Thoughts For Thursday: Still Climbing In Fits And Starts

The stock market shows no real signs of dropping. To the contrary, it continues to climb, albeit in fits and starts.

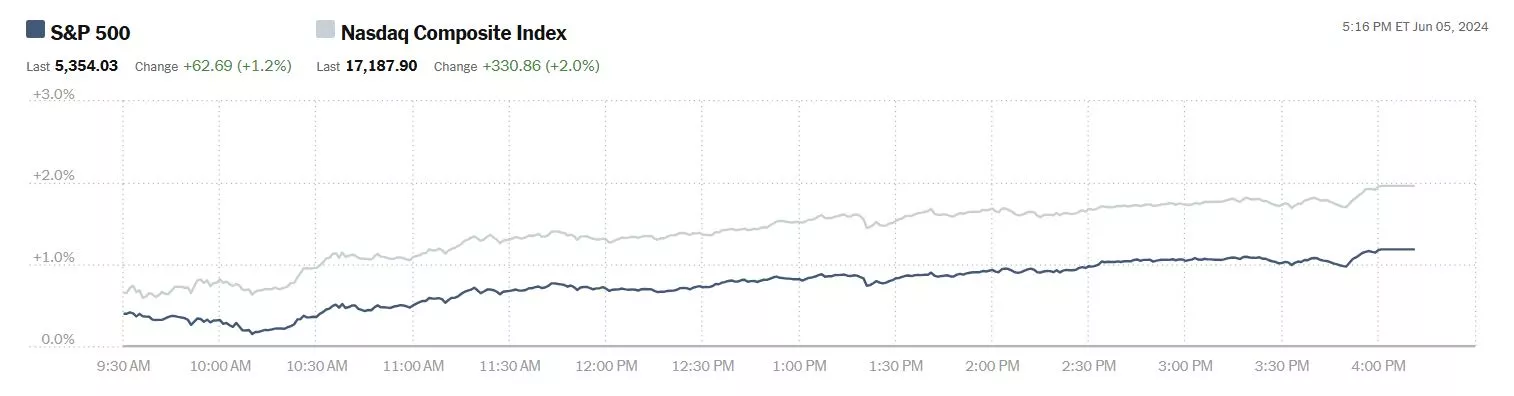

On Wednesday the S&P 500 closed at 5,354, up 63 points, the Dow closed at 38,807, up 96 points and the Nasdaq Composite closed at 17,188, up 331 points.

Chart: The New York Times

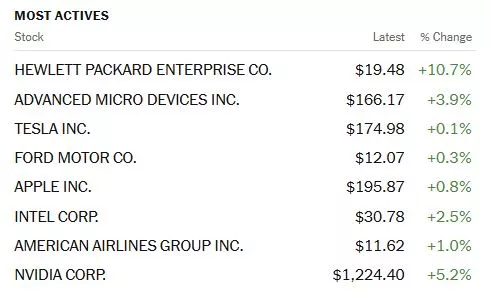

Most actives were led by Hewlett Packard Enterprise (HPE), up 10.7%, followed by Advanced Micro Devices (ADM), up 3.9% and Tesla (TSLA), up 0.1%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are down 2 points, Dow market futures are down 22 points and Nasdaq 100 market futures are up 7 points.

TalkMarkets contributor Michael J. Kramer notes that The Nvidia Rally Continues To Overwhelm.

"Stocks finished mostly higher as the Nvidia craze continued to drive a bigger wedge between the indexes with and without Nvidia. As of today, Nvidia accounts for about 42% of the gains in the Nasdaq 100, and what is surprising is the split between the 62 advancers and the 42 decliners on the year. It was closer than I would have guessed.

(Bloomberg)

At this point, Nvidia and Meta account for just a bit more than 50% of the index’s gains. So we hear about the market going up, but is the market going up, or is Nvidia going up? Is Nvidia just happening to drag names like Meta and Broadcom up with it? Through Broadcom into the mix, we are talking about nearly 60% of the gains coming from just three stocks.

