Thoughts For Thursday: Indices Continue Climbing

The major stock market indices continued in their current climb upwards, yesterday as well, despite a small hiccup coming from the Dow. This despite a global backdrop that is not improving.

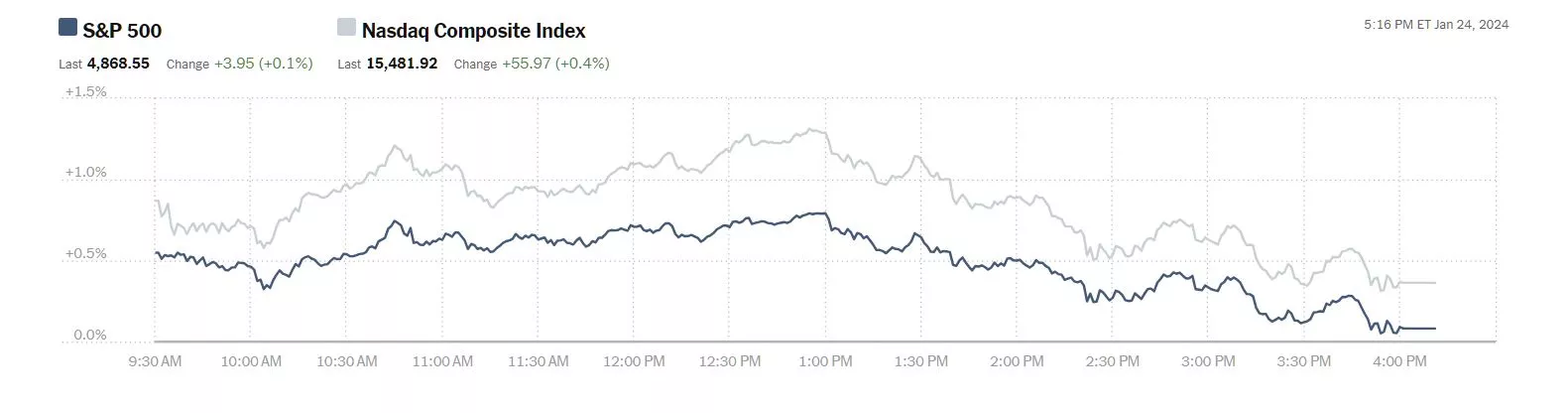

Wednesday the S&P 500 closed at 4,869, up 4 points, the Dow closed at 37,806, down 99 points and the Nasdaq Composite closed at 15,842, up 56 points.

Chart: The New York Times

Most actives were led by Advanced Micro Devices (AMD) up 5.9%, followed by Tesla (TSLA), down 0.6% and AT&T (T), down 3.0%.

In morning futures action, S&P 500 market futures are up 3 points, Dow market futures are down 18 points and Nasdaq 100 market futures are up 33 points.

TalkMarkets contributor Staff at JustMarkets notes Corporative Reporting Supports US Stock Indices.

"Optimism about the US economic outlook and strong corporate earnings results boosted stock prices on Wednesday.

Strong earnings from technology companies supported the broader market, as Netflix (NFLX) closed higher by more than 10% after reporting fourth-quarter streaming pay-per-view numbers well above consensus. Additionally, shares of ASML Holding NV rose more than 8% and led gains in chip stocks after reporting record Q4 orders, indicating the strength of the semiconductor industry. S&P's US manufacturing PMI for January unexpectedly rose by 2.4 to 50.3, beating expectations for a decline to 47.6 and showing the fastest pace of growth in 15 months."

Contributor James Harte provides some Crude Oil Commentary - Thursday, January 25.

"Crude Rallying on Inventories Data

Oil prices are pushing higher today with crude futures close to testing the December highs. The latest inventories report from the EIA yesterday recorded a heavy 9.5 million barre drawdown, far deeper than the 1.5 million-barrel draw the market was looking for. This comes on the back of a 2.5-million-barrel decline over the prior week. Storms in the US recently have caused major disruption to US crude supply, allowing demand to catch up and eat into stockpiles. This dynamic is keeping oil prices supported for now and looks likely to continue near-term while refiners work through the fallout.

