UK Wage Growth Slows As Recruitment Difficulties Ease

UK private sector pay growth now sits a fair bit below the Bank of England's November projections. That opens the door to a rate cut, though we think it requires further progress on both wages and services inflation. A lot will also depend on the extent of tax cuts at the March budget.

We’ve now got the last set of UK wage data ahead of the February Bank of England decision, and it confirms that pay growth is tracking a fair bit below where policymakers had forecast it to be at this point. Private sector regular pay growth – which removes the volatile bonus category – now sits at 6.5%, down from a peak of over 8% last summer.

Admittedly, that doesn’t represent a surprise on consensus expectations for today’s release – and indeed there aren’t any major shocks in the latest jobs numbers overall. And the Bank of England itself has been warning that the official wage figures have been tracking a little high relative to what we’ve been seeing in other measures of pay.

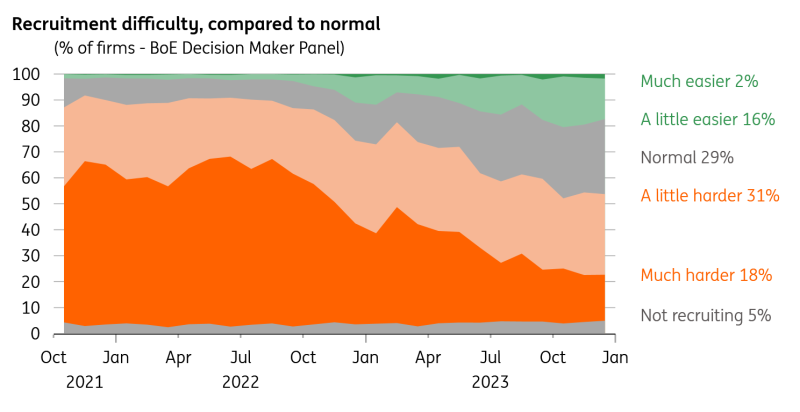

Still, the bottom line is that both wage growth and services inflation, the datasets that are guiding monetary policy right now, are below Bank of England projections. But further progress is likely to be steady, at least for the next quarter or so. BoE survey data shows that wage growth expectations among companies have been stuck around the 5% area for much of the last year, despite firms saying that recruitment difficulties have eased considerably.

Recruitment difficulties have eased

(Click on image to enlarge)

Macrobond

Part of the issue for policymakers is that we still don’t have a true grip on what’s happening to unemployment. Experimental data suggests the jobless rate has essentially been flat at 4.2% for the past few months, but we won’t know for sure until we get improved labour force data over the next few months. Vacancy numbers continue to come down and will probably hit pre-Covid levels in the first half of this year. But for now nothing suggests the cooling in the jobs market is picking up pace.

Nothing in these latest figures is likely to alter the market’s view that the BoE is headed for a May rate cut. But we’d caution that the Bank will want to see more progress on both the official pay numbers as well as those survey expectations of wages before kick-starting an easing cycle. We also think the budget on 6 March will have a strong influence on the timing of the first cut. A sizeable package of tax cuts would probably help convince the committee to keep rates higher for a little longer. Our base case for now is that the Bank starts rate cuts in August.

More By This Author:

Rates Spark: The ECB Pushes BackIndustry Continues To Decline In The Eurozone, And The Outlook Is Bleak

How UK inflation Can Fall To 1.5% By May

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more