So, sitting here and trying to stare at the chart and do an Elliot wave or some kind of other analysis seems kind of pointless when just three stocks can dominate the way these three have. If you throw Microsoft and Amazon into the mix, we are probably talking about 80% of all of the gains in the index coming from just 4 or 5 stocks.

This is probably why the Nasdaq 100 equal-weight index is up just 5% on the year, compared to the NDX market cap-weighted index, which is up 14% on the year."

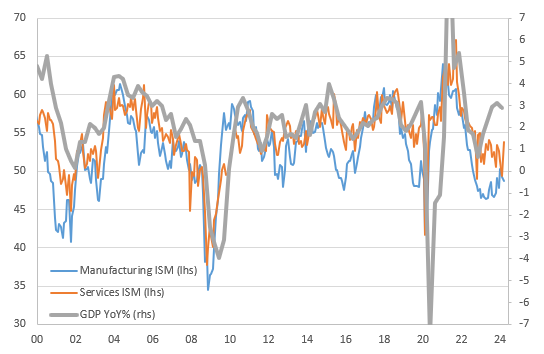

Contributor James Knightley says Rebound In U.S. Service Sector May Overstate The Story.

"The jump in May services activity follows a steep plunge into contraction territory in April. So, we prefer to look at a two-month average, which paints a picture of solid but slowing service sector growth. With employment in contraction territory for a fourth consecutive month, businesses appear wary about the future.

The May US ISM services index rose quite a bit more than expected to a nine-month high of 53.8 from 49.4. It was led by strong business activity (61.2 versus 50.9 in April) and rising new orders (54.1 versus 52.2) which, in turn, appears to be driven by export order strength (61.8 versus 47.9 in April). The volatility in the activity component is surprising and it may be best to take an average of May and April, which would give 56.1 versus 57.4 in March and 57.2 in February.

So that would be consistent with firm, but modestly slowing services activity. As the chart below shows, the ISM business surveys, which have historically been amount the best lead indicators for the path of the economy, continue to paint a weaker growth story than the official GDP growth numbers indicate.

ISM headline indices and GDP growth (YoY%)

Source: Macrobond, ING

It seems firms remain reluctant to add additional workers and again points to a cooling of employment in Friday’s jobs report - as did the softer-than-expected ADP employment number. It also, perhaps, suggests again that the surge in business activity seen in today’s May report is not seen as sustainable, hence why we should indeed take an average of April and May..."

TM contributor Mark Vickery is more upbeat about the service sector headlining: Jobs, Services Data Lead To Green Markets.

"Markets were up across major indices today. They started the session higher after a favorably cooler private-sector jobs report from Automatic Data Processing (ADP - Free Report), and basically set on cruise control throughout the day tilted slightly higher, closing at or near session highs. The Dow, which had picked up more significant gains earlier in the week, was up +96 points, or +0.25%, but the Nasdaq roared ahead +329 points, +1.95% for the day. The S&P 500 and Russell 2000 closed the session up +1.18% and +1.31%, respectively.

During the course of the trading day, we also saw some other economic indicators. ISM Services PMI for May for came in nicely ahead of expectations — +53.8% versus +50.7% — and back over the 50 threshold, indicating growth from an unrevised +49.4% the previous month. This marks the 46th higher ISM Services report in the past 48 months. Its Business Activity Index came in at a buoyant +61.2%, while its Employment Index ratcheted down for the fifth month in six to +47.1%. This combination of enterprise engagement and a subtle planning of labor force is the stuff a “soft landing” is made of.

S&P Services PMI, also for May, was solid. It’s +54.8 was in-line with both estimates and the unrevised prior month tally. It also saw a healthy enterprise side coupled with a quietly diminished employment scenario, with output growth hitting a one-year high while employees exiting the field and not being replaced slimmed the labor force margins. S&P saw renewed expansion for new orders offset by another month lower on new export orders, suggesting perhaps the U.S. services sector is a bit too rich for the rest of the world at this point."

Contributor Francesco Pesole takes a look at ECB rates action in FX Daily: The Big Reveal From The ECB.

