Thoughts For Thursday: All About Earnings

And the Fed meeting too, I suppose. As August starts there are a slew of earnings coming in, many exceeding expectations which is always a good thing. The appointment of a new CEO at Boeing yesterday pushed the stock higher by $3.74.

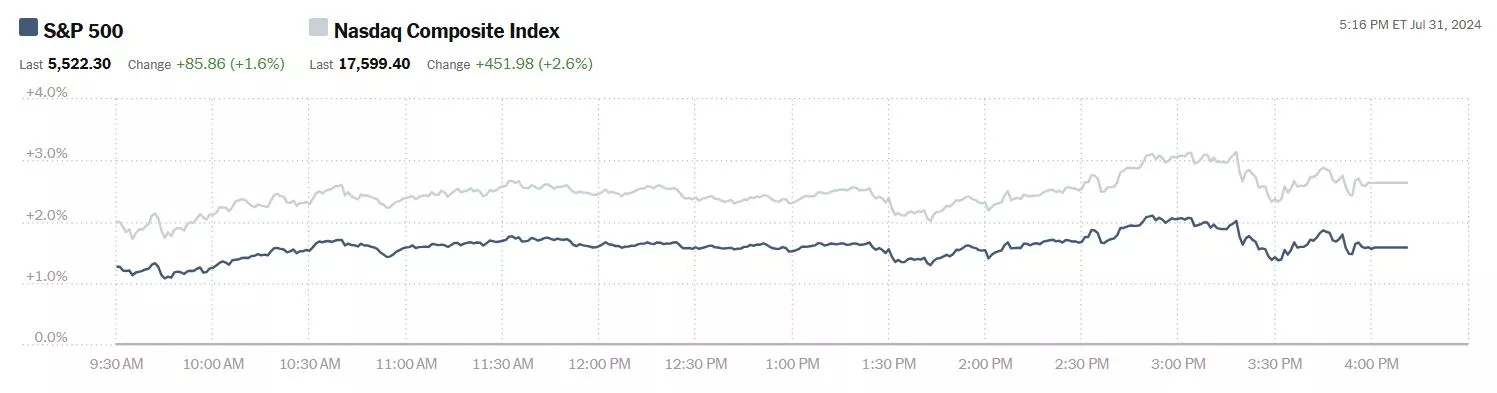

Yesterday the S&P 500 closed at 5,522, up 86 points, the Dow closed at 40,843, up 99 points and the Nasdaq Composite closed at 17,599, up 452 points.

Chart: The New York Times

Most actives were led by Nvidia (NVDA), up 12.8%, followed by Advanced Micro Devices (AMD), up 4,4% and Ford Motor Co. (F), down 0.2%.

Chart: The New York Times

In morning futures trading S&P 500 market futures are up 20 points, Dow market futures are up 51 points and Nasdaq 100 market futures are up 80 points.

TalkMarkets contributor Sheraz Mian looks at Breaking Down The Q2 Earnings Season Scorecard.

"For the 285 S&P 500 companies that have reported Q2 results, or 54.3% of the index’s total membership, total earnings are up +9.8% from the same period last year on +4.8% higher revenues, with 80.7% beating EPS estimates and 59.6% beating revenue estimates.

- Except for the revenue beats percentage, which at 59.6% is near the lowest for this group of 285 index members over the preceding 20-quarter period, all of the other performance metrics are tracking better relative to what we have seen in other recent periods.

- Looking at Q2 as a whole, total earnings for the index are expected to be up +9.0% from the same period last year on +5.3% higher revenues. This will be the highest earnings growth pace since the +10% earnings growth rate in the first quarter of 2022.

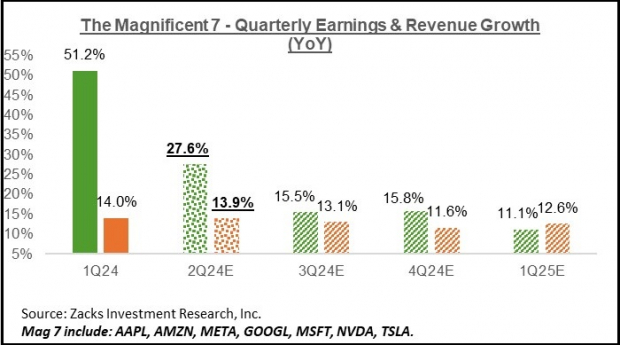

- Q2 earnings for the ‘Magnificent 7’ companies are expected to be up +27.6% from the same period last year on +13.9% higher revenues. Excluding the ‘Mag 7’, Q2 earnings growth for the rest of the index drops to +5.1% (from +9.0%).

