Tuesday Talk: Punting For The Holiday

Tomorrow the market will be closed for Juneteenth. This is a relatively new holiday, so I do not think there is enough data to generate behavior expectations. Unrelated, the market is jittery and anxious so the holiday may help.

Monday the S&P 500 closed at 5,473, up 42 points, the Dow closed at 38,778, up 189 points and the Nasdaq Composite closed at 17,857, up 168 points.

Chart: The New York Times

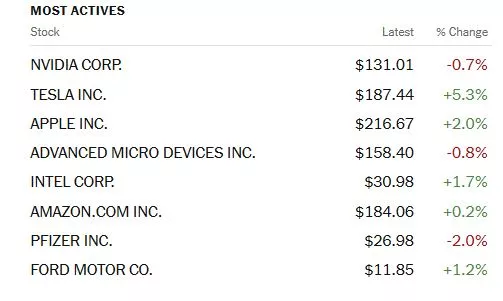

Most actives were led by Nvidia (NVDA), down 0.7%, followed by Tesla (TSLA), up 5.3% and Apple (AAPL), up 2.0%.

Chart: The New York Times

In morning futures action S&P 500 market futures are down 2 points, Dow market futures are down 36 points and Nasdaq 100 market futures are up 27 points.

TalkMarkets contributor Sheraz Mian notes The Q2 Earnings Season Gets Underway.

"The recent Adobe (ADBE - Free Report) and Oracle (ORCL - Free Report) quarterly releases kicked off the 2024 Q2 earnings season. These results from the two Tech players followed quarterly reports from Costco and AutoZone for their respective fiscal quarters ending in May...

Regular readers of our earnings commentary are familiar with our sanguine view of corporate profitability. The growth picture has been steadily improving over the last few quarters, and the revisions trend has notably stabilized lately...

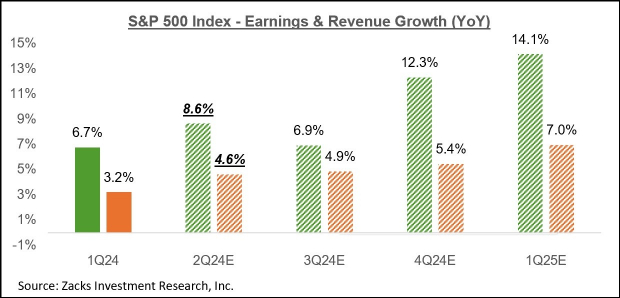

The current expectation is that Q2 earnings for the S&P index will be up +8.6% from the same period last year on +4.6% higher revenues. This would follow the +6.7% earnings growth on +3.2% revenue gains in 2024 Q1.

The chart below shows current earnings and revenue growth expectations for 2024 Q2 in the context of where growth has been over the preceding five quarters and what is currently expected for the following three quarters.

Image Source: Zacks Investment Research

As we have consistently flagged in our commentaries, the revisions trend for 2024 Q2 and full-year 2024 has been very favorable lately...

Embedded in current Q2 earnings and revenue estimates is a steady improvement in margins, continuing the positive trend that has been in place since 2023 Q3...

The Tech sector has been a major contributor to the index growth in recent quarters. That trend is also expected to remain in place in 2024 Q2, with total earnings for the sector expected to be up +15.3% on +9.4% higher revenues paired with a 117-basis point expansion in net margins...

As noted earlier, the recent earnings reports from Adobe, Oracle, Costco (COST - Free Report), and AutoZone (AZO - Free Report) for their respective fiscal quarters ending in May get counted as part of our official 2024 Q2 earnings tally. This week brings an additional 7 S&P 500 members reporting similar Q2 results, including Darden Restaurants, Accenture, Lennar, and others.

For the four S&P 500 members that have reported their fiscal May quarter results already, total earnings are up +6.2% from the same period last year on +7.8% higher revenues, with all four beating EPS estimates and only one of the four able to beat revenue estimates."

The expectations for the year continue to look good. Mian has additional charts in the full article.

Contributor and economist Scott Sumner likes Nominal GDP As An Indicator.

"Many of my contrarian opinions derive from my focus on a single macroeconomic variable—NGDP.

Consider the recent period of high inflation. Almost all economists believe the inflation was caused by a mix of supply and demand side shocks. In contrast, I believe the high inflation was all demand-side, with supply shocks playing no role at all, at least over the 2019-24 period as a whole.

Consider some data from the past 4 1/4 years:

Under 4% NGDP targeting, NGDP should have risen by 18.1% between 2019:Q4 and 2024:Q1. Actual increase was 29.0%.

Under 2% PCE inflation targeting, prices should have risen by 8.8% between January 2020 and April 2024. Actual increase was 17.8%.

