Words For Wednesday: No Major Shoe Dropping Yet

On Tuesday the market did not move much, no visible Harris or Bibi effects. We will have to see what plays out today and Thursday.

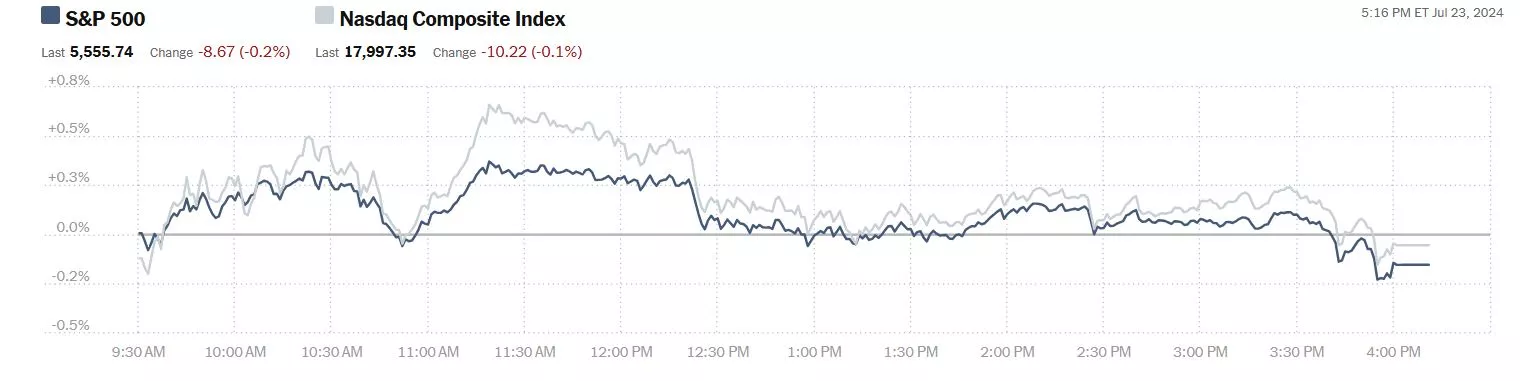

Yesterday the S&P 500 closed at 5,556, down points, the Dow closed at 40,358, down 57 points and the Nasdaq Composite closed at 17,997, down 10 points.

Chart: The New York Times

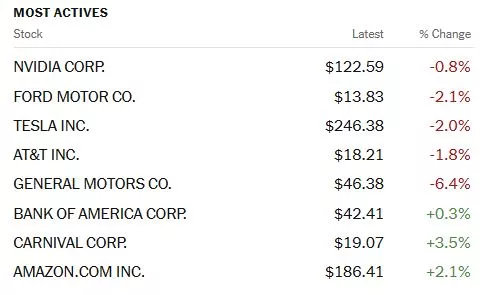

Most actives were led by Nvidia (NVDA), down 0.8% followed by Ford Motor Co. (F), down 2.1% and Tesla (TSLA), down 2.0%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are down 43 points, Dow market futures are down 169 points and Nasdaq 100 market futures are down 240 points.

With no major action in the markets, today's column is a little bit of this and a little bit of that. TalkMarkets contributor Ironman discusses the Climbing Limo GDP Forecast For 2024-Q2.

"Later this week, on Thursday, 25 July 2024, the Bureau of Economic Analysis will publish its first estimate of the United States' Gross Domestic Product during the second quarter of 2024.

With that date just a day away, it's a good time to check in with how 2024-Q2's GDP tracks with what a momentum-based forecasting method projected it would be for this quarter over seven months ago. That simple method, called the "Climbing Limo", uses nominal GDP data that was available back in December 2023 in its projections.

As you can see in the following chart, that method came within one percent of anticipating the final GDP estimate for the first quarter of 2024 (2024-Q!), the data for which only became available last month.

Coincidentally, the Atlanta Fed's GDPNow forecast for 2024-Q1 was correct in projecting 2024-Q1's actual GDP exceeded the climbing limo's momentum-based forecast for this period.

Looking forward, since the GDP data for 2024-Q1 has been finalized, the Climbing Limo projection of GDP built using that data point suggests the United States' nominal GDP is on track to rise through the end of 2024 at a steady pace."

Now that's an optimistic chart, if you've ever seen one.

