Tuesday Talk: April Flowers

So far it's April flowers as stocks continued upwards on Monday, with the announced OPEC+ production cut creating a rally in Oil related issues.

Yesterday the S&P 500 closed at 4,125, up 15 points, the Dow closed at 33,601, up 327 points, while the Nasdaq Composite closed at 12,189, down 32 points. Top gainers were led by Marathon Oil (MRO), up 9.9%, followed by ConocoPhillips (COP), up 9.3% and APA Corp (APA), up 8.7%.

Chart: The New York Times

In early morning trading S&P 500 market futures are trading up 12 points, Dow market futures are trading up 41 points and Nasdaq 100 futures are trading up 66 points.

Contributor Brett Steenbarger in a TM editor's choice column, Breadth Thrusts In The Stock Market: What Comes Next?, take a look at the latest activity in the market.

"(Last week) we went from a defensive market theme to an aggressive one, creating a breadth thrust: the great majority of shares participated to the upside. This strength continued through the week. The change in market theme was signaled by a shift in the patterning of market breadth.

We can look at this from two perspectives.

First, the presence of strength. I looked back to 2006 and identified all market occasions in which more than 90% of SPX stocks were above their three-, five-, and 10-day moving averages at the same time. Interestingly, out of well over 4000 market days, this only occurred on 42 occasions.

Over the next five trading sessions, the market was down by an average of -.26%, compared with a gain of +.18% for the remainder of the sample. No particular edge was seen here, even going out by 20 days. Returns over a next 20-day period were volatile, with 17 of the 42 occasions rising or falling by over 5%.

Second, the absence of weakness. If we get a true breadth thrust, we should see very few stocks demonstrating weakness. I track the number of NYSE stocks giving sell signals on two technical indicator measures: the Bollinger Bands and the Parabolic SAR. These track price action over differing time periods.

On Friday, we had 10 or fewer stocks giving sell signals on both measures. Out of almost 900 market days in my database, this only occurred on 7 occasions. Again, this is very unusual. The number of occasions is too small for reliable statistical inference, but it is noteworthy that the market overall underperformed over the next ten trading sessions and outperformed 30 days out.

Most interesting, however, is that four of those seven instances occurred as a cluster in April of 2020. The question this invites is whether the current period (with a possible Fed pivot in rate policy due to bank concerns) is similar to the 2020 period (with a Fed pivot in the face of COVID-19's impact).

Analyses such as these are meant to help in the formulation of credible market hypotheses, not the generation of infallible ideas..."

"At present, I'm open to the notion that we are, indeed, seeing a regime shift in the stock market, reflecting a change in central bank policy. If that is the case, near-term weakness could become an opportunity to participate in longer-term cyclical strength."

TM Contributor Prof. Bradford Cornell takes a first look at Q1 in Investor Memo Q1 2023: Banks, Interest Rates, And Debt.