Note that NGDP rising by an excessive 11% led to 9% above target inflation. That means supply shocks explain none of the total cumulative excess inflation. Yes, supply shocks clearly played a role during certain months back in 2022. But those negative shocks were offset by positive supply shocks during other months. The economy’s supply side has been strong—real GDP has risen more rapidly than expected, mostly due to immigration. Indeed, given the rate of NGDP growth, we are lucky that inflation was not even a bit higher. A positive supply shock (a surge in immigration) held inflation to a level slightly below what one would have predicted based on NGDP growth alone...

My focus on nominal GDP also explains why I am not impressed by unconditional forecasts. I notice that lots of people that were right about the inflation of the early 2020s were wrong about the effects of the previous QE programs under Bernanke.(And vice versa.) I am far more impressed by conditional forecasts. What do you think would happen if the Fed allows 29% NGDP growth in the 4 1/4 years after 2019? That’s the sort of question we should be thinking about.

While NGDP is a useful indicator, inflation and interest rates are not. If you tell me that inflation is rising, I don’t know what that means for the economy without knowing whether the increase was due to supply or demand shocks. If you tell me that interest rates are going to be lower, it means nothing unless I know whether the fall in rates is due to easy money or a weak economy.

Only NGDP gives an unambiguous indication of the current state of the economy. It doesn’t tell us everything we need to know, especially in the long run. But over the short to medium run, no other variable comes close as a way of understanding current macroeconomic conditions..."

A bit too much econospeak perhaps, but a good reminder not to rely soley on the Fed for insight.

TM contributor Declan Fallon illustrates a Bullish Engulfing Pattern For Russell 2000 As S&P And Nasdaq Post New Highs.

"A strong day for markets stretched as far as the beleaguered Russell 2000 (IWM). The Small Caps index enjoyed a bullish engulfing pattern on the bullish mid-line of stochastics. It should be noted, the mid-line of stochastics [39,1] is the "oversold" state for a bullish market and today's action matched this thesis (for a bull market reversal). Supporting technicals like the ADX, On-Balance-Volume and MACD are still bearish, but I suspect this won't remain the case for long.

The S&P was clearer in its intentions. Increased volume buying to new highs on positive net technicals leaves little to the imagination. Only its relative underperformance to the Nasdaq is the "concern" - but not really...

The Nasdaq ticked all the boxes, with just one exception, it didn't manage to post its gain on higher volume accumulation. It does have the relative performance advantage over its peers, which will help.

Nasdaq breadth metrics don't point to an oversold condition but if they do generate a 'buy' signal from here then there will be significant upside available..."

See the article for the Nasdaq chart, as well.

Contributor Seb of The Private Banker reminds us that US Federal Debt Interest Costs Soar To Record $890 Billion In 2024.

"The US Treasury projects net interest costs on the federal debt to reach an unprecedented $890 billion in 2024. This marks a significant increase from previous years, reflecting the growing financial burden on the US government due to rising interest rates and an expanding national debt.

Key Developments

Projected Interest Costs:

- 2024 Projection: $890 billion

- 2023 Comparison: Increase of $331 billion from the previous year

- 2022 Comparison: Almost double the $476 billion spent in 2022

Economic Impact:

- Percentage of GDP: Interest costs will account for 2.6% of the US GDP in 2024

Factors Contributing to Increase:

- Rising Interest Rates: Higher rates have increased the cost of borrowing

- Growing National Debt: Continued borrowing has compounded the debt

- Government Borrowing: Ongoing fiscal policies that rely heavily on borrowing

Analysis

The US federal debt’s interest costs are set to reach record levels in 2024, highlighting a significant financial challenge for the country. The projected $890 billion in net interest costs represents an 82% increase from the $476 billion spent in 2022. This substantial rise can be attributed to a combination of factors, including increased interest rates and the ever-growing national debt.

To put this into perspective, consider the analogy of a credit card balance. If you had a $100,000 balance, your minimum monthly payment might be around $2,000. Now, imagine that payment suddenly jumps to $3,310 per month. This illustrates the financial strain on the US government as it grapples with escalating interest payments.

Furthermore, the projected interest costs will consume 2.6% of the entire US GDP. This substantial slice of the economic pie underscores the gravity of the situation and its potential impact on the broader economy..."

