Tuesday Talk: Looking Good Across The Board, What About China?

World equity markets continue to forge ahead except for China. They say you get what you deserve but this is a problem for everyone down the road given the sheer audacity of how China continues to prop up its economy by injecting false liquidity into the market.

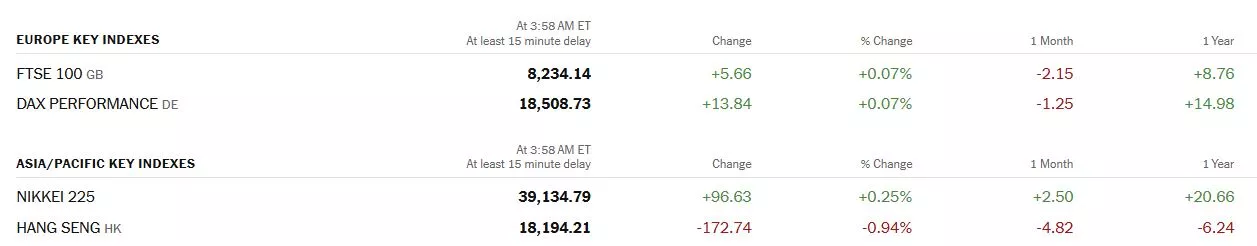

Chart: The New York Times

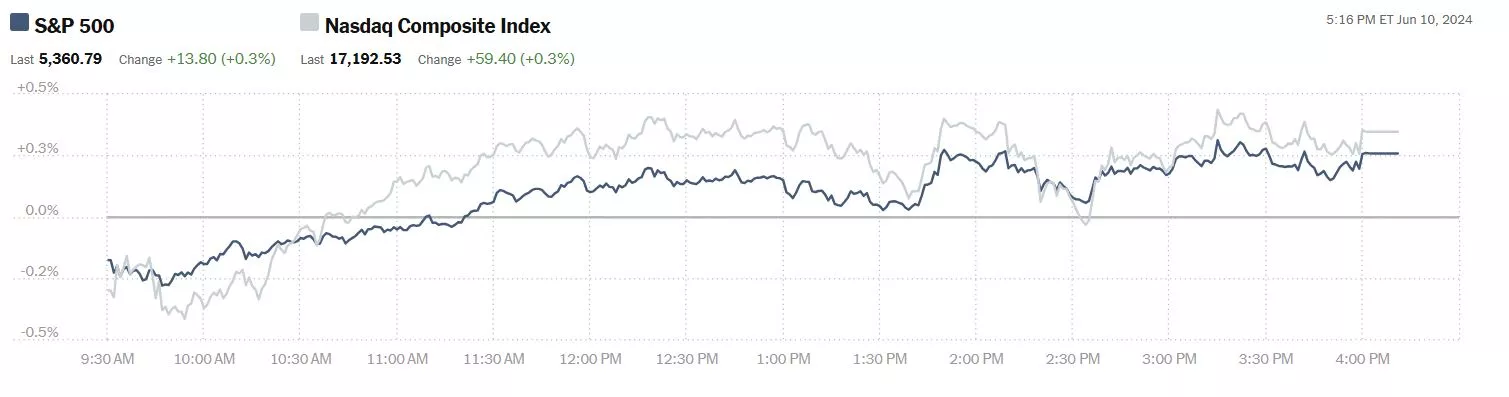

On Monday the US stock market continued its green path across the board. The S&P 500 closed at 5361, up 14 points, the Dow closed at 38,868, up 69 points and the Nasdaq Composite closed at 17,193 up 59 points.

Chart: The New York Times

Most actives were led by Nvidia (NVDA), up 0.7%, followed by Apple (AAPL), down 1.9% and Ford (F), up 1.9%.

Chart: The New York Times

In morning options trading S&P 500 market futures are down 13 points, Dow market futures are down 129 points and Nasdaq 100 market futures are down 48 points.

TalkMarkets contributor Mike Maharrey notes Credit Card Spending Sagged Again In April.

Image Source: Unsplash

"American consumers kept their credit cards in their pockets for the second straight month in April, a bad sign for an economy that has run on plastic for the last year.

After cratering in March, revolving credit contracted in April.