Microsoft (MSFT - Free Report), Alphabet (GOOG - Free Report), and Tesla (TSLA - Free Report) kicked off the Q2 reporting cycle for the ‘Magnificent 7’ stocks, with the market unimpressed with either of the reports. This contrasted with the companies’ Q1 releases when Alphabet and Tesla were up big on the quarterly results while Microsoft was only modestly down.

There is no surprise in the Tesla sell-off, as the company not only missed estimates but also had nothing good to say about the near-term outlook. The EV maker has been suffering competitive challenges in its core market, prompting it to cut prices that are weighing on its margins. As a result, Tesla’s Q2 earnings were down -45.3% on +2.3% higher revenues. Given Tesla shares’ gain of more than +40% in the three-month period ahead of the quarterly release, the post-release sell-off makes perfect sense.

The sell-off in Alphabet and Microsoft shares is far more challenging to understand, as both of the Tech giants handily beat estimates and showed broadly positive trends in all of their businesses.

The issue in the Alphabet report appears to be the market’s disappointment with a bigger-than-expected capital spending level of $13.2 billion in the period relative to expectations of $12.2 billion. Management also indicated that they saw underspending as a bigger risk at this stage of the AI rollout than the alternative, which was interpreted as indicative of an elevated capex spend trend compared to what investors had been factoring in.

The issue with Microsoft appears to be the seeming deceleration in the company’s Azure unit. However, management explicitly stated that demand remained strong and that it’s faced challenges in meeting the demand due to capacity issues...

For the Mag 7 group as a whole, Q2 earnings are expected to be up +27.6% on +13.9% higher revenues, as the chart below shows.

Image Source: Zacks Investment Research

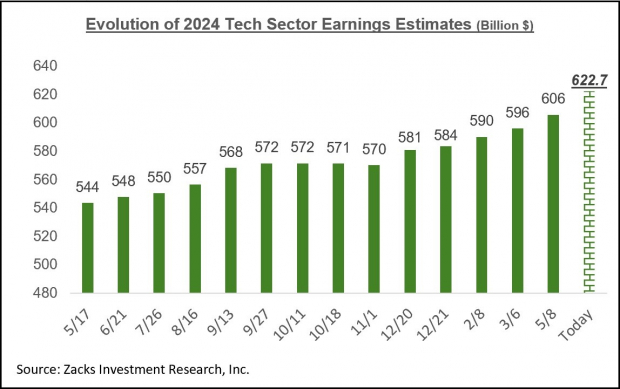

Beyond the Mag 7, Q2 earnings for the Tech sector as a whole are expected to be up +17.9% from the same period last year. The revisions trend for the Tech sector has been positive for a while now, which is important since the sector alone is on track to bring in almost 30% of all S&P 500 earnings over the coming four-quarter period.

For full-year 2024, Tech sector earnings are expected to be up +17.4%, followed by another strong showing expected next year. The chart below shows how the aggregate earnings total for the Tech sector has evolved over the past year.

Image Source: Zacks Investment Research

...The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

Please note that this year’s +8.4% earnings growth on only +1.8% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +8.1%, and the revenue growth rate improves to +4.1%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest..."

Economist and contributor Scott Sumner asks What If The Fed Doesn't Cut?

"It’s widely expected that the Fed will cut its target interest rate in September. Nonetheless, Fed Chair Powell insists that the decision will be data-dependent. Suppose the Fed decides not to cut interest rates in September—what will that imply about growth prospects for the fourth quarter of 2024?...

Here the answer depends on whether you are making a conditional prediction or an unconditional prediction. Let’s start with conditional predictions:

Suppose that at the time of its September meeting, 12-month PCE inflation has been running at about 2.5% and the Atlanta Fed continues to predict that 3rd quarter real GDP will grow by 2.8% (which is its current prediction.) Under those conditions, a Fed rate cut would likely lead to faster economic growth expectations than a decision not to cut rates.

Now let’s look at an unconditional forecast. Would I expect faster economic growth after a rate cut, or after a decision not to cut rates? Probably the latter. That’s because the Fed would only refrain from cutting rates in September if the economy were to show significantly more momentum than is currently expected. A decision not to cut rates would likely reflect an unexpected change in the trajectory of the economy. If all I knew was that the Fed opted not to cut rates, I’d raise my forecast for 4th quarter GDP growth..."

TM contributor Dr. Duru enhances our financial education with The New Recession Obsession: The Sahm Rule.