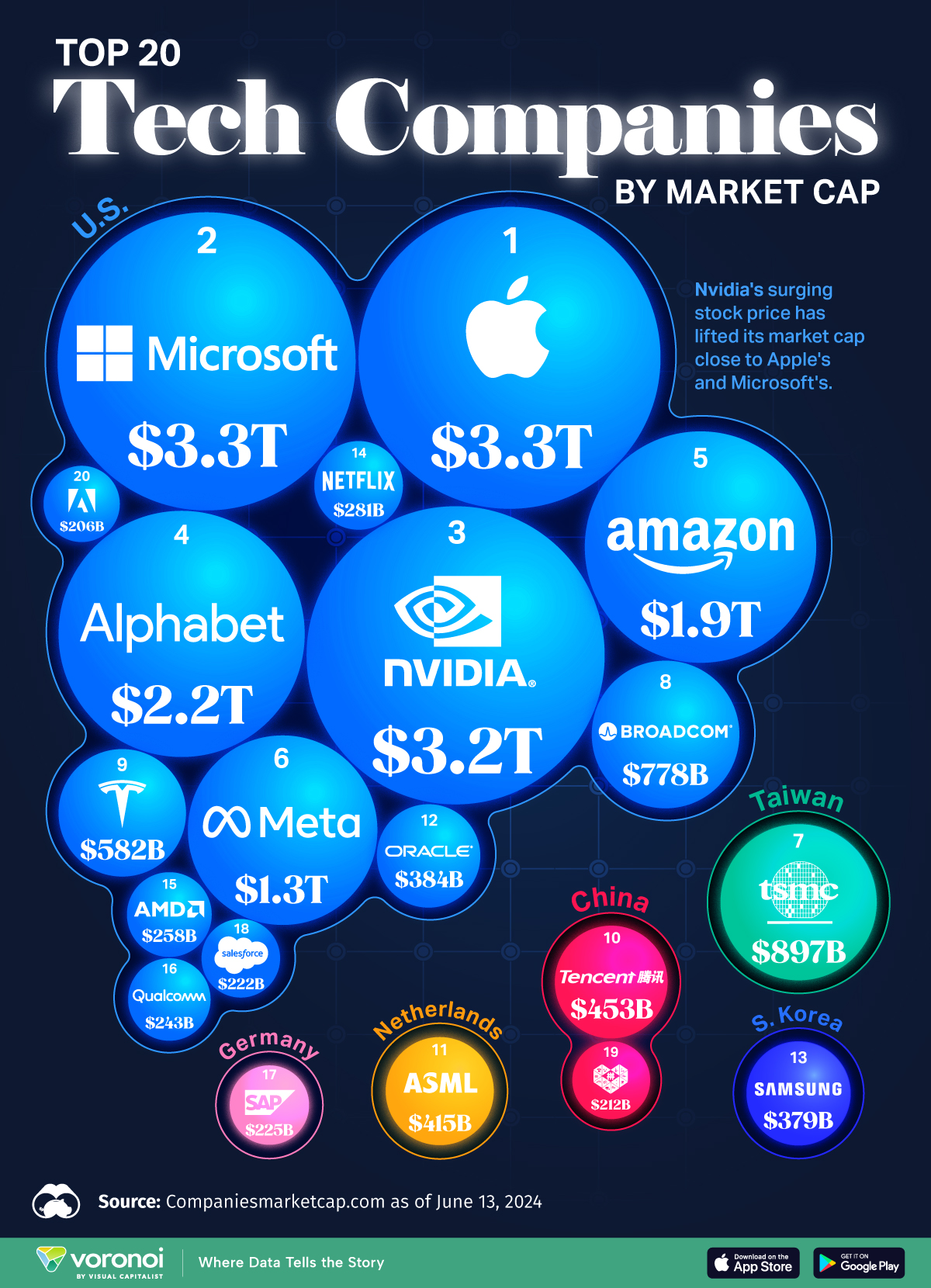

TalkMarkets contributor Dorothy Neufeld takes us out with a graphic analysis of The 20 Biggest Tech Companies By Market Cap.

"The world’s 20 biggest tech companies are worth over $20 trillion in total. To put this in perspective, this is nearly 18% of the stock market value globally.

This graphic shows which companies top the ranks, using data from Companiesmarketcap.com.

A Closer Look at The Top 20

Market capitalization (market cap) measures what a company is worth by taking the current share price and multiplying it by the number of shares outstanding. Here are the biggest tech companies according to their market cap on June 13, 2024...

...AI a Driver of the Biggest Tech Companies

It’s clear from the biggest tech companies that involvement in AI can contribute to investor confidence.

Among S&P 500 companies, AI has certainly become a focus topic. In fact, 199 companies cited the term “AI” during their first quarter earnings calls, the highest on record. The companies who mentioned AI the most were Meta (95 times), Nvidia (86 times), and Microsoft (74 times)."

That's a wrap for today.

Enjoy tomorrow's holiday.

Peace.

More By This Author:

Thoughts For Thursday: Tech Still Leading

Tuesday Talk: Looking Good Across The Board, What About China?

Thoughts For Thursday: Still Climbing In Fits and Starts