Meanwhile, non-revolving credit continued to grow at a tepid rate, a trend we've seen for well over a year.

Both of these data points, along with the crash in retail sales in April and slowing GDP growth signal the American consumer may well be tapped out.

Overall, consumer debt grew by $6.4 billion in April, a 1.5 percent annual increase, according to the latest data from the Federal Reserve. Americans now owe $5.05 trillion in consumer debt.

The Federal Reserve consumer debt figures include credit card debt, student loans, and auto loans, but do not factor in mortgage debt. When you include mortgages, U.S. households are buried under a record level of debt. As of the end of 2023, total household debt stood at $17.5 trillion

Pundits and politicians have talked up the "robust economy" and the "resilient" American consumer for months, but this economic growth was brought to you by Visa and Mastercard. Now, it appears the Americans might have maxed out their credit cards, or they're at least feeling the strain of sky-high interest rates.

Revolving debt, primarily reflecting credit card balances, contracted by $500 million in April, a 0.4 percent decline.

Even with this slight decline in revolving debt, Americans still owe $1.34 trillion.

The double whammy of rising debt and interest rates exacerbates the debt problem. Average credit card interest rates eclipsed the previous record high of 17.87 percent months ago. The average annual percentage rate (APR) currently stands at 20.68 percent, with some companies charging rates as high as 28 percent.

This is one of the problems confronting the Federal Reserve. Even though inflation remains sticky, the central bank needs to ease interest rates before they bury debt-saddled American consumers."

Contributor Frank Holmes writes Business Travel Comeback Pushes Global Spending Past $1.5 Trillion.

"The International Air Transport Association (IATA) significantly upgraded its profitability projections for airlines in 2024. The trade group now expects net profits to reach $30.5 billion, an increase from $27.4 billion in 2023.

This surge in profitability is accompanied by record-high traveler numbers and revenues. A new record number of passengers is expected to fly in the U.S. this summer. For the full year, the total global number of travelers is forecasted to reach approximately 5 billion, with revenues projected to soar to $996 billion, a 9.7% increase from 2023.

The recovery in travel has been nothing short of remarkable. Domestic travel bounced back to pre-pandemic levels by the spring of 2023, while international routes have recently surpassed 2019 numbers. The IATA now expects the number of world passengers to grow by an average of 3.8% per year over the next 20 years, resulting in over 4 billion additional passenger journeys by 2043.

“The human need to fly has never been stronger,” said Willie Walsh, IATA’s Director General.

Business Travel Spending Set To Surpass $1.5 Trillion This Year

While leisure travel has been leading the recovery, business travel is steadily gaining momentum, albeit at a slower rate. A Morning Consult survey found that only 10% of U.S. adults had traveled domestically for work in March 2024.

The trend appears to be headed in the right direction, however, with corporations prioritizing domestic trips over long-haul international travel. The Global Business Travel Association (GBTA) predicts global business travel spending will surpass $1.5 trillion in 2024, up from $1.02 trillion in 2022.

Regarding the hotel market, investors are optimistic, but forecasts are being downgraded. Profitability still lags pre-pandemic levels. Earlier this week, STR and Tourism Economics revised down their 2024-2025 U.S. hotel forecast, reflecting lower-than-expected performance in early 2024 and reduced growth projections for the rest of the year."

The Staff at Crypto Adventure reports Bitcoin Set For Parabolic Rally To $100,000 In 7 Days, Says Crypto Strategist

Following recent predictions and market movements, significant shifts are occurring within the Bitcoin ecosystem. Notably, on-chain data shows movements from long-dormant Bitcoin wallets, sparking speculation and potential market shifts. According to a CNF post, predictions now point to a potential peak of $350,000 post-halving, underscoring the optimistic sentiment pervading the market.

According to tweets by CrediBULL Crypto, a crypto trader and analysist, the market is poised for significant movement. He suggests that Bitcoin has already reached its lowest point in the current market cycle, marking a bottom at $60,000. This level, he believes, might not be revisited anytime soon.

In his analysis, CrediBULL Crypto highlights three key points:

- Current Market Position: Bitcoin is currently priced around $56,000, which is 20% lower than his predicted bottom. He reassures investors who have weathered the recent market downturn, indicating that the worst of the correction is likely over.

