Tuesday Talk: Eggs Still In The Basket

Investors returned to the market Monday, after the Good Friday trading holiday, with most of their eggs still intact. The early Spring rally seems to be holding as the market prepares for Q1 banking sector earnings.

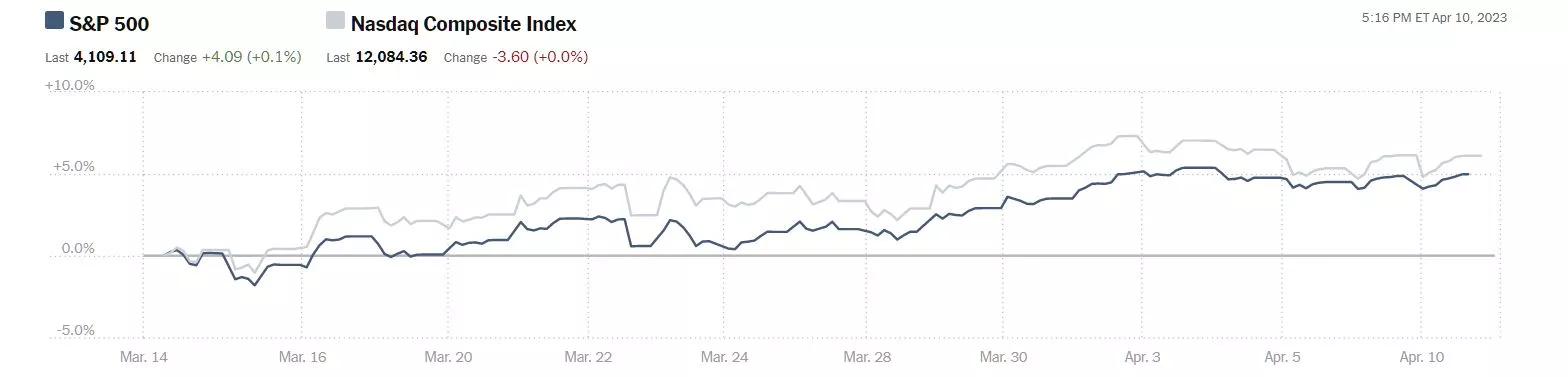

Yesterday the S&P 500 closed at 4,109, up 4 points, the Dow Jones Industrial Average closed at 33,587, up 101 points, while the Nasdaq Composite closed down just 4 points, at 12,084. The one month chart below shows the market's current upward ascent.

Chart: The New York Times

Yesterday's top gainers were led by Western Digital (WDC), up 8.2%, followed by Micron Technologies (MU), up 8% and Pioneer Natural Resources (PXD), up 5.8%.

Chart: The New York Times

In morning futures trading S&P 500 market futures are up 12 points, Dow market futures are up 55 points and Nasdaq 100 market futures are up 47 points.

TalkMarkets contributor James Harte writes in his Global Equities Commentary - Tuesday, April 11 that equites seem to be headed higher. Here are some of his insights this morning:

"Global equities benchmarks are starting the day with an air of cautious optimism, seeing most indices tracked here trading in the green across the European open on Tuesday. Traders returning from the long Easter weekend are seemingly buoyed, rather than concerned by last week's better-than-forecast US jobs report...

If inflation is seen cooling further last month, equities are likely to continue higher into the back end of the week as traders dial back their Fed rate-hike expectations. However, should inflation be seen rising unexpectedly last month, this will add to hawkish expectations leading to some giveback in equities markets...

The DAX index is holding above the 15642.76 level for now and with momentum studies still bullish, while the market holds above here the focus is on a further push higher towards the 16278.35 level next. To the downside, should the index break back below current support, focus will turn to the 15163.41 level next."

"The recent turn lower in the NIKKEI index has seen strong support kicking in on a retest of the 27422.9 level. Price has since bounced and is holding above the level. While above that support, and with momentum studies bullish, focus is on a further push higher towards the 28356.6 level next."

Contributor and chartist Tim Knight posits on the Dollar’s Direction?

"We could look at this (the dollar's direction) in a macro sense by way of the dollar index ($DXY) which seems to my eyes to be rather bullishly formed, provided it stays above that dashed line."

"If I had to make a call, I’d be inclined to say the US Dollar is going to be stronger. What do you think?"