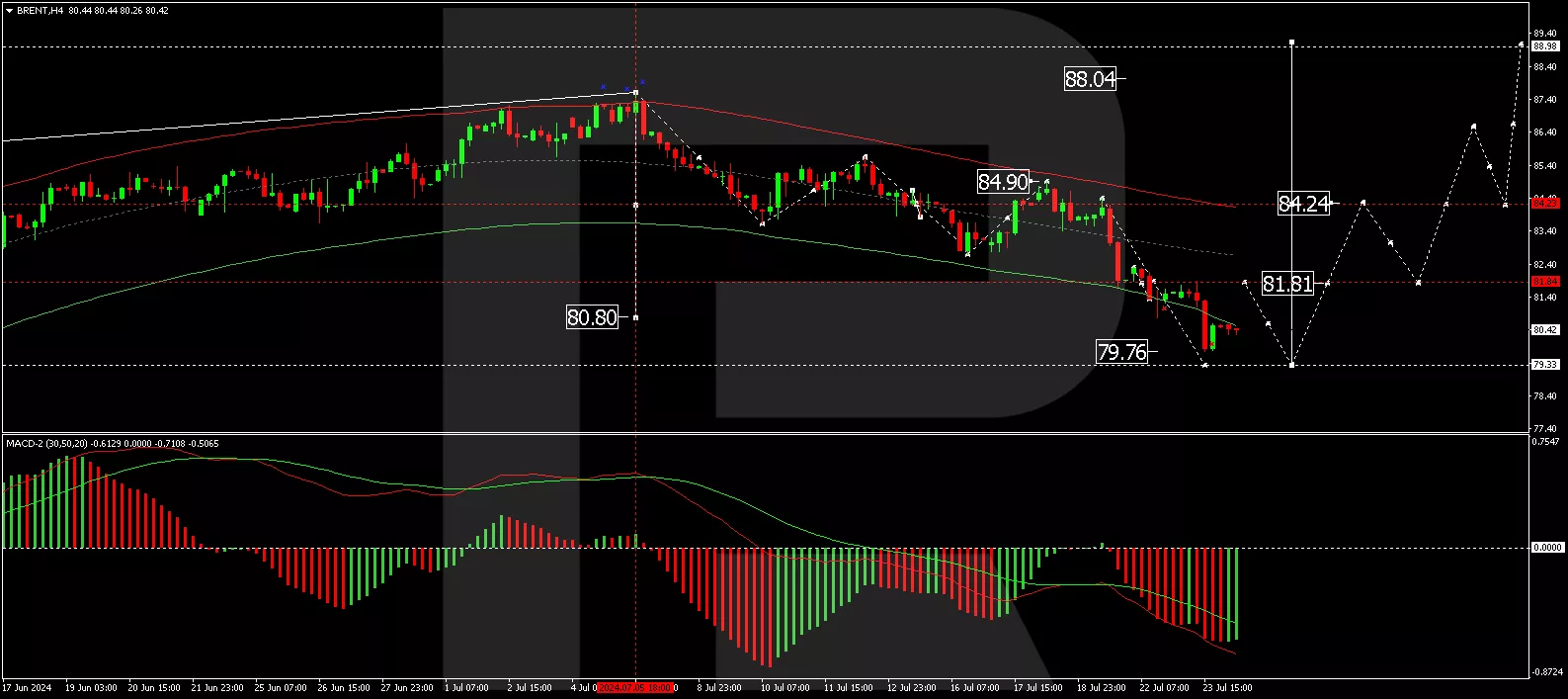

Contributor Andrey Goilov writes Brent Oil Prices Decline Amid Inventory Reductions And Middle East Optimism. Lately the term "Middle East Optimism" only seems to show up in articles about crude oil price forecasts.

"Brent crude oil prices have continued their downward trajectory, reaching 81.14 USD per barrel as of Wednesday. This marks the fifth consecutive session of decline, primarily influenced by significant reductions in US oil inventories. The latest data from the API indicates a decrease of 3.9 million barrels, surpassing the forecasted reduction of 2.5 million barrels and marking the fourth consecutive week without a correction.

Concurrently, developments in the Middle East are also impacting oil prices. There is emerging optimism regarding ceasefire negotiations between Israel and Hamas, which has helped alleviate some geopolitical pressures on oil prices. Additionally, concerns about potential disruptions in oil supplies due to forest fires in Canada influence market dynamics, albeit helping to stabilize prices momentarily.

The strength of the US dollar continues to make commodities less attractive, as a stronger dollar typically reduces the purchasing power of other currencies in the commodities market.

Technical analysis of Brent

Brent oil (BNO) is forming a consolidation range around the 80.80 USD level with an extension down to 79.76 USD. A further decline to 79.33 USD may occur. If the price exits this range on the upside, we might see the initiation of a growth wave targeting 84.24 USD. The MACD indicator supports this scenario, showing potential for new growth as it prepares at the lows...