- Future Projections: He forecasts minimal downside risk for Bitcoin, with a potential drop capped at $60,000. More realistically, he does not expect the price to fall below the $62,000 to $63,000 range. He suggests that these levels might even be surpassed before they are tested due to aggressive buying behavior in the market.

- Impending Rally: CrediBULL Crypto predicts a massive rally for Bitcoin in the next 7 to 10 days, with a target exceeding $100,000. This surge is expected as liquidity shifts from alternative cryptocurrencies like Dogecoin, which may experience a decline, back into Bitcoin, which is anticipated to dominate market attention and investment inflows.

Anticipating a Substantial Uptick

Predicting a vigorous upswing, CrediBULL Crypto anticipates Bitcoin’s price to rocket beyond $100,000 in the coming 7 to 10 days. This bullish trend is expected to be fueled by a migration of liquidity from altcoins, such as Dogecoin, back into Bitcoin, reinforcing its dominance in the crypto market.

At present, Bitcoin (BITCOMP) trades at $69,426.99, marking a slight decrease of 0.21% in the last day, yet a rise of 0.56% over the past week.

Contributor Stephen Innes posits that The Economic Data Is As Clear As Mud

"Stocks in the US were a bit higher, but for the most part, traders are sitting tight ahead of this week's core US consumer price update and the much-anticipated Federal Reserve meeting.

Meanwhile, Nvidia (NVDA), the darling of the AI world, pulled off a 10-for-1 stock split on Friday. But despite the hype, investors were as divided as a pie at a family reunion, with shares barely budging, rising just 0.8%. The thinking behind the split is that the lower price would make the stock more accessible to the masses, but it seems the masses are still figuring out what to do with it.

With the fiery debate over the hot Establishment Survey and the cool Household Survey now simmering down, it's time to shift our gaze to the high-stakes world of inflation reports and the Federal Reserve's latest decision on interest rates. Investors dream of a scenario that avoids the extremes—one that lands us gently in the economic Goldilocks zone, where everything is just right.

The ideal scenario? Inflation cools down just enough to ease the pressure on prices, potentially giving the Federal Reserve the green light to cut its main interest rate from its highest level in over two decades. Think of it as the financial equivalent of finding that perfect porridge—not too hot, not too cold, but just right.

The economic data has been as clear as mud and just as tricky to decipher. Friday's stronger-than-expected jobs report followed closely on the heels of disappointing numbers from US manufacturing and other economic sectors. Even within the realm of US consumer spending—the beating heart of the economy—there's a sharp divide. Lower-income households struggle to keep pace with persistent inflation, while higher-income households are cruising along much more comfortably. It's like watching a three-legged race where one team is limp, and the other is sprinting ahead.

Indeed, while America's elite in the corporate echelons and household domains might find themselves shielded from the blows of restrictive policy settings—arguably even benefiting from high rates—the same cannot be said for the "have-nots." For most middle and lower-class Americans, Fed policy feels like a straitjacket that's far too tight.

Unfortunately for most on Main Street, The Federal Reserve finds itself in an unenviable role in the economic theatre—caught between a rock and a hard place. Picture this( see below): a backdrop of drooping economic surprises set against the rising curtain of inflation surprises. It's a challenging combination that leaves the Fed with minimal room for maneuvering.

The dilemma is apparent: Should the Fed consider cutting rates to prevent GDP from taking a nosedive? It may seem like a logical move to keep the economic ship steady as it navigates into the following year. However, the specter of inflation looms large, casting a shadow over any potential rate cuts."

Contributor and economist Menzie Chinn explains “Why The Recession Still Isn’t Here”.

"That’s the title of a Timiraos/WSJ article three days ago:

Typically in the recovery from a downturn, households are more cautious about spending and are likely to save. When rates are low, borrowing supports spending. High rates choke off that spending.

This time, economic activity has been supported more by wealth and incomes than by credit. The pandemic altered spending habits which, together with higher asset prices, solid job prospects and government stimulus, left more households feeling flush.

