tuesday. The rise of the WTI price is bolstered by the hope for a strong summer driving demand and oil supply concerns amid the ongoing geopolitical tensions in the Middle East.

Summer demand is likely to drive the WTI price higher. JPMorgan reported that global oil demand has increased by 1.4 million bpd this month, supported by robust summer travel across Europe and Asia...

On the other hand, the stronger US Dollar (USD) and the hawkish stance of Federal Reserve (Fed) officials might weigh on the black gold. San Francisco Federal Reserve Bank President Mary Daly said on Monday that she does not believe the Fed should cut rates before policymakers are confident that inflation is headed towards 2%. Higher interest rates generally weigh on WTI prices as it increases the cost of borrowing, which can dampen economic activity and oil demand."

TalkMarkets contributor Wajeeh Khan wants us to know that Amazon Is Building A ChatGPT Rival Codenamed ‘Metis’.

"Amazon.com Inc is in focus today following a report that it’s working on a new AI chatbot that will compete with the world-renowned ChatGPT.

Shares of the tech titan are currently up some 25% versus their year-to-date low.

What we know about ‘Metis’ so far

Andy Jassy – the chief executive of AMZN is personally overseeing the strategic project that the multinational has codenamed “Metis”, as per a source who talked to Business Insider on condition of anonymity on Monday.

Metis will reportedly be more powerful than Amazon’s existing Titan foundation model. The new artificial intelligence chatbot will likely offer advanced features including follow-up suggestions, sharing links to sources, and image-based responses.

It may also serve as an AI agent capable of concocting detailed plans like travel itineraries.

Metis is already in an advanced stage and will likely roll out as early as September, the report added.

AI could be the next growth driver for AMZN

The news arrived a couple of months after Amazon.com Inc. launched “Q” – a generative AI chatbot for writing or fixing code.

Representatives of the Nasdaq-listed firm refrained from commenting on the report on Monday. The aforementioned development, however, is in line with the company’s commitment to artificial intelligence which CEO Andy Jassy recently dubbed the next major growth driver for AMZN.

Amazon shares are down about 1.0% at writing suggesting investors are cautiously assessing how it impacts Amazon’s standing in the AI race.

Note that Amazon stock has not joined its tech peers in announcing a dividend yet.

Is Amazon stock worth investing in June 2024?

Also on Monday, analysts at Bank of America Securities reiterated their “buy” rating on Amazon stock following a report that it plans on starting to charge for Alexa.

Reuters reports that Amazon is working to replace its current voice assistant with a two-tiered AI-powered Remarkable Alexa by August."

Caveat Emptor.