Chinese Stimulus News

Alongside supply disruptions in the US, news of potential Chinese stimulus is also helping boost the demand outlook for crude. Reports emerged this week regarding plans for a near $300 billion stock market support package which traders anticipate will likely be accompanied by other measures. The prospect of fiscal support in China is being cheered by oil bulls given the expected impact on demand. While this optimism continues, oil prices look likely to continue higher near-term.

Technical Views

Crude Oil

The rally in crude oil has seen the market breaking back above the bear channel highs and the 72.61 level resistance. Price is now fast approaching a test of the 77.64 level and with momentum studies moving higher, the focus is on a break higher here. 82.59 sits above as the next bull target should we break local resistance."

Sweet words for crude oil bulls, though I am skeptical of this whole Chinese stimulus talk...

TM contributor Carsten Brzeski reports German Ifo Index Drops To Its Lowest Level Since 2020.

" Pessimism is now fully back in Germany as new supply chain disruptions and a train drivers' strike increase the risk of yet another quarter with a contracting economy...

It sometimes feels as if someone in Germany must have smashed a mirror, causing seven years of bad luck. As if the last four years of pandemic, war in Ukraine, supply chain frictions, energy crisis, and structural shortcomings weren’t enough, 2024 has not started any better. On the contrary, the new year brought new problems for the German economy: there are the government’s austerity measures but also ongoing strikes by train drivers and supply chain disruptions as a result of the military conflict in the Red Sea. In fact, another contraction of the German economy in the first quarter of the year looks even more likely.

Looking beyond the near term, we expect the current state of stagnation and shallow recession to continue. The risk that 2024 will be another year of recession is high. We expect the German economy to shrink by 0.3% YoY this year. It would be the first time since the early 2000s that Germany has gone through a two-year recession, even though it could be a shallow one."

Contributor Dennis Miller writes When It Comes To Inflation, The Fat Lady Isn’t Even Close.

"...“It ain’t over ’til the fat lady sings” is a phrase that comes from a tendency in operas to end with a heavy-set lady singing an aria. It’s a reference to Valkyrie Brunnhilde’s 10-minute solo that ends Wagner’s Ring Cycle opera.

Sportscasters use the line frequently. One should not presume to know the outcome of the event, even if it appears near its conclusion.

While politicians try to minimize inflation, don’t buy it, the fat lady is home, worrying about paying her bills, not even thinking about her closing aria.

James Rickards explains the propaganda currently being fed to the public:

“Everyday Americans understand inflation perfectly. …. Inflation is one of the biggest concerns of those who live in the real world.

…. Here’s the reality and here’s the political narrative: Reality is that prices have been going up at the fastest rate in 40 years and they are still going up.

…. The average price of a pound of ground beef in the U.S. was $5.11 in September 2023. In October 2023 the price of a pound of ground beef was $5.23. That’s a 2.3% increase on a month-over-month basis, which annualizes to over 25%.

That’s the kind of inflation that real Americans confront every day.

Morningstar reports on a recent Allianz survey:

“A new survey finds that 61% of us are more afraid of running out of money in our old age than we are of dying itself.”

The politicos want us to believe they have everything under control. Treasury Secretary Yellen recently said, “It certainly takes skill on the part of the Fed to calibrate monetary policy properly.” The public knows better, prices are going up rapidly while wages and/or retirement income are not keeping pace.

Inflation is NOT under control; people are scrambling to protect their wealth and lifestyle. Something has to give...

What to do?

Friend and expert Chuck Butler has warned us about what happens when a country loses “reserve currency” status, pointing to the poverty in England when the British Pound got knocked off its perch. While that is eventually coming for the US dollar, I’m seeing a lot of people already hurting. I contacted Chuck...

