Tuesday Talk: Walking Back From The Holiday

I hope you all had a meaningful MLK holiday. A look at early morning futures action shows that the market is slightly unnerved. There certainly are enough reasons, but it is premature to postulate on which way the action will go today.

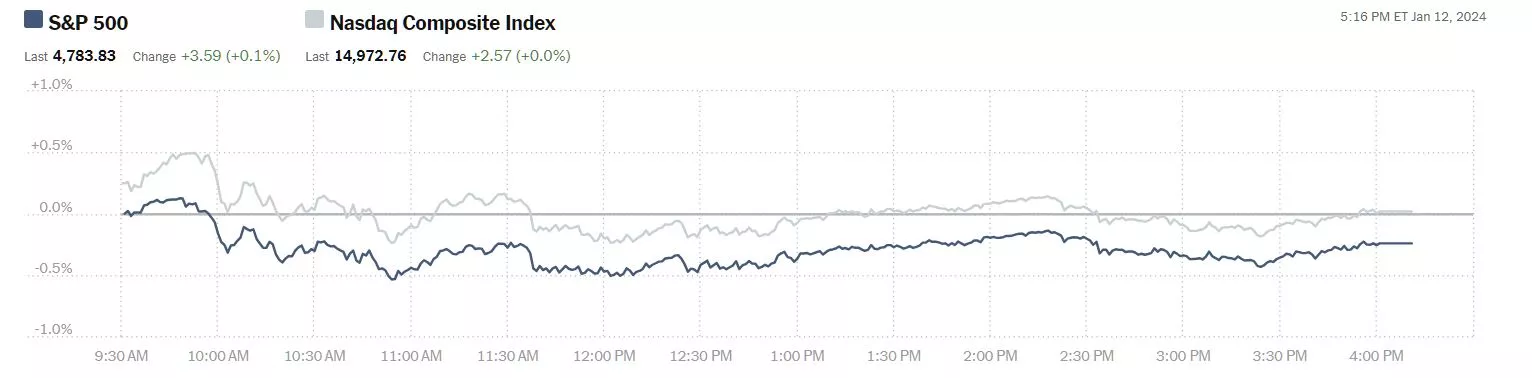

On Friday the S&P 500 closed at 4,784, up 4 points, the Dow closed at 37,593, down 118 points, and the Nasdaq Composite closed at 14,973, up 3 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), down 3.7%, followed by American Airlines (AAL), down 9.5% and Bank of America (BAC), down 1.1%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are trading down 28 points, Dow market futures are trading down 188 points and Nasdaq 100 market futures are trading down 127 points.

Talk Markets contributor Sheraz Mian, in an Editor's Choice piece, works at Breaking Down Early Q4 Earnings Results.

"We are off to a good enough start in the Q4 earnings season, though it may be hard to reach that conclusion from the seemingly ‘noisy’ big bank results. Please note that the bank results aren’t bad or weak, though most struggled to beat consensus revenue estimates.

...Bank of America’s strong net interest earnings performance mirrored what we saw from JPMorgan, Wells Fargo, and even Citigroup, who appeared to be following a kitchen-sink approach in its Q4 earnings release.

With respect to the 2024 outlook for this key profitability driver, JPMorgan expects its net interest earnings to be flat, Wells Fargo is projecting a high single-digit decline, and Citi expects a ‘modest’ decline. This all makes sense, given the expected decline in rates and the macro-driven moderation in credit demand...

In terms of the Finance sector’s Q4 scorecard, we now have results from 22.8% of the sector’s total market capitalization in the S&P 500 index. Total earnings for these banks are up +6.3% from the same period last year on +2.3% higher revenues, with all of the banks beating EPS estimates (100% beats percentage) and only 50% exceeding revenue estimates. The lower revenue beats percentage for the banks is a trend we are noticing outside of the Finance sector as well...

If anything, revenue growth is trending up.

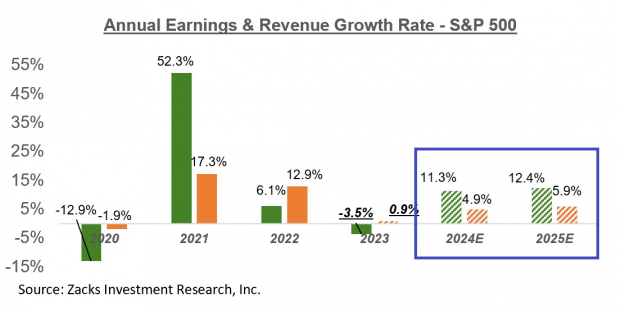

The chart below shows the earnings picture on an annual basis.

