Thoughts For Thursday: Which Way Through Uncertainty?

Markets are trying to maintain resistance levels generated from last week's rally, but finding the path to doing so is proving to be no easy matter.

Yesterday the S&P 500 closed down 3 points at 3,819, the Dow closed up 82 points at 31,029 and the Nasdaq Composite close at 11,178, down 4 points.

Most actives were in Travel, Tech, Finance and Industrial sectors, recording swings high and low.

Chart: The New York Times

Heading into the last trading day of the quarter markets are negative in early morning futures trading. Currently S&P market futures are trading down 53 points, Dow market futures are trading down 360 points and Nasdaq 100 futures are trading down 196 points.

TalkMarkets contributor Diego Colman finds S&P 500 And Nasdaq 100 Subdued On Hawkish Fed, Recession Risks Torment Investors.

"Concerns about the outlook increased after Fed Chairman Powell pledged to use the tools at his disposal to bring inflation down to 2% and said the biggest mistake would be to allow expectations to become unanchored, a sign that policymakers will press ahead with their plans to front-load interest rate hikes."

"Tighter financial conditions and extremely bearish sentiment will exacerbate near-term volatility, preventing equities from staging a meaningful and sustainable rebound. Against this backdrop, the S&P 500 (SPY) and Nasdaq 100 (QQQ) will remain biased to the downside heading into the second half of the year, with traders selling rallies every chance they get.

The investment landscape could get worse before it gets better. With the second-quarter reporting season just around the corner, traders should prepare for the possibility of weak earnings and poor corporate guidance amid falling margins and rising recession risks. Should this scenario play out, we could see another leg lower on Wall Street in coming weeks and months before risky assets start to bottom out."

Contributor Brad Thomas, who generally covers REITS, notes Everyone’s Dependent On China, And That’s A Problem.

"For decades, China has enjoyed a celebrated status as the world’s manufacturing mecca. Since Bill Clinton signed the NATO expansion of ‘98, a substantial slice of the American industrial sector has relied on the People’s Republic to produce everything from iPhones to outerwear.

Chinese exports soon became essential to the economic health of our country and so many other nations as well. So when COVID-19 hit China first and foremost, inducing lockdown after lockdown after lockdown the past 2.5 years…

The global economy began experiencing product shortage (after product shortage after product shortage) and shipping chaos. Naturally then, many a business has suffered too."

"With China continuing its strict COVID policies, many businesses around Europe and America are now reassessing their relationship with the global industrial giant. In fact, nearly a quarter of European companies are now considering cutting their ties to the country...Obviously, China’s place in the global economy is shifting. COVID truly tested the resilience of this regime and revealed the weaknesses inherent in our over-dependence on it."

China dependencies notwithstanding the Staff at Bespoke Investment Group says Happy Birthday, Iphone!

"Whether it is currently in your pocket or in your hand as you read this, if you own an Apple iPhone, make sure to wish it a happy birthday. Exactly a decade and a half ago to the day, what is now the staple of the smartphone market first hit the shelves."

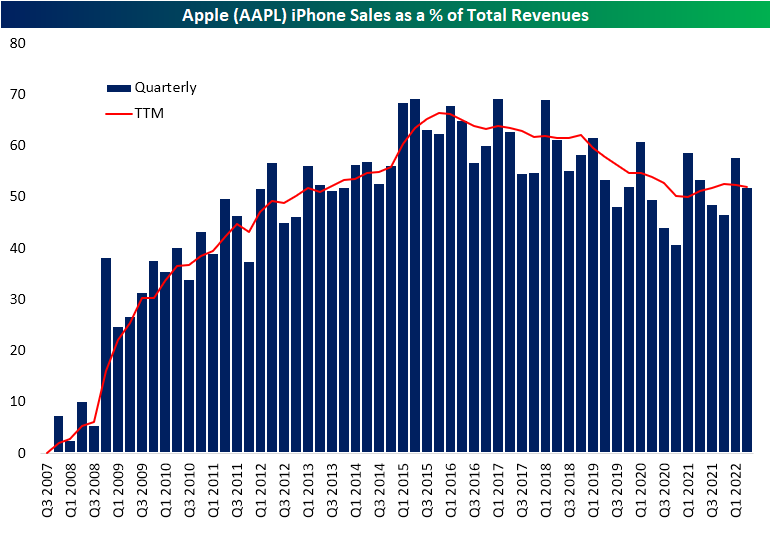

"Much of Apple’s (AAPL) growth in the years since the smartphone debuted can be credited to this revolutionary device. Over the past four quarters the phone accounted for $200 billion in sales which is a 52% share of total revenues for the company. Even though it still currently accounts for a majority of one of the world’s biggest companies’ revenues, over the past few years, that share has been on the decline having peaked at 69.4% in Q1 2017.