"I first heard of the Sahm Rule on a trading podcast earlier this week. When I heard the economic rule mentioned again during the Federal Reserve press conference on monetary policy, my ears perked up and my eyes opened wide. Surely this combination and recency was not a coincidence...Conventionally, the Sahm Rule signals the onset of recession when it hits 0.5. As of today, this ominous rule in economics is at 0.43 (using June, 2024 data), its highest level in over 3 years.

Source: Sahm, Claudia, Real-time Sahm Rule Recession Indicator [SAHMREALTIME], retrieved from FRED, Federal Reserve Bank of St. Louis, July 31, 2024.

The chart shows the uncanny consistency of the Sahm Rule. Since 1960, the Sahm Rule has had just one false positive (in 2003) and no false negatives. Thus, the persistent and consistent upward trend in the Sahm Rule since October 2021 all but locks in a recession signal in the coming months...

The definition of the Sahm Rule is buried in a policy proposal from economist Claudia Sahm. Sahm sought to create an automatic rule for initiating economic relief payments to take the edge off a recession.

“Automatic lump-sum stimulus payments would be made to individuals when the three-month average national unemployment rate rises by at least 0.50 percentage points relative to its low in the previous 12 months.”

The graph provided by the St Louis Federal Reserve calculates the percentage points used in that rule. Clearly, this rule looks like a very good harbinger of recession...

I strongly suspect the buzz about the Sahm rule will produce a drum beat synchronous with history’s rhyme. The irony is that, for now anyway, Wall Street will welcome increasing fears of a recession as those worries will act like co-signers to a September rate cut. The predicted near certainty of a rate cut initiated a dramatic market rotation favoring a whole host of rate sensitive sectors over growth, big cap tech stocks. That rotation looked ready to take its next logical step as the iShares Russell 2000 ETF (IWM) surged to a new 2-year high. However, the ETF of small caps faded back to a 0.6% gain and failed to confirm the invalidation of a prior blow-off top. Still, I remain patiently bullish on IWM...

And then there are bond yields. Lower yields should correlate with an intensifying recession obsession. For now, I am sticking to the presumed trading range on iShares 20+ Year Treasury Bond ETF (TLT). TLT closed right at the top of that range. If TLT breaks out, I will draw a new presumed trading range; I still think ballooning U.S. debt levels and persistently strong economic data provide catalysts for downward pressure on TLT. I bought a fresh round of TLT put options near the close on the assumption TLT will have at least one more fade back to some support level...

The latest recession obsession in the form of the Sahm Rule is sure to produce additional trading opportunities…and surprises to come."

The Staff of Seasonax reflect on Bitcoin’s Summer Blues.

"Bitcoin’s (BITCOMP) summer tends to be a weak period with average falls in the double digits between August 01 and September 29 over the last 13 years. The largest drop was over 60% and prices have only gained 23.08% of the time. However, this is a very volatile time as the largest gain was over 50% in 2017, so the potential for a wild ride during the summer months is also high...

The two weakest months of the year for Bitcoin are in August and September, with September being the weakest month of the two. In fact every other month of the year tends to see average gains in Bitcoin, apart from August and September. So, this means that this coming period stands out as the seasonally most vulnerable time for Bitcoin downside."

Contributor Emily Basil reports Intel To Lay Off Thousands To Reduce Costs, Focus On Research, Development And New Plants.

"Intel Corp. (INTC) is expected to announce major job cuts in the coming days, with a view to cutting its cost base and regaining its position as the world’s largest chipmaker. According to anonymous sources reported by Bloomberg, the layoffs will be announced as early as this week...

In recent years, Intel has been losing market share to competitors as its earnings and revenue decline. The job cuts are part of a bold plan to tackle these challenges. In chip technology, competitors such as Taiwan Semiconductor Manufacturing Co. have beaten Intel, particularly in the AI-RELATED segment...

Under Pat Gelsinger’s leadership, Intel has made considerable investments in R&D to gain a better competitive advantage. In addition, Intel has set up new chip factories in the US, Europe, and Israel to produce semiconductors for other chip makers...

Workers around the world are going to be affected by these layoffs. Intel laid off more than 300 employees in California earlier this year, affecting roles related to GPUs, cloud computing, and AI computing.

Intel shares rose slightly in reaction to this news, although the company has not commented officially..."

That's a wrap for this Thursday.

Be well and stay safe.

Peace.

More By This Author:

Tuesday Talk: Almost Gone Fishing Time

Words For Wednesday: No Major Shoe Dropping Yet

Words For Wednesday: Politics and Economics

Good roundup. Thanks.