...Including Friday’s results from the big banks, we now have Q4 results from 29 S&P 500 members. Total earnings for these 29 index members are up +7.6% from the same period last year on +6% higher revenues, with 93.1% beating EPS estimates and 55.2% beating revenue estimates."

See the full article for more details.

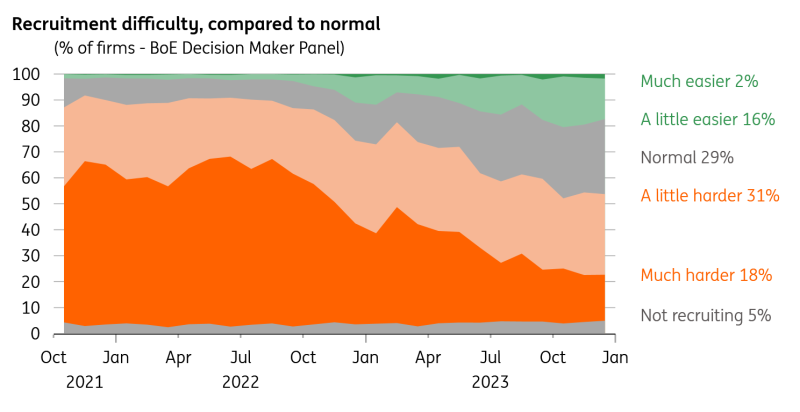

Contributor James Smith notes UK Wage Growth Slows As Recruitment Difficulties Ease.

"UK private sector pay growth now sits a fair bit below the Bank of England's November projections. That opens the door to a rate cut, though we think it requires further progress on both wages and services inflation. A lot will also depend on the extent of tax cuts at the March budget.

... The bottom line is that both wage growth and services inflation, the datasets that are guiding monetary policy right now, are below Bank of England projections. But further progress is likely to be steady, at least for the next quarter or so. BoE survey data shows that wage growth expectations among companies have been stuck around the 5% area for much of the last year, despite firms saying that recruitment difficulties have eased considerably...

Nothing in these latest figures is likely to alter the market’s view that the BoE is headed for a May rate cut. But we’d caution that the Bank will want to see more progress on both the official pay numbers as well as those survey expectations of wages before kick-starting an easing cycle. We also think the budget on 6 March will have a strong influence on the timing of the first cut. A sizeable package of tax cuts would probably help convince the committee to keep rates higher for a little longer. Our base case for now is that the Bank starts rate cuts in August."

TM contributor Mish Shedlock finds Top Issue In Iowa Is Immigration, Not The Economy, 75 Percent Say Immigration Hurts.

"Trump wins Iowa easily. Results were declared with only 3% of the vote in. Surprisingly, immigration, not the economy is the top concern.

I don’t know if that lead image holds. But it is a major uphill battle for Biden if immigration decides this race.

Heck, Biden is well behind on the economy as well.

Next up, is New Hampshire."

The presidential contest will offer up some surprises, it remains to be seen if the market tradition of positive election year results will hold up.

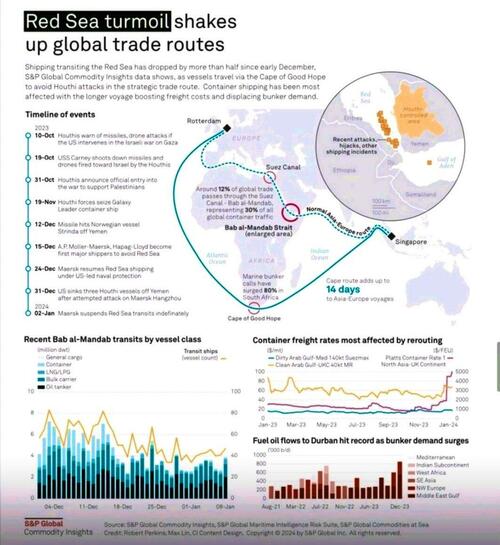

Contributor Tyler Durden reports Qatar Pauses LNG Shipments In Red Sea After US Bombs Houthis.

"The US and British bombing of Iran-backed Houthis in Yemen marks a significant intensification of the Middle East crisis.

...Shipping disruptions across the Red Sea threaten global trade after major shippers, such as Maersk and others, have rerouted vessels to the Cape of Good Hope following a series of drone and missile attacks on commercial vessels by Houthi rebels. The attacks and resulting supply chain disruptions are what forced the US and allies last week to launch bombing raids on Houthi targets.

With US and UK navies in the Red Sea advising commercial vessels to avoid the area, another top shipper has abandoned the critical waterway: The world's second-largest LNG exporter, QatarEnergy, according to Reuters.