As I noted in a previous recounting of business cycle indicators for May/April, the answer to the above question could be: (1) the recession is here and we just don’t see it in the preliminary data, (2) the recession is still coming, since the timing between term spread inversion and recession onset is variable, (3) the model we used is wrong, (4) it’s just luck of the draw (earlier estimates based on shorter samples still did not indicate 100% probabilities, e.g. here).

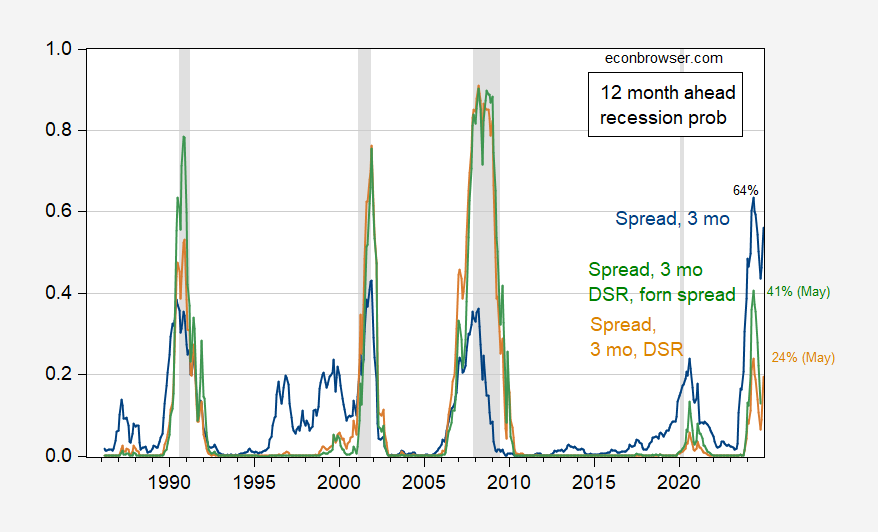

Here is an updated assessment of recession probabilities (for 12 months ahead), including data through May 2024, and assuming no recession has arrived as of June 2024.

Figure 1: Probit estimated recession probabilities for 12 months ahead, using 10yr-3mo spread and 3 month rate (blue), 10yr-3mo spread, 3 mo rate, and debt-service-ratio for private nonfinancial sector (tan), and 10yr-3mo spread, 3 mo rate, debt-service-ratio for private nonfinancial sector, and foreign term spread (green). Sample for estimation 1985M03-2024M06. NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations, and NBER.

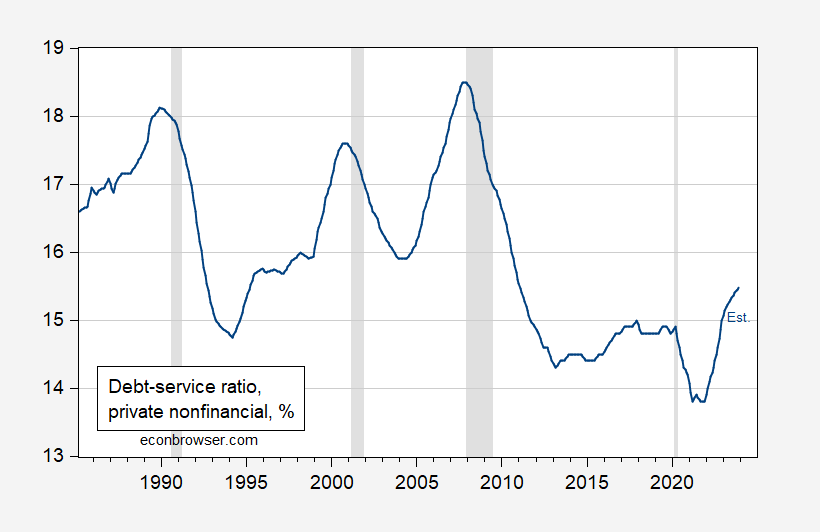

Note that the foreign term spread augmented specification (an Ahmed-Chinn specification stripped of oil prices, equity returns/volatility, and financial condition index, augmented with debt service ratio) only peaks at 41% for May. The DSR augmented specification (following Chinn-Ferrara, omitting financial conditions index) produces a 24% peak recession probability for May 2024. This latter specification incorporates the idea of strong consumer balance sheets, and the insulation of mortgage holders via fixed rate mortgages, to the extent that the debt service ratio remains relatively low.