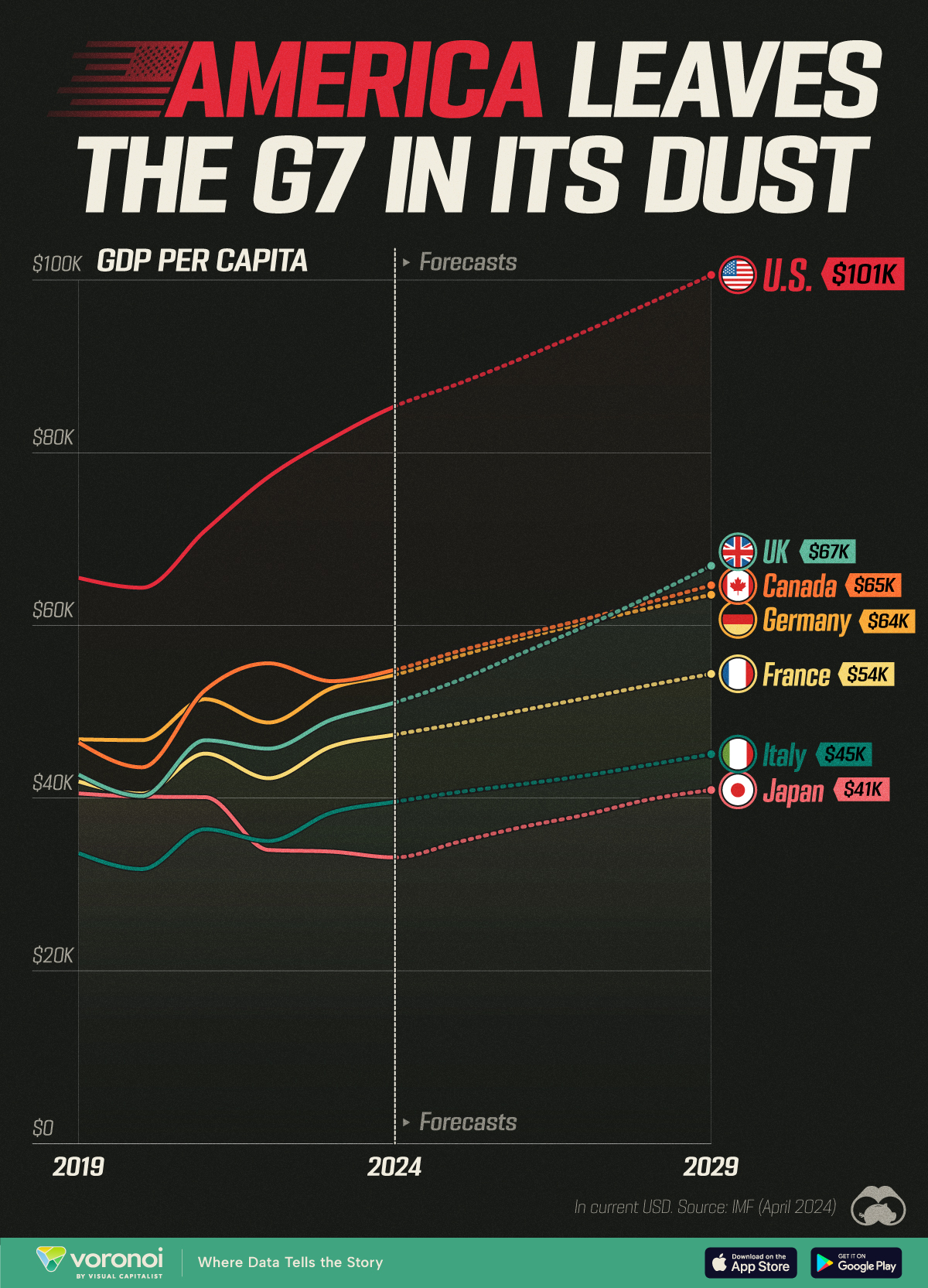

Closing out with a macro view our contributor Marcus Lu charts GDP Per Capita, By G7 Country (2019-2029F) for a guess at how things will look 5 years out.

"GDP per capita takes the total economic output of a country in a year, and divides it by the total population, providing a measure of a country’s economic performance and living standards on a per person basis.

In this graphic, we’ve visualized GDP per capita for G7 nations, from 2019 to 2029 (forecasted). All figures come from the International Monetary Fund and are as of April 2024.

Data and Key Takeaways

The data we used to create this graphic can also be found in the table below."

| GDP per capita (current USD) |

Canada | France | Germany | Italy | Japan | UK | U.S. |

|---|---|---|---|---|---|---|---|

| 2019 | $46,431 | $41,925 | $46,810 | $33,628 | $40,548 | $42,713 | $65,505 |

| 2020 | $43,573 | $40,529 | $46,712 | $31,789 | $40,172 | $40,246 | $64,367 |

| 2021 | $52,521 | $45,161 | $51,461 | $36,402 | $40,114 | $46,704 | $70,996 |

| 2022 | $55,613 | $42,306 | $48,756 | $35,043 | $34,005 | $45,730 | $77,192 |

| 2023 | $53,548 | $46,001 | $52,727 | $38,326 | $33,806 | $49,099 | $81,632 |

| 2024F | $54,866 | $47,359 | $54,291 | $39,580 | $33,138 | $51,075 | $85,373 |

| 2025F | $57,021 | $48,631 | $56,439 | $40,701 | $34,922 | $53,627 | $87,978 |

| 2026F | $58,907 | $50,143 | $58,472 | $41,612 | $36,643 | $56,759 | $90,903 |

| 2027F | $60,729 | $51,571 | $60,264 | $42,604 | $38,065 | $59,870 | $94,012 |

| 2028F | $62,636 | $53,040 | $61,965 | $43,835 | $39,820 | $63,279 | $97,231 |

| 2029F | $64,653 | $54,388 | $63,551 | $45,096 | $40,949 | $66,911 | $100,580 |

That's a wrap for today.

Have a good one.

Peace.

More By This Author:

Thoughts For Thursday: AI Is Still Ascending

Tuesday Talk: Punting For The Holiday

Thoughts For Thursday: Tech Still Leading