See the article for Knight's USD/JPY and EUR/USD charts, as well.

Contributor Chris Kimble weighs in on the state of the semiconductor sector writing, Semiconductors Rally Trades Into Critical Resistance.

"As you can see in the “monthly” chart below, SMH has been trading in a bull market trend for over the past decade. And it has spent much of that time in a rising trend channel.

That said, price briefly broke out above the channel before falling back into the channel (after a bearish reversal). And it is now retesting the upper end of the trend channel at (1). This resistance area is also fortified by horizontal resistance from the prior’s bearish reversal pattern breakdown.

So let’s just say that this is a place of interest for bulls and bears. And it would be quite concerning for tech and the broader stock market if the Semiconductors started selling off form here."

![]()

Recovery seems to be in the offing as TM contributor Rod Raynovitch says April Is Busting Out For Healthcare And Biotech.

"Last week was a good week for healthcare stocks and most large cap biopharmaceutical stocks resumed an upward trend...What has changed is that investors are investors are more concerned about a slowing economy or even stagflation and seek growth with a defensive posture. The big movers after the banks collapsed were large cap techs with the QQQ up 19.44% YTD and 6% over one month.

The Healthcare SPDR ETF (XLV) has finally outperformed up 4.24% for the week although still down 1.72% YTD. UNH is a large core holding up 9.09% for the week to $512.81. This ETF also has major holdings in MedTech and Dx players: ABT, DHR, JNJ and TMO. It should be noted that an ETF that covers U.S. Healthcare Providers (IHF) was up 5.38% this week led by CVS, ELV, HCA and HUM."

Go to the full article for additional analysis, charts and graphs. At present Raynovitch believes "the issue going forward is small cap growth tied to Fed and “soft landing” ,otherwise healthcare looks good."

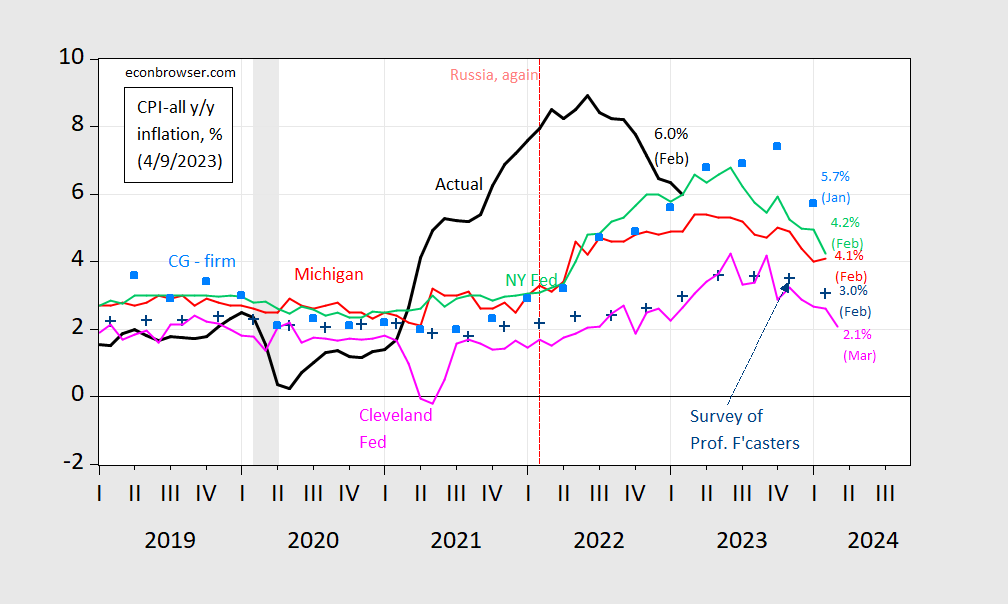

TM contributor and economist Menzie Chinn closes out the column with a look at One Year Ahead Inflation Expectations with this chart as of Monday, April 10.

"Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers FINAL (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares], all in %. NBER defined peak-to-trough recession dates shaded gray.

Source: BLS, University of Michigan via FRED and Investing.com, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko, and NBER."

Have a good one.

Image: D. Marshall

More By This Author:

TalkMarkets Image Library

Tuesday Talk: April Flowers

Thoughts For Thursday: Springing Ahead...