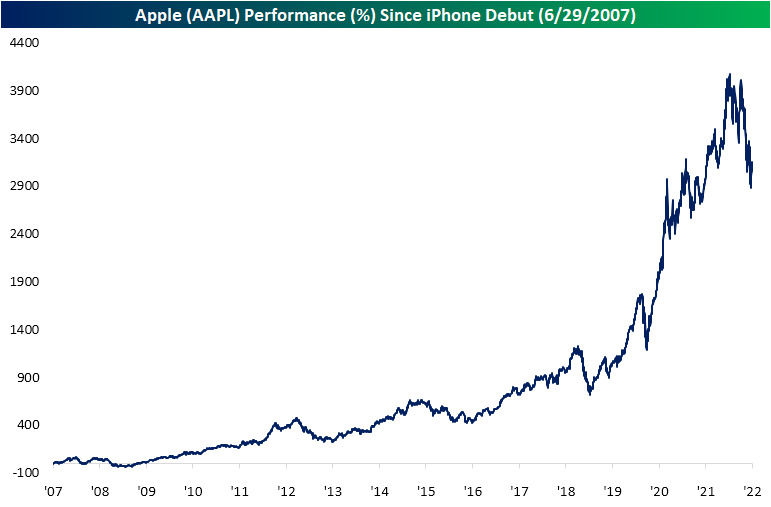

Since the first generation iPhone was released, the stock of Apple has posted astounding gains. In fact, of all current S&P 500 members, AAPL ranks as the fifth-best performer (based on price change) in the index since the iPhone debut 15 years ago. The only stocks to have posted even more impressive gains have been Netflix (NFLX), DexCom (DXCM), Regeneron (RGEN), and Amazon (AMZN). That is not to mention that at its high earlier this year, Apple’s post-iPhone rally stood above 4,000%!

Not only has AAPL left most of the market in the dust over the past 15 years, but it is especially the case for the stocks of other smartphone makers...While other names like Blackberry, HTC, Samsung, and LG saw some outperformance versus Apple in the late 2000s, there has been absolutely no competition over the long run. "

In a deep dive into the current state of the market and investor sentiment, contributor Scott Martindale lets in a few rays of optimism, observing Investors Await Bullish Catalysts As Inflation, Interest Rates, And Money Supply Growth Show Signs Of Topping. Below is some of what he has to say.

"...despite the negative headlines and ugly numbers, it mostly has been an orderly selloff, with few signs of panic. The VIX has not reached 40, and in fact, it hasn’t eclipsed that level since April 2020 during the pandemic selloff."

"A mild recession is becoming more likely, and in fact, it has become desirable to many as a way to hasten a reduction in inflationary pressures. Although volatility will likely persist for the foreseeable future, I think inflation and the 10-year Treasury yield are already in topping patterns."

"Falling bonds pushed up yields and exacerbated the selloff in stocks (by raising the discount rate and lowering the equity risk premium), particularly as rates broke out above 2021 highs to levels not seen since 2018 (just prior to the Q4 2018 selloff)...with money supply growth slowing, demand destruction underway, and supply chains recovering, my bet is on falling inflation and yields…and limited stagflation."

"As for corporate earnings, Q2 reports will start soon, and they surely will reveal inflation is hurting margins. Because multinationals in the S&P 500 get a lot of revenue from overseas and then convert those sales from weaker currencies into strong dollars, current EPS estimates might be hard to achieve. Stocks have sold off faster than earnings estimates have come down due to a combination of deleveraging (largely due to margin calls), the Fed “talking up” interest rates with hawkish rhetoric, and an investor shift from speculative fervor (“animal spirits”) to demanding actual (and high quality) profits. But I think as inflation begins to recede in 2H, investors will be willing to allow some expansion in valuation multiples (P/E ratio) in anticipation of improving margins down the road."

"From a contrarian standpoint, excessive pessimism is bullish. The stock market is a leading indicator that tends to move up in advance of improving data. And from a historical perspective, such divergence between the actual economy and sentiment tends to converge rapidly. Other encouraging signs include indications of massive buying programs among institutional traders, and the insider buy-sell ratio recently hit its highest level since March 2020, reflecting behavior consistent with historical market bottoms."

"I still expect a sequence of events over the coming months as follows: more hawkish Fed rhetoric and further tightening actions, modest demand destruction, a temporary economic slowdown or mild recession, and more stock market volatility…followed by mending supply chains, some catch-up of supply to slowing demand, moderating inflationary pressures, bonds continuing to find buyers (and yields falling), and a dovish/neutral/less-hawkish pivot from the Fed – ultimately leading to a rising stock market. But again, rather than investing in the major cap-weighted index ETFs, stocks outside of the big-name mega-caps may offer better opportunities due to lower valuations and higher growth rates."

The article is extensive in scope and worth a look. Martindale ends with some ETF investment suggestions.

Over in the Where to (or Where Not to) Invest Department, TM contributor Giles Coghlan ponders, Bitcoin: When Will Prices Recover?

"The recent falls in the crypto space have left many traders reeling. Bitcoin prices have collapsed around a wider market sell-off as high inflation has prompted central banks to enter step hiking cycles. So, what are some tips for managing Bitcoin’s price? Well, it appears at this stage to be really quite straightforward."

"Take a look at the chart below which overlays Bitcoin prices and the Nasdaq. You will notice that BTC prices and Nasdaq prices are moving in tandem

BTC tracks the Nasdaq

Why is this correlation so tight? The best explanation is likely to be that BTC is now grouped with tech stock for risk management. So, when risk dictates sell tech, then BTC gets sold too.

This means that BTC should recover alongside stocks. When will stocks recover? That will most likely be the moment that the Federal Reserve indicates that it will be pausing/stopping its rate hiking cycle. So, if you are wondering what the next path for BTC (BITCOMP) will be then watching the Nasdaq may prove to be a reliable guide as long as this close correlation remains and there is no obvious reason why that relationship should break down."

Hmm...seems a bit over simplistic given what we've been reading about some of the crypto trading, exchanges..

Caveat Emptor.

Elsewhere, the G7 seems to be coming up short in finding ways to shorten the Ukraine war, which is not good for anyone or anything.

Enjoy the upcoming July 4th holiday and support Ukrainian relief efforts, our liberty, among other things, depends on it.