We anticipate a new consolidation range forming at these lows, potentially followed by another decline to 79.33 USD. If the price exits the range upward, a rebound to 81.44 USD could occur. The Stochastic oscillator, currently below the 50 level and heading towards 20, supports this potential downward movementב

Contributor Bill Conerly takes a look at the Economic Forecast Impacts Of The 2024 Presidential Election.

"Business leaders looking to the future wonder how the election will impact the economy...

Most business planning decisions can be made before the election. Those business decisions that would best be postponed are surprisingly few in number...

With President Biden out of the race, it appears, as of this writing, that Vice President Harris will be the Democrats’ candidate. As a working assumption, she’ll probably pursue Biden’s agenda if she wins the election...

A few economic assumptions seem pretty safe. Both President Biden and President Trump spent big when they were in office. That would likely continue under either a Trump or Harris administration. Members of Congress from both parties support growing federal expenditures...

Taxes are uncertain. President Trump pushed through tax cuts, especially on corporate income, in the Tax Cuts and Jobs Act of 2017. The personal income changes, which include lower tax rates for middle-income people, are scheduled to expire at the end of 2025, and the Child Tax Credit will be reduced at that time as well. Donald Trump would probably try to keep the tax cuts in place, plus cut corporate income tax rates another percentage point. He has also mentioned using tariffs to replace the personal income tax, but the numbers don’t add up, and this idea will likely die. The Biden campaign had a list of tax cuts for lower- and middle-income people that he wanted to implement, as well as increased taxes on the rich. Harris would probably adopt, in broad format, those proposals. Congressional action would be needed for any tax change, aside from expirations already written into law. Congressional action seems unlikely unless one party wins both the White House and both houses of Congress with significant majorities.

Regulatory policy is the area of greatest difference. President Biden’s regulatory agencies have aggressively tried to limit large corporations and provide greater consumer protections. President Trump talked about deregulation, but his main contribution to the effort was not adding too many additional regulations...

The final area of economic impact is through court appointments, especially the Supreme Court. Trump’s appointees have been skeptical about deference to regulatory agencies. But keep in mind that Supreme Court appointees do not vote in lockstep with the president’s wishes...

From a business perspective, the regulatory arena presents the greatest uncertainty. Generally, though, business leaders would do better concentrating on business than worrying about the upcoming election."

Across the pond in Europe Carsten Brzeski notes July PMIs Point To A Very Sluggish Eurozone Recovery.

"...The return of optimism in the Eurozone since the start of the year continues to lose steam. While improving business sentiment in the first months of the year as well as better-than-expected GDP growth in the first quarter had supported hopes of a surprise recovery of the Eurozone economy, the latest developments have proved to be something of a cold shower for those expectations. Not the relieving kind on a hot summer's day, but rather an ice cold shower in the winter when the central heating is broken.

For the Eurozone, the July PMI composite index came in at 50.1, from 50.8 in June and dangerously close to the 50-threshold that traditional pointing separated expansion from contraction. Today’s drop in the PMI points to a further weakening of economic activity at the start of the third quarter. The PMI manufacturing dropped to 45.6, illustrating the ongoing weakness of the sector. At the same time, activity in services also weakened, with the PMI dropping to 51.9. The only positive aspect of today’s PMI reports is the fact that selling price expectations softened...

Remember that the ECB last week changed its official language, stating that risks to the Eurozone growth outlook were no longer balanced but tilted to the downside. While this change in language seems to be mainly driven by a weaker-than-expected second quarter, the risk is also high that the ECB’s near-term growth forecasts will once again have to be revised downwards in September...

All in all, admittedly, there is more to Eurozone growth than only PMIs. However, today’s PMI readings do not paint a rosy picture of the region's growth outlook and once again illustrate the sluggishness of its recovery."

More than a shot of espresso seems to be needed there.

Closing out the column for today, in the where to invest department, TalkMarkets contributor Adam Sharp finds that Alibaba Is A Top AI Stock At A Deep Value Price.

"China’s tech sector has been devastated over the past few years. The Invesco China Technology ETF (CQQQ) is down about 68% from its February 2021 high. The country’s housing bubble has popped (or is popping), and the entire market got smashed as a result.