Figure 2: Debt-service ratios for nonfinancial private sector, % (blue). 2023Q4 is estimated using interest rates (see here). NBER defined peak-to-trough recession dates shaded gray. Source: BIS, Dora Fan Xia, NBER, and author’s calculations.

And other more reliable indicators suggest less robust growth, at least through the end of 2023.

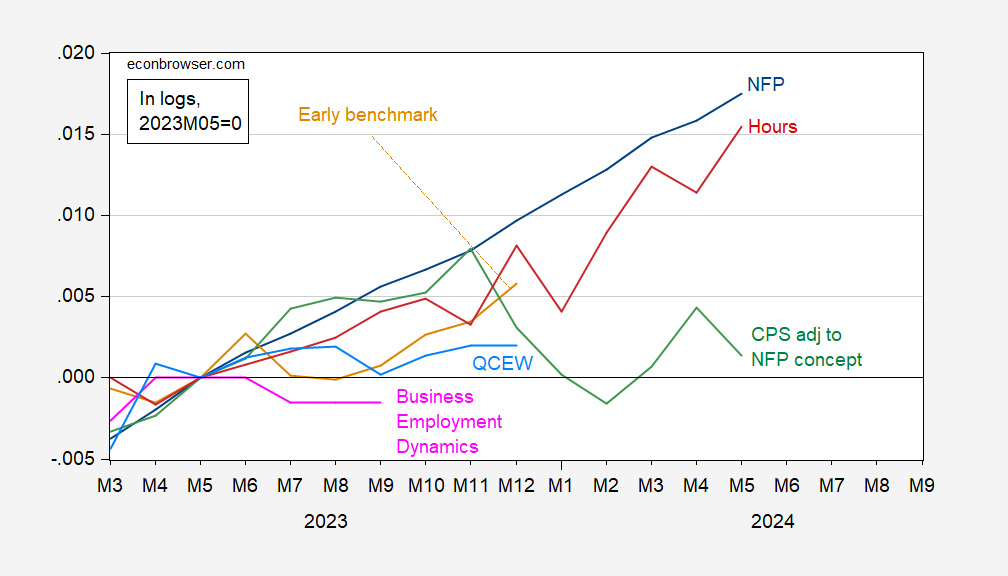

Figure 4: Nonfarm payroll employment (blue), early benchmark, calculated by adjusting actual using ratio of early benchmark sum of states to CES sum of states (tan), CPS measure adjusted to NFP concept (green), QCEW total covered employment seasonally adjusted by author by using geometric moving average (sky blue), Business Employment Dynamics net growth cumulated on 2019Q4 NFP (pink), and aggregate hours (red), all in logs, 2023M05=0. Source: BLS, Philadelphia Fed, and author’s calculations."

There are additional charts in the complete article.

To close out the column today we go across the pond where contributor James Harte provides us the latest UK Market Commentary - Tuesday, June 11.

"UK Jobs Market Weakens

The near-term outlook in the UK remains muddy on the back of the latest labour market data this morning. The unemployment rate was seen rising to 4.4% from 4.3% prior with the claimant count topping 50k, a sharp rise from the prior month’s 8.4k reading and the expected 10.2k reading the market was looking for. While the labour market was seen softening, wages growth remained firm at 5.9%, above an expected drop to 4.7%. The difficulty for the BOE is that the labour market is visibly weakening, while inflationary pressure remains in wages. As such, the scope for near-term easing is limited due to the risks of a rate-cut causing a fresh uptick in inflation.

BOE Rates in Focus

Near-term, the chances of BOE action look limited given the upcoming general election on July 4th. The BOE meeting at the end of June is therefore likely to see the bank outlining its near-term guidance on rates with a view to possibly setting up an August cut if we don’t see any material shift in market conditions ahead of that date. By that time too, we will have had a further CPI print which should confirm things one way or the other. If CPI is seen to have fallen further, this should all but guarantee an August cut, keeping GBP pressured ahead of the meeting."

That's a wrap.

Have a good one.

Peace.

More By This Author:

Thoughts For Thursday: Still Climbing In Fits and Starts

Thoughts For Thursday: Nowhere To Go

Tuesday Talk: Onwards And Upwards