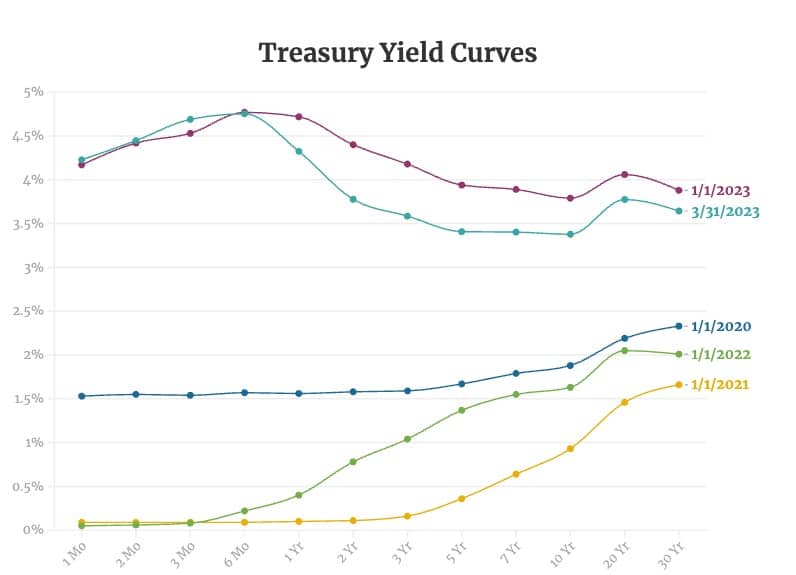

"During the first quarter the story of both the fixed income and stock market revolved around the ongoing evolution of the yield curve. To review, the yield curve plots the yield on Treasury securities as a function of their maturity. The graph below plots the yield curves at the start of the year for the last three years along with the current yield curve."

"The dramatic shift in the yield curve had two critical impacts on banks, particularly banks that held large amounts of long-term government securities. First, they faced a choice of paying about 4.5% on deposits or risk losing them. Second, the value of their long-term government bonds, whether recognized for accounting purposes or not, dropped by about 20% on average. This put banks that held large amounts of such bonds at risk. For example, Silicon Valley Bank (SVB) reported in December 2022 that deposits represented 82% of the bank’s liabilities and over 60% of those deposits were invested in cash or government securities.

Aware of the decline in the value of SVB’s government bonds, sophisticated investors rushed to withdraw their money quickly, whether or not the bank paid a competitive rate on deposits, for fear that the market value of the assets was insufficient to cover all of the deposits. Because those investors were correct, the drop in the value of bonds rendered the bank insolvent on a mark to market basis and the regulators were forced to seize the bank. The resulting fear that such problems could be more widespread led to a sharp drop in the stock prices of most banks and a collapse in the stock prices of banks deemed most at risk such as SVB and First Republic. The bank panic, in turn, led to a decline in the overall stock market...

Periodically, stock market concentration has attracted the attention of investors. Now should be one of those times. Exhibit 3 presents both the market capitalization of the five largest companies in the S&P 500 and their fraction of the total capitalization of the index. The exhibit shows that the market is significantly more concentrated than it was at the height of the dot.com bubble. Since 2010 the concentration ratio for the top 5 companies has more than doubled."

"The market concentration is not necessarily a bad thing (especially when the market is going up). Apple, Microsoft, Alphabet, and Amazon are remarkable companies. However, they are not infallible or immune to competition."

"In our view valuations remain on the high side, so we will have to look carefully to find companies trading below their fundamental value. We also plan to make continued use of options both to hedge and to increase income in situations where our analysis implies it improves the risk/return tradeoff."

See the full article for additional elucidation.

The Staff at ReadTheTicker.com writes that Oil Is Looking Very Bullish.

"Oil is a major influence on inflation. So its going to make issues for western economies in about 6 to 9 months.

- China opening

- Russia cutting production to boost revenue.

- OPEC cant increase production (or refuses to or the CUT! Update OPEC cut $1M barrels 2023-04)

- Target: Oil back over to the range of $100 to $130+ is the goal.

Of course OIL moves gold, silver and inflation higher (and interest rates) at different stages. Meanwhile the US will have to sell a lot of treasuries and the US dollar will have to be lower to do that. Oil could hit $150+ just like 2007/08 period."

Contributor Charles Hugh Smith explains Here's How We'll Have Labor Shortages And High Unemployment At The Same Time. Below are some of his observations.

"...numbers such as the unemployment rate tell us very little about the labor force and the job market in terms of what matters going forward. So what does matter going forward?

1. Demographics--the aging and retirement of key sectors of the work force.

2. Skills and experience that will be increasingly scarce due to mismatched demand for skills that are diminishing as older workers retire.

3. What skills and experience will be demanded by re-industrialization, reshoring and expanding the electrification of the economy.