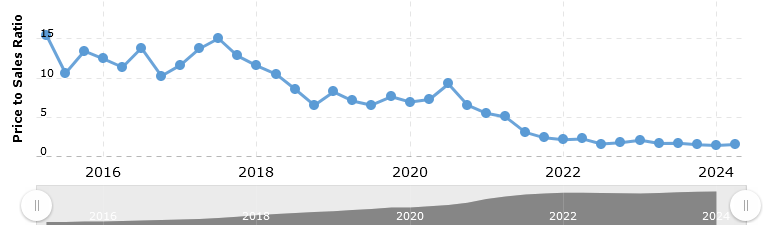

Alibaba (BABA), once the darling of Chinese tech stocks, is down about 71% from its October 2020 all-time high of $306. At $75.80 as of writing, shares are trading not far above the company’s 2014 IPO price of $68...

It is remarkable that BABA 0.00%↑ is trading near its IPO price after an 18x increase in revenue over the last decade. Shares currently trade at a near-record low price/sales ratio of just 1.54. Here’s a historical chart:

Currently BABA 0.00%↑ trades at a trailing P/E ratio of 18x and a forward estimate of 9x. It’s important to note that trailing earnings were impacted by mark-to-market losses due to plunging Chinese equity prices over the past year (Alibaba owns equity in a many public and private companies, and when those values fall, it is reflected in the company’s earnings).

Alibaba currently has about $50 billion of net cash (at a market cap of ~$179B). Sporting a free cash flow yield of ~11%, Alibaba is cheap. Especially compared with richly-valued AI stocks like NVIDIA at 36x price/sales, and Microsoft (MSFT) at 13x price/sales...

Importantly, Alibaba is not competing against GPT-4 and Claude 3.5 in China. On July 9 2024, access to OpenAI’s APIs in China was turned off by the company. According to a friend in Beijing, even VPN access is sometimes blocked by OpenAI. Anthropic’s impressive Claude models are also blocked at the country IP level, but apparently can be accessed via VPN, for now.

Since OpenAI cut off developer access to Chinese developers, business is booming for Alibaba Cloud according to Qwen program manager Wang Xiaoming.

"We observed a significant number of developers and users turning to Tongyi Qianwen [Qwen] large model and API. In terms of technology, we are catching up with and have even surpassed ChatGPT-4 in some capabilities, particularly in the processing of long documents, images, audio, and video," Wang said.

In the world of LLM development, access to proprietary data sources is a key advantage. And Alibaba has a trove of unique ecommerce and business data, rivaled only by giants like Amazon.

Another opportunity worth noting is that Apple is currently in the market for an AI partner in China. Since OpenAI and Anthropic are not operating in China, Apple needs a local partner to integrate with the iPhone. According to the WSJ, Apple is considering a partnership with Alibaba, Baidu, and Baichuan among others. If Alibaba manages to win Apple’s China AI business, that would be a significant vote of confidence.

As a bonus, BABA 0.00%↑ owns large stakes in some of China’s fastest-growing AI unicorns, including 01.AI (estimated 10-20% equity ownership) and Moonshot AI (36% stake, purchased with cloud credits). The company also has developed its own proprietary AI accelerator chips (similar to GPUs, but specialized for AI tasks)...

In terms of using AI to help its merchants sell more, I found some details in the WSJ’s recent article “Alibaba Leans Into AI to Draw Shoppers Beyond China”:

Alibaba’s family of generative AI models and new teams focused on AI applications are beginning to support the company’s drive to expand well beyond China, including by helping small sellers overcome language barriers and take on more complex tasks like negotiating refunds, said Zhang Kaifu, head of AI development at Alibaba’s international e-commerce unit.

The WSJ piece quotes an Alibaba representative as saying the company has more than 500,000 merchants currently using its new AI tools. According to the article, some merchants are seeing a 30% bump in sales. As these tools are refined, they should become extremely useful to both merchants and Alibaba itself.

Alibaba is not going to be left behind as AI transforms the business world...

Alibaba is currently my favorite “AI stock”, and it’s not even close. The stock is cheap and the business is still growing, with revenue up 7% YoY in the most recent quarter. Buybacks are flowing, the company is cash-rich and recently instituted a $1 per share annual dividend. Now the company has a real chance to reinvigorate growth by tapping into its leading AI expertise. Once the market realizes this, I believe we will see a positive re-rating of Alibaba’s valuation..."

There is plenty more to chew on in the full article.

Caveat Emptor.

Have a good week.

Peace.

More By This Author:

Words For Wednesday: Politics and Economics

Thoughts For Thursday: Fed Expectations Continue To Push Market Higher

Tuesday Talk: Bitcoin And Boeing