"EUR: Timid ECB cut should not rock the FX market (up)

The ECB has virtually pre-announced a 25bp rate cut at today's meeting, and while holding could make sense given the latest wages and CPI data, the reputational risk is too high. Should they surprisingly hold, the euro could face a brief earthquake. Here is our market preview of the meeting.

But, as mentioned, a cut looks almost guaranteed and is fully priced in, so the attention will be on communication. We think it is likely there will be almost no new forward guidance, with the ECB potentially signaling any further easing would only be gradual (in line with off-meeting comments) and that there are still risks to inflation. Inflation forecasts will be watched closely, although the ECB should backpedal towards short-term data dependency, so building policy expectations on new projections would be quite speculative, if not misleading.

The risks to the euro appear slightly tilted to the upside today, but we doubt this will be a huge event for FX. Unless President Lagarde revamps some of her eloquence (she has seemingly made press conferences intentionally uneventful), then the FX market may be left with more questions than answers.

The US story isn't only the naturally dominant one in EUR/USD but also the most dynamic at the moment, with still elevated uncertainty around the Fed's first cut. So, we suspect EUR/USD will rather quickly default to looking at US data and payrolls, above all. Our 1.10 call for EUR/USD for 3Q and 4Q currently embeds 75bp of easing by both the ECB (today's cut included) and the Fed in 2024.

Denmark's central bank, whose mandate is to keep stability in the EUR/DKK exchange rate (currently at the central peg level of 7.46) will likely cut rates by the same 25bp a few hours after the ECB. - Francesco Pesole"

Stock analyst and contributor Sweta Killa takes us back to the Nvidia madness picking ETFs To Tap On Nvidia's 10-For-1 Stock Split Retail Frenzy.

"Nvidia (NVDA) has been on a solid run with no signs of a slowdown. After blockbuster results, the AI chipmaker is making a series of new record highs on the upcoming 10-for-1 stock split, which will make its shares more affordable to a wider range of investors, including the ones who make small trades, and increase liquidity.

Investors seeking to tap the opportune moment could consider ETFs having the largest allocation to this AI darling. These are Strive U.S. Semiconductor ETF (SHOC - Free Report), AXS Esoterica NextG Economy ETF (WUGI - Free Report), VanEck Vectors Semiconductor ETF (SMH - Free Report), Grizzle Growth ETF (DARP - Free Report) and TrueShares Technology, AI and Deep Learning ETF (LRNZ - Free Report)...

In a stock split, the company increases the number of shares, reducing the share price. However, the total dollar value of all shares outstanding remains the same and doesn’t affect the company’s valuation. At the end of the week, NVDA will undergo a 10-for-1 stock split. This means that for each Nvidia share that an investor owns, they will receive an extra nine after the split is completed. Thus, Nvidia’s stockholders will receive a higher number of shares at lower prices.

To receive the additional shares, an investor must be a shareholder of Nvidia on the record date, Jun 6. Nvidia will issue the new shares at the end of the next trading day. The stock will then begin trading at the adjusted price after the split on Jun 10.

Also, the lower price of NVDA will likely pave the way for the company’s inclusion in the Dow Jones Industrial Average. Amazon (AMZN - Free Report) joined the Dow earlier this year after undergoing a 20-for-1 stock split in June 2022...

Strive U.S. Semiconductor ETF – Nvidia occupies the top position with 31.8% of assets.

AXS Esoterica NextG Economy ETF - Nvidia occupies the top position with a 25.6% share in the basket.

VanEck Vectors Semiconductor ETF - Nvidia is the top firm, accounting for 24.2% share.

Grizzle Growth ETF - Nvidia occupies the top position with 23.7% of the assets.

TrueShares Technology, AI and Deep Learning ETF - Nvidia takes the top spot at 17.5% share."

Caveat Emptor, as always.

That's a wrap for today.

Have a good one.

Peace.

More By This Author:

Thoughts For Thursday: Nowhere To Go

Tuesday Talk: Onwards And Upwards

Thoughts For Thursday: AI In Ascendence