(What follows is some of that exchange. There is more in the full article.)

DENNIS: We have talked about the investing side before, owning gold and inflation-protecting assets, but today I want to look at spending. People are realizing the “stuff” they once could easily afford, may be out of reach today.

Four years ago, a person with a monthly housing budget of $2,000 could qualify for a home valued at more than $400,000. Today, that same buyer would need to find a home valued at $295,000 or less...

CHUCK: Dennis, for years we’ve all witnessed how prices seem to rise and never come back down. I’m sure you remember when gas was 17 cents a gallon. Compound inflation continues to erode the buying power of our earnings, and disposable income. So, to me… I don’t see prices coming down; maybe electronics, which have been on a downward spiral for years now.

Dennis, inflation begets higher wages; unions in particular fight to keep up. The higher labor costs ripple through the system from manufacturer, distributor and retailer. They all must increase their prices to pay for the wage increases… It’s a vicious cycle...

DENNIS: The survey said younger generations are also struggling. They can’t afford the McMansions and BMWs they expected in their 30s. What advice would you have for them about providing for their family and being able to retire?

CHUCK: I’d share what my dad told me when I began to work; don’t rely solely on Social Security… Today, the government is paying out more in benefits than it is taking in, increasing the government debt. The US will soon be paying $2 trillion to service this debt. It will be impossible for the government to keep their Social Security promises in the future….

I recently quoted Lew Rockwell in my letter, A Pfennig For Your Thoughts:

“Americans are largely maxed out…. Americans had surpassed a combined total of over $1 trillion in credit card debt back in August. Three months later, the balance had already gone up an additional $48 billion.

…. Household Debt and Credit…continues to worsen as Americans struggle…. What’s more alarming is that credit card APRs have gone up 30% in the last year and a half, eating away at consumers’ budgets more than ever before.”

Forbes recently reported the average interest on credit cards is 27.8%. Those interest rates will eat you alive – don’t let them! Pay off your credit card purchases monthly and enjoy a good night’s sleep!"

Well, yes inflation is still here and maybe stronger than some statistics would allow for, but here are two articles from the "Where To Invest" department which shed some light on the "inflation" darkness so to speak...

Contributor Mark Vickery looks at some earnings in Tesla Disappoints In Q4, But IBM, ServiceNow Beat.

" After having reported auto deliveries for Q4 a couple weeks ago,Tesla is out with somewhat disappointing numbers in its quarterly earnings statement: 71 cents per share is below the 75 cents in the Zacks estimate (and down further from the year-ago report of $1.19 per share. Revenues also dipped below expectations: $25.17 billion versus expected sales of $25.94 billion. Profits fell -23% in total for 2023.

Tesla mentioned in its statement that “volume growth may be noticeably lower this year that it was last year.” And, with shares coming down another -5% on the news in the late session following a -16% sell-off year to date, we see the sparkle coming off this peach — or rather the peachy returns Tesla had been making over the past year, +44%, and over the pasty five years: +950%. It’s also the second earnings miss in a row fro the EV leader, following 10 straight earnings beats in the quarters prior.

IBM Corp. (IBM) outperformed expectations on both top and bottom lines in Q4 results this afternoon. Earnings of $3.87 per share surpassed the $3.78 in the Zacks consensus, on $17.4 billion in quarterly revenues which outstripped the $17.28 billion analysts had been looking for. IBM projects $12 billion in free cash flow for 2024; 2023 posted $11.2 billion in free cash flow. Shares shot up nearly +5% on the beat; IBM is now higher by double digits year to date.