LSEG shiptracking data showed that Qatar's Al Ghariya, Al Huwaila and Al Nuaman vessels had loaded LNG at Ras Laffan and were heading to the Suez Canal before stopping off in Oman on Jan. 14. The Al Rekayyat, which was sailing back to Qatar, stopped along its route on Jan. 13 in the Red Sea.

"It is a pause to get security advice, if passing (through the) Red Sea remains unsafe we will go via the Cape," the source told Reuters on Monday regarding QatarEnergy. -Reuters

Qatar is a major supplier of liquefied natural gas to Europe after the US, and disruptions in shipments, or at least delays, due rerouting efforts around the Cape of Good Hope might threaten the continent's energy security. "

Elsewhere TM contributor Tim Fries notes Global Funds Offloaded $1.1B Of Chinese Stocks In The First 2 Weeks Of 2024.

"Foreign investors are turning increasingly bearish on Chinese stocks, offloading $1.1 billion of onshore equities during the first two weeks of this year. Investors faced further disappointment on Monday when China’s central bank kept the key borrowing rate unchanged.

Image courtesy of 123rf.com

According to data from Bloomberg, global funds sold 7.9 billion yuan ($1.1 billion) worth of Chinese stocks in the first two weeks of 2024, highlighting bearish investor sentiment amid the sluggish economic recovery.

After attracting large-scale investments from foreign investors in the final week of 2023, Chinese equities witnessed their worst start to a year since 2019. This slump has pushed stocks down to near five-year lows...

Data released Friday indicated that China experienced its lengthiest period of deflation since 2009 in December. Financing and loan growth for the past month fell short of expectations, and exports recorded an annual decline, marking the first such instance since 2016.

President Xi Jinping’s government is contending with challenges like weak domestic demand, an extended property crisis, and a sluggish job market while aiming for an ambitious growth goal this year.

China is set to release its Q4 gross domestic numbers on Wednesday, providing investors with a more comprehensive overview of the country’s economic state."

In the "Where to Invest Department" contributor Shaun Pruitt picks 3 Building Products Stocks.

"Gibraltar Industries (ROCK)

The Zacks Building Products-Miscellaneous Industry is in the top 30% of over 250 Zacks industries and Gibraltar Industries continues to stand out as a provider of ventilation and expanded metal along with mail storage solutions and rain dispersion products.

Gibraltar's stock has soared +54% over the last year with the company’s bottom line expansion sparking its stellar performance. Rounding out its fiscal 2023, Gibraltar’s annual earnings are now expected to be up 21% and forecasted to expand another 12% in FY24 to $4.63 per share. Plus, earnings estimate revisions are modestly higher for both FY23 and FY24 over the last 60 days and Gibraltar’s stock still trades at a reasonable 17.1X forward earnings multiple.

Granite Construction (GVA)

An expansive bottom line also makes Granite Construction’s stock very enticing right now with its Zacks Building Products-Heavy Construction Industry in the top 42% of all Zacks industries. Granite is benefiting as one of the nation’s largest infrastructure contractors and construction materials producers.

Annual earnings are projected to be up 35% as Granite rounds out FY23 to $3.12 per share versus $2.31 a share in 2022. More impressive, FY24 EPS is expected to expand another 37% to $4.29 a share. Intriguingly, Granite’s stock is up a very respectable +20% in the last year and trades at just 10.9X forward earnings.

Lennox International (LII)

Lastly, the Zacks Building Products-Air Conditioner and Heading Industry is in the top 6% of all Zacks industries and Lennox International’s stock is certainly worthy of consideration. As a global leader in the heating, air conditioning, and refrigeration markets, Lennox's steady top and bottom line growth shouldn’t be ignored with its stock skyrocketing +70% over the last year.

Forecast of 26% EPS growth to round out FY23 and expectations of another 11% earnings growth in FY24 to a whopping $19.83 per share is extremely appealing. Total sales are projected to be up 4% in FY23 and are expected rise another 6% in FY24 to $5.20 billion. Pleasantly, at 21.7X forward earnings investors aren’t paying a premium for Lennox shares considering this is below its industry average of 26.7X and closer to the S&P 500’s 20X.

Takeaway

The growth and expansion of these key construction sector players look likely to continue in 2024 giving investors another opportunity to get in while times are good. Their reasonable valuations also attest to this making now an ideal time to buy."

Caveat Emptor!

That's a wrap for today.

Peace.

More By This Author:

Tuesday Talk: Magnificent Monday?

Thoughts For Thursday: A Bumpy Ride At The New Year

Thoughts For Thursday: With War Clouds As A Backdrop The Market Is Set To End The Year On A High