Consider the below two charts of the US work force by age. (Courtesy of CH @econimica) In the first chart, Total US Employees, note that the prime working age work force (ages 25-54) has been flatlined for the past 20 years at 101-102 million. In contrast, the 55-and-older cohort of employees soared from 17 million to 37 million. This increase of 20 million accounts for virtually all growth in the employed work force...

While the total US population increased by 18% from 281 million in 2000 to 331 million today, the 55+ cohort increased 74% (from 57 million to 99 million).

The key takeaway here is the number of experienced workers who will retire in the next decade will track the explosive growth in the 55+ cohort. The general consensus is this will not be a problem because there are plenty of younger workers available to fill the vacated slots.

But this overlooks the qualitative and quantitative differences in the millions leaving the work force and those joining the work force. This is especially consequential in real-world jobs, i.e. all those jobs that require engaging real-world materials rather than staring at screens...

What few seem to realize is the work force that's aging and retiring is the cohort with the real-world skills.

In other words, there is a massive mismatch between the skills available to hire in the young-worker cohort and the skills and experience needed to rebuild the material, real-world foundations of the US economy. It's well-known but apparently not worth worrying about that the average age of the US farmer is pushing 60 years of age...

The average age of skilled tradespeople is also skewed to the aging work force. There is no easy way to quantify real-world skills gained by on-the-job experience. I suspect it follows a power-law distribution: the newly minted worker just out of school / apprenticeship can handle basic functions, but when tough problems arise, the number of workers with the requisite experience to diagnose and fix the problem diminishes rapidly.

This distribution presents an enormous problem for the economy and employers. Once the super-experienced workers who can solve any problem leave, they cannot be replaced by inexperienced workers. So when the really big problems arise, the systems will break down because those who knew how to deal with the problems are no longer available.

This is how you can have 10 million unemployed workers and 1 million unfilled positions that can't be filled because few are truly qualified.

My direct experience is that many young people don't know how to put air in the tires of the vehicle Mom and Dad gave them. Young people with graduate-level diplomas don't know what a green bean plant looks like.

Yes, there are many young workers with sharp real-world skills. The question is, are there enough?

This is how we'll end up with severe shortages of truly skilled labor and high unemployment in the cohort of workers with few real-world skills and a surplus of skills for which there is limited demand.

Who's going to do all the real-world work going forward? A few people talk about it as an abstraction, but it's not an issue to everyone focused on Federal Reserve policy or GDP.

Read Smith's full article for more peppery analysis.

In this week's "Where to Invest" Department, contributor Keith Park offer these April 2023 Stock Considerations.

"Let’s take a look at my April stock considerations which are similar to recent considerations from one to four months ago.

First up, I am looking at Verizon Communications Inc. (VZ) once again...This stock is trading with a low forward PE of just over 7 and sports a very juicy yield getting close to 7% and a moderate payout ratio of around 51% making this dividend appear to be very safe going forward. I realize that this company may not be a growth machine going forward but what it lacks in growth the current yield makes up for.

Next, I am taking a look at another large telco AT&T Inc. (T)...T has largely remained off my buy list. However, that juicy yield approaching 6% is enticing me once again. With a reasonably low forward PE north of 7, the stock is looking fairly valued in the high teens.

I am also looking at the stock everyone loves to hate Altria Group, Inc. (MO). MO still looks a little rich at current prices but I’ll be waiting for entry points closer to $40. As mentioned, the stock still appears to be expensive but for those looking to cash in on the current yield this stock may be the ticket.

Finally, I’m taking a look at a name that I haven’t touched for several years, Leggett & Platt, Incorporated (LEG). This is another stock that had a rough start to 2022 and is now sporting a yield of around 5.5% as a result of the share price decline. With a comfortable payout ratio of about 76% the dividend still appears to be safe going forward."

That's a wrap for this Tuesday. Happy Passover to all of our readers who are celebrating.

Image: D. Marshall

More By This Author:

TalkMarkets Image LibraryThoughts For Thursday: Springing Ahead...

Tuesday Talk: Walking It Back, Moving Forward