Enterprise software growth-driver ServiceNow (NOW) outperformed expectations on both top and bottom lines in its Q4 earnings report after today’s close, with earnings coming in at $3.14 per share, compared with $2.77 expected and $2.28 per share reported in the year-ago quarter. (The company has no negative earnings surprises in its history.) Revenues also outshone estimates, reaching $2.44 billon in the quarter, up from $2.40 billion expected. Subscriber revenues grew +27% year over year, and ServiceNow credits its strong A.I. rollout for its robust results."

And Talk Markets contributor Shaun Pruitt finds 3 Computer Software Stocks That Could Keep Rising In 2024.

"Here are three expansive software companies that could see their stocks rise even more in 2024.

Blackbaud (BLKB)

Currently coveting a Zacks Rank #1 (Strong Buy) Blackbaud offers a full spectrum of cloud-based and on-premise software solutions. More appealing to investors is that Blackbaud provides its leading software solutions for social causes combining technology and expertise to help organizations achieve their missions.

Steady top-line growth and expansive profitability have pushed Blackbaud’s stock up +35% over the last year. The company is now expected to round out its fiscal 2023 with earnings up 43% to $3.86 per share versus $2.69 a share in 2022. More impressive, FY24 EPS is projected to expand another 17% with total sales now anticipated to rise 5% in FY23 and jump another 8% this year to $1.2 billion.

Further reassuring investors is that Blackbaud has now surpassed earnings expectations for six consecutive quarters with its fourth quarter report scheduled for February 12. Blackbaud most recently beat Q3 earnings expectations by 15% in October with EPS at $1.12 per share compared to estimates of $0.97 a share.

Microsoft (MSFT)

Nowadays it's still hard to have a top software list without Microsoft which sports a Zacks Rank #2 (Buy) and notably has an “A” Zacks Style Scores grade for Growth. Microsoft shares have climbed +64% in the last year to outpace the Zacks Computer-Software Industry’s strong performance.

Even better, over the last five years, Microsoft’s stock is up +273% and has now climbed almost 1000% in the last decade which has comfortably eclipsed the performance of the broader indexes and the Zacks Computer-Software Markets’ +587%.

Microsoft's growth has continued to be fueled by enterprise-to-consumer software solutions and leading cloud capabilities through Microsoft Azure along with lucrative acquisitions including the likes of LinkedIn, Skype, and most recently Activision Blizzard. Artificial intelligence should keep propelling Microsoft's software capabilities going forward having a stake and long-term partnership in OpenAI the creator of ChatGPT.

Hitting 52-week highs today, Microsoft will be reporting its fiscal second quarter results next Tuesday with Q2 EPS projected to be up 19% to $2.76 per share. Quarterly sales are forecasted to jump 16% to $61.03 billion as Microsoft is expected to post double-digit percentage growth on its top and bottom-lines in FY24 and FY25.

Trend Micro (TMICY)

While Trend Micro may be playing catch up on its growth story its stock has an “A” Zacks Style Scores grade for Momentum and boasts a Zacks Rank #1 (Strong Buy). The Japan-based software solutions provider has increasing relevance due to its endpoint and Web security software and services.

Trend Micro’s stock has risen a very respectable +15% over the last year with shares rebounding and soaring +52% in the last three months. As one of the hottest performers in the market of late, fiscal 2024 EPS estimates have climbed 20% in the last 30 days from projections of $1.48 a share to $1.78 per share.

FY24 EPS projections would also represent a sharp rebound and 86% growth from end-of-the-year projections that call for annual earnings of $0.95 a share for FY23.

Boosting Trend Micro’s bottom line recovery is steady top line growth as total sales are now forecasted to rise 3% in FY23 and pop another 9% in FY24 to $1.93 billion. Trend Micro will be reporting its Q4 results for fiscal 2023 on February 15 and positive guidance that reconfirms the company's stronger FY24 outlook could keep the rally going."

Caveat Emptor.

Have a good day.

Peace.

More By This Author:

Tuesday Talk: Spiking

Thoughts For Thursday: What Kind Of A Week Is This?

Tuesday Talk: